During the MA OEP, beneficiaries can:

- Enroll in a new Medicare Advantage plan

- Change from one Medicare Advantage plan to another

- Disenroll from a Medicare Advantage plan and return to Original Medicare

- Enroll into a Medicare Supplement

- Join a Medicare Prescription Drug Plan (Part D)

It’s important to note that the MA OEP is separate from the Annual Enrollment Period (AEP), which is the time when all Medicare beneficiaries can make changes to their coverage for the following year.

Many beneficiaries don’t realize how much flexibility they actually have during the OEP. You may be able to switch to a MA plan that better fits your current prescription needs or offers added perks like dental and vision coverage. These adjustments can lead to better outcomes and greater satisfaction with your overall coverage.

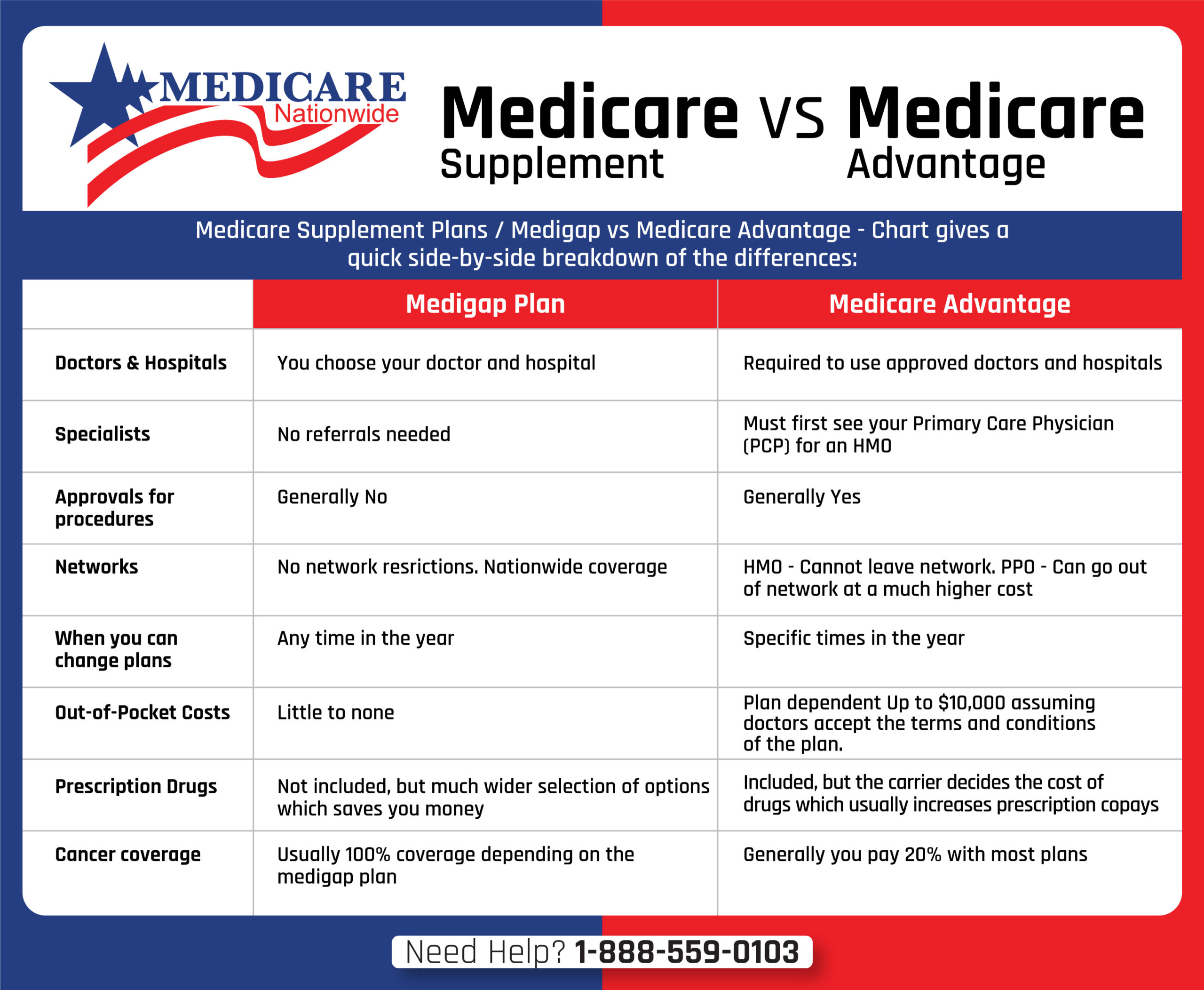

Here are a few examples of scenarios where Medicare beneficiaries may have benefited from switching from Medicare Advantage to Original Medicare with a Medicare supplement:

- Joe was diagnosed with cancer. He needs to get a MRI. Joe must first go to his PCP to then get referred to a specialist who then orders the MRI. This process has taken 3 weeks. To add to it, he doesn’t like the facility, but it’s his only option based on his plan’s limitations.

-

Mary is enrolled in a Medicare Advantage plan with a zero premium, but she finds that the plan’s provider network is very limited, and she is unable to find a provider who accepts her plan in her area. She decides to switch to Original Medicare with a Medicare supplement so that she can see any provider that accepts Medicare.

- John is enrolled in a Medicare Advantage plan with a zero premium, but he has high medical expenses due to a chronic condition. He finds that the out-of-pocket costs for his plan are still too high, even with the plan’s maximum out-of-pocket limit. He decides to switch to Original Medicare with a Medicare supplement so that he can take advantage of the plan’s lower out-of-pocket costs.

- Sue is enrolled in a Medicare Advantage plan with a zero premium, but she frequently travels internationally for extended periods of time. She finds that the coverage for international travel offered by her Medicare Advantage plan is very limited and does not provide the level of protection that she needs. She decides to switch to Original Medicare with a Medicare supplement so that she can have more comprehensive coverage for emergency medical care while traveling.

