3 Most-Popular Transamerica Medicare Supplement Plans

Transamerica Medicare Supplement programs have long provided coverage to Americans. Before we move any further, it is important to note that Transamerica has discontinued offering its Medicare Supplement Plans. We believe Transamerica’s Medicare supplement offering might be subject to higher rate increases as they are unable to offer plans to Medicare recipients. Understanding the nuts and bolts of these plans will help you get a broader view of supplement insurance.

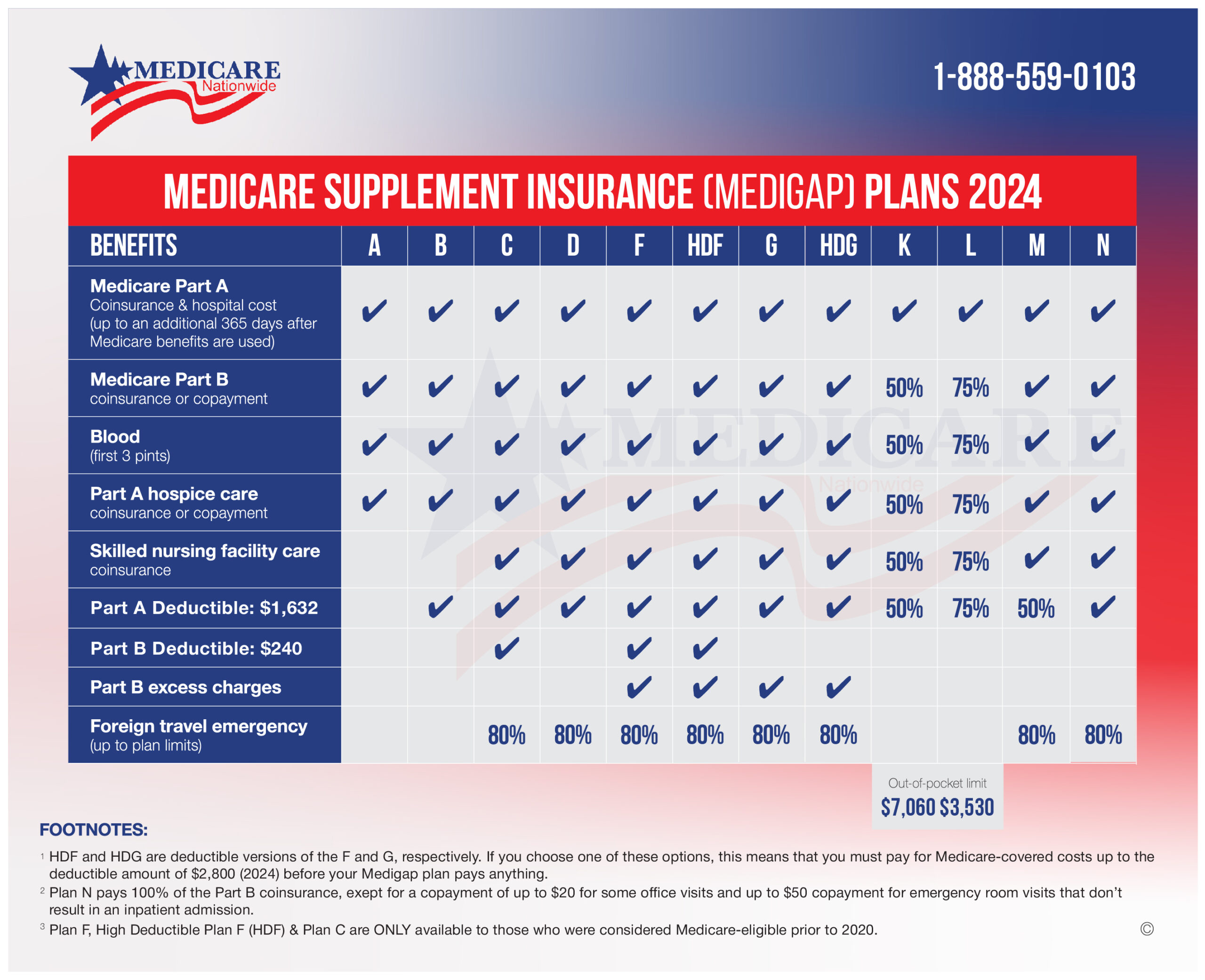

The most popular Medigap plans are F (discontinued), G, and N. The price structure of Transamerica’s Medigap policies is dependent on your state, age, health conditions, and more. The prices might fluctuate with time under the lieu of “rate adjustments,” which are again subjected to different state insurance regulations.

