Enrolling in Medicare Part A

If you are already collecting Social Security benefits or Railroad Retirement Board benefits at age 65, you are automatically enrolled in Medicare Part A at no additional cost. If this applies to you, then three months before your 65th birthday, your Medicare card will arrive by mail. If you aren’t yet collecting these benefits, you can enroll in Medicare during the open enrollment period in the three months before turning 65.

Here’s a video on Medicare Part A in 2024.

You’re eligible to join Medicare Part A in the following cases:

- You are at least 65 years old, or if you are younger, you fulfill the requirements because of a handicap or another unusual situation.

- You have resided in the country lawfully for at least five years and are a citizen or legal resident.

Keep these details regarding the “age 65” restriction in mind, in case you want to apply,

- You must wait until you are 65 years old, even if you are now receiving Social Security.

- You have to be 65. The age of your partner has no influence.

- You are qualified at age 65, even if you are not currently receiving Social Security benefits.

If you receive Social Security benefits once you turn 65, Medicare Parts A and B should automatically be added to your coverage. Contact the Social Security office in your area if you think there is a problem.

Hospital inpatient stays, skilled nursing facilities, hospice care, and a few home health services are all covered by Medicare Part A.

Let’s learn about these factors in more detail.

Inpatient Hospital Care:

It covers your stay in a hospital that accepts Medicare in Part A. It also covers any diagnostic procedures or medical care you require after being taken to the hospital.

To treat an injury or disease, a doctor must certify that hospitalization is required, and the facility must recognize Medicare.

Semi-private rooms, general nursing, drug treatment, food, hospital services, and supplies are all included in hospital services or providers. Your doctor might recommend services that Medicare doesn’t cover; in this situation, you will have to pay additional charges for Medicare. Furthermore, every private-duty nurse or private room will incur additional fees unless medically essential.

Hospital Stay (Longer than 60 days):

You will get this kind of coverage if a doctor formally admits you to a hospital for drug plan health. Besides the 60 lifetime reserve days, you are covered for up to 90 days throughout each benefit term in a general hospital. In addition, Medicare also covers 190 lifetime days in a psychiatric hospital.

If you are admitted within 60 days of an inpatient hospital admission in the past or if someone transfer immediately from an acute care hospital, there will be no additional deductible for an extended stay. Otherwise, a new benefit period starts if you have beyond the 60-day mark. You will have to fulfill the Part A deductible again at the start of each new benefit period.

Skilled Nursing Facility Care:

Expert Nursing Facility, providers of Medicare or drug plans is medical attention provided to diagnose and cure your disease by a trained nurse or therapist. If you have a hospital stay or your doctor has determined you need skilled care daily, the facility is Medicare-certified, and there are still days left in your benefit period. Part A coverage covers this on a short-term basis for drug plans.

Medicare pays for lodging, food, and find other open services offered at an SNF, such as the administration of medication, tube feedings, and wound dressings. If you are eligible for coverage, you are covered for up to 100 days throughout each benefit period. To be eligible, you must find skilled nursing or therapy treatments and have spent at least three successive days in the hospital within 30 days of your SNF admission.

Hospice in Medicare:

When you decide to get hospice care rather than therapy for a terminal illness, Medicare and other providers will pay for most of your medical expenses. Part A Includes treatment to relieve your symptoms and reduce your discomfort if you are chronically sick. Furthermore, it covers official home medical devices and residential care. You are covered if your provider verifies you require treatment and care.

Home Health Care in Part A:

Part-time or occasional skilled nursing care, physiotherapy, speech-language pathology treatments, or ongoing occupational therapy services are covered by Medicare if they are medically required. Medical social care, part-time or occasional home-based healthcare services, durable healthcare equipment, and hospital-quality medical supplies are all examples of additional home healthcare. Before certifying that you require home health care services, a doctor or other health care professional must examine you. A physician or other healthcare must prescribe your care professional. Furthermore, it must be delivered by a home health company certified by Medicare.

If you are “homebound,” which is defined as you may require frequent or occasional professional care, Medicare will pay for your home health care. It implies:

- Based on your health condition, you cannot leave your house without the help of a wheelchair, walker, crutches, or the support of another person.

- It’s risky to leave the house, considering your health.

- Normally, you are unable to leave your home because it requires a lot of effort.

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Medicare Part A Costs

In most cases, people eligible for Medicare Part A do not have to pay a premium. It applies to you in the following circumstances:

Suppose you are 65 years old and have paid Medicare taxes (FICA) for ten years. It also applies if your spouse or former spouse has paid FICA taxes for at least 10 years.

