DISCLAIMER: The information provided in this carrier review is for general information purposes only. Discounts and offers may vary by state and may not be fully detailed in this article found on our website. For more information on the discounts available in your state, please contact us at 1-888-559-0103.

Atlantic Capital Life Assurance Company (ACLAC) is a leading provider of Medicare supplement insurance in the United States. As a wholly owned subsidiary of Bankers Fidelity Life Insurance Company (BFLIC), ACLAC is strategically positioned to offer reliable and flexible insurance solutions tailored to the needs of Medicare beneficiaries. This article explores ACLAC’s background, products, financial stability, and its role in the insurance industry.

Who is Atlantic Capital Life Assurance Company (ACLAC)?

Atlantic Capital Life Assurance Company (ACLAC) specializes in Medicare supplement insurance, which helps cover out-of-pocket expenses not paid by Original Medicare. Established as an extension of Bankers Fidelity Life Insurance Company, ACLAC provides financial protection to seniors and individuals seeking additional health coverage.

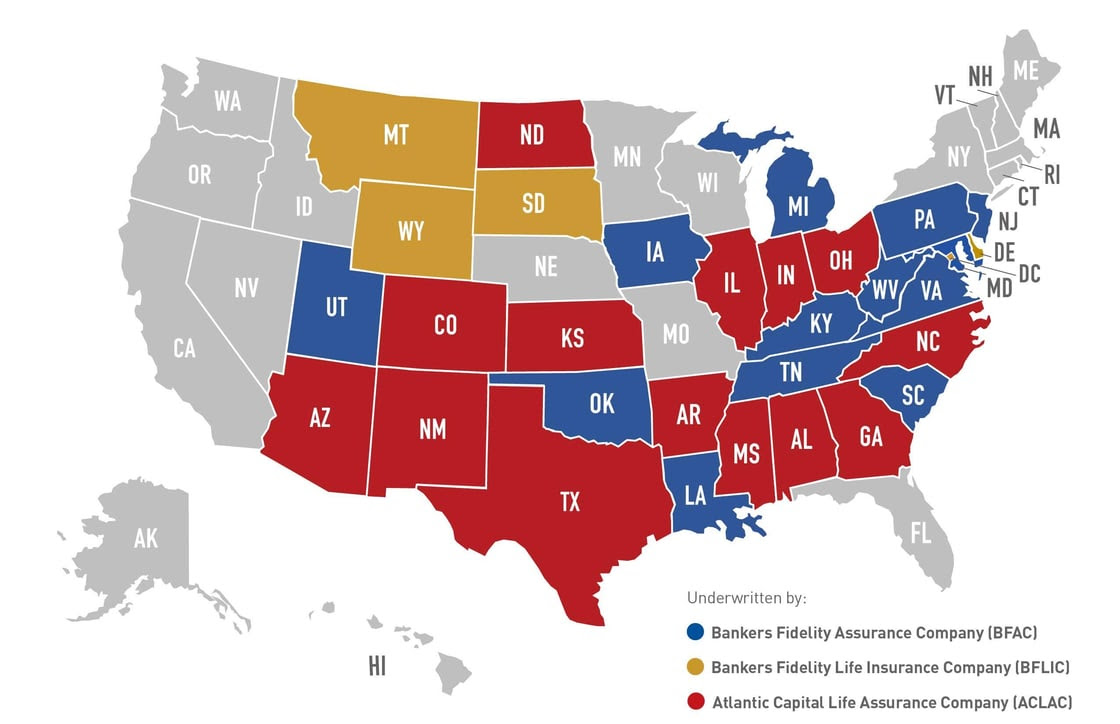

Atlantic Capital Life Assurance Company (ACLAC) is now available in 14 states, including Alabama, Arkansas, Arizona, Colorado, Georgia, Illinois, Indiana, Kansas, Mississippi, North Carolina, North Dakota, New Mexico, Ohio, and Texas. This expansion allows more individuals and families across the country to access ACLAC’s trusted insurance solutions. See the image below for a full list of newly added states.

Key Features of ACLAC:

- Medicare Supplement Expertise: ACLAC focuses on Medicare supplement plans, ensuring clients receive the best options available.

- Financial Strength: Rated A- (Excellent) by AM Best, indicating a stable financial position.

- Customer-Centric Approach: Offers comprehensive support and seamless claims processing.

- Integration with Bankers Fidelity Life: Operates under the well-established Bankers Fidelity brand, benefiting from its experience and reputation.

