In today’s unpredictable world, where medical emergencies can arise without warning, protecting your financial stability is more crucial than ever. Hospital Indemnity Insurance emerges as a beacon of hope, offering a safety net for those unforeseen hospital stays that can drain your savings.

This comprehensive guide delves into the intricacies of Hospital Indemnity Insurance, particularly focusing on Medico’s Hospital Indemnity plan, to illuminate how it stands as an indispensable asset for safeguarding your financial health during medical crises.

Understanding Hospital Indemnity Insurance

Hospital Indemnity Insurance is specifically designed to provide cash benefits when you’re hospitalized due to an illness or injury. Its compatibility with Medicare Advantage or ACA plans sets it apart, making it a versatile addition to your healthcare coverage portfolio. Whether you’re seeking coverage for hospitalization alone or a more comprehensive plan that includes outpatient services and skilled nursing facility benefits, Medico’s Hospital Indemnity plan offers peace of mind and financial security during challenging times.

Key Features of Medico’s Hospital Indemnity Plan

- Hospital Confinement Benefit: Ranging from $100 to $600 per day, this benefit covers days 1 through 3, 6, 7, 8, 9, 10, 21, or 31, with a lifetime restoration of 60 days.

- Observation Unit Benefit: Compensates 100% of the inpatient benefit for up to 6 days per calendar year, with no restrictions on the duration of each stay.

- Emergency Room Benefit: This benefit provides $150 per day, up to four days per calendar year, for covered injuries.

- Inpatient Mental Health Benefit: This benefit offers $175 per day for up to 7 days per calendar year for covered mental or nervous disorders.

- Transportation and Lodging Benefit: Aids with $100 per day (up to $1,000) for a maximum of 10 days per calendar year, applicable when traveling at least 50 miles for treatment.

Enhancements and Optional Rider Benefits

To cater to diverse needs, its plan includes several optional rider benefits:

- Ambulance Services: $250 per day, up to four days per year, with a lifetime maximum of $2,500.

- Outpatient Therapy/Chiropractic Services: $50 per day, covering up to 30 days for outpatient therapy and five days for chiropractic services annually.

- Outpatient Surgery: Options ranging from $250 to $1,000 per day for up to two days per year.

- Skilled Nursing Facility: Provides $100 to $200 per day for up to 50 days per calendar year, with a one-time restoration of benefits.

- Lump Sum Cancer: Offers a one-time payment ranging from $1,000 to $10,000, available up to age 80.

- Urgent Care Center: $50 per day, up to four days per calendar year.

- Lump Sum Hospital Confinement: $250 to $750 per occurrence for up to three benefit periods.

Why Choose Medico’s Hospital Indemnity Plan?

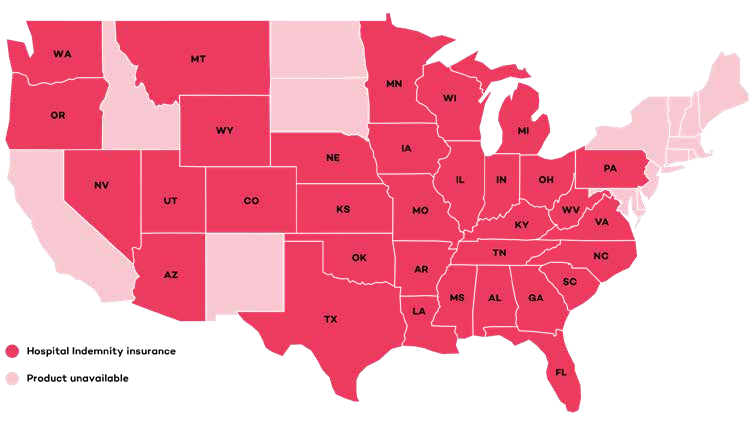

Choosing Medico’s Hospital Indemnity Plan is a proactive step towards ensuring your financial well-being. It complements existing health insurance plans and offers flexible coverage options tailored to individual needs. With benefits like a guaranteed issue period for applicants aged 60 to 79 and a simplified application process, it’s designed to offer ease and convenience. Furthermore, a household discount of 7% (excluding Pennsylvania) enhances its appeal, making it an economical choice for families.

Securing Your Financial Future

In an era where medical expenses are a leading cause of financial strain, investing in a Hospital Indemnity Insurance plan is more than just prudent; it’s essential. The Hospital Indemnity Plan stands out as a comprehensive solution that offers varied coverage options and provides the peace of mind that comes from knowing you’re protected against the unexpected. By opting for this plan, you’re not just securing your health; you’re safeguarding your savings and ensuring that a hospital stay doesn’t derail your financial stability.

Conclusion

In conclusion, as you navigate the complexities of healthcare and insurance, remember that Hospital Indemnity Insurance is your ally in maintaining financial health in the face of medical emergencies.

Medico’s Hospital Indemnity Plan, with its wide range of benefits and rider options, offers a robust solution tailored to meet the diverse needs of individuals seeking to protect themselves and their families from the unforeseen costs of hospitalization. Investing in such a plan is a testament to the foresight and responsibility we owe to our future selves and our loved ones. Feel free to reach out to one of our reliable representatives. Would you prefer to chat by phone? Give us a call at 1-888-559-0103.