If you are a disabled individual and have paid FICA taxes for 10 years, you are eligible for Medicare after receiving Social Security benefits for 2 years. Again, this applies if a spouse has paid the FICA taxes for at least 10 years.

If the above points do not apply, you can still purchase Part A coverage, though you must pay a premium. If you choose to purchase Part A, your monthly premium will range from $278 to $505 ($285 or $518 in 2025) based on how long you or your spouse worked and contributed to Medicare taxes.

In most cases, purchasing Part A also involves purchasing Part B and paying monthly premiums for both. If you are qualified, you may still purchase Part B even if you decide not to purchase Part A.

Remember that your monthly premium could increase by 10% if you aren’t qualified for Part A’s premium-free option and don’t purchase it when you first become eligible. You will have to pay the higher premium for twice as many years as you might have had Part A but didn’t sign up.

What does Medicare Part A NOT cover?

Medicare does not offer coverage for every service. Any services you require that are not covered by Part you must pay for A or Part B unless:

- You have additional insurance, like Medicaid, to cover the expenses.

- You have a Medicare Advantage or Cost Plan that covers these services as part of your enrollment. Some supplemental benefits, like workout routines and visual, auditory, and dental services, may be covered by Medicare Advantage Plans and Medicare Cost Plans.

Medicare part A does not provide coverage for some items and services, such plans include:

- Various Dental Services

- Eye Tests (for prescription glasses)

- Dentures

- Cosmetic Procedures

- Massage Treatment

- Regular Physical Examinations

- Examinations for Fitting Hearing Aids

- Long-term Care

- Concierge Services (also referred to as concierge medicine, retainer-based medicine, boutique medicine, platinum practice, or direct care)

- Products or services you receive from an opt-out physician or other providers (except for an emergency or urgent need).

