MCO & D-SNP plans are two important types of Medicare Advantage options designed to support individuals with specific healthcare needs. These plans often combine medical, prescription, and sometimes additional support services. Understanding their differences can help you choose the right coverage for your situation.

What’s the Typical Setup for MCO and D-SNP Alignment?

Let’s start with the basics. Medicaid Managed Care Organizations (MCOs) are companies contracted by state governments to manage Medicaid services, covering costs like doctor visits or long-term care for low-income individuals.

Dual Eligible Special Needs Plans (D-SNPs) are a type of Medicare Advantage plan (an alternative to Original Medicare) designed for people with both Medicare and Medicaid, focusing on coordinated care.

State Medicaid Agency Contracts (SMACs) are agreements with the Centers for Medicare & Medicaid Services (CMS) that set integration rules.

In most states with Medicaid managed care (28 states), alignment means the same or related company handles your Medicare and Medicaid, simplifying care. Options include:

- Coordination-Only (CO) D-SNPs: Basic coordination with separate systems.

- Highly Integrated Dual Eligible (HIDE) SNPs: More integrated services.

- Fully Integrated Dual Eligible (FIDE) SNPs: Full merging of benefits.

Many states use default enrollment (automatic enrollment in an MCO’s D-SNP) or aligned enrollment (choosing a linked Dual Eligible Special Needs Plan). Where choices exist, shopping around for carriers can offer different benefits or networks, impacting state defaults.

Why This Matters: A Simple Example

Imagine you’re 68, using Medicare for hospital stays and Medicaid for extra help. Without alignment, you juggle two companies, risking missed care. Alignment unifies this, but if your state allows choice, you might prefer a carrier with a better doctor network over the default plan.

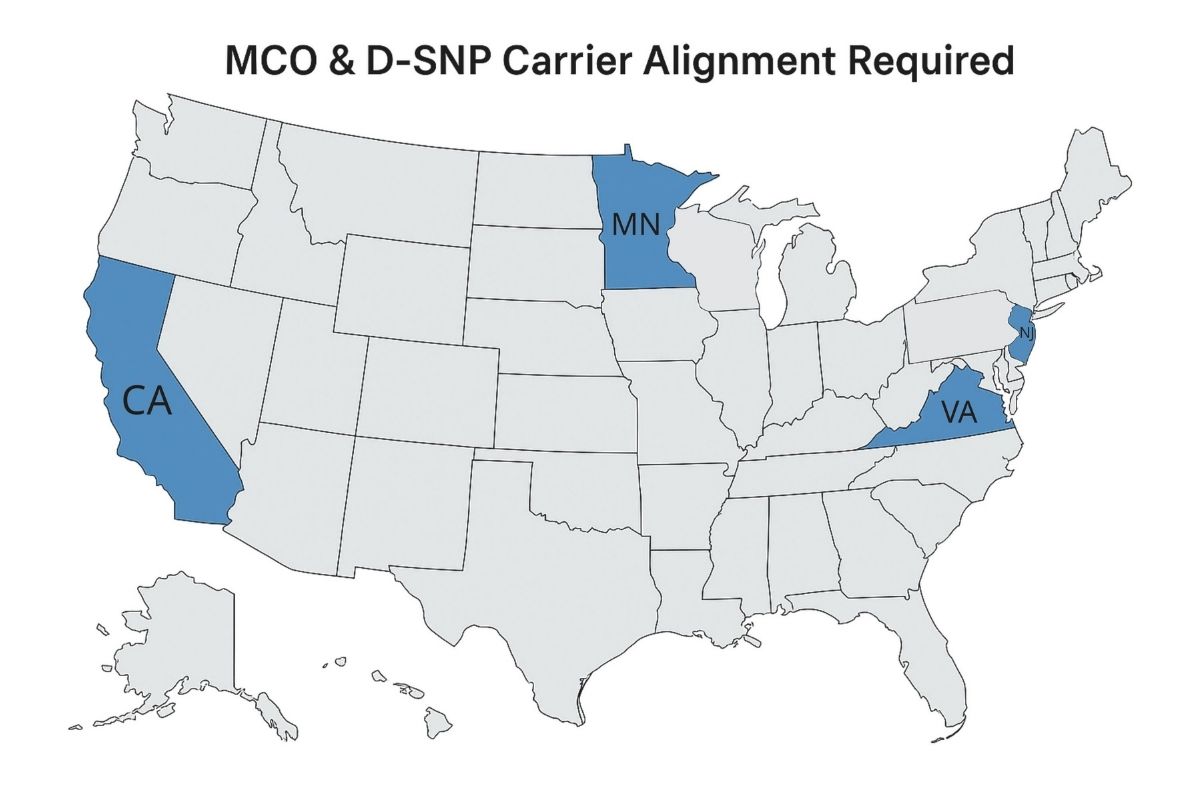

States That Stand Out and How They Differ

Not all states align the same way. Here’s how they vary, with shopping considerations based on known options:

- Alaska, Illinois, New Hampshire, Vermont: No D-SNPs; they use fee-for-service Medicaid (state pays providers directly). You’re automatically enrolled in Medicaid, and no Dual Eligible Special Needs Plans are available. Shopping is limited to Original Medicare or standalone Medicare Advantage plans.

- California: Mandates Exclusively Aligned Enrollment (EAE) from 2025, auto-reassigning unaligned Dual Eligible Special Needs Plans members to their MCO’s Medicaid plan. Example: If defaulted to Blue Shield D-SNP, you can’t shop for an unaligned plan; you’re locked into the MCO network.

