Here’s a video on Medicare Part B in 2024:

Medicare Part B: A Comprehensive Guide

Part B is optional, but if you rely on Medicare for primary coverage, it is strongly recommended to ensure complete coverage of your healthcare needs. Even if you have private insurance and do not rely on Medicare, you can use Part B in coordination with your coverage to reduce spending.

Inpatient care, outpatient care, home health care, durable medical equipment, and some preventative services are all covered by Medicare Part B (medical insurance).

Who is Eligible for Medicare Part B?

If you are eligible for Medicare Part A, you are eligible for Part B coverage, which is optional and carries a monthly premium for enrollees. If you are already enrolled in Social Security benefits, Medicare will deduct the Part B premium from your Social Security check. If this does not apply to you, then Medicare will bill you quarterly.

Additionally, if you don’t enroll during the initial period, you will face a Part B penalty. The Part B monthly premium will continue to increase until your eventual enrollment, should you choose to later. The premium increases by 10 percent for every year that you don’t enroll while eligible.

Special Enrollment Period

Based on your current employment or that of your spouse, a group health plan may provide medical insurance coverage for you.

In this situation, applying for Medicare Part B at age 65 may not be necessary.

You might be eligible for a “SEP” that enables you to enroll in Part B during:

- Any month you or your spouse continue to work and are still covered by the group health plan.

- The eight-month span starts the month following the termination of your group health plan coverage or the earnings it is based on.

People who were performing volunteer work (govt authorized social or otherwise) outside of the country for at least a year on behalf of a tax-exempt organization and had health insurance that covered them throughout the voluntary service might join during this SEP if they did not initially enroll in Part B or premium Part A.

Part B Late Enrollment Penalty

For as long as they have Medicare, a person who did not enroll in Part B when initially eligible may have to pay a late enrollment fee. Every 12-month period during which the individual could have enrolled in Part B but chose not to do so could result in a 10% increase in the monthly premium for Part B.

Coverage and Benefits

Part B covers many of the more expensive services that can occur during your hospital stay. This includes procedures like surgery, radiation, chemotherapy, dialysis, and diagnostic imaging, among others. Part B includes many preventive medical services such as doctor visits, ambulance rides, screenings, and diagnostic tests. It also covers preventative care like colonoscopies, mammograms, flu shots, and in some cases chiropractic care. Special Medicare drug plan is drafted in highly exclusive circumstances.

Medically Necessary Services

These are the services and supplies used to diagnose and treat medical conditions within standard medical practice. Also included are medical equipment, such as wheelchairs, hospital beds, and oxygen equipment.

Preventive Services

This refers to health care that either prevents illness or detects it at the earliest stage possible for optimal medical attention. In most cases, the patient will not have to pay anything for preventive services if your healthcare provider agrees to accept the payment amount Medicare approves for the service.

Diagnostic tests included are MRIs, CT scans, EKGs, and X-rays. Covered screenings often include pap tests, HIV screening, glaucoma tests, hearing tests, diabetes screening, and colorectal cancer screenings.

A licensed agent can help you determine if Part B fits your current needs. Connect directly with one of our agents to learn more with no obligation.

Coverage Limitations

As a general rule, as long as your care is medically essential to treat an illness or condition, Part B does not place a cap on the amount of Part B services you may obtain. There are restrictions on a few services, though. There are restrictions on how much Part B will cover occupational therapy and speech therapy in a given year, for instance.

Certain preventive services and tests, such as the annual flu vaccination, are only covered at predetermined periods. Long-term care (such as nursing home care), routine dental, vision or hearing aids, eyeglasses/ lenses, or private-duty nursing are covered only under extremely specific circumstances. Contact your agent or providers for more information.

The advantages of Part B are the same everywhere in the United States. However, the scope of medical care you receive outside of the US is highly debatable on the coverage list.

