Disability Benefits through Social Security

Under the Social Security Act, an individual is considered disabled if they meet the following criteria:

- They are unable to perform their previous job due to their health condition.

- They are unable to adjust to a different job as a result of their health condition.

- Their disability is either expected to last for at least a year or result in death.

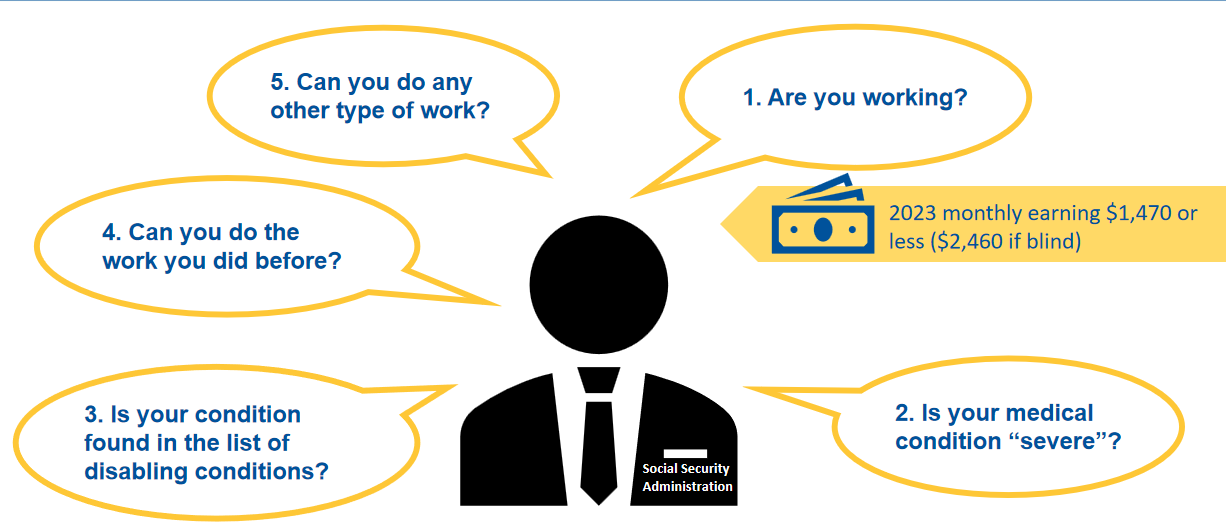

Process for Determining Disability

Below is an illustration of the process of how the Social Security Administration determines disability.

Disability Programs under Social Security

- Social Security offers disability benefits through two main programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

- These programs provide financial assistance to individuals who meet the stringent criteria for disability. They do not offer monthly cash benefits for those with partial or short-term disabilities.

- If you meet the eligibility criteria for both SSDI and SSI, you may qualify for benefits from both programs.

- Additionally, certain family members of disabled workers may also be eligible for monthly cash benefits.

What is Social Security Disability Insurance (SSDI)?

If you have insurance, Social Security offers monthly cash benefits to you and certain family members. The amount of these benefits is based on the average of your lifetime earnings. These benefits continue as long as your medical condition remains the same and you are unable to work.

Who Can Get Social Security Disability Insurance (SSDI) Benefits Based On Your Work?

Your spouse:

- If he or she is 62 or older

- At any age, if he or she is caring for your child who is younger than 16 or disabled

Your child (unmarried or adopted), or, in some cases, a stepchild or grandchild, who’s:

- Younger than 18, or younger than 19 if still in high school

- 18 or older, if he or she has a disability that started before 22 (the child’s disability must also meet the definition of disability for adults)

Qualifications of Social Security Disability Insurance (SSDI)

To qualify, you need to pass two earnings assessments:

- A “recent work” test, which varies based on your age when you became disabled.

- A “duration of work” test, demonstrating sufficient work history under Social Security.

These tests rely on your accumulation of work credits, also known as quarters of coverage. In 2023, you earn one credit for every $1,640 of income, with a maximum of four credits per year.