- Virginia: Requires EAE for Full Benefit Dual Eligibles (FBDE) (those with full Medicaid) from January 1, 2025, moving unaligned to the D-SNP MCO’s plan, focusing on long-term services and supports (LTSS) (like home care) and claims coordination. Example: Defaulted to Anthem Dual Eligible Special Needs Plans with Aetna Medicaid? You must switch to Anthem Medicaid, with no unaligned options.

- Wisconsin: Uses default enrollment into Dual Eligible Special Needs Plans linked to Medicaid HMOs with an opt-out. Example: Defaulted to Dean Health Plan D-SNP, but you can opt out and choose another Dual Eligible Special Needs Plan or Original Medicare if available.

- Washington: Uses a managed fee-for-service model with health homes (care teams) instead of MCO alignment. Example: Default is state-run care; shopping for a Medicare Advantage plan is an option if available locally.

- Minnesota: Offers FIDE SNPs with full integration, including LTSS and behavioral health. Example: Defaulted to UCare FIDE SNP, but you can shop for another FIDE SNP like HealthPartners if it fits your needs.

- New Jersey: Runs FIDE SNPs with a single card and appeals. Example: Defaulted to Horizon BCBS FIDE SNP, but you can explore other FIDE SNPs like AmeriHealth if preferred.

Why the Differences? Unraveling the Web of Regulations

Healthcare is split between federal Medicare (national rules) and state-run Medicaid (tailored programs), creating a regulatory web. The Bipartisan Budget Act of 2018 pushed for better integration after data showed dual eligibles (19% of Medicare enrollees, 34% of spending) faced $300 billion in annual fragmentation costs—41% have behavioral health needs, 40% need LTSS. States differ due to:

- Budgets: Alaska can’t fund MCOs, sticking to fee-for-service.

- Needs: Minnesota’s LTSS focus suits its rural elderly.

- Politics: Washington prefers public models over private MCOs.

Think of it like a national road trip—federal rules pave the highway, but states choose detours based on local needs. Enhanced integration was pushed to cut costs, improve health (e.g., fewer hospital readmissions), and ease navigation for those with low health literacy, but states adapt based on resources.

Pros and Cons of Changing to Aligned Systems

Here’s what to consider when deciding between state defaults and shopping where options exist:

General Situation

| Pros | Cons |

| Easier care coordination with one team | Risk of losing your preferred doctor |

| Fewer billing mix-ups | Confusion about switching plans |

| Option to shop for better networks | Limited choices in mandatory states |

State-Specific Situations

| State | Pros | Cons |

| California | Unified care with EAE | No choice to shop unaligned plans |

| Virginia | Strong LTSS and claims support | No unaligned shopping options |

| Wisconsin | Flexibility to opt out and shop | Default may not match preferences |

| Washington | Personalized health home care | No D-SNP shopping |

| Minnesota | Comprehensive FIDE SNP benefits | Shopping limited to FIDE options |

| New Jersey | Unified care with shopping choice | Network changes with new carriers |

Examples to Learn From

Mishandling Your Options

- Pennsylvania Mishap: A 72-year-old was auto-placed with Company A Dual Eligible Special Needs Plans. PA allows choice among A-J (10 carriers), but they stayed with A, missing a chance to shop for a better network, as alignment isn’t mandatory.

- Virginia Trap: A 65-year-old with Aetna Medicaid and UnitedHealthcare Dual Eligible Special Needs Plans was forced to switch to UnitedHealthcare Medicaid in 2025 due to EAE, losing the chance to shop for a preferred network.

- California Oversight: A 70-year-old defaulted to Blue Shield Dual Eligible Special Needs Plans, didn’t explore opting for Original Medicare, missing a potential fit with their doctor preferences.

Suitable Changes to Consider

- Pennsylvania Win: That 72-year-old could shop among A-J, choosing Company C for a better doctor network, as PA allows flexibility.

- Virginia Adjustment: If defaulted to Anthem D-SNP, accept the Medicaid switch to keep LTSS benefits, as unaligned options aren’t available.

- Minnesota Move: A 68-year-old needing home care could switch from UCare to HealthPartners FIDE SNP for a preferred provider, where options exist.

- New Jersey Shift: A 70-year-old on Horizon BCBS could try AmeriHealth FIDE SNP for a better network, leveraging available choices.

- General Tip: Call your state helpline (e.g., Virginia’s 1-800-643-2273) or use www.medicare.gov to compare carrier networks.

Key Things to Consider

Navigating MCO and Dual Eligible Special Needs Plans alignment, plus shopping where allowed, can feel tricky, but here are the essentials for MedicareNationwide.com readers:

- Integration Level: Check if your state offers CO, HIDE, or FIDE SNPs—full integration (e.g., Minnesota) offers more but limits shopping.

- State Rules: Know if alignment is mandatory (Virginia, California) or flexible (Wisconsin, PA)—shop only where options exist.

- Transition Support: Expect provider shifts; use state resources (e.g., Medicare Plan Finder) to explore networks.

- Health Needs: Consider LTSS (Virginia) or behavioral health—alignment supports these, but shopping may improve access.

- Action Steps: Don’t wait—contact your state’s Medicaid office or VICAP (e.g., Virginia at 1-800-552-3402) to plan, especially with 2025 deadlines.

Not all 52 states (including D.C. and territories) are covered—only key examples are detailed due to data limits, reflecting known D-SNP availability.

As Medicare and Medicaid continue evolving, understanding how MCO and D-SNP alignment works in your state can make a real difference in the quality and coordination of your care. While some states limit your options, others allow you to shop around, making it crucial to stay informed and proactive.

At Medicare Nationwide, we’re committed to helping you navigate these complex systems with confidence, so you can make the best decision for your healthcare needs. Prefer to chat by phone? Give us a call at 1-888-559-0103for a no-obligation consultation!