A Brief Overview about Medicare Supplement Plans

Transamerica Medicare Supplement plans, or Medigap, are compatible with Original Medicare Parts A and B. They assist in covering copays1, coinsurance2, and deductibles3, which lowers your out-of-pocket expenses. Plans are guaranteed to be renewed as long as you keep paying your premiums, and coverage is valid at hospitals and providers that accept Medicare. Medicare supplement is federally standardized, which means the outline of your coverage is fixed by the federal government, and it is accepted nationwide. Even in the cases where your doctor or hospital does not accept Medicare, your Medicare will reimburse for all the Medicare-approved claims. If there are still out-of-pocket expenses left, your supplement plan will take care of them.

Medicare Advantage plans are different. Since Medicare Advantage plans are the primary insurance and not Medicare, you can’t ask for reimbursement from Medicare and the supplement if you have a Medicare Advantage plan. That means that if your doctor does not accept the terms of your Medicare Advantage plan, you cannot receive reimbursement from Medicare. Medicare with a Medicare supplement allows you to see medical providers nationwide, while a Medicare Advantage plan restricts you to doctors willing to accept the plan’s terms and conditions.

Despite Medigap’s extensive coverage, there are certain coverage areas, like Long-term care provided in a nursing home, vision and dental treatment, hearing aids, eyeglasses, and private-duty nursing, that it does not cover. Also, Medicare supplement plans do not cover prescription drugs, so you might also stay safe with a low-cost Part D prescription drug plan. Not buying one when eligible may result in a penalty in the future when you would seek enrollment.

1-Coinsurance implies the percentage of healthcare expenses you share with your Medicare insurance plan. E.g., You pay 20%, and your Part B Medicare pays 80%.

2-Copayments are fixed payments you make to your medical service provider when you receive their services. E.g., you pay $20 for an office visit.

3- Deductible- A deductible is an amount you have to pay for health care before any of your Medicare/ Advantage/ Prescription/ other insurance plans begin their coverage.

The following state-specific benefits and savings are available to you as an existing member of the Transamerica Medicare Supplement plan:

- EasyPay (5% off your premium) program

- Regular dental, visual, and hearing exams (additional premiums may apply).

Please note that third-party discounts are not insurance. Different carriers offer them to increase their popularity and attract new customers. Here you must understand that the federal government has set the outline insurance coverage of Medicare Supplement Plans. This means for every carrier, Plan G would be Plan G, and any extra incentive outside the scope of this coverage would depend on the carrier. Plans A, B, C, D, F, G, K, L, M, and N are ten universal Medigap insurance with federally standardized coverage. Please note that only current Medicare beneficiaries who first became eligible for Medicare before 2020 may purchase Plans C and F.

Let’s see more on coverage, enrollment, and eligibility for these Medigap policies:

Here let’s do a quick sweep of the most popular Transamerica Medicare Supplement plans:

Medicare Supplement Plan F

Plan F is the most comprehensive Medicare Supplement available. It covers everything that the original Medicare does not pay in full. For years, this has been the most frequently purchased plan because of its comprehensive coverage.

- Medicare Part A & Part B coinsurance

- Hospital costs are covered for 365 days after you deplete the Medicare benefit.

- The First 3 pints of blood needed

- Nursing Facility Coinsurance

- Medicare Part A & B deductibles

- Emergency Medical expenses in a foreign country

- Part B excess charges*

If you see a physician who excepts Medicare and your treatment is a covered expense, you will not have any out-of-pocket medical expenses.

*Not all doctors are willing to accept the full payment from Medicare. The Medicare-approved sum for these doctors is decreased by 5% with Medicare. These providers may bill you up to an additional 15% of the lower Medicare-approved rate under Part B. (In other states, this cap is less than 15%, and in some, all further fees are outlawed.) This is commonly called “Balance billing” or “excess charges.”

Medicare Supplement Plan G

Plan G covers almost every Medicare Supplemental benefit except Part B’s annual deductible. The out-of-pocket spending will be higher than Plan F. This is the most popular plan with Transamerica because it is cheaper than Plan F. The amount you save in premium is generally more than the deductible, which in most cases justifies Plan G over F. Rate increases tend to be less on average with Plan G.

Medicare Supplement Plan N

Medicare Plan N is a good option for healthy seniors who don’t see the doctor very often. You can potentially save up to 25% of your monthly premiums on this plan. You will have a small office co-pay with Plan N, but you will save on your insurance premiums.

