What exactly is the Marketplace?

It’s a service designed to facilitate the process of shopping for and enrolling in health insurance. This can be done online, over the phone, or with in-person assistance. Through the Marketplace, individuals can compare various private health plans, considering factors such as price, benefits, and quality. Additionally, small businesses have the option to utilize the Small Business Health Options Program (SHOP) Marketplace to provide health and dental insurance for their employees.

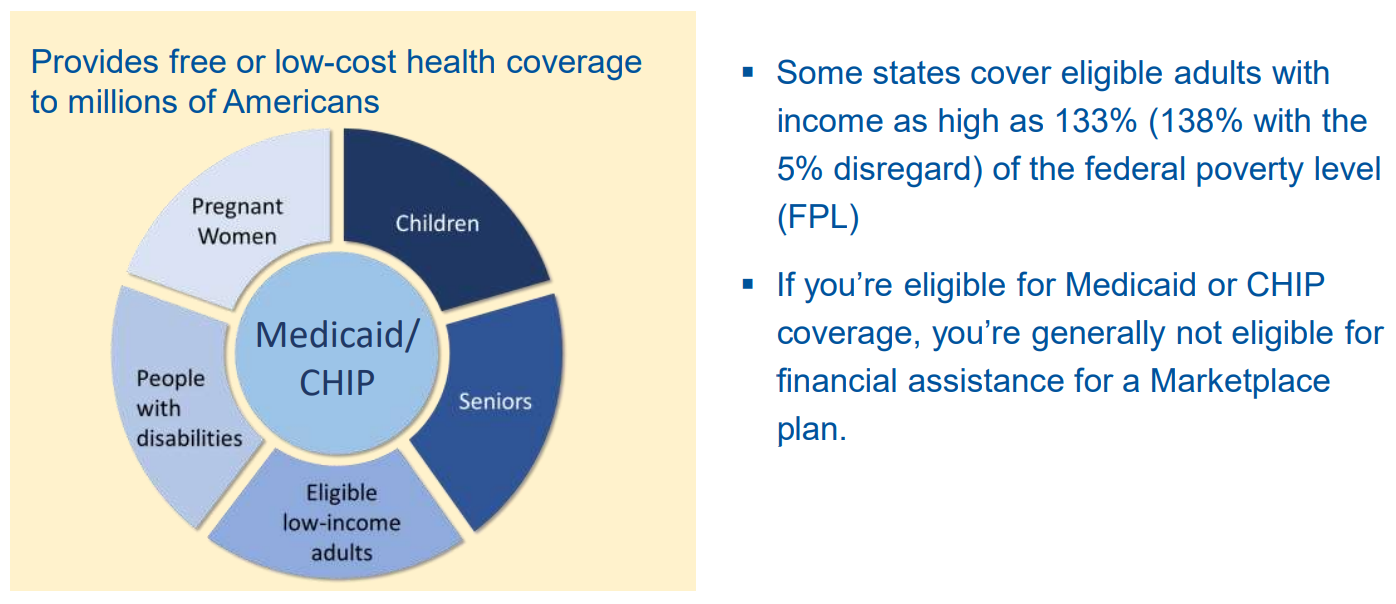

For some individuals applying for coverage through the Marketplace, they may qualify for Medicaid or the Children’s Health Insurance Program (CHIP). If eligible, their state will handle their enrollment.

The Marketplace operates through different models:

- State-based Marketplaces (SBM) manage all functions internally.

- Some states have a State-based Marketplace that utilizes the federal platform (SBM-FP).

- Federally-facilitated Marketplaces (FFM) are managed entirely by the federal government.

- Some states, even if part of the FFM for individual plans, operate their own SHOP Marketplace.

The application process is streamlined, allowing individuals to submit a single application through various channels such as online, phone, paper, or in-person. This application covers enrollment for Medicaid, CHIP, and Marketplace plans, including eligibility for premium tax credits and cost-sharing reductions. Eligible individuals may be able to enroll immediately upon approval.

Requirements for Health Insurance Companies to Sell Marketplace Plans

Health insurance providers are mandated to adhere to the following criteria for selling marketplace plans:

- Obtain state licensure and maintain good standing.

- Offer health plans that encompass essential health benefits and comply with specified cost-sharing regulations.