The Costing Plan

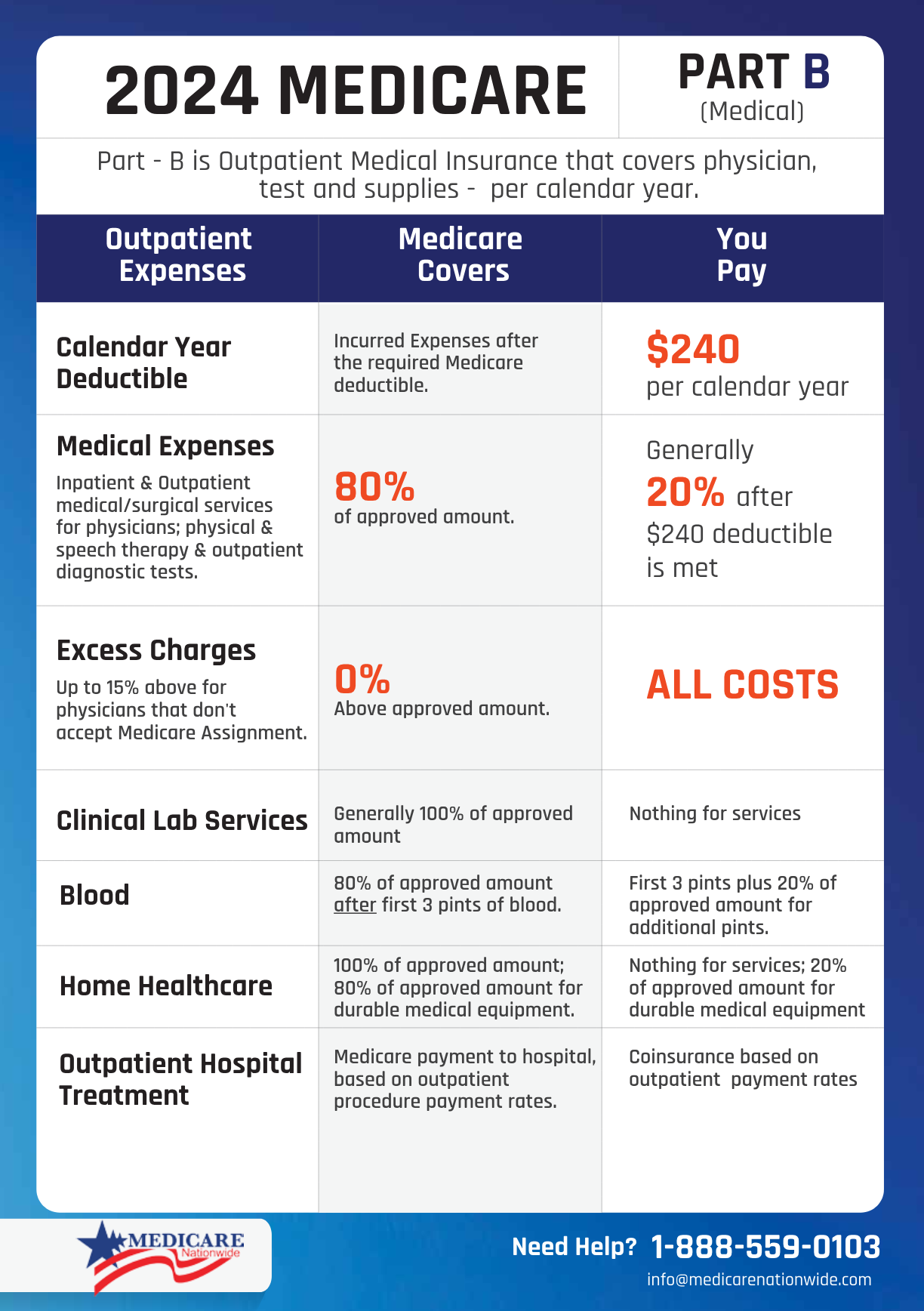

The Part B annual deductible may increase. Once this deductible is met by your healthcare provider, you will pay 20% of the Medicare-approved covered services.

