General Review of Allstate Benefits

Allstate, one of the biggest insurance providers in the country today, was founded in 1931. It provides all kinds of insurance coverages and services to clients in all 50 states and Washington, D.C. National General Supplement Insurance and Allstate may offer the following perks (discounts are offered through third-party vendors and are not considered insurance, subject to state availability).

- Huge Savings of up to 25% off of Standard rates are available. In fact, they have the lowest premium price in much of the country for Medicare supplement plans.

- A.M. Best has rated Allstate as A+ of 2022.

- Except for Connecticut, Hawaii, Maine, Massachusetts, New Hampshire, New York, Rhode Island, Vermont, and Washington, it is available in every state.

- Medicare Supplement Plans A, F, G, and N are available.

- Access to Active & Fit at more than 10,000 gyms.

- 10% off of Senior Dental Plans.

- Miracle Ear offers Free Hearing Tests and Hearing Aids starting at $695.

- Hearing Tests at one of Amplifon’s Nationwide Network Facilities at a $75 Copay.

- Automatic claims filing by paying your medical providers after Medicare approves the claim.

- Activity Tracker Discount – register your activity tracker or smartwatch for 5% off your premium.

- Annual Pay Discount – Get 10% of your premium if you pay annually.

- 12-month rate guarantee – lock in your initial rate for an entire year.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

What is a Medicare Supplement Plan?

In this section, we will discuss Medicare supplement plans offered by Allstate. Please keep in mind that the “plans” offered are Medigap plans. Medigap plans are secondary insurance plans that pay the remaining amount of what Medicare only partially covers for Part A and Part B.

Medicare Part A is hospital insurance, and Part B is outpatient medical insurance. You would enroll with the federal government to receive Part A and Part B. Once you in enroll in Original Medicare, it becomes your primary insurance.

The role of your primary insurance offered by Medicare is to review if your medical services would be Medicare-approved. If they are approved, then Medicare will pay a partial amount but not the full Medicare-approved amount accepted by your Medical provider. You would need to purchase secondary insurance or a Medigap plan to cover the remaining out-of-pocket expenses incurred.

Medicare Supplement Insurance (Medigap) policies provided by private companies like Allstate can help cover a portion of large payments like copayments, coinsurance, and deductibles for authorized treatments and supplies.

- Coinsurance is a percentage you owe after the deductible, in this case, 20% for Part B and Part A has their own charges.

- Copayments are fixed payments you make to your medical service provider when you receive their services. E.g., you pay $20 for an office visit.

- Deductible- A deductible is an amount you have to pay for health care before any of your Medicare/ Advantage/ Prescription/ other insurance plans begin their coverage.

For example, you might receive a bill in the mail that says the cost of services for your MRI was $20,000.00. You then would read that it was adjusted to the Medicare-approved rate that your provider was willing to accept of $10,000.00. Medicare as your primary insurance would confirm that it was a Medicare-approved service and pay 80% or $8,000.00. This would leave you with a responsibility to pay $2,000.00.

However, if you had a secondary Medigap insurance plan, they would receive notice from Medicare (the primary insurance) that your claim was approved and that the Medigap plan is responsible for the $2,000.00.

If you have Medicare as your primary insurance and Medigap as your secondary insurance, then you would receive a statement in the mail showing you that your Medicare-approved claims have been fully paid for by the federal government and the secondary insurance carrier (perhaps Allstate).

What is covered by Medicare Part A and Part B?