- Provide at least one Silver plan and one Gold plan.

- Apply consistent premium charges, regardless of whether plans are offered within or outside the Marketplace.

Marketplace Plan Obligations

Marketplace plans are required to:

- Furnish qualifying health coverage inclusive of essential health benefits.

- Adhere to predefined limits on cost-sharing, encompassing deductibles, copayments, and maximum out-of-pocket expenses.

- Fulfill specific criteria regarding nondiscrimination and network adequacy.

Essential Health Benefits

All Marketplace plans must cover the following 10 essential health benefits:

- Ambulatory patient services, such as doctor visits and clinic consultations.

- Emergency services, including ambulance assistance and initial medical aid.

- Hospitalization, encompassing surgical procedures and overnight stays.

- Pregnancy, maternity, and newborn care.

- Mental health and substance use disorder services, incorporating behavioral health treatment.

- Prescription drugs.

- Rehabilitative and habilitative services and devices, like therapy sessions, wheelchairs, and oxygen support.

- Laboratory services.

- Preventive and wellness services alongside chronic disease management, such as blood pressure screenings and immunizations.

- Pediatric services, encompassing dental and vision care.

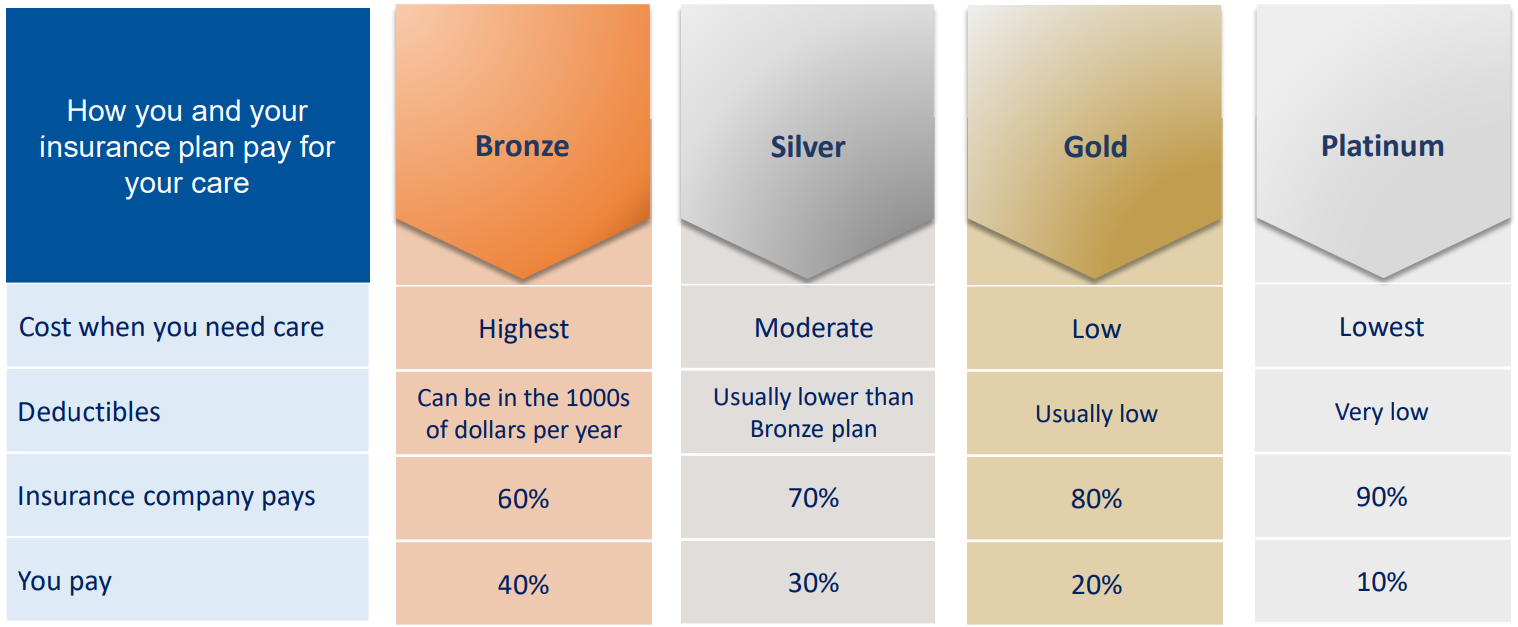

4 Health Plan

NOTE: If you’re eligible for cost-sharing reductions, you must select a Silver plan in order to access additional savings.

