Navigating how to apply for Medicare can seem daunting, but understanding the steps involved makes it manageable. From determining eligibility based on age, disability, or medical conditions to choosing between the various parts of it, the process requires careful consideration. Knowing your enrollment periods and gathering necessary information, such as Social Security details and current health coverage, is crucial. Whether applying online, by phone, or in person, each method offers its own conveniences. Regularly reviewing coverage options and keeping your information updated ensures you maintain the best possible healthcare coverage with them.

Medicare Enrollment Guide

Applying for Medicare involves several steps, but the process is relatively straightforward. Here’s a general guide:

Determine Your Eligibility

Most people become eligible for Medicare when they turn 65. However, you can also qualify if you have a disability or certain medical conditions.

- People aged 65 or older

- Under-65 individuals with disabilities

- People with End-Stage Renal Disease

Understand the Different Parts of Medicare

Medicare is divided into several parts:

- Part A: Hospital Insurance

- Part B: Medical Insurance

- Part C: Medicare Advantage Plans (offered by private companies)

- Part D: Prescription Drug Coverage

Automatic Enrollment: Medicare Part A & Part B

Enrollment is automatic for people who:

- Get Social Security or RRB Benefits

- Are under 65 and have a disability

Look for your “Get Ready for Medicare” package (Includes a letter, booklet, and Medicare card), mailed 3 months before:

- Your 65th birthday

- Your 25th month of disability benefits

Decide Which Parts You Need

Most people are automatically enrolled in Part A and can choose whether to enroll in Part B, Part C, and/or Part D. If you’re receiving Social Security benefits before turning 65, you’ll be automatically enrolled in Part A and Part B.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Enrollment Period

There are different enrollment periods for different parts of it. It’s important to enroll during the appropriate time frame to avoid late penalties and gaps in coverage. Each enrollment window offers different options and deadlines depending on your situation.

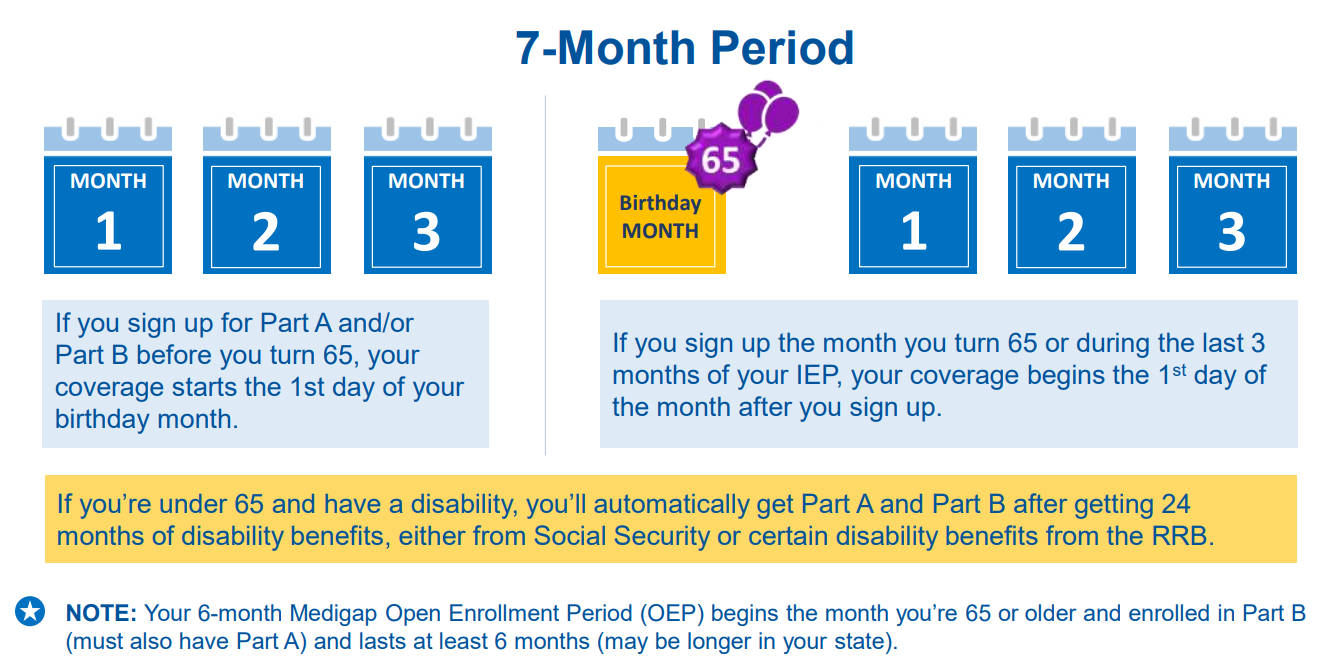

Initial Enrollment Period (IEP)

