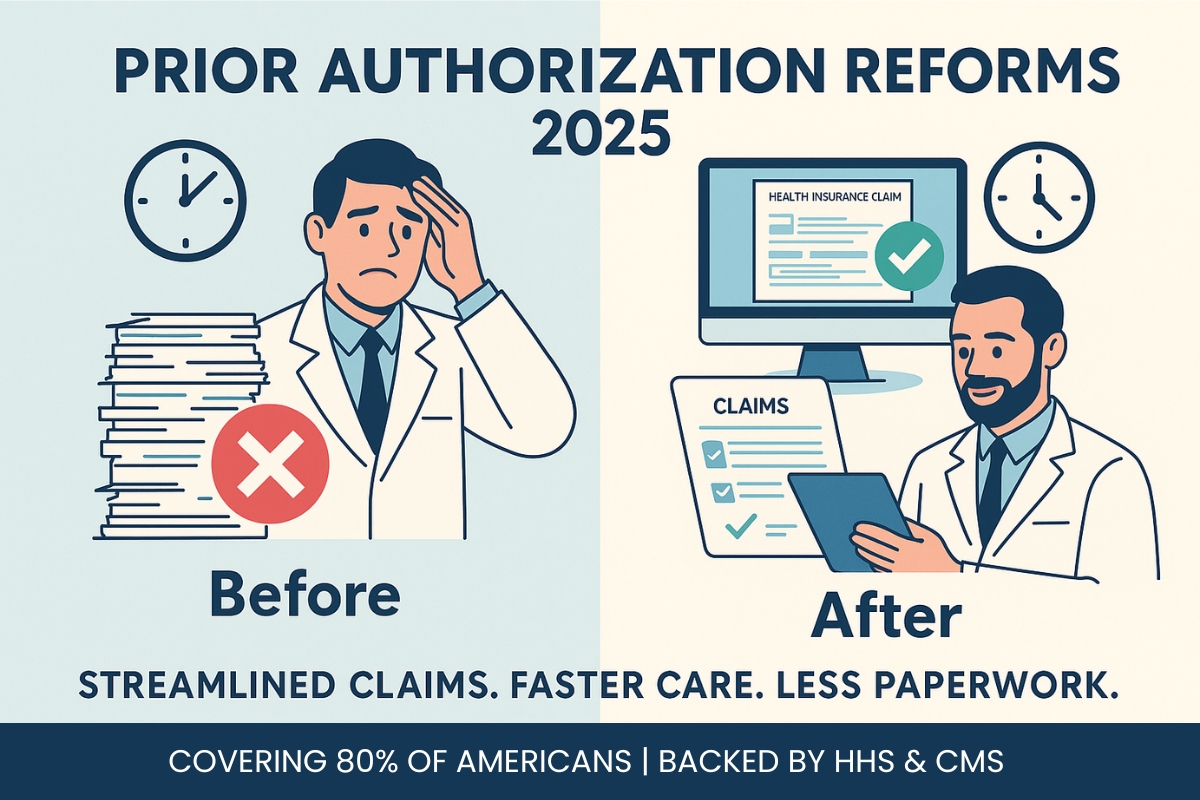

Prior Authorization Reforms mark a major turning point in healthcare policy aimed at reducing delays and inefficiencies. The new Prior Authorization reforms were announced by HHS and CMS on June 23, 2025, with the goal of simplifying approvals for millions of Americans. These Prior Authorization reforms bring together major insurers in a voluntary agreement to modernize and streamline the process across Medicare, Medicaid, and private plans.

Led by HHS Secretary Robert F. Kennedy Jr. and CMS Administrator Dr. Mehmet Oz, the Prior Authorization reforms include commitments from insurers like UnitedHealthcare, Aetna, and Humana. By implementing digital systems and real-time approvals, the Prior Authorization reforms aim to ease burdens on providers and improve patient access to care. These Prior Authorization reforms are expected to reshape the insurance landscape by 2026, with oversight and accountability playing a crucial role.

What Are the Proposed Reforms?

The initiative includes six key voluntary commitments to address delays, inefficiencies, and administrative burdens in prior authorization reforms, building on CMS’s 2024 Interoperability and Prior Authorization Final Rule (CMS-0057-F). The reforms are:

- Standardized Electronic Prior Authorization: Insurers will adopt Fast Healthcare Interoperability Resources (FHIR®)-based application programming interfaces (APIs) to streamline electronic submissions, integrating with electronic health records for efficiency.