Catastrophic Health Plans

Catastrophic health plans are designed with high deductibles and typically lower premiums. They offer benefits such as a minimum of three primary care visits annually and certain preventive services without any out-of-pocket costs prior to meeting the deductible. These plans aim to shield individuals from significant out-of-pocket expenses.

Under this plan, you are responsible for covering all medical expenses for covered care until reaching the annual limit on cost sharing for the plan year. Eligibility for catastrophic health plans is granted to individuals under 30 upon enrollment or those qualifying for a hardship or affordability exemption.

Eligibility & Enrollment Basics

Who Qualifies for Marketplace Coverage

To be eligible, you need to:

Affordability Program: Premium Tax Credits

- Advance payments of the premium tax credit (APTC) are accessible only upon enrollment in a Marketplace plan.

- If eligible, you can choose to apply all, some, or none of the tax credits in advance to reduce your monthly expenses.

- You may qualify for the premium tax credit if your household income for the coverage year falls between 100%–400% of the Federal Poverty Level (FPL), subject to meeting other eligibility criteria.

- The American Rescue Plan extends additional savings and reduced costs to certain consumers with higher incomes. These benefits are sustained through 2025 by the Inflation Reduction Act.

- Savings may be available if your household income is below 100% of the FPL and you do not qualify for Medicaid based on immigration status, subject to meeting other eligibility requirements.

Changes in Eligibility and Tax Credits

- The amount of premium tax credit you qualify for may fluctuate during the coverage year due to changes in household income, size, or other factors.

- It’s important to promptly report any life changes to the Marketplace.

- At tax time, you’ll need to reconcile the premium tax credit based on your tax filing information with the amount received in advance.

- If you received:

- More tax credit in advance than you’re entitled to, you may owe some or all of the excess when filing your federal income tax return.

- Less tax credit in advance than you’re eligible for, you could receive the additional tax credit as a refund.

Affordability Programs: Cost-Sharing Reductions (CSRs)

If you qualify for premium tax credits, you may also be eligible for cost-sharing reductions (CSRs), referred to as “extra savings.” To qualify for CSR based on income, you need to:

- Have a household income below 250% of the Federal Poverty Level (FPL)

- Be eligible for premium tax credits

- Enroll in a Silver plan through the Marketplace

Special Enrollment Period (SEP) Starting November 2023

- Consumers eligible for advance premium tax credit (APTC) with household income not exceeding 150% of the FPL can benefit.

- This special enrollment period runs until December 2025, during which those eligible for APTC with household income not exceeding 150% of the FPL are exempt from paying premiums for a benchmark plan before APTC coverage kicks in.

- Consumers with income below 150% FPL but ineligible for APTC do not qualify for the SEP (typically, individuals aren’t eligible for APTC if their projected household income is below 100% FPL).

Special Benefits for American Indian/Alaska Natives (AI/AN)

- If you receive services from an Indian Health Care provider, you won’t incur any out-of-pocket costs.

- For incomes between 100%–300% of the FPL, you can enroll in a “zero cost-sharing” plan through the Marketplace, eliminating deductibles or copayments for covered services.

- Incomes above 300% of the FPL can enroll in a “limited cost-sharing” plan, with no out-of-pocket costs for covered services from a Marketplace plan, upon referral from an Indian Health Care provider.

- Enrollment in a Marketplace health insurance plan is open at any time, with the flexibility to change plans monthly.

- Tribal and non-tribal members should enroll in separate plans to maximize potential savings.

Applying for Coverage

Enrollment Options

- You have the opportunity to enroll in or modify Marketplace plans during either the annual Open Enrollment Period (OEP) or a Special Enrollment Period (SEP).

- Exception: American Indian/Alaska Native (AI/AN) individuals can enroll in or change plans at any time throughout the year.

- If you miss a Medicare enrollment period and lose Medicaid eligibility due to special circumstances, there’s an SEP to ensure continuous coverage.

- In federally-facilitated Marketplaces, the OEP runs from November 1 to January 15.

- Certain life events can trigger eligibility for a SEP, such as losing health coverage, moving, getting married, or having a baby/adopting a child.