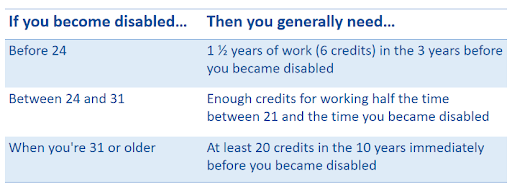

“Recent Work” Test for Social Security Disability Insurance (SSDI)

The table below outlines the requirements for the “recent work” test, which vary depending on your age and when your disability began.

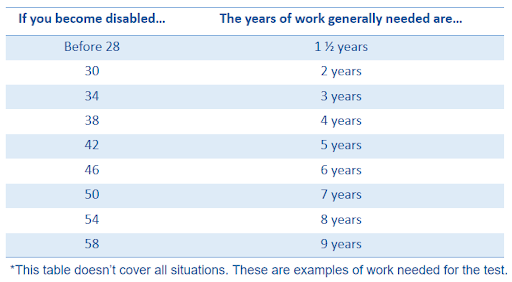

“Duration of Work” Test for Social Security Disability Insurance (SSDI)

This table illustrates the amount of work required to fulfill the “duration of work” test at different ages when disability occurs. Unlike the “recent work” test, there’s no specific time frame for the “duration of work” test. Additionally, certain visually impaired workers only need to meet the “duration of work” test.

Waiting Period for SSDI

Typically, there’s a waiting period of five complete calendar months from when your disability commenced until your SSDI benefits commence. Upon approval of your application, your initial Social Security benefit will start on the sixth full month after the onset of your disability. For instance:

- If Social Security determines your disability began on January 15, your first disability benefit would be disbursed for the month of July.

- Social Security benefits are disbursed in the month following the month for which the benefit is due, so you would receive your July benefit payment in August.

However, the five-month waiting period for cash benefits doesn’t apply to individuals receiving childhood disability benefits, or to certain individuals who were previously entitled to disability benefits within the past five years.

What is Supplemental Security Income (SSI)?

SSI is a federal program offering monthly payments to individuals with limited income and minimal resources. Eligibility for SSI are:

- 65 years or older

- completely or partially blind

- a disabled adult unable to work due to a medical condition

- a disabled child under 18 with a physical or mental impairment resulting in significant functional limitations

There are different benefits for children with disabilities.

Qualifications for Supplemental Security Income (SSI)

To be eligible for certain benefits, you need to meet these requirements:

- Your income must be limited, which includes sources like Social Security benefits, pensions, and the value of goods received from others, such as food and shelter.

- Your resources must be minimal, totaling less than $2,000 for an individual or less than $3,000 for a married couple residing together.

- You must be a U.S. citizen residing in any of the 50 states, the District of Columbia, or the Northern Mariana Islands.

NOTE: If you are not a citizen of the United States but legally residing in the U.S., you might still qualify for SSI.

Supplemental Security Income (SSI) & Medicaid Coverage

In most states, if you receive SSI, you are automatically eligible for Medicaid. This is because your SSI application also serves as a Medicaid application.

However, in some states, you need to apply for Medicaid separately through another agency and prove your eligibility. If you live in one of these states, Social Security will guide you to the appropriate office where you can apply for Medicaid.

Application of Disability Benefits

It’s important to apply for disability benefits as soon as you become disabled. Providing the following information may help speed up the application process with Social Security:

- Social Security Numbers for you and your dependents

- Proof of your age, such as your birth certificate

- Contact details (names, addresses, and phone numbers) of your doctors, caseworkers, hospitals, and clinics, along with the dates of your visits

- Names and dosages of any medications you’re taking

- Medical records from your healthcare providers, including doctors, therapists, hospitals, clinics, and caseworkers

- Results of any laboratory tests

- Summary of your work history, including the type of work you did

- Copy of your most recent W-2 form, or if self-employed, your federal tax return

It’s important not to delay your application, even if you don’t have all the required information. Social Security can help you get the necessary details. If you have railroad employment, you can contact the Railroad Retirement Board (RRB) at 1-877-772-5772 (TTY: 1-312-751-4701), or get in touch with your local RRB office.

NOTE: As part of your SSI application, you will need to disclose your income and resources to determine eligibility.

How to Apply for Disability Benefits

You have three options to apply for disability benefits:

- Apply online by visiting SSA.gov.