Part A

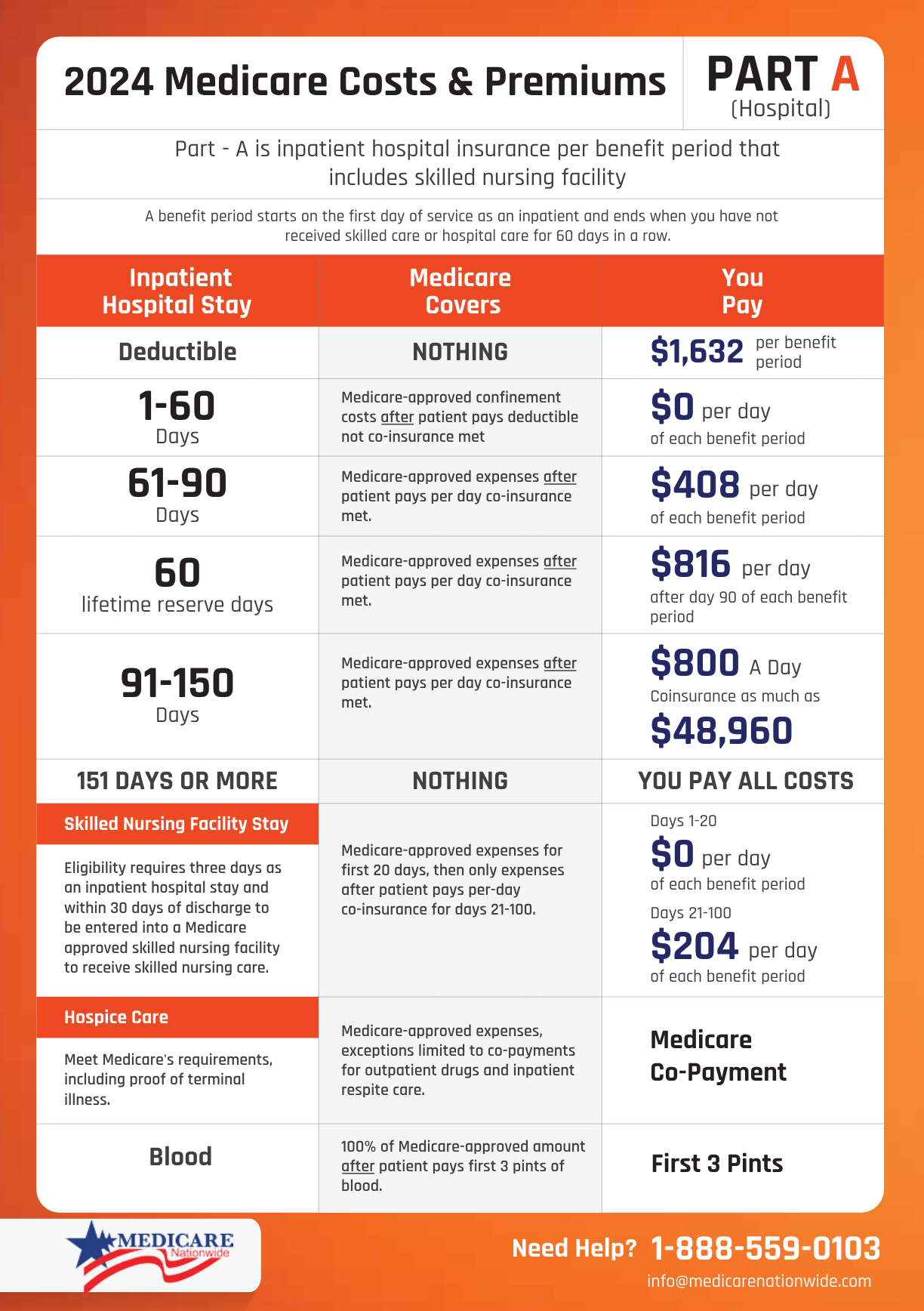

Part A is fundamentally your hospital insurance, commonly known as inpatient hospital and skilled nursing care. Here is a Medicare Part A Chart so you understand what is covered with your original Medicare without supplemental insurance secondary coverage.

