Medicare Nationwide vs Local Agent?

Medicare agent selection can significantly impact the quality of your healthcare experience. With so many options, it’s important to choose someone who understands your needs and state-specific rules. This guide explains why a nationwide Medicare agent may offer broader expertise and long-term support.

When deciding to choose a Medicare Supplement, you may have questions whether to go with a local agent or a nationwide agent. In this article we build the argument of why we think a nationwide is superior.

Medicare Nationwide agents are licensed in at least 48 states throughout the country servicing thousands of clients. Medicare supplement rules differ depending on the state in which you live. For instance, California is the only state with what’s called the “Birthday Rule” which allows you to switch plans and companies of equal or lesser value within 30 days of your birthday once per year without medical underwriting. All these different rules take years to learn and memorize and our agents have become experts in any given state.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Understanding the Role of a Medicare Agent

When it comes to navigating Medicare Supplement insurance, having the right guidance is crucial. A Medicare agent is a licensed professional who helps individuals compare, select, and enroll in Medicare-related plans, including Medigap, Part D, and Medicare Advantage options. These agents are trained to understand the complexities of Medicare, which can vary not only by plan type but also by state regulations. For example, some states offer special enrollment rules such as the California Birthday Rule, allowing policyholders to switch plans annually without medical underwriting.

Whether you’re enrolling for the first time or reassessing your current coverage, a Medicare agent serves as a trusted advisor who simplifies the process, answers your questions, and ensures that you’re selecting the best plan for your needs and budget. The value of having an expert on your side becomes even more apparent as you explore the differences between local and nationwide agents.

Local vs. Nationwide Medicare Agents: Which One is Right for You?

One of the most common questions among Medicare enrollees is whether to work with a local Medicare agent or a nationwide Medicare agent. Local agents are often familiar with the immediate area, including regional providers and networks. However, their service area is typically limited, and their licenses may not cover multiple states. This can be problematic if you plan to move or have loved ones in different states who may need assistance.

In contrast, nationwide Medicare agents are licensed in dozens of states and often service thousands of clients across the country. These agents are extensively trained in the nuances of Medicare regulations in various regions, making them well-equipped to provide expert advice no matter where you live or relocate. If you’re someone who values flexibility, continuity of service, and broad expertise, a nationwide agent offers distinct advantages.

Moreover, with a nationwide agent, your relationship doesn’t end when you move. They can help you transition to new coverage without the headache of searching for a new agent in your destination state. This ongoing relationship ensures that your Medicare needs are always handled by someone who knows your history and preferences, saving time and minimizing stress.

Benefits of Working with a Licensed Nationwide Medicare Agent

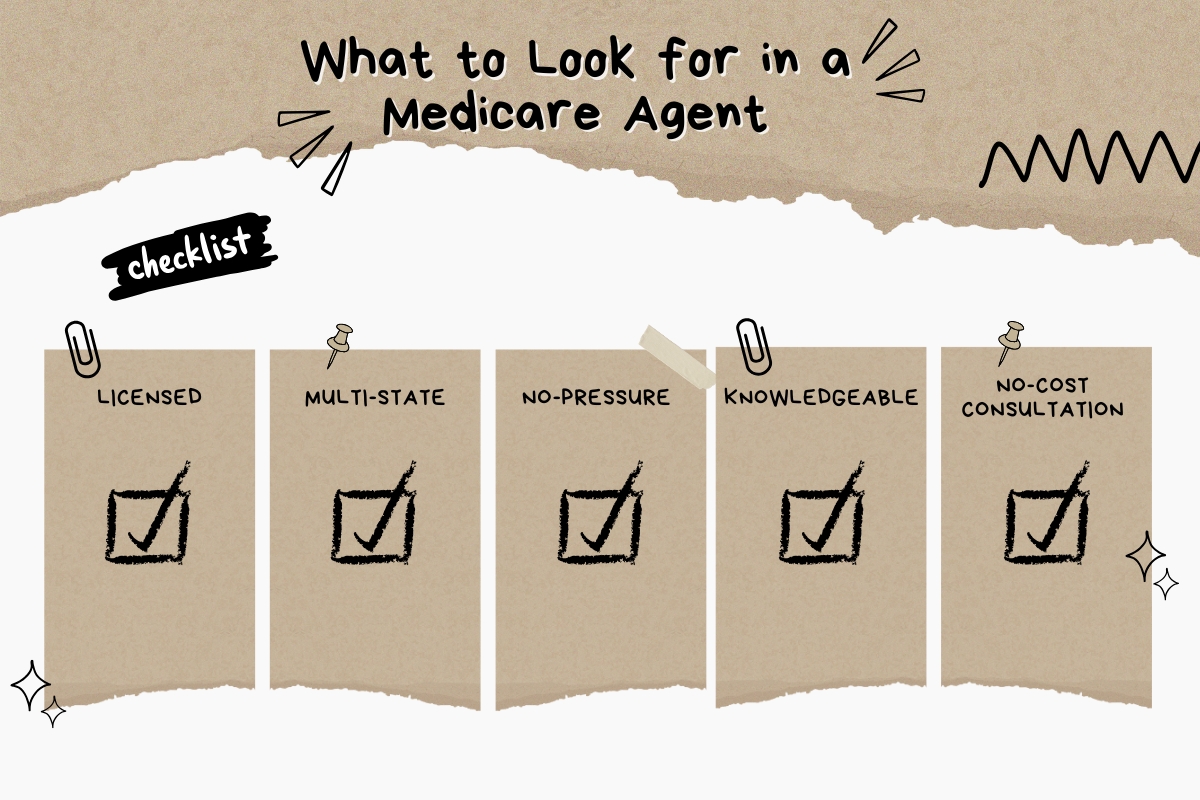

Choosing a licensed nationwide Medicare agent means choosing peace of mind. These professionals are held to high regulatory standards and are required to pass certification exams to operate in multiple states. This means you’re not just getting someone who can sell insurance, you’re getting a qualified expert who understands the rules, exceptions, and eligibility requirements across different state lines.

A nationwide Medicare agent is also more accessible for multi-state families. Whether your spouse, parent, or sibling lives in another state, the same agent can often assist the entire family. This is especially helpful for adult children helping their parents navigate Medicare.

In addition, reputable nationwide agencies often offer no-cost consultations and policy reviews, so you can evaluate your options without any pressure to commit. With access to a broader selection of Medicare Supplement plans, these agents can compare multiple insurance carriers and recommend the most affordable and comprehensive coverage tailored to your needs.

Conclusion

If you were to move states, many local agents do not have the knowledge or licenses to write you a new policy or even make suggestions on where to go. Time and time again, we get clients calling us stating that their agent isn’t licensed in the state in which they’re moving and now they have to find a new agent and build that relationship all over again.

With a Medicare Nationwide agent, you build that relationship from the beginning and this agent can “travel” with you no matter where you go.

You may have friends/relatives that you refer us to and no matter where they are we can service them whether it be to become a client or just general questions. Medicare Nationwide agents are true experts nationwide bar none.

To speak with an agent about the different plans and prices in your area, please reach out to us at 1-888-559-0103.