It does NOT cover the following:

- Part B deductible

- Part B excess charges

- Doctor office co-pays

- $50 Emergency Room Visits

When should you apply for a Medicare Supplement Insurance plan?

Like all Medicare supplement plans, you should apply during your personal open enrollment period. Each person’s enrollment period lasts for 6 months, beginning 3 months prior to their 65th birthday and ending three months after turning 65.

The enrollment period is important because all carriers are required to sell you a plan regardless of pre-existing health conditions. If you enroll during this period, coverage will begin immediately. Outside of the enrollment period, you can be subject to stricter underwriting guidelines which could reject your application or increase your rate structure.

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Transamerica History

Transamerica Insurance Company has offered insurance products since 1904. You probably know them because of their iconic pyramid skyscraper hovering over the San Francisco skyline. Transamerica was founded in San Francisco by Amadeo Giannini but didn’t start using the brand name Transamerica until the 1950s. Known primarily for life insurance products, Transamerica has offered Medicare supplement products for many years under the name Stonebridge Life. In 2015, Stonebridge announced it was transferring its supplement products to the Transamerica name. One indicator you must consider when choosing a supplement carrier is financial strength. Competitive pricing doesn’t matter if the company can not pay claims.

Financial services provider Transamerica has leveraged its century of experience to bring innovative products and sustain its image in the market. They have spread their brand voice along the lines of “wealth is harder to earn and retain without health.” Transamerica, which was founded in 1904, has a long history of sound financial management and risk control. One of the biggest Aegon subsidiaries in the US, the company was purchased by the Aegon Group in 1999.

What Special benefits are there to Transamerica Medicare Supplement?

Discounts: Transamerica has been known to provide a discount to customers who allow automatic withdrawal payments for their premiums, though availability may differ depending on your residential area. If you are looking for Medicare Supplement plans within a budget constraint, we can help you navigate different carriers, plans, and the best eligible discounts. Give us a call!

Well-versed Experience: Transamerica has a long history in the American financial and insurance markets. It shares a close relationship with the far more well-known Bank of America, which likewise grandfathered from Bank of Italy.

A Variety of Products: Transamerica and its subsidiaries offer a wide range of financial, investment, and insurance products. Other than their now discontinued Medicare Supplement policy, certain seniors can look at other insurance products from Transamerica. Term Life insurance, Whole life, Final expense, and Insured Universal Life Insurance are some of the services they offer.

This can also be a perfect fit for people who have never used Transamerica before but are seeking opportunities that can offer a variety of financial possibilities.

Exploring other alternatives for Transamerica Medigap Policy in different US states

Your selection of plans and carriers varies according to your state. Only a few of the aforementioned plans will be available in some states, while a few states may offer different options. The easiest approach to learning about what company is currently offering the best Medigap plan in your state is to connect with our independent agents.

You can compare discounts, coverage, rates, and other incentives different carriers offer. And finally, make the choice that best appeals to your medical and financial needs.

Be aware that there is ample confusion in Medigap coverage if you reside in Minnesota, Massachusetts, or Wisconsin. These three states don’t use the common, standardized terminologies for supplement plans like most states do. Our insurance advisors would be able to guide you through all the major and minor differences. Despite having distinct names, Massachusetts, Minnesota, and Wisconsin provide comparable plans to the rest of the nation. For instance, Plan G is known as MedSupp1A in Massachusetts, whereas Plan G is known as Plan G in all other places.

Transamerica Premier Medicare Supplement insurance has been discontinued. Depending on your state and zip code, prices vary for the policyholders. To learn more about Transamerica discontinuing its Medicare Supplement offerings and discuss your options, reach out to an agent with Medicare Nationwide.

How do the prices vary for Transamerica Medicare Supplement Plans?

There is no universally applicable response to this query because prices will differ depending on the particular plan you select, your medical underwriting, and the state where you reside. You should consider your gender, age, tobacco usage, and general health condition (past and current).

For a clearer idea, you can check the plan rates at the time of insurance and its increasing cost over time. If you need help with comparing or finding the pricing history, you can get in touch with us.

Let’s have a clearer look at the factors that determine the prices of your Medicare Supplement Plans:

Medical Underwriting: Medical underwriting entails asking medical questions to asses a customer’s health and basing the results on the approval and/or price-setting. Enrolling during a “guaranteed issue” period is critical to get the cheapest pricing and assurance that your application will be approved, as most medical underwriting is prohibited during these times. It is best to register as soon as possible. We can give you a personalized quote so you can get an idea of the exact costs of the most popular plans.

