DISCLAIMER: The information provided in this carrier review is for general information purposes only. Discounts and offers may vary by state and may not be fully detailed in this article found on our website. For more information on the discounts available in your state, please contact us at 1-888-559-0103.

Dental insurance helps pay for dental care costs, like cleanings, fillings, and X-rays. Medicare doesn’t cover most dental services, like routine cleanings or dentures. Dental insurance works like other insurance—by paying a part of your dental bills. It covers services like check-ups, emergency treatments, and fillings. You’ll either pay the dentist directly or get reimbursed for covered costs.

Mutual of Omaha dental insurance helps cover the cost of many dental services. There’s no waiting period, so you can use it right away for cleanings, exams, fillings, extractions, crowns, dentures, and more. You can also add vision benefits for eye exams, glasses, and lenses. Choose from two plans to find the best option for your budget and needs.

When Should I Consider Dental Insurance?

You should consider individual dental insurance if:

- You’re a senior on Medicare and need dental care (since Medicare doesn’t cover it).

- You’re retired and no longer have dental coverage from your employer.

- You’re self-employed and need your own dental insurance.

- You want to switch to a plan that better fits your needs.

Why Should I Choose Mutual Omaha?

If you’re looking for dental insurance, Mutual of Omaha offers a great option through its DenteMax Plus dental network. This network includes over 400,000 dental provider locations across the United States, making it easy to find a dentist near you. The network includes dentists from DenteMax, United Concordia Dental, and Connection Dental. If you need to find a dentist, you can visit dentistsforme.com/mutualofomaha.

How the Provider Network Works

Mutual of Omaha partners with DenteMax Plus, which is a large national network. The network is updated weekly to make sure the information is always accurate. If you have a dentist you love but they’re not in the network, you can even nominate them by calling the customer service center at 855-218-1466. However, please note that in North Carolina, only the DenteMax and Connection Dental networks are available.

Using Out-of-Network Providers

If you decide to see a dentist who is not in the DenteMax Plus network, the charges are paid at the 80th percentile of the average cost of dental services in your area. This means that Mutual of Omaha will pay a large part of the bill, but you will have to pay the remaining difference.

For Mutual Dental ProtectionSM, the amount Mutual of Omaha will pay is limited to the in-network discounted fee schedule. This means the dentist might charge you the remaining balance, and you’ll need to pay it.

Vision Benefit Optional Rider

Did you know you can add a vision benefit rider to your dental insurance? This optional rider helps pay for eye exams, glasses, and contacts. Here’s what it covers:

- Eye exam: Up to $50 every year (with no waiting period)

- Eyeglasses or contact lenses: Up to $150 every two years (after a six-month waiting period)

Please note that this vision benefit is not available in Maryland and Washington. However, in New Mexico, you can get up to $150 every calendar year for eyeglasses or contacts.

Multi-Policy Dental Discount

If you have both a Mutual of Omaha dental policy and a Mutual of Omaha or affiliate Medicare supplement policy, you could get a 15% discount on your dental premium. To qualify, the dental application must be signed after your Medicare supplement application, and within 30 days after the Med supp issue date.

Keep in mind that this discount is not available in Washington.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Mutual of Omaha Dental Insurance Plans