In most cases, if your income exceeds $91,000 (or $182,000 for married couples), then your monthly premium will cost more. Medicare uses the modified adjusted gross income from your two years ago tax return to calculate your monthly premium.

Is Medicare Part B Worth it?

You can apply for Medicare Part A and Part B using a simple online form. Part B coverage requires a premium. Therefore you are free to decline it. Your Initial Enrollment Period (IEP), if you are eligible at age 65, starts three months before your birthday, including the month you turn 65, and ends three months after that.

Your coverage might be postponed if you opt not to enroll in Medicare Part B but change your mind later. For as long as you hold Part B, you might have to pay a larger monthly premium. For each 12-month period in which you were eligible for Part B but didn’t sign up for it, your monthly premium will increase by 10%. If you are qualified for a “Special Enrollment Period,” this does not apply to you (SEP).

You have another opportunity to enroll each year during the “General Enrollment Period” (GEP), which runs from January 1 through March 31 if you don’t sign up for Medicare Part B during your IEP. After you sign up, your coverage begins on the first of the next month.

Additional Medicare Plans for a Wholesome Health Insurance Security:

Medigap Plans: Medicare out-of-pocket costs for copayments, coinsurance, and deductibles are covered by supplemental (Medigap) insurance.

Medicare Advantage Plan: Prescription medicines and extra benefits, including vision, hearing, and dentistry, are all covered under Part A and Part B by the Medicare Advantage Plan (formerly known as Part C), which combines all of these benefits into a single plan.

Medicare Part D: Prescription drug costs are partially covered by Medicare Part D (Medicare prescription drug coverage).

If they have worked and paid Medicare taxes for a sufficient amount of time, the majority of adults 65 and older are qualified for free Medicare hospital insurance (Part A).

You can enroll in Medicare Part B medical insurance by making a monthly premium payment. Some recipients who earn more will pay a larger premium each month.

Medicare Advantage Special Needs Plans

Care management plans, a special form of coordinated care specifically created for people with special needs, are referred to as Medicare Advantage Special Needs Plans. They incorporate outpatient treatment, hospital care, doctor visits, and other outpatient care into one package. To find out more about who is qualified for a Special Needs Plan, get in touch with our experts.

In addition to Medicare eligibility, some plans may well have additional qualifying requirements. To join some plans, for instance, you may be required to be eligible for Medicaid. As long as you are qualified, you may enroll in a Special Needs Plan at any time during the year.

The specifics of things like premiums and cost-sharing fluctuate from plan to plan, just like with other Medicare Advantage plans. Pay close attention to the small print.

How to know if the Plan Covers your Needs?

Discuss your reasons for needing specific services or materials with your doctor or other healthcare professional. Find out if Medicare will pay for them. Your provider may believe that Medicare won’t cover something you require since it isn’t often covered in your circumstance.

If so, a notification will need to be read and signed. You can be required to pay for the good, service, or supply, according to the notice.

Can Part B Deny or Delay its Coverage?

If you qualify for Medicare, you cannot be denied Part B coverage due to a pre-existing condition or your medical history. Depending on when you sign up, your coverage will start at a specific time.

Your coverage will start on the first day of the month you become eligible for Medicare if you enroll as soon as your initial enrollment period opens.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

How Does Renewal of Policy Operate?

As long as you continue to pay the payment, your Medicare Part B coverage will automatically renew each year. You don’t need to take any specific action.

Conclusion

If you need help enrolling into Medicare Part B, connect with one of our independent agents to learn more. We look forward to assisting with your Medicare needs and ensuring that our clients find suitable plans and plan providers. Make a sound decision with the most updated and reliable information on Medicare. Prefer to speak by phone? We find it much more manageable. Give us a call today!

Prefer to chat by phone? Give us a call at 1-888-559-0103