Marketplace Application Process

You can apply for Marketplace coverage through HealthCare.gov (English) and CuidadoDeSalud.gov (Spanish), select Marketplace plan issuers, the Marketplace Call Center, Marketplace enrollment assisters, Marketplace-registered agents and brokers, or via a paper application. Language assistance is available through interpreters, Call Center support, print materials, and online resources.

Marketplace Call Center

- The Marketplace Call Center assists individuals in federally-facilitated Marketplaces (FFMs) or State-based Marketplaces on the Federal platform (SBM-FP).

- Customer service representatives are accessible 24/7 and provide support with eligibility, enrollment, and referrals in both English and Spanish, with oral interpretations available in over 240 additional languages.

- SBMs have their own dedicated call centers.

Steps for Applying on HealthCare.gov

- Create a Marketplace account.

- Prepare for the application process.

- Receive “Eligibility Results” promptly.

- Enroll in health coverage.

Getting Assistance

Various resources are available to aid with applying and enrolling in health insurance, including Navigators, Certified Application Counselors, and Agents and Brokers.

Marketplace Coverage

Your Monthly Premium

- To activate coverage, ensure you pay the initial month’s premium directly to your insurer before the plan’s deadline.

- Monthly premium payments are necessary to maintain coverage; failure to pay could result in loss of coverage.

- Marketplace plans accept various payment methods including paper check, cashier’s check, money order, electronic fund transfer (EFT), and general-purpose prepaid debit cards. Some plans may also allow online, credit card, or debit card payments.

Reporting Life Changes

Update your Marketplace application for changes such as income adjustments, and household modifications (like a new member or a dependent obtaining other coverage). Certain changes may trigger a Special Enrollment Period (SEP) for adjusting your plan or impact your eligibility or savings. Neglecting to report life changes might result in missing out on potential savings or facing payment obligations during tax filing. Update your application online through your HealthCare.gov account, by contacting the Marketplace Call Center, or by seeking local assistance.

Canceling Marketplace Coverage

- To cancel coverage for specific individuals on your application, contact the Marketplace Call Center, typically for termination the day after you intend to end coverage. Note that in some instances, coverage may not cease immediately, such as when remaining household members qualify for a SEP and need to re-enroll.

- To cancel coverage for everyone on the application, log in to your HealthCare.gov account or contact the Marketplace Call Center. You can opt for immediate termination or schedule it for a future date.

Marketplace Appeals

You have the right to appeal Marketplace decisions if:

- You’re deemed ineligible for advance payments of the premium tax credit (APTC).

- You qualify for APTC, but the allocated amount is incorrect.

- You’re not eligible for a Special Enrollment Period (SEP).

- You’re deemed ineligible to purchase a Marketplace plan or choose a Catastrophic plan.

- You’re not eligible for an exemption from the health insurance requirement (individuals aged 30 or older need an exemption to enroll in a Catastrophic health plan).

Health Coverage Options

Here are other types of qualifying health coverage:

- Many individual plans are purchased outside of the Marketplace, as long as they meet qualified health plan standards.

- Medicare Part A (Hospital Insurance) or coverage under a Medicare Advantage Plan (Part C) through a parent’s plan.

- Most student health plans (check with your school to confirm).

- TRICARE coverage.

- Plans obtained through the Small Business Health Insurance Program (SHOP) Marketplace.

- Health coverage for Peace Corps volunteers.

- Specific types of veteran health coverage provided by the Department of Veterans Affairs.

- Any individual insurance plan that has been “grandfathered” since March 23, 2010, or earlier.

- Coverage under the Department of Defense Non-Appropriated Fund Health Benefits Program.

- Refugee Medical Assistance.

- State high-risk pools for plan or policy years commencing on or prior to December 31, 2014.

Medicaid/CHIP

Marketplace & Medicaid/CHIP Evaluation and Determination

After you submit a Marketplace application, your Medicaid/CHIP eligibility will be assessed. If eligible, your details will be securely sent to your state’s agency. In some states, final Medicaid eligibility is determined by the state agency. If referred:

- For assessment, you’ll receive instructions on the next steps.

- For determination, you’ll get enrollment info or a notice for required details.

- If ineligible, you’ll be assessed for Marketplace coverage, possibly with financial assistance.