This is usually the 7-month period that begins 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

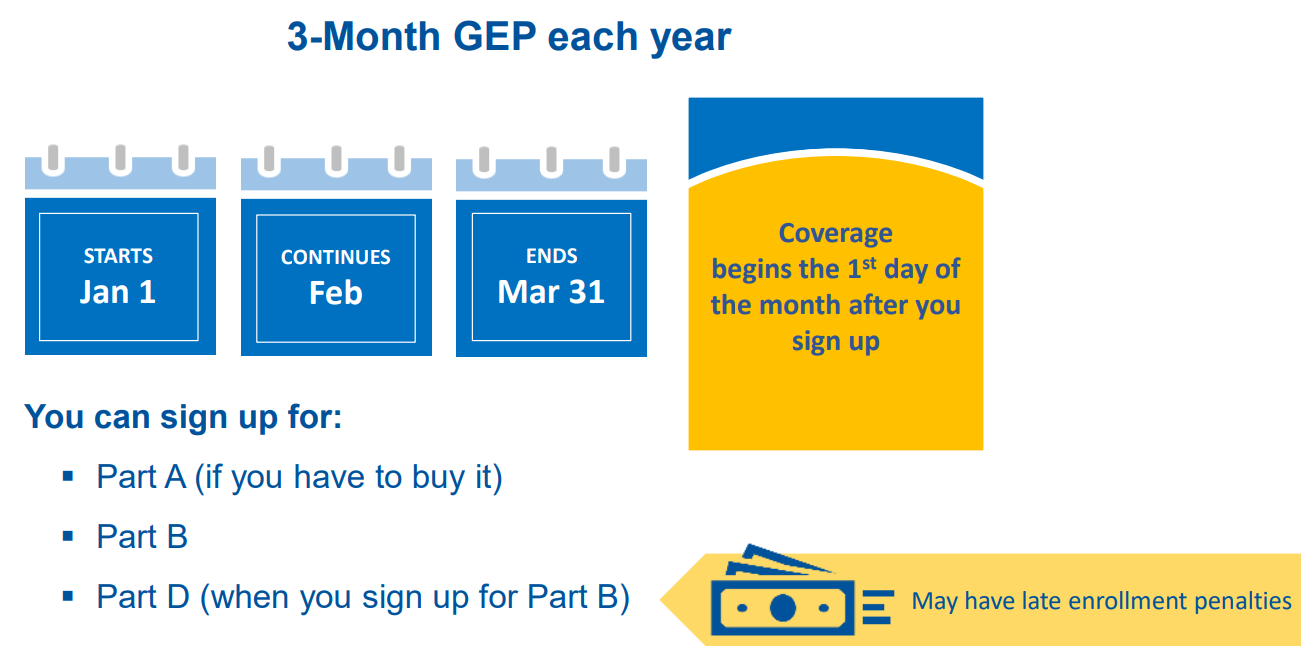

General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, you can enroll during the General Enrollment Period, which runs from January 1 to March 31 each year.

