Understanding different aspects of Medicare Supplement: Medicare Advantage vs Medigap

Once you approach 65, you know you have to make some big decisions regarding Medicare. You are probably aware that Medicare is not enough. There are gaps in coverage. Medicare has 4 basic parts: A (Hospital Care), B (Doctors, Procedures, etc.), C (let’s leave that a mystery for now), and D (Prescription Drugs). The gaps Medicare does not cover are deductibles, co-pays, and other expenses that could eat into your nest egg or monthly income.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Why do we need either of these Additional Medicare Plans?

Perhaps a quick explanation of the need for plan comparison would help you understand the importance of analysis in choosing Medicare. Healthcare budgeting for your post-retirement aging can be challenging because it’s frequently impossible to predict whether your annual expense needs will be modest or significant.

Although original, traditional Medicare (Parts A and B) offers adequate fundamental coverage, it only covers roughly 80% of the costs for the hospitals, doctors, and medical treatments that it approves. As you are presumably aware, using Medicare coverage entails several expenditures, including

- Deductibles

- Co-insurance

- Excess Fees

- Emergency Care Outside of the United States

Unlike coverage provided by the Affordable Care Act (ACA), the remaining 20% of the bill is the responsibility of the individual, and there is no cap on how much they may have to pay in a given year. Hence, no out-of-pocket max.

Consider the scenario where you require heart bypass surgery. That surgery can cost up to $200,000. Without a Medicare supplement plan, you would owe 20% after Medicare Part B pays 80%, so you would owe $40,000 out-of-pocket, or Medicare Advantage plans have a max-out-of-pocket that would significantly protect you. So that is why you would want to choose one or the other (you can’t select both.) The key is not to stick with traditional Medicare without additional protection; otherwise, you would have highly unprotective gaps in coverage.

On a similar note, Original Medicare does not provide any coverage for some health requirements, including those for prescription medications, hearing aids, eyeglasses, and dental care (Parts A and B).

There are basically two ways for recipients to close most of these coverage holes and lessen the possibility of astronomical costs in a year of poor health:

- Medicare Supplement Insurance Plans or Medigap

- Medicare Advantage Plans

Coverage Gap Examples

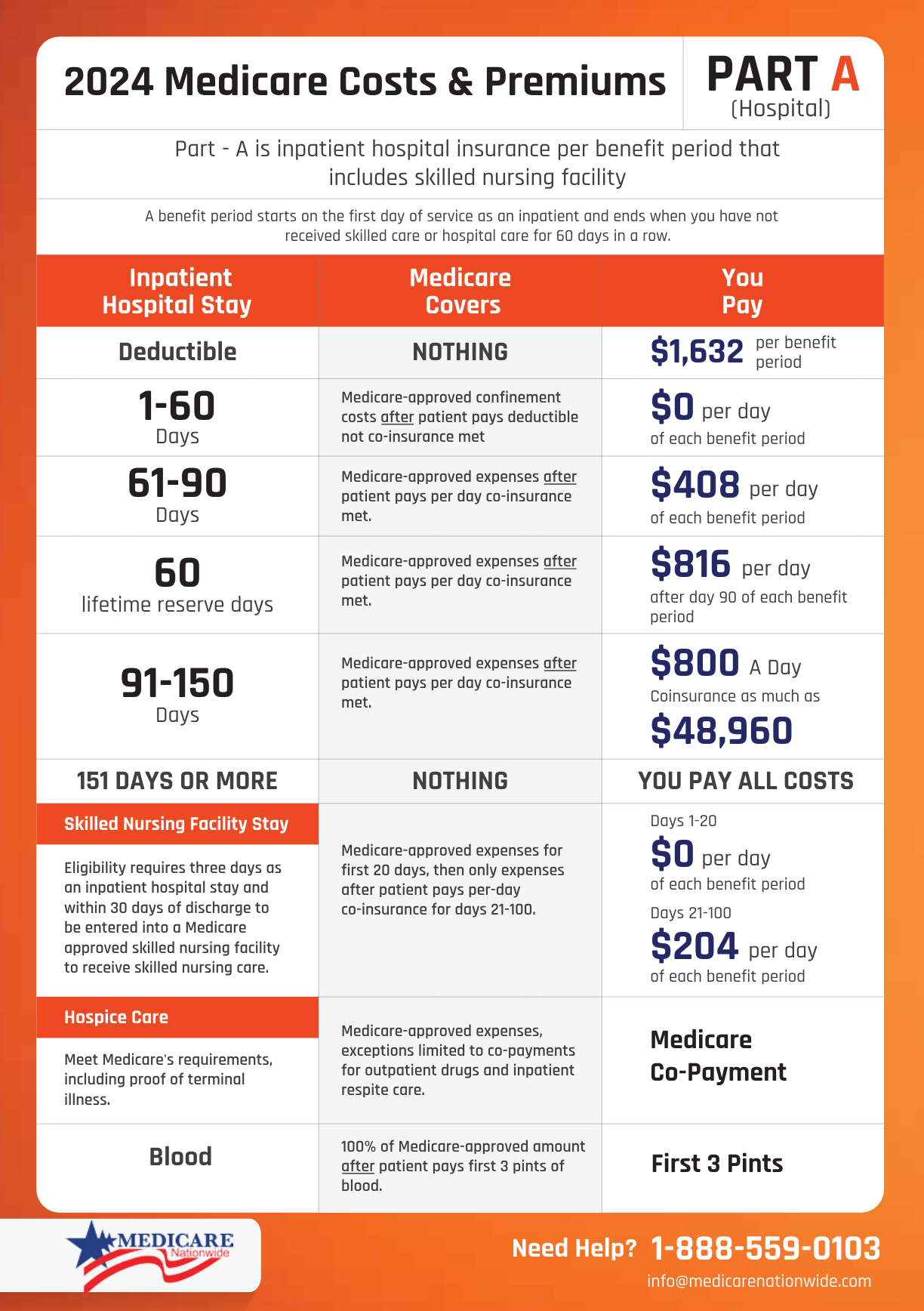

Hospital Gaps:

Let’s say you have to be admitted to the hospital, and you only have Original Medicare coverage. You will pay the first $1,632 of expenses incurred in the Part A deductible.

If your hospitalization becomes extended and you stay in the hospital for more than 60 days, you have to pay a portion of each day’s cost. Your daily payment depends on how long you’ve been in the hospital. It continues to increase the longer you stay.

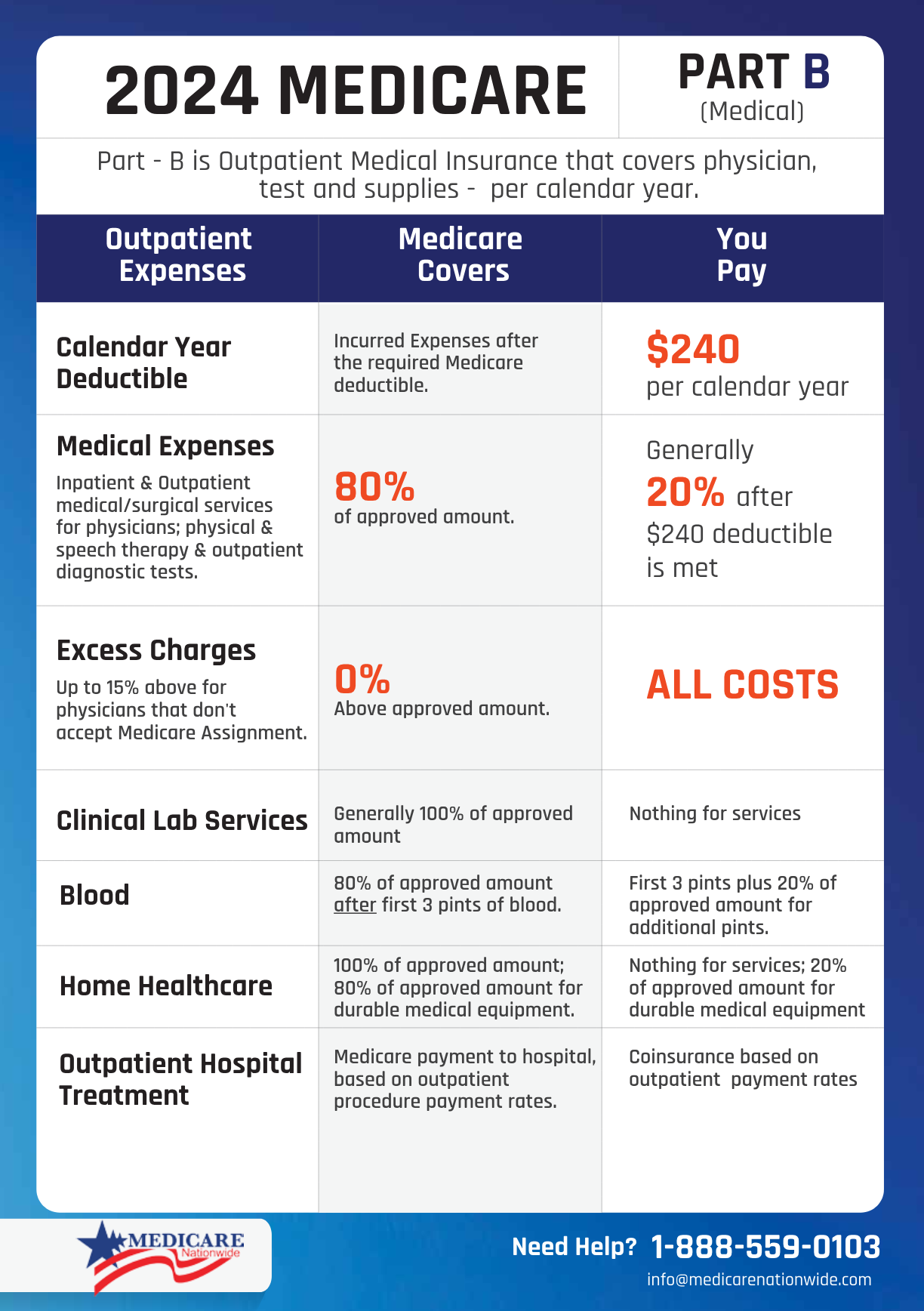

Doctor Visits:

Under traditional Medicare, your deductible is $240, but after that, you have to pay 20% of the Medicare-approved amount. That doesn’t sound bad, does it?

What if you have $100,000 in medical expenses? Enrollees will be receiving a $20,000 bill in the mail. Ugh. There is no limit on how high those expenses will go either.

There are two basic products designed to bridge those gaps and provide full health insurance benefits to you. The products are the Medicare Advantage plan and the Medicare Supplement or Medigap plan. So how do you know which one to choose? In this article, we will give you the basics of each product, complete with pros and cons. Then we will discuss the ideal person for each product.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Medigap Plans or Medicare Supplement Insurance Plans

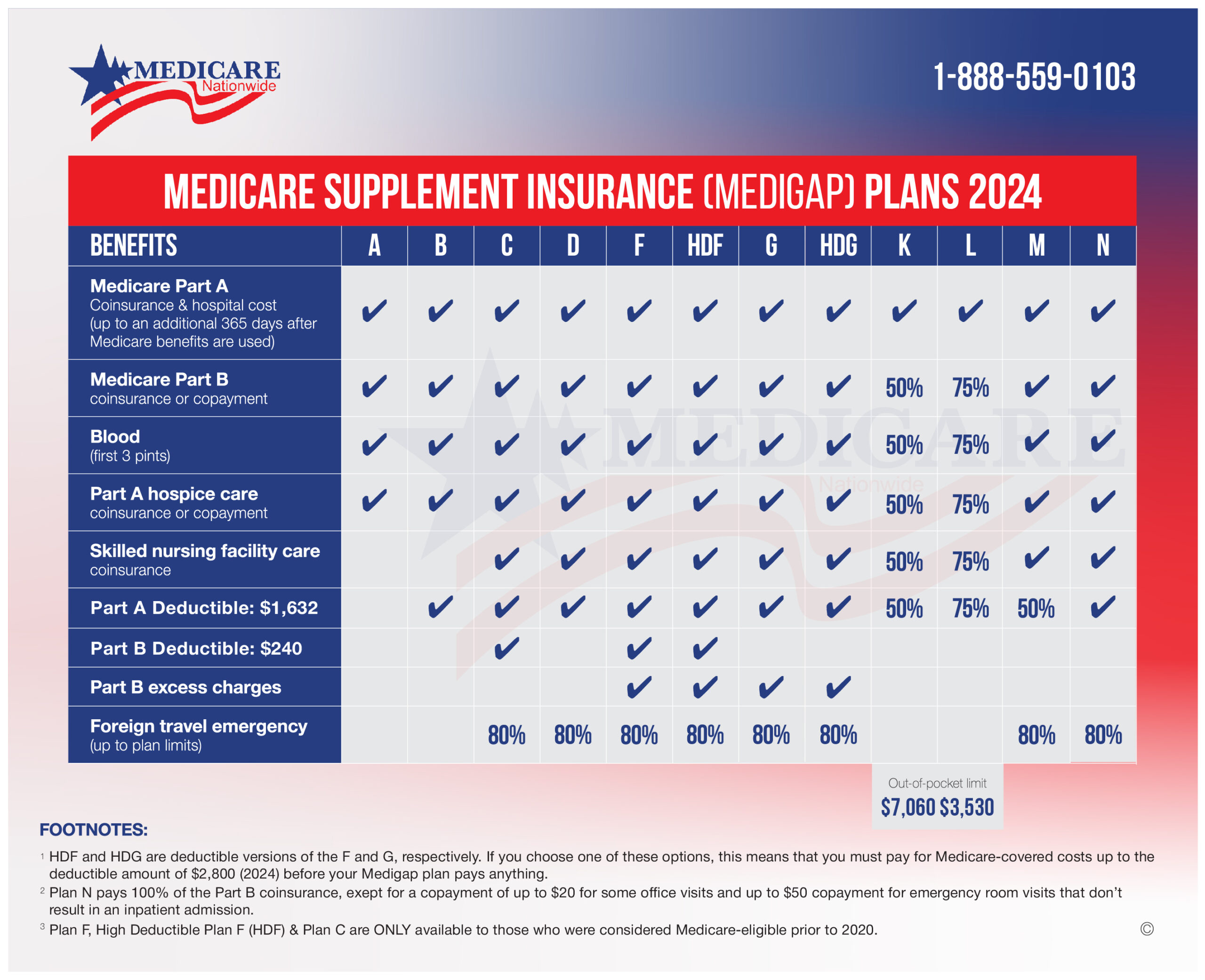

Medigap policies are supplements you purchase on top of traditional Medicare. There are 10 Medigap insurance plans available in most areas. The plan is designated by a letter and the benefits are regulated by the federal government regardless of the insurance provider.

To enroll in a Medigap plan, it is to your advantage if you do so during the open enrollment period. This period lasts 3 months prior to your 65th birthday through 3 months after your birthday. The benefit of enrolling during this period is that underwriting is loosened and you can qualify regardless of pre-existing conditions. If you wait till after the period, you will be subjected to individual company underwriting and may be declined by certain insurance carriers.

Medicare Supplement Chart A

Medicare Supplement Chart B

Medicare Advantage

Medicare Advantage is the mysterious Medicare Part C we mentioned above. Advantage Plans are delivered through private insurance companies and include traditional Medicare Plans A & B plus other benefits. Like most health plans they pay for doctor visits, labs, surgery, etc. after a co-pay. The plans can vary from state to state and may offer HMO or PPO networks along with yearly max out-of-pocket limits for doctors willing to accept your coverage.

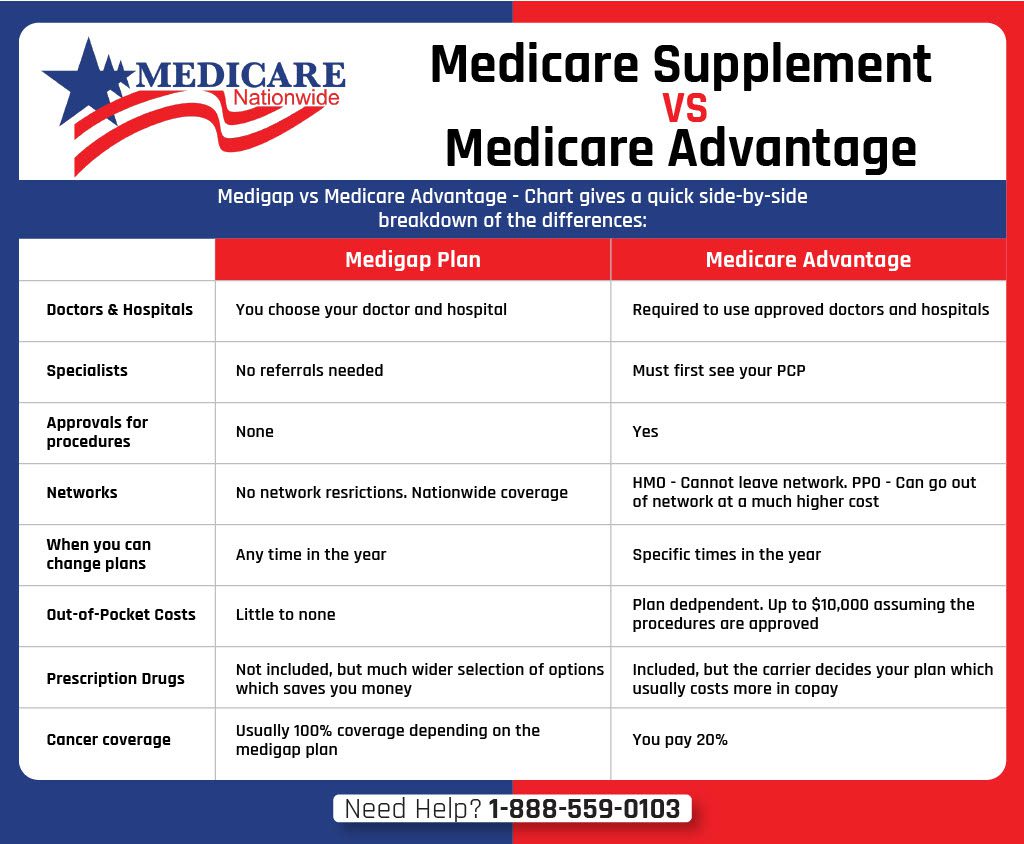

Medicare Advantage vs Medigap Made Easy

This Medicare Supplement Plans vs Medicare Advantage Chart gives a quick side-by-side breakdown of the differences:

So now you know the basics of each product, let’s run through the Pros and Cons of each product.

Medicare Advantage Plans Pros & Cons

Pros:

- Advantage plans offer the potential of bundling your medical, dental, and drug plan.

- Generally, you won’t be denied for preexisting conditions.

- You can potentially save on premium with an HMO, PPO, or another Advantage plan. Medigap plans will have similar plans, so you should compare the premiums with those plans.

- Typically plans provide extra added value services such as a preventative dental plan. However, you most likely will need to pay an optional premium to get a plan that covers major dental services.

Cons:

- There are stricter enrollment periods on when you can join, change or leave your plan.

- Depending on the plan you might need referrals from your Primary Care Physician (PCP.)

- Generally, you will be limited to a more restrictive network of acceptable providers and hospitals.

- Many Medicare Advantage plans can become a burden when your doctor leaves your network. Changes can also occur unexpectedly while you are still under your 1-year contract.

- There is a higher chance that a Medicare Advantage Plan will have unintended and unexpected expenses.

- You cannot take your Medicare Advantage plan with you when you move states or out of your coverage area.

- They are managed care plans that take over Medicare so you are under their rules and regulations

- Approvals for procedures and approval from claims from the private insurance carrier

- Step therapy: To decrease costs, Advantage plans always begin with the cheapest pharmaceuticals and then step you up if needed. You may have to change your current medication to something cheaper even if the current prescription is working for you.

- These plans have higher out-of-pocket maximums and more co-payments.

- If your drugs are expensive, you might be best advised to leave your coverage from the Advantage plan during the appropriate enrollment period. You can pick a standalone drug plan to significantly lower your drug costs of which there are over 25 Stand Alone Part D plans to choose from in your area.

Medigap Pros & Cons

Pros:

- A Medicare Supplement Plan is pretty straightforward. After Medicare approves coverage, generally your Medicare Supplement (aka Medigap) plan pays as well. You can see any doctor/hospital of your choice and your insurance will be honored and respected.

- Enrollment periods are determined on a monthly basis.

- Plans are guaranteed renewable on a monthly basis.

- You can take your plan with you if you move states.

- Predictable health care costs that you can budget and estimate more easily.

- Open Enrollment for Medigap plans happens within 6 months of your Part B effective date or 6 months of turning 65 where you will not be asked health questions and not be denied claims after Medicare approves services under any circumstances.

- Your doctors and hospitals will have to accept the Medigap coverage for payment after Medicare approves services.

Cons:

- In certain enrollment situations, you can be denied for preexisting conditions or need to satisfy a waiting period of 3-6 months for a preexisting condition. However, not the case for those turning 65 or those 6 months from their Part B effective date. Medicare does not have a waiting period, only the insurance carrier for the balance of the bill.

- Potentially higher premiums due to lower out-of-pocket costs, but a rate comparison is still needed to confirm price rate differences.

- You cannot