- Reduced Scope of Prior Authorization Reforms: By January 1, 2026, insurers will limit prior authorization requirements for common procedures, such as colonoscopies, diagnostic imaging, physical therapy, and outpatient surgeries.

- Continuity of Care: Existing authorizations will be honored during plan transitions to prevent disruptions in ongoing treatments.

- Improved Transparency: Insurers will provide clearer denial reasons and enhance communication about appeals processes.

- Real-Time Approvals: By 2027, most prior authorization reforms requests will receive real-time responses to minimize care delays.

- Professional Clinical Review: All clinical denials will be reviewed by medical professionals to ensure evidence-based decisions.

These changes aim to reduce the administrative burden on providers, who spend an estimated 12 hours weekly on prior authorization reforms paperwork, and ensure timely care for patients.

Why Are These Changes Needed?

Prior authorization reforms has long frustrated patients and providers. CMS Administrator Dr. Mehmet Oz stated that 85% of Americans have faced negative impacts from prior authorization, including care delays and administrative hurdles. HHS Secretary Kennedy emphasized that the current system pits patients and doctors against insurers, undermining trust and efficiency.

In 2023, Medicare Advantage plans processed 50 million prior authorization requests, denying 3.2 million (6.4%), though 80% of appealed denials were overturned, highlighting inefficiencies. The reforms seek to restore patient-centered care, particularly for Medicare Advantage and Medicaid beneficiaries reliant on timely services.

How Will These Reforms Impact Different Health Insurance Plans?

By reducing prior authorization reform requirements and speeding approvals, the reforms will likely increase claims costs for insurers, raising concerns about premium increases. This is particularly relevant as the Medicare Supplement (Medigap) market faces severe financial pressure, with loss ratios—claims paid relative to premiums—nearing 100% in 2025, meaning premiums barely cover claims.

Quoting data ballpark estimates show Medigap premiums rose 8% on average in 2023, 14% in 2024, and an estimated 16% in 2025, with increases over 20% not uncommon and up to 38% in rare cases. Below, we explore the impact of different plans and whether large insurers like UnitedHealthcare, Humana, and Aetna can manage these costs.

Impact on Medicare Advantage

Medicare Advantage beneficiaries are unlikely to face significant premium increases in 2026. CMS’s 5.06% payment increase for 2026, higher than the proposed 2.2%, provides revenue to cover higher claims costs from reforms, which could affect the 50 million prior authorization reform requests processed in 2023 (3.2 million denied).

Large carriers, with billions in revenue (e.g., UnitedHealthcare’s $281 billion in 2024), can invest in cost-saving technologies like FHIR-based APIs, reducing administrative burdens (e.g., 12 hours weekly physicians spend on paperwork). Competition in Medicare Advantage, covering 54% of Medicare enrollees in 2024, and CMS oversight limit premium hikes.

However, if claims volumes rise due to Medigap enrollment shifts or financial strain, carriers might adjust supplemental benefits (e.g., flex cards, transportation) or raise premiums modestly (2–5%) by 2027.

Medigap Market Pressures

Medigap faces intense pressure, with loss ratios nearing 100% in 2025, indicating claims nearly match premiums.

The National Association of Insurance Commissioners (NAIC) reported 2023 loss ratios exceeding 80% in most states, with 2024 claims rising 4.4% versus 4% premium growth. Premium increases of 8% in 2023, 14% in 2024, and 16% in 2025, with over 20% common for plans like G and N, reflect efforts to stabilize losses, though rare 38% hikes occur in high-cost markets.

These pressures stem from rising healthcare costs, competitive pricing, and regulatory changes like guaranteed issue expansions in Virginia and Utah. Fortunately, Medigap is unaffected by the prior authorization reforms, as it supplements Original Medicare without requiring prior authorization reforms.

Impact on Other Plans

- Medicaid Managed Care: State oversight and capped funding limit premium increases. Carriers will likely absorb reform costs through efficiencies, maintaining affordability for low-income and dually eligible beneficiaries.