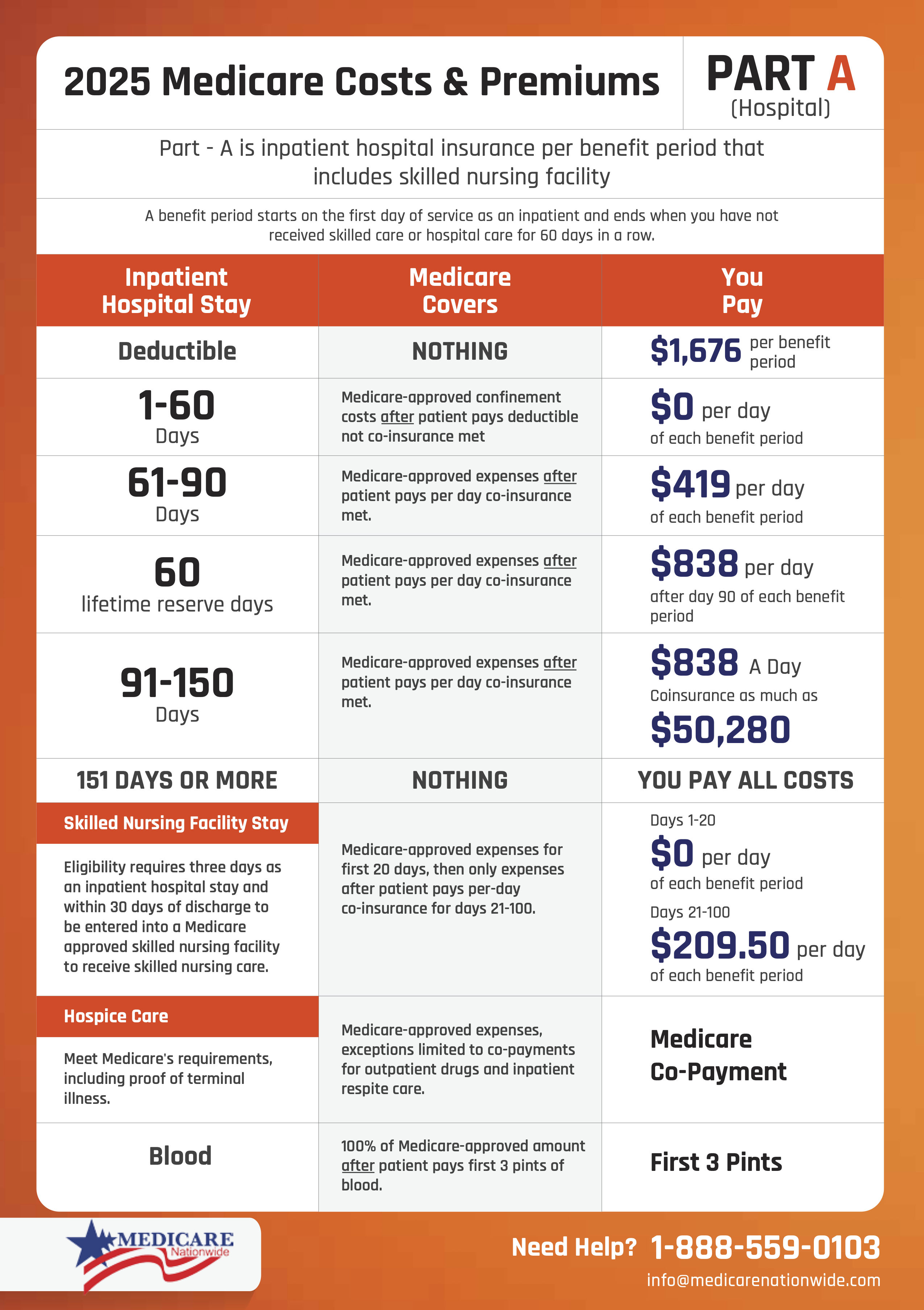

Medicare Part A Deductibles and Copays

A deductible for official Medicare Part A Insurance is assessed for each benefit period.

- The beginning of a benefit period Insurance is the day you join, check and find a hospital or skilled nursing facility for treatment, and it concludes when you will be out of the facility for 60 straight days. You might visit the hospital more than once throughout this period.

- There is no restriction on the number of benefit periods you may have. They are all covered by Medicare.

- The Part A deductible is charged for each benefit period.

There are copays for Medicare Part A while you are hospitalized, in a nursing home, or in hospice care. For each, the copays and regulations function differently.

- Hospital copays depend on how long you stay. You can use up your lifetime reserve days if you stay longer than 90 days.

- Medicare Part A insurance charges copays for skilled nursing facilities each benefit period. By the number of days you stay in the facility receiving therapy.

- Part A copay for hospice care is required for using adaptive medical devices in the home, discomfort, symptom management drugs, and residential care.

FAQs

What Is Medicare Part A?

Medicare Part A insurance pays the medically essential expenses related to an inpatient hospital stay. Part A also provides coverage for skilled nursing facility care, hospice care for terminally ill patients, and a portion of skilled home health care for the housebound. In some cases, it helps pay for blood transfusions.

What are the Different Parts of Medicare?

Medicare comprises 4 parts. All these parts have different offerings:

Part A (Hospital Insurance)

Part B (Outpatient Medical Insurance)

Part C (Medicare Advantage plan)

Part D (Prescription Drug Plan or Coverage)

There are providers who will help you find the plan.

What is Special Enrollment Period & Medicare Advantage Plan?

A Special Enrollment Period (SEP) provides you the chance of enrolling in Medicare outside of the general enrollment period due to exceptions, such as, you lost coverage when you moved states or you no longer qualify for Medicaid, among many other circumstances. There is a general enrollment period for the Medicare drug plan called the Annual Election Period that runs from October 15 – December 7. Medicare Advantage Plans are private plans that replace Medicare and the eligibility is during the Annual Election Period as well or during a SEP. Medicare supplement plans you can switch at any time but you may be subjected to underwriting. There is also an initial enrollment period, but it has different requirements.

How much does Medicare Part A cost?

If you or your spouse contributed Medicare taxes while working for a defined period, you will often not be required to pay an insurance payment for Part A coverage. It is also known as the premium-free Part A. You might be able to purchase Part A if you are not qualified for premium-free Part A.

Considering how many years you or your spouse worked and paid Medicare taxes, the amount of your monthly Part A payment will range from $278 to $505 ($285 or $518 in 2025).

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Conclusion

If you want to find and learn more about Medicare Part A, connect directly with one of our independent agents. We look forward to assisting with your Medicare needs and ensuring our clients make the best choice for them. Prefer to speak by phone for information about Part A? Give us a call today.

Prefer to chat by phone? Give us a call at 1-888-559-0103.

Sources:

- Medicare Part A Coverage: What You Need to Know for 2022, Healthline, December 15, 2021.

- Medicare Part A: Hospital Care and Services, WebMD, July 27, 2021