- Call 1-800-772-1213 or TTY: 1-800-325-0778 to schedule an appointment to file your claim in person at your nearby Social Security office.

- Visit your local Social Security office by scheduling an appointment.

The interview for disability claims usually lasts for an hour. Once you schedule an appointment, Social Security will send you a “Disability Starter Kit” to assist you in preparing for the interview. Alternatively, you can visit SSA.gov/disability for assistance.

Processing an application for disability benefits typically takes 3-5 months. You will be required to fill out several forms, including an application for Social Security benefits and the “Adult Disability Report.” You can complete the Adult Disability Report online or print it and submit a completed copy to your local Social Security office. Additionally, you will need to complete forms that gather information about your medical condition and its impact on your ability to work, as well as forms authorizing healthcare professionals to share information about your medical condition with Social Security.

What is Compassionate Allowances (CAL)?

Compassionate Allowances (CAL) serve as a swift method to identify diseases and medical conditions that automatically meet Social Security’s disability benefit criteria. These primarily encompass specific cancers, adult brain disorders, and rare disorders affecting children. CAL aids in reducing the waiting period for individuals with severe disabilities to receive a disability determination.

Social Security applies the same assessment rules to evaluate CAL conditions for both SSDI and SSI Programs. CAL conditions expedite the identification of medical conditions qualifying under the “List of Impairments” with minimal information.

There’s no distinct application or form for CAL. If you have a CAL condition, apply for benefits through the standard Social Security claims process for SSDI, SSI, or both. Social Security will expedite the review of your application, potentially resulting in a decision within weeks rather than months or years.

Social Security gathers information from various sources, including the public, advocacy groups, Disability Determination Service, medical and scientific experts, NIH research findings, and past outreach hearings on potential CAL conditions. Refer to SSA.gov/compassionateallowances/conditions.htm to access the CAL conditions list.

NOTE: Military service members receive expedited processing of disability claims from Social Security. Those disabled while serving on active duty since October 1, 2001, are eligible for this expedited process. Additionally, veterans applying for SSDI benefits receive quicker processing if the VA rates them as 100% “permanent and total” disabled. However, VA disability compensation approval doesn’t guarantee eligibility for Social Security disability, as both agencies have different disability standards.

Disability Decision

Once the Social Security Administration decides on your case, they will send you a letter with the outcome. If your application is approved, the letter will provide details on the amount of your benefit and the start date of your payments. However, if your application is not approved, the letter will explain the reasons for the decision and provide instructions on how to appeal if you disagree. You can find the available options for appeal in the document titled “Your Right to Question the Decision Made On Your Claim.“

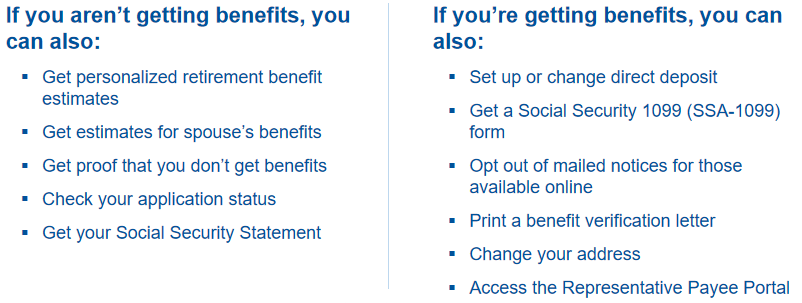

If you meet specific requirements, you can utilize your account to request a replacement Social Security card.

Meeting Eligibility Criteria for Medicare Due to Disability

You become eligible for Medicare after 30 months of disability, with two exceptions:

- 5-Month: The waiting period doesn’t affect individuals receiving childhood disability benefits or those who were previously entitled to disability benefits.

- 24-Month: The Medicare waiting period is waived for individuals disabled by ALS (Amyotrophic lateral sclerosis), also known as Lou Gehrig’s disease.

24-Month Waiting Period for Medicare

- Eligibility for Medicare due to disability involves:

- Receiving Social Security Disability Insurance (SSDI) benefits for 24 months.

- Automatic enrollment in Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) starting on the 25th month.

- During the 24-month waiting period for SSDI, alternative healthcare coverage options are available.