Why the Open Enrollment Period Matters

The open enrollment period is a critical time for Medicare beneficiaries to reassess their healthcare needs and make strategic plan adjustments. Unlike the Annual Enrollment Period (AEP) in the fall, the Medicare Advantage Open Enrollment Period—from January 1 to March 31—specifically allows individuals already enrolled in a Medicare Advantage plan to make a one-time change.

During this open enrollment period, you can switch to a different Medicare Advantage plan or return to Original Medicare and add a standalone Part D prescription drug plan. This flexibility can be especially helpful if your current plan’s provider network, cost-sharing structure, or extra benefits no longer meet your needs.

Taking action during the open enrollment period can prevent you from being locked into a plan that may not align with your health or financial situation for the rest of the year. Be sure to compare coverage options, review any recent plan changes, and contact a licensed agent if you need help evaluating your choices during this important open enrollment period.

To set an appointment with us to speak about your options, click here.

Conclusion

The Medicare Advantage Open Enrollment Period is an annual event that allows Medicare beneficiaries to review their current coverage and make changes to their Medicare Advantage plans or switch back to Original Medicare. There are a few reasons why Medicare beneficiaries may decide to switch away from a Medicare Advantage plan that has a zero-dollar premium at the time and switch to Original Medicare with a Medicare supplement, such as a limited provider network, high out-of-pocket costs, lack of coverage for certain services, or better coverage for international travel. By carefully considering their needs and comparing their options, Medicare beneficiaries can choose a coverage option that meets their needs and provides the best value.

Making informed decisions about your healthcare coverage can greatly impact both your finances and peace of mind. For many individuals, this time of year provides a valuable opportunity to evaluate their current plan benefits, provider access, and out-of-pocket costs. If your current coverage no longer suits your lifestyle or medical needs, it may be the right moment to consider alternatives.

To download a copy of the “Understanding Medicare Advantage and Medicare Drug Plan Enrollment Periods” packet, click here.

If you’d like to chat about your options, give us a call at 1-888-559-0103