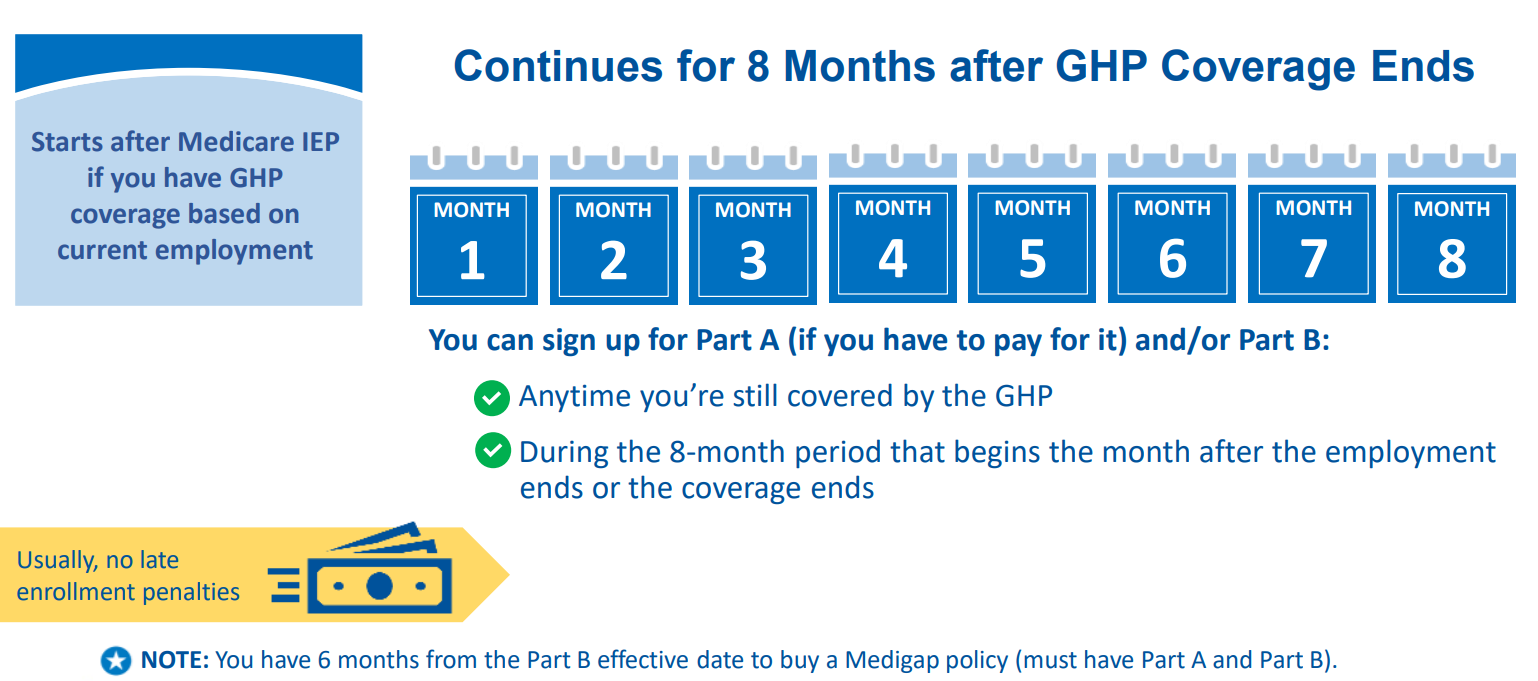

Special Enrollment Period (SEP)

You may qualify for a Special Enrollment Period if you have certain life events, such as moving, losing other health coverage, or qualifying for Extra Help.

Gather Necessary Information

Before applying, make sure you have the following information:

- Your Social Security number

- Information about any employer or union health coverage you have

- Your current health insurance information

- Information about any prescription drugs you take

Apply for Medicare

You can apply for it online, by phone, or in person.

- Online: Visit the Social Security website or the Medicare website to fill out an application.

- By Phone: Call Social Security at 1-800-772-1213 (TTY 1-800-325-0778) to apply over the phone.

- In Person: Visit your local Social Security office to apply in person.

Review Your Coverage Options

Once you’re enrolled in it, review your coverage options regularly to ensure they still meet your needs. You can make changes during certain enrollment periods if necessary.

Keep Your Information Updated

Notify them of any changes to your address, phone number, or other contact information to ensure you receive important updates and documents.

By following these steps, you can successfully apply for it and ensure you have the coverage you need for your healthcare needs.

In Summary

In conclusion, knowledge about Medicare enrollment is paramount for securing optimal healthcare coverage. Understanding eligibility criteria, the different parts of Medicare, and enrollment periods empowers individuals to make informed decisions. Gathering necessary information and applying through convenient channels streamlines the process. Regularly reviewing coverage options and keeping information updated ensures continued access to the best healthcare through them.

By navigating the enrollment process with confidence, individuals can secure comprehensive coverage tailored to their needs, promoting overall well-being and peace of mind.