Brief Overview of Medigap

Medigap is the common name for Medicare supplemental insurance.

Supplements were created by the federal government to help seniors with out-of-pocket expenses that are not covered by Medicare. Expenses such as deductibles, copays, and coinsurance can be high even with Medicare coverage.

The federal government regulates supplement Medicare policies, but they are administered by private insurance companies. Through regulation, you will find that the coverages are standardized regardless of the company. This helps when you compare policies and plans.

Medigap policies are divided into plans labeled A-N. Plan A is the base plan that all other plans are built around. Each succeeding plan modifies or increases the coverage provided by Plan A.

Basic coverage under Medigap Plan A includes:

- Part A Medicare coinsurance, including an extra 365 days of hospital costs

- Part B coinsurance

- three pints of blood

- Part A Hospice care

The most comprehensive plan available to newly enrolled Seniors in 2023 is Medigap Plan G. Plan G covers:

- Medicare Part A deductible, coinsurance, and hospital costs (inclusive of hospice care co-payment)

- Medicare Part B Coinsurance, co-payment, and excess charges

- Foreign Travel Emergency (up to $50,000, but varies by plan)

- Preventive Care Part B Coinsurance

- Skilled nursing facility coinsurance

- This is inclusive of most doctor services when you are a hospital inpatient and also outpatient therapy

- Durable medical equipment (DME), blood transfusions, lab work, X-rays, surgeries, ambulance rides, and much more

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Am I Eligible for Medigap?

Many seniors wonder if they are eligible for Medigap. This is one of the most common questions we get about Medigap policies. The answer is Yes. If you are eligible for Medicare, you are eligible for a Medigap policy. The only exception is if you have a Medicare Advantage Plan (Medicare – Part C). The Advantage plan is another way Medicare provides for the gaps and out-of-pocket costs. You can’t have both a Medigap plan and an Advantage plan. Read about the pros and cons of both policies here.

Important Dates for Enrolling in Medigap

Even though every Medicare recipient is eligible for a Medigap policy, there are several dates to consider when deciding whether to enroll. If you are new to Medicare, you can enroll in a Medigap policy in the same window you enroll in Medicare. That special window is 3 months prior to your 65th birthday, your birth month, and 3 months after your birthday. By enrolling in a Medigap policy during that window, you receive special privileges.

During that window, the company is obligated to offer you a Medicare Supplemental policy without special underwriting, medical tests, or questions. You are guaranteed coverage. If you decide to enroll in a Medigap policy after that period, insurance companies will look at your medical history and any pre-existing conditions and determine whether to offer you coverage and for how much. That window is your friend, and you should take advantage of that time, because it may be difficult to get the same coverage later.

What if you are older than 65 and have a Medigap policy? Can you change coverage without going through all the qualifying rules? Yes, you can. Once you have a plan in place, you can change plans without special underwriting. The key is to get a supplement plan in place during the guaranteed coverage window.

What Medicare Supplement Plans are available?

The plans available to you greatly depends on your location and the insurance companies that operate in your state. Most states have companies that will offer the full range of options from Plan A to Plan N. The only exception is Plan F.

In 2020, there were changes to the availability of Plan F to new Medicare enrollees. After 2020, no new Medicare recipient could pick this plan. But if you were already enrolled in Plan F, you are grandfathered into the program, and you will not be non-renewed from it to another plan.

How to Compare Medigap Plans

There are only two things to consider when comparing Medigap plans as you begin shopping for options: Coverage and Company.

Comparing Coverages

As mentioned earlier, coverages are standardized across companies by the federal government. Regardless of which company you choose, the plans will remain the same. The main difference will be the premiums and the extra benefits those companies provide.