Part B

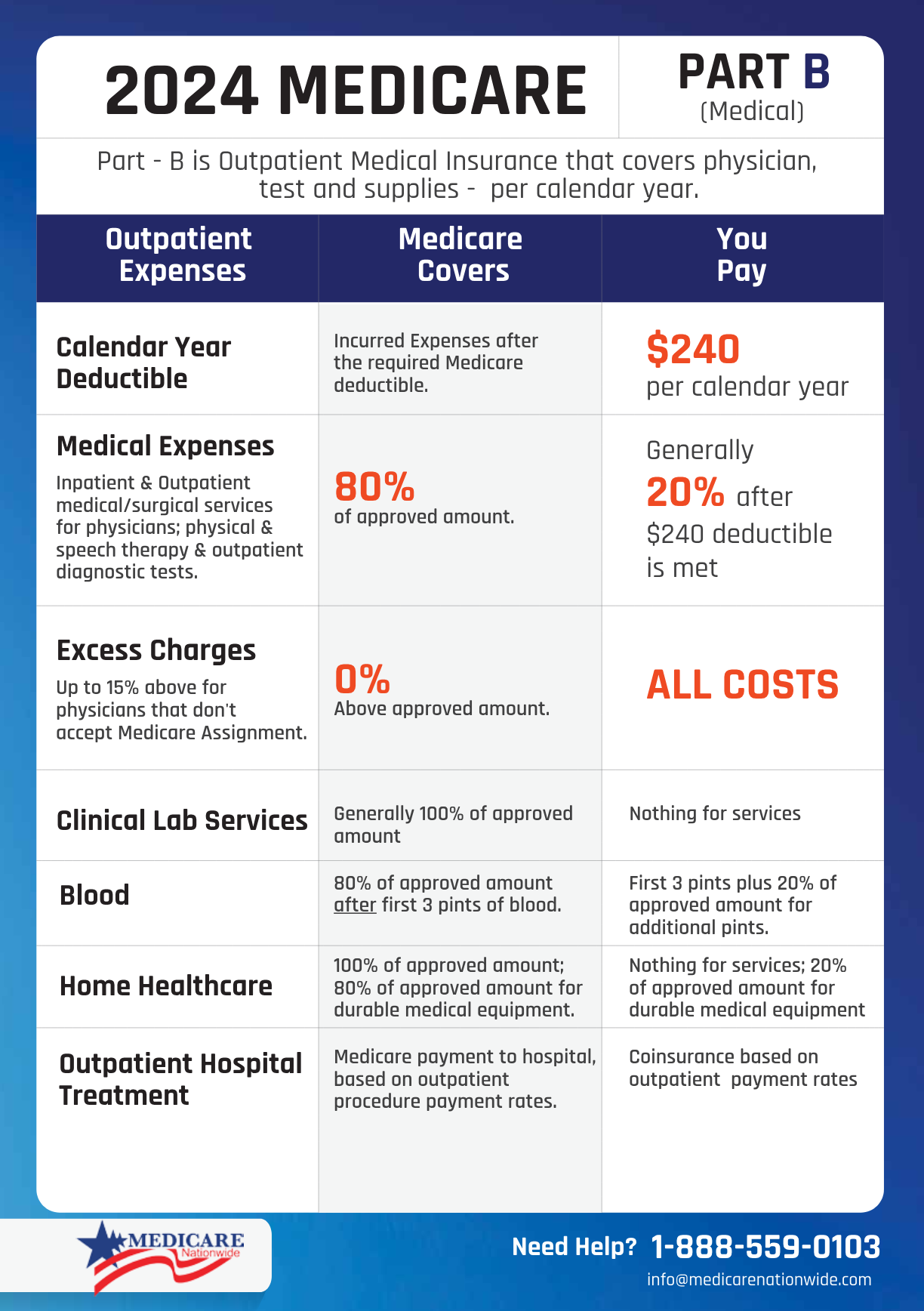

Part B is outpatient medical insurance covering your diagnosis, observation, treatment, consultation, and rehabilitation. For the specifics, you can check out our Medicare ParB chart.

What are the different Medicare Supplement Plans offered by Allstate Health Solutions?

