DISCLAIMER: The information provided in this carrier review is for general information purposes only. Discounts and offers may vary by state and may not be fully detailed in this article found on our website. For more information on the discounts available in your state, please contact us at 1-888-559-0103.

Bankers Fidelity Assurance Company BFAC is a well-established insurance provider specializing in life and supplemental health insurance products. With a history spanning over 65 years, the company has built a reputation for offering reliable coverage tailored to the needs of seniors, individuals, and families. This article explores the company’s background, products, benefits, and why it might be a good choice for your insurance needs.

Company Overview

Founded in 1955, Bankers Fidelity Assurance Company (BFAC) operates as a subsidiary of Atlantic American Corporation. It is headquartered in Atlanta, Georgia, and is known for its strong financial standing and customer-focused approach. The company is licensed in multiple states and has a network of experienced agents who assist customers in choosing the right insurance plans.

Bankers Fidelity Assurance Company BFAC is a life and health insurance provider that offers a variety of insurance products. It’s part of the Bankers Fidelity family, which has been serving customers for decades. The company primarily focuses on providing supplemental health insurance, including Medicare Supplement (Medigap) plans, and life insurance policies, among other health-related coverage options.

They offer plans that help cover the gaps in traditional Medicare coverage, such as out-of-pocket costs for medical services, as well as other products like hospital indemnity and critical illness insurance.

Bankers Fidelity is known for its strong financial stability and customer-focused services, and their Medicare Supplement plans are often marketed to seniors looking for additional coverage to help manage medical expenses not covered by Medicare.

Bankers Fidelity Assurance Company, a wholly-owned subsidiary of Bankers Fidelity Life Insurance Company, plays a key role in the distribution of Medicare Supplement (Medigap) policies across select states. Working in tandem with its parent company, it offers a range of standardized Medigap plans, including Plans A, F, G, High Deductible G, K, and N. These plans are designed to help cover out-of-pocket costs that Original Medicare does not, such as copayments, coinsurance, and deductibles. As noted on their official website, availability may vary by state, with Ohio being one example where multiple plan options are actively offered.

As of 2025, both Bankers Fidelity Life Insurance Company and Bankers Fidelity Assurance Company hold an A- (Excellent) rating from A.M. Best, reflecting their strong financial footing and ability to meet policyholder obligations. However, it’s important to understand that this rating applies to the companies’ overall financial health and does not guarantee specific policy features, benefits, or pricing. For those seeking deeper insights into corporate structure, financial stability, or available products, you can visit the official websites of Atlantic American Corporation and Bankers Fidelity, or access regulatory filings at SEC.gov.

Insurance Products Offered

Bankers Fidelity provides a range of insurance products designed to offer financial security and peace of mind. Some of their key offerings include:

Medicare Supplement Insurance (Medigap)

One of the most popular insurance products offered by Bankers Fidelity is Medicare Supplement Insurance, commonly known as Medigap. These plans are designed to cover healthcare costs not included in Original Medicare (Parts A & B), such as:

- Deductibles

- Copayments

- Coinsurance

Benefits of BFAC Medigap Plans:

- Guaranteed Renewability – Your policy cannot be canceled as long as you pay your premiums.

- Nationwide Coverage – No network restrictions; visit any doctor who accepts Medicare.

- Multiple Plan Options – Choose from Plan A, Plan F, Plan G, Plan N, and more.

- Predictable Costs – Helps avoid unexpected medical bills.

Final Expense Life Insurance

Final expense insurance is a type of whole life insurance designed to cover end-of-life costs, including:

- Funeral expenses

- Burial costs

- Medical bills

- Outstanding debts

Benefits of BFAC Final Expense Insurance:

- No Medical Exam Required – Simplified underwriting.

- Fixed Premiums – Your rates do not increase over time.

- Immediate Coverage – No waiting period in most cases.

- Flexible Payouts – Beneficiaries receive cash benefits to cover expenses.

Short-Term Care Insurance

Unlike traditional long-term care insurance, short-term care insurance covers care for a limited period, usually less than one year. This policy is ideal for individuals recovering from illness or surgery and needing temporary assistance.

Key Features:

- Affordable Premiums – Lower than long-term care insurance.

- Covers In-Home & Facility Care – Flexible options for different needs.

- Daily Benefit Payouts – Helps cover nursing or rehabilitative care costs.

Hospital Indemnity Insurance

Hospital stays can lead to high out-of-pocket expenses. BFAC’s hospital indemnity insurance provides lump-sum payments for hospital admissions, helping policyholders manage medical bills.

Why Consider Hospital Indemnity Insurance?

- Pays Cash Directly to You – Use funds for medical or personal expenses.

- No Network Restrictions – Visit any hospital or provider.

- Works with Medicare & Other Plans – Fills gaps in coverage.