- Health Insurance Marketplace Plans: CMS’s focus on affordability (e.g., projected 5% premium reductions in 2025) and competition among younger, healthier enrollees constrain premium hikes, though implementation costs could lead to modest increases.

- Commercial Plans: Without CMS subsidies, commercial plans face a higher risk of premium increases to cover increased claims and technological upgrades, particularly for employer-sponsored plans. Competitive pressures may limit the extent of hikes.

Can Large Carriers Manage These Costs?

Despite Medigap’s challenges, large carriers are well-positioned to handle the reforms. Their diversified portfolios, including profitable Medicare Advantage and commercial plans, offset Medigap losses. For example, Humana’s home health services and Aetna’s pharmacy benefit management bolster financial stability.

CMS’s Medicare Advantage payment increase and cost-saving automation (e.g., via FHIR-based APIs) help absorb reform costs. In Medigap, 16%+ premium increases in 2025 stabilize the market, reducing cross-market strain. However, if high Medigap premiums (20%+ not uncommon) drive beneficiaries to Medicare Advantage, increased claims could prompt minor premium or benefit adjustments by 2027. CMS oversight and market competition should keep Medicare Advantage premiums stable in the near term.

Pros and Cons Table

| PROS | CONS |

| Faster approvals for care (real-time by 2027) | Potential premium increases (2–5% in Medicare Advantage if claims rise) |

| Reduced delays for procedures (e.g., imaging) | Implementation costs for APIs and reviews |

| Fewer disruptions during plan transitions | Voluntary nature may limit enforcement |

| Improved transparency with clearer denials | Excludes prescription drugs (Part B/D) |

| Less provider paperwork (12 hours/week saved) | Medigap financial strain (loss ratios ~100%) |

Likelihood of Implementation

The reforms are likely to be implemented, though challenges remain:

Supporting Factors

- Broad Industry Support: Major insurers covering 257 million Americans have committed to the prior authorization reforms, driven by public and governmental pressure to address prior authorization issues.

- Regulatory Alignment: The reforms build on CMS’s 2024 Interoperability and Prior Authorization Final Rule, mandating API adoption and faster decisions by 2027. Large carriers are already investing in compliance infrastructure.

- Strong Oversight: CMS and HHS will monitor progress with specific metrics and deadlines (e.g., reduced scope by 2026, real-time approvals by 2027), with regulatory action as a backstop if insurers fall short.

- Public and Political Momentum: Frustration with prior authorization, amplified by patient stories and support from figures like Sen. Roger Marshall and Rep. Greg Murphy, fuels momentum.

- Federal Backing: The Trump administration’s focus on reducing healthcare bureaucracy supports the initiative.

Potential Challenges

- Voluntary Commitments: The prior authorization reforms are not legally binding, raising enforcement concerns. Past pledges, like the 2018 consensus statement, yielded limited results.

- Implementation Costs: Standardizing APIs and expanding clinical reviews require significant investments, which could strain smaller insurers, though large carriers’ scale mitigates this.

- Medigap Financial Strain: With Medigap loss ratios nearing 100% and premium increases of 16%+ in 2025, carriers face tighter budgets, but diversified revenues and CMS payments for Medicare Advantage provide a buffer.

- Prescription Drug Exclusion: The reforms exclude Medicare Part B and D drugs, limiting their scope. Future rulemaking may address this, but it remains a gap.

Overall, the reforms are poised for success by 2026, with large carriers’ resources and CMS oversight driving progress. However, accountability and monitoring will be critical to ensure compliance.

What’s Next?

CMS and HHS will track implementation through public metrics, with insurers expected to reduce prior authorization scope by January 1, 2026, and achieve real-time approvals by 2027. Beneficiaries and providers can stay informed via CMS news updates at cms.gov/newsroom or by following CMS on X at @CMSgov.

For Medicare Advantage enrollees, these reforms promise faster care access, fewer disruptions, and greater transparency. Medigap beneficiaries, while unaffected by the reforms, should prepare for continued premium increases (16%+ in 2025) and explore cost-saving options like plan comparisons or discounts.

At MedicareNationwide.com, we’re committed to keeping you updated and helping you navigate these changes. Have questions about how these reforms or Medigap trends affect your coverage? Contact our team at 1-888-559-0103 for personalized guidance today!