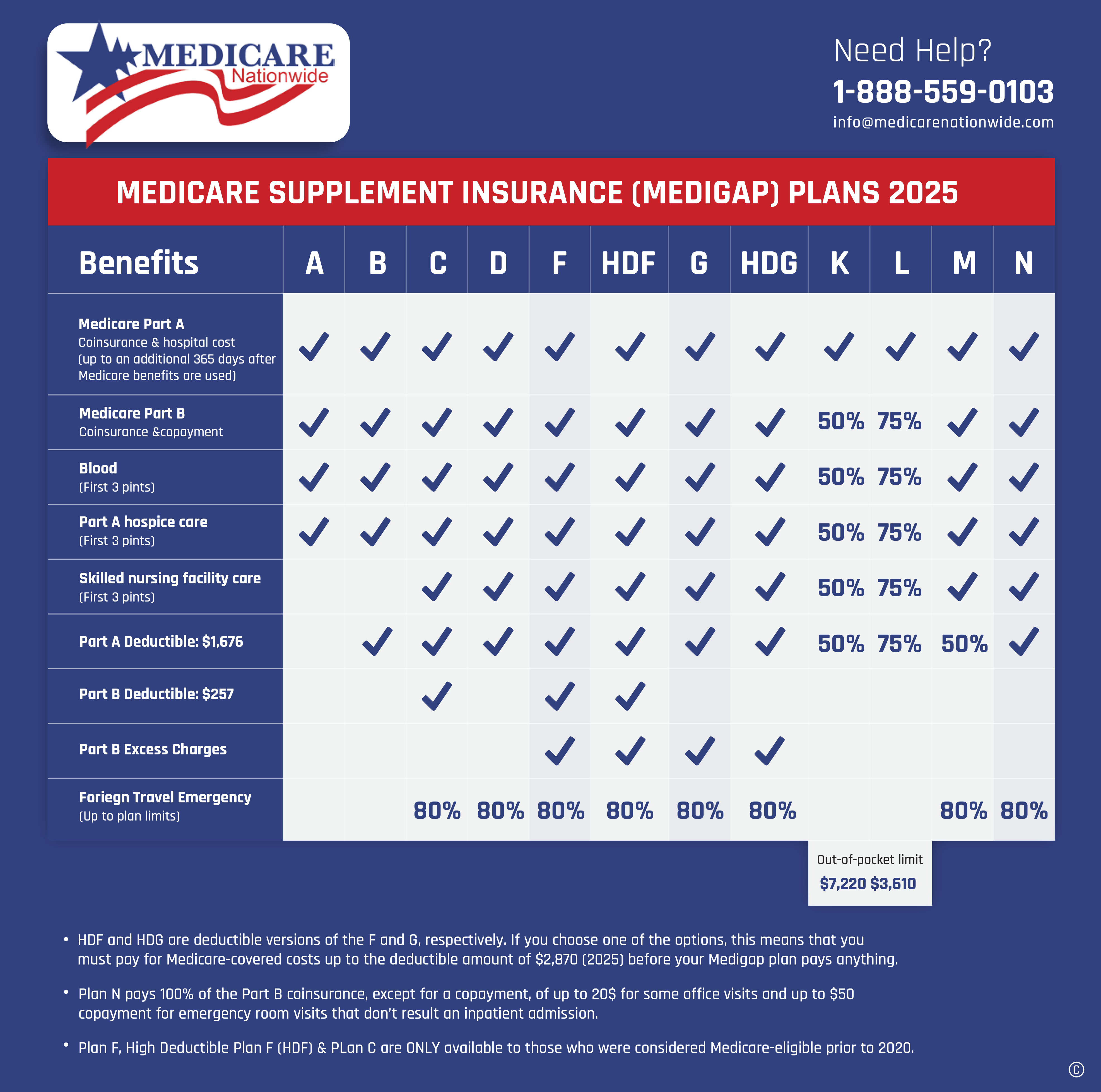

We created this simple chart to help you compare the current plans, so you can decide on what is right for your own healthcare needs.

Comparing Companies

Analyzing the various companies may be more difficult. Some companies have better name recognition, and it is easy to just go to the names you know. That can be good, but you might pay a higher premium.

The other option is to look solely at price, which sometimes can get you in trouble, too. A company with the cheapest price may not be the most stable company. You need to be confident they can service your policies and pay your claims.

We recommend looking at six factors when considering a company:

- Financial Stability

- Longevity

- Company Size

- Investment in Technology

- Added Benefits

- Customer Feedback

Medicare Nationwide agents analyze each one of these components in every one of our company reviews. This gives you a clear picture of the company before you sign up for one of its policies. We also use this same formula when deciding whether to partner with a company and provide its products to our customers.

We are confident in all the companies we represent, but also know each company has different benefits that appeal to different customers.

What are the Most Popular Medigap Plans?

The most popular Medicare Supplement insurance plans are Plans F and G. They are popular because they offer more coverage than other plans. As we mentioned earlier, Plan G is only available for new customers to Medicare.

Plan G has two types of plans most people tend to choose: the standard plan and the high-deductible plan.

The high-deductible Medigap plan is the cheapest of the G plans, but there are more out-of-pocket costs. If your healthcare costs are normally low and you don’t have any pre-existing conditions, this plan could save you in the long run.

Medicare Nationwide’s Top Recommended Medigap Companies

When we review all the companies we represent, these 5 companies stand out as the biggest winners among our customers:

We represent other well-known and reputable companies that may be a better fit for you. These companies tend to stay at the top because they offer their products in more states and generally provide more plan options. However, there are some states such as the New England states that have companies unique only to their market that provides excellent products, premiums, and service. Medicare Nationwide had created a nice resource comparing medigap policies.

What affects cost of Medigap Plans?

Ultimately, you want to know the cost of a Medigap policy. Medicare Supplement rates vary throughout the United States. Your geography affects pricing more than any other factor.

The other major factors that affect Medigap insurance pricing are:

- Gender

- Age

- Tobacco Use

- Household Discounts

Household discounts are included because many companies will discount your plan if you and your spouse are covered by the same company.

Medicare Supplement Plan Monthly Premiums

To give you an idea of the difference in pricing by company and state, here’s an illustration of a 65-year-old male non-tobacco user in Ohio and Florida for Plan G.

Ohio monthly premiums for Plan G:

| ABC Insurance | $99.58 |

| DEF Insurance | $108.51 |

| GHI Insurance | $120.38 |

| JKL Insurance | $138.61 |

Florida monthly premiums for Plan G:

| ABC Insurance | $61.51 |

| DEF Insurance | $117.43 |

| GHI Insurance | $127.67 |

| JKL Insurance | $138.03 |

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

We Can Help You Make Medigap Decisions!

Here’s how Medicare Nationwide can help you make a good Medigap decision.

Our agents can offer hundreds of plan options that have been selected by thousands of American seniors since 2012. Medicare Nationwide is a boutique medical insurance agency focusing on one-to-one connections to ensure seniors select the correct plan for them.

Because of our broad industry connections, we can shop your coverage and help find you a tailored product designed for your budget and health needs.

Our customers rate us as Excellent or Great 100% of the time. We are ready to find the right plan for you to ensure you have the proper coverage when you need it all at the lowest possible cost.

Prefer to chat by phone? Give us a call at 1-888-559-0103.