Location: Because the cost of living is typically higher in large cities, so are the health insurance premiums. Pricing in your state is probably broken down by county or by zip code. It’s crucial to keep in mind that rate increases differ depending on the plan letters across various states.

Plan Type: Typically, the most comprehensive plan in your region will be the most expensive. Although exceptions are there, rarely will a plan with relatively little coverage has a surprisingly high price. It’s crucial to choose not only based on price but also by having a clear knowledge of coverage. For a price quote on a specific plan, you may also get in touch with us directly.

Cost Hikes: Almost all insurance policies are susceptible to gradual premium price increases. In various states, Transamerica employs various models for pricing increases. If your Transamerica insurance plan features “attained age pricing,” you can anticipate that the price will rise steadily as you get older (we can help you look at the comparative analysis of these price trends).

If the plan uses “community pricing,” its premiums might rise in response to inflation and other variables but not age. If it has “issue age” pricing, it will be more expensive the older you are when you sign up, but after you do, it won’t increase based on your age, but it may still increase due to other “rate adjustments”. Usually, these rate adjustments are assessed once a year, sometimes twice. For Transamerica Medicare Supplement plans, the average rate increase is 9%. However, the key thing to remember here is that rate fluctuations vary with the states and the concerned plan letters. Some insurance companies won’t experience significant rate hikes for a number of years, but eventually, they may do so within a single year.

So, how can you get the best coverage at the lowest cost from a provider that has generally had small rate increases? Cooperate with a broker who represents a number of carriers. A broker like us will sell you the finest insurance for your circumstances. Like a cherry on top, when you work with us, you get a detailed pricing breakdown to fit our budget and a side-by-side comparison of policies, carriers, and their benefits. It is free to work with a broker, so why navigate this alone?

Customer Reviews

The customer reviews of Transamerica are a bit of a mix of both the good and the bad. We have to really fine-comb through them to catch the drift of the general public opinion, particularly for Transamerica’s Medicare Supplement Plans.

While the customers appreciate their friendly attitude and customer service, they are often criticized on certain fronts. It can get frustrating to navigate through the different stages of the claims process. However, rest assured that you will get your claims paid for Medicare-approved expenses. Since Medicare supplements are federally standardized secondary insurance to Medicare, it must pay what its primary Medicare insurance approves. Medicare Nationwide is familiar with Medicare supplement carriers that allow you to understand the turnaround time for claims processing.

Point to note: Transamerica is no longer able to offer new Medigap enrollments; therefore, for the majority who are seeking, it is not a realistic alternative. If you are interested in a Medigap Plan, you will need to find a different carrier.

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Financial Ratings of Transamerica Medicare

Here’s how to tell if a company is financially secure. Insurance companies are given a rating by various organizations to indicate financial health. The most popular rating agency is AM Best. The credit rating company A.M. Best focuses on the insurance sector. Make sure you find the company’s rating before purchasing its products.

AM Best rates Transamerica with an A+ rating as of 2022. Thus, rightfully implies that Transamerica has an excellent ability to fulfill its insurance responsibilities, according to A.M. Best. Transamerica had a 3.8-star rating from Consumer Affairs based on just 16 customer ratings. Although they noticed that the carrier does not accept electronic claims from providers, beneficiaries acknowledged and appreciated the company’s customer service. Despite not being certified by the Better Business Bureau, the Transamerica Life Insurance Company maintains a B rating.

In the last three years, 328 complaints have been resolved. Hence implying their accountability and commitment to fulfill their obligations, even though their Medicare Supplement Plans have been discontinued.

What do I do if I already have a Transamerica Medicare Supplement Plan?

We highly recommend contacting us to determine how stable your rate has been with your current Medicare supplement carrier. We offer plenty of strong carriers like Transamerica and what you might need is to find a group with a large enrollment of healthy individuals to keep your rate stable. You can switch Medicare supplement plans at any time, so why wait?

Because of the differences in companies and products, it helps to work with an agent who can shop your supplement coverage among a wide variety of companies. Pricing and accessibility can vary among the states, and we work nationwide. You can feel confident that Medicare Nationwide has tailored a program to your needs and geography and can follow you wherever you live. Not only is finding competitive coverage important but understanding your coverage and which plans to choose is critical. The professionals at Medicare Nationwide can help you sift through all the options among Medicare supplement plans. It is free to work with us!

Contact one of our agents today or get a quick competitive Medicare supplement quote.

Prefer to chat by phone? Give us a call at 1-888-559-0103.