- You might be eligible for Medicaid or a Marketplace plan offering premium tax credits and cost-sharing reductions, reducing your out-of-pocket expenses.

Medicare Eligibility Based on Disability

- Social Security offers work incentives to aid those who are medically disabled but attempting to work.

- One such incentive is the continuation of Medicare coverage, which includes:

- Eligibility for premium-free Part A for up to 8 ½ years after returning to work.

- The option to purchase Part A coverage thereafter.

- The requirement to continue paying the Part B premium to retain Part B coverage.

- Your Medicare entitlement status changes at age 65, where:

- Any penalties incurred for late enrollment are waived.

- You gain another Initial Enrollment Period (IEP).

Medicare Options for Individuals with Disabilities

You have the option to choose from a range of Medicare plans available in your local area. These include Original Medicare, Medicare Advantage Plans, other Medicare health plans, and Medicare drug coverage. You may decide to continue with Original Medicare or select a Medicare Advantage Plan that includes drug coverage.

Coordination of Benefits

Understanding how the Coordination of Benefits works between Large Group Health Plans (GHP) and Retiree Plans is crucial for optimizing healthcare coverage and minimizing out-of-pocket expenses.

Retiree Plans

Medicare takes the primary position in covering your health insurance claims, with your retiree health coverage assuming the secondary role. This secondary coverage may address any deficiencies in Medicare coverage and could provide extra benefits such as prescription drug coverage and routine dental care. For details on how your retiree coverage interacts with Medicare, consult your plan’s benefits booklet or the summary plan description provided by your employer.

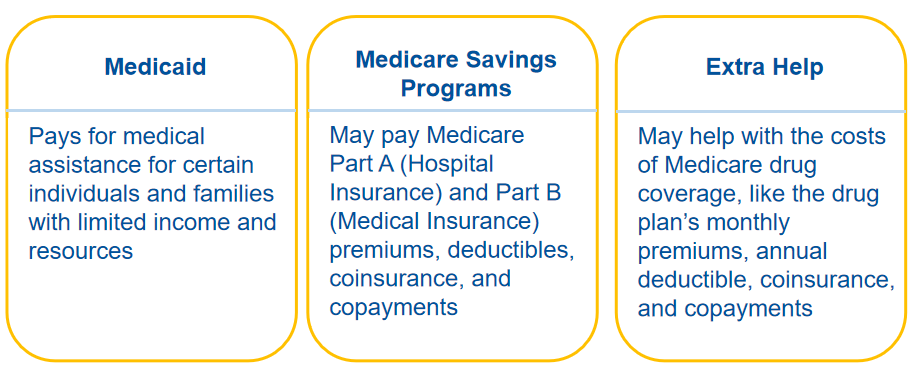

Other Programs for People with Disabilities

These programs assist individuals with disabilities who have constrained income and limited resources to cover their medical expenses. See the illustration below:

In Summary

Medicare and Social Security offer crucial support to individuals with disabilities. Social Security determines disability based on one’s inability to work due to a medical condition expected to last at least a year or result in death. Disability benefits come through Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), providing financial aid to those meeting strict criteria.

SSDI entitles you to monthly cash benefits based on your work history, while SSI offers assistance to those with limited income and resources. Medicaid coverage often accompanies SSI benefits, varying by state. Applying for disability benefits involves providing detailed information about your medical condition and work history.

Medicare eligibility typically begins 30 months after disability onset, with exceptions for specific cases like ALS. During the 24-month waiting period for SSDI, alternative healthcare options are available, including Medicaid or Marketplace plans. Work incentives are available for those attempting to work despite their disability, including continued Medicare coverage and an extended enrollment period.

When it comes to healthcare coverage, understanding the coordination of benefits between Large Group Health Plans (GHP) and Retiree Plans is vital. Medicare serves as the secondary payer in GHP scenarios, while in Retiree Plans, it is the primary coverage, supplemented by retiree health benefits.

Exploring these programs and understanding their intricacies can provide vital support for individuals navigating disability and healthcare challenges.

DISCLAIMER: Please verify the information provided here with the primary source to ensure accuracy. We strive to present information correctly. It is advisable to confirm details directly from the primary source for accuracy and reliability.