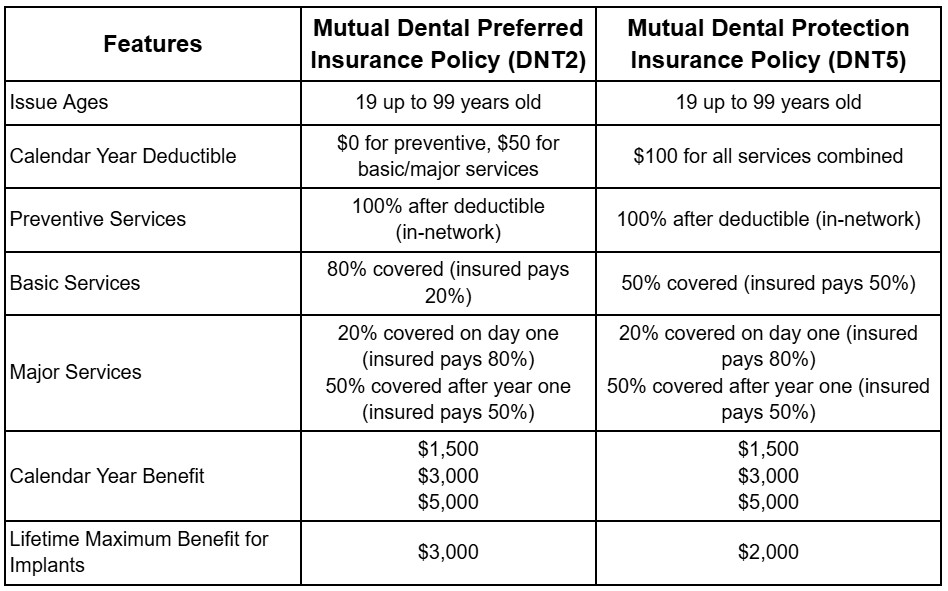

When selecting a dental insurance plan, it’s important to compare the features and benefits of each option. Below, we compare two of Mutual of Omaha’s dental insurance plans: Mutual Dental Preferred and Mutual Dental Protection. Both plans offer great coverage, but there are some key differences in terms of costs and benefits.

Issue Ages

Both plans are available for individuals aged 19 to 99, ensuring that people of all ages can take advantage of the dental coverage.

Calendar Year Deductible

Mutual Dental Preferred (DNT2) offers great value with no deductible for preventive services, like cleanings and check-ups. There is a $50 deductible for basic and major services, which helps keep your costs lower. On the other hand, Mutual Dental Protection (DNT5) requires a $100 deductible for all services combined, including preventive, basic, and major treatments. This means you pay a higher deductible, but it covers all services under one amount. Both plans help you save on dental care, but the deductible amounts differ.

Preventive Services

Both the Mutual Dental Preferred (DNT2) and Mutual Dental Protection (DNT5) plans cover important preventive services like two cleanings per year and X-rays. After you meet your deductible, both plans will cover 100% of the costs for in-network providers, meaning you won’t have to pay anything for these services. This makes it easy to stay on top of your dental health without worrying about extra costs.

Basic Services

Basic services include essential treatments like fillings, simple extractions, and emergency treatment. After meeting the deductible, here’s how the plans cover these services:

- Mutual Dental Preferred (DNT2): Pays 80% for in-network providers, meaning you pay 20%.

- Mutual Dental Protection (DNT5): Pays 50% for in-network providers, meaning you pay 50%.

Major Services

Major services include important treatments like crowns, dentures, bridges, implants, root canals, periodontics (gum disease treatment), and surgical extractions. Both plans have no waiting period for these services, so you’re covered right away. After meeting the deductible:

- Mutual Dental Preferred (DNT2): Pays 20% on day one, and this coverage increases to 50% after one year.

- Mutual Dental Protection (DNT5): Pays 20% on day one, with coverage increasing to 50% after one year.

Both plans offer the same coverage for major services, with an increase in benefits after one year of coverage.

Calendar Year Benefit

This is the maximum amount each plan will pay for covered services in one calendar year. The options are $1,500, $3,000, and $5,000.

Lifetime Maximum Benefit for Implants

Each dental insurance plan has a maximum amount it will pay for dental implants. With Mutual Dental Preferred (DNT2), the plan will cover up to $3,000 for implants, helping you with the cost of this important procedure. On the other hand, Mutual Dental Protection (DNT5) will cover up to $2,000 for implants. This means the DNT2 plan offers more coverage for dental implants, which can help you save more money.

Plan Summary Comparison

Which Plan is Right for You?

- Mutual Dental Preferred (DNT2): This plan offers a lower deductible for preventive services and pays more for basic services. It’s ideal if you expect to need a higher level of coverage for basic dental treatments and implants.

- Mutual Dental Protection (DNT5): This plan has a higher deductible but offers flexibility in coverage, with a slightly lower implant benefit. It may be a better option for those who prefer to pay a single deductible for all services.

Choose the plan that best fits your needs, based on the services you expect to use most.

Conclusion

Dental health is an important part of overall well-being, and Mutual of Omaha offers dental insurance plans that help cover the costs of essential treatments. Whether you need preventive care like cleanings and exams or more complex services like crowns and implants, Mutual of Omaha has a plan to fit your needs. With the option to add vision coverage and savings through a multi-policy discount, these plans provide great value.

Choosing the right dental insurance is simple. Consider your needs and budget, then choose between Mutual Dental Preferred and Mutual Dental Protection. Both plans offer great coverage, with different deductibles and coverage options to suit your unique situation.

If you’re ready to take the next step in protecting your dental health, Mutual of Omaha can help. Contact us today, and we will guide you through selecting the perfect plan for you. You can reach out by phone at 1-888-559-0103, or chat with us directly. Start taking care of your smile today!