For more detailed information on the company’s organizational structure, financial status, or product offerings, you can explore the official websites of Atlantic American Corporation and Bankers Fidelity or consult their filings with the SEC.

ACLAC’s Role in Medicare Supplement Insurance

Medicare Supplement Insurance, also known as Medigap, is designed to cover expenses such as copayments, coinsurance, and deductibles. ACLAC’s primary function is to offer Medigap policies that help policyholders manage healthcare costs efficiently.

Benefits of ACLAC’s Medicare Supplement Plans:

- Predictable Costs: Reduces unexpected medical expenses.

- Nationwide Coverage: Accepted by any healthcare provider that accepts Medicare.

- No Network Restrictions: Policyholders can see any doctor or specialist without referrals.

- Guaranteed Renewability: As long as premiums are paid, coverage remains active.

In collaboration with its parent company, it offers a selection of standardized Medigap plans, including Plans A, F, G, High Deductible G, K, and N. These plans are designed to help fill the coverage gaps left by Original Medicare, such as coinsurance, deductibles, and copayments. According to the company’s official website, plan availability depends on the state, with Ohio being one of the states where several options are currently offered.

Financial Strength and Stability

One of the key factors when choosing an insurance provider is financial strength. ACLAC has been assigned an A- (Excellent) rating by AM Best, which signifies a strong ability to meet policyholder obligations. This rating reflects ACLAC’s solid financial foundation, prudent management, and effective risk mitigation strategies.

Key Financial Highlights:

- A- Rating by AM Best: A mark of excellence in financial security.

- Stable Market Position: Supported by Bankers Fidelity’s extensive experience.

- Efficient Risk Management: Premiums ceded to BFLIC for optimal financial performance.

ACLAC’s Relationship with Bankers Fidelity Life Insurance Company

ACLAC operates as a subsidiary of Bankers Fidelity Life Insurance Company, leveraging its parent company’s expertise, distribution channels, and customer service infrastructure.

Advantages of this Relationship:

- Stronger Market Presence: ACLAC benefits from Bankers Fidelity’s brand recognition.

- Operational Efficiency: Shares management, risk assessment, and administrative services with BFLIC.

- Comprehensive Insurance Solutions: Expands options for policyholders seeking additional coverage.

Why Choose ACLAC?

With many Medicare supplement providers in the market, ACLAC stands out due to its commitment to policyholder satisfaction, strong financial backing, and customer-first approach.

Reasons to Choose ACLAC:

- Trusted Brand: Backed by Bankers Fidelity, a company with decades of experience in life and health insurance.

- Competitive Medigap Plans: Designed to reduce out-of-pocket medical expenses.

- Superior Financial Strength: Ensures long-term policyholder protection.

- Simplified Claims Process: Hassle-free and efficient claim handling.

- Comprehensive Customer Support: Dedicated agents assist with inquiries and policy selection.

Common Questions About ACLAC

Is ACLAC Different from Atlantic Coast Life Insurance?

-Yes, ACLAC is distinct from Atlantic Coast Life Insurance Company. ACLAC focuses solely on Medicare supplement insurance, while Atlantic Coast Life offers life insurance and annuities.

Can Anyone Purchase an ACLAC Policy?

-ACLAC’s Medicare supplement policies are available to individuals enrolled in Medicare Part A and Part B. Availability may vary by state, so it’s essential to check with an ACLAC licensed agent.

How Do I Get a Quote for an ACLAC Policy?

-Prospective policyholders can request a quote through ACLAC’s website or from authorized insurance agents who specialize in Medicare supplement insurance.

Final Thoughts

Atlantic Capital Life Assurance Company (ACLAC) plays a crucial role in the Medicare supplement insurance market, offering reliable coverage to individuals seeking additional financial protection for healthcare expenses. With strong financial backing from Bankers Fidelity Life, ACLAC ensures stability, trustworthiness, and exceptional customer service.

For those looking for a dependable Medicare supplement provider, ACLAC is a top choice due to its competitive plans, financial strength, and commitment to policyholder satisfaction. If you’re considering Medigap coverage, explore ACLAC’s offerings to find a plan that best suits your needs.

Our team is here to guide you every step of the way, ensuring you get the best value for your coverage. Plus, you’ll have a dedicated agent you can call anytime for support. Don’t wait—call us today at 1-888-559-0103 to explore your options and secure your Medicare supplement plan with confidence!