Lump Sum Cancer Insurance

Bankers Fidelity Assurance Company (BFAC) offers Lump Sum Cancer Insurance to help cover costs if you are diagnosed with cancer. This plan gives you a one-time cash payment that you can use for medical bills, daily expenses, or anything you need.

Cancer treatments can be very expensive. Even with health insurance, you may still have out-of-pocket costs like:

- Deductibles and copays

- Travel expenses for treatment

- Lost income if you can’t work

A lump sum payment gives you financial support when you need it most.

Key Benefits of BFAC Lump Sum Cancer Insurance

- Flexible Coverage Amounts – Choose the cash benefit amount that fits your needs.

- No Restrictions – Use the money however you want.

- Simple Enrollment – Easy application process with no medical exam required in many cases.

- Affordable Premiums – Budget-friendly options available.

Benefits of Choosing Bankers Fidelity

Bankers Fidelity stands out in the insurance industry for several reasons:

- Financial Stability – With decades of experience and strong financial backing, the company provides reliable coverage.

- Customer-Centric Approach – The company is known for its excellent customer service and personalized support.

- Flexible Plan Options – Offers a variety of plans to meet different financial and healthcare needs.

- Easy Claims Process – A streamlined claims process ensures that policyholders receive their benefits promptly.

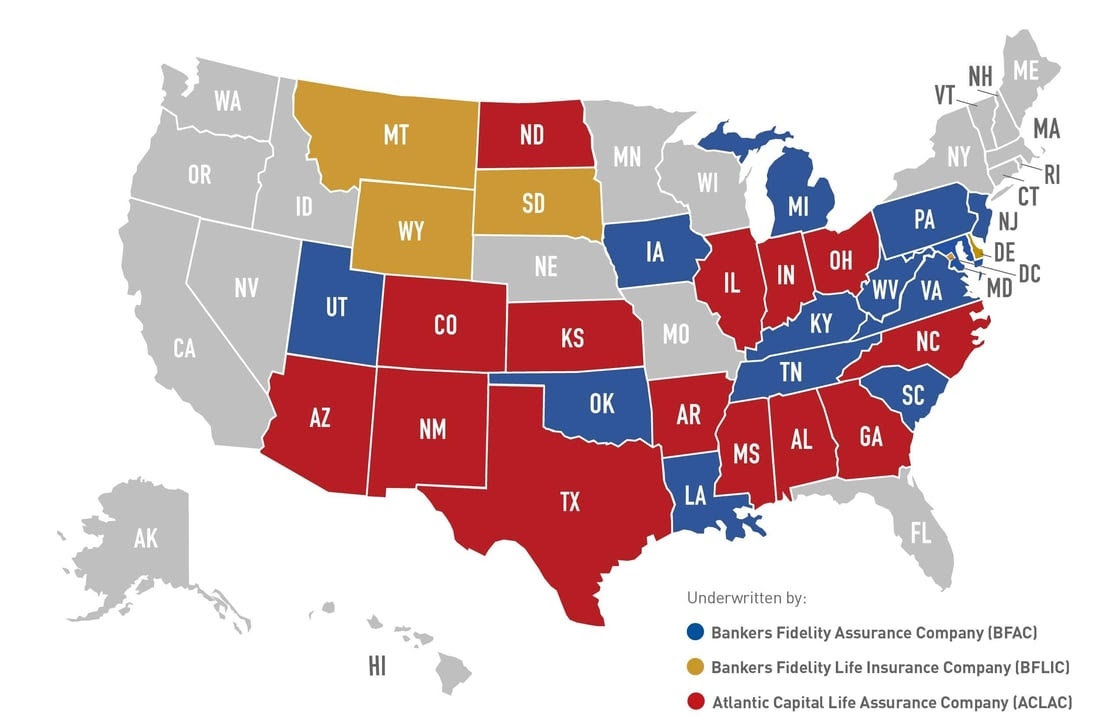

State Availability of Bankers Fidelity Assurance Company (BFAC)

Bankers Fidelity Assurance Company (BFAC) offers its insurance products in select states across the country. Whether you’re considering a Medicare Supplement plan or other health insurance options, it’s important to confirm if BFAC is available in your state before applying. Availability may vary based on the specific product line, so reviewing the latest information is crucial.

Refer to the map below to check the current states where Bankers Fidelity Assurance Company is available. This visual guide helps you quickly identify whether BFAC serves your area and what plan options may be accessible to you.

Final Thoughts

Bankers Fidelity Assurance Company BFAC has been a trusted name in insurance for over 65 years, offering reliable coverage and excellent customer service. Whether you need Medicare Supplement, life insurance, or hospital indemnity coverage, they have flexible options to fit your needs.

Choosing the right insurance plan is important, and we are here to help. Our team can guide you through your options and find the best value for your situation. Plus, our support doesn’t stop after you enroll—you’ll have a dedicated agent available whenever you need assistance.

Call us today at 1-888-559-0103 to discuss your coverage options and get expert guidance!