Marketplace Redetermination

Your state may initiate the renewal process to verify your continued eligibility for Medicaid or Children’s Health Insurance Program (CHIP). You will be contacted if additional information is needed. If your state finds you no longer qualify, you may lose your Medicaid or CHIP coverage.

You may be eligible for health coverage through the Marketplace with savings if you or members of your household:

- Previously had Medicaid or CHIP coverage but lost it.

- Currently have Medicaid or CHIP coverage but are expected to lose it.

- Applied for Medicaid or CHIP coverage through your state agency and were denied.

- Applied for coverage through the Marketplace and were deemed potentially eligible for Medicaid or CHIP coverage, but your state determined you (or household members) do not qualify.

The Marketplace & Medicare

If you’re approaching 65 and on Marketplace coverage, it’s crucial to grasp the advantages of enrolling in Medicare when you’re eligible. Missing your Initial Enrollment Period or having job-based coverage could lead to pricier premiums. Also, Medicare eligibility typically disqualifies you from Marketplace financial aid.

Other Considerations

- Marketplace plans may not cover claims that would typically be covered by Part B if you are eligible but did not sign up.

- Delaying Medicare enrollment may result in penalties, and if Medicare coverage is retroactively terminated, you may be required to repay any claims Medicare paid during that period.

- Opting for Marketplace coverage instead of Medicare may not offer significant benefits.

- If you already have Medicare, you likely cannot enroll in the Marketplace.

Job-based Coverage & the Marketplace

- Many individuals receive health care coverage through their employer or a family member’s employer.

- If you have access to coverage through your employer, you may not be eligible for cost-sharing reductions or premium tax credits in the Marketplace, unless your employer’s coverage does not meet certain standards or is considered unaffordable.

Short-term, Limited-Duration Insurance (STLDI)

STLDI offers short-term coverage for coverage gaps or transitions between health plans. It doesn’t follow Marketplace rules or count as qualifying health coverage. STLDI can deny coverage for pre-existing conditions, have yearly coverage limits, and may not cover essential health benefits. You can’t get tax credits or cost-sharing reductions with STLDI. Losing STLDI doesn’t qualify you for a Special Enrollment Period for Marketplace coverage, even if you end the plan or terminate it yourself.

Small Business Health Options Program (SHOP)

The Small Business Health Options Program (SHOP) is designed for small employers seeking to offer health and/or dental insurance to their staff. Typically catering to businesses with 1-50 employees, SHOP plans are accessible through various channels such as issuers, agents, and brokers.

Eligible small employers have the flexibility to determine their group’s annual Open Enrollment Period (OEP) and can provide SHOP coverage to employees at any time during the year.

Additionally, the Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is available for small employers who do not provide health coverage to assist with medical expenses. This arrangement can aid in covering household healthcare expenses, including monthly premiums for qualifying health coverage, and may affect the eligibility for premium tax credits.

For those preferring individual coverage, Individual Coverage Health Reimbursement Arrangements (HRAs) offer an alternative to traditional group health plans. Individuals enrolled in individual health insurance coverage, such as through the Marketplace, or Medicare Part A and Part B, or a Medicare Advantage Plan, can utilize an individual coverage HRA to reimburse medical expenses like premiums and out-of-pocket costs.

However, eligibility for financial assistance through the Marketplace is contingent upon the plan’s affordability and opting out if it fails to meet minimum standards. Prior to applying through the Marketplace, employees can utilize the HRA tool for an estimate of their individual coverage HRA’s affordability.

In Summary

The Marketplace serves as a pivotal platform for individuals and small businesses to access and enroll in health insurance plans, offering a range of options and assistance. From Medicaid and CHIP eligibility to premium tax credits and cost-sharing reductions, the Marketplace aims to make healthcare coverage more accessible and affordable. With streamlined application processes, diverse coverage options, and avenues for assistance, it’s a vital resource for navigating the complexities of healthcare enrollment.

Whether through individual plans, employer-sponsored coverage, or specialized programs like SHOP and HRAs, the Marketplace endeavors to ensure that everyone has the opportunity to secure essential health coverage tailored to their needs.

DISCLAIMER: Please verify the information provided here with the primary source to ensure accuracy. We strive to present information correctly. It is advisable to confirm details directly from the primary source for accuracy and reliability.