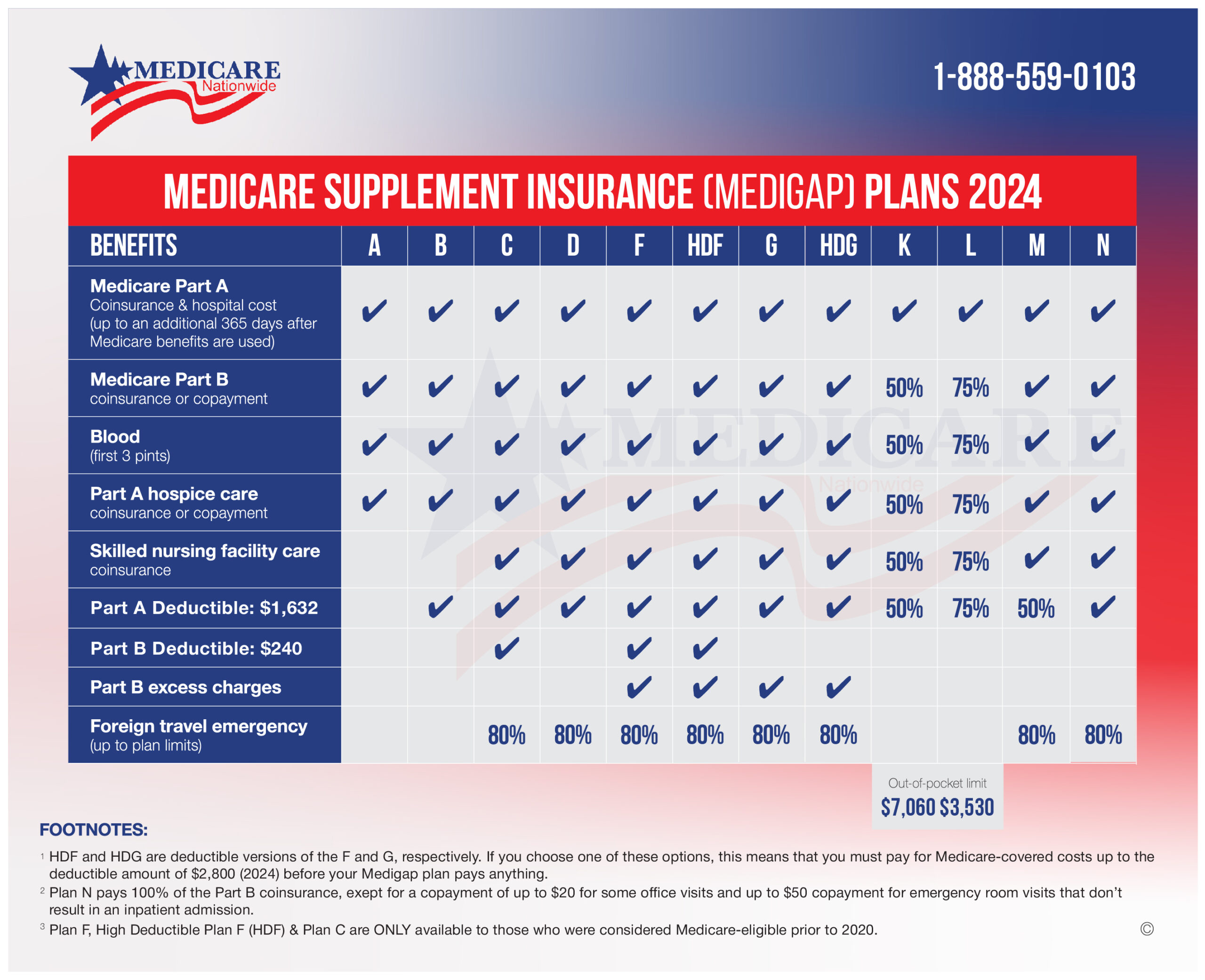

The supplement plans are federally standardized, which means regardless of the carrier you choose, the coverage stays the same. Now, there are ten Medicare Supplement plans lettered, but most everyone chooses between Plan F (discontinued for newly eligible Medicare recipients), G, and N. There are also plans that you adopt a deductible to lower your premium. Here is an article on our High Deductible plan: https://medicarenationwide.com/high-deductible-plan-g-medicare-supplement-review/

Different plans cover different aspects of your Original Medicare gaps. The cost of these plans is proportionate to their extent of coverage and the additional services they might offer other than your standard Medicare, e.g. Plan F, G, and N cover foreign emergency travel which is otherwise not covered by Original Medicare.

Amongst all the plans, F, G, and N are the most popular Allstate Medicare Supplement plans with a great price-to-coverage ratio. Here’s a chart depicting what’s included in which particular plan for your understanding.

How Should You Choose a Medicare Plan?

Insurance is a choice that is majorly determined by your health condition, needs, and budget.

Some people are ready to take on more risks in order to reduce their rates, such as adopting co-payments for doctor’s appointments and other office visits. Others are exceedingly risk-averse and desire a plan that provides additional coverage and peace of mind.

Choosing the best plan for you requires assessing your health and risk tolerance as well as consulting with an insurance advisor, such as one of our brokers, who can ensure that you are selecting the best option for both your finances and health. It is free to work with us and no one is new to the industry. Think about the benefit of working with someone that does this day in and day out for years.

Depending on your age, where you live, and the ability to make future plan adjustments, there are short-term and long-term concerns when selecting a plan. As each individual’s situation is different, there is no definitive guide for all. We can assist you in analyzing your options and picking one that is in your best interest.

What are the eligibility criteria for Medicare Supplement Plan?

If you currently get Medicare or will soon be eligible for Medicare, you are eligible for a Medicare Supplement plan. You can enroll in a Medicare Supplement plan for the first six months after becoming eligible and your application won’t be rejected because of preexisting conditions.

If you postponed your Part B enrollment because you have accepted creditable coverage elsewhere, your Open Enrollment period is when you start Part B.

We help people leave their employer’s or union’s coverage and sign up for Part B. Please be aware that if you don’t declare your current income to Medicare for reassessment or if you wait too long to enroll in Medicare, you could face fines or taxes.

We can explain that procedure to you and remove any ambiguity.

What States offer Allstate Health Solutions?

Allstate Health Solutions offer Medicare Supplement in the following states:

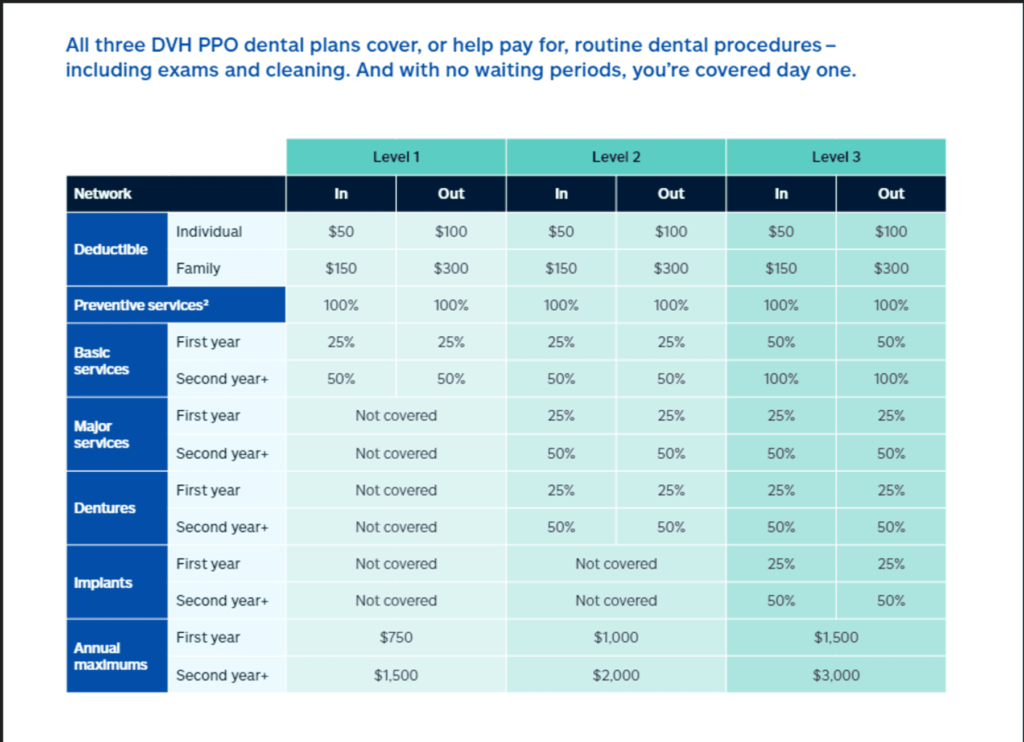

Allstate Dental Plan Chart

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Conclusion

We believe Allstate is a solid and dependable insurance carrier for Medicare supplements. Allstate has very competitive prices and strong customer service. Health care can be quite complicated which is why we are here to assist you.

If you want to learn more about Allstate as your preferred Medicare Supplement provider or to look at their prices, then get in contact with us. Our advisors will listen to your concerns and educate you on what you should consider when choosing a Medicare supplement plan.

Working with us is cost-free, so why try to figure this out on your own?

Prefer to talk on the phone?

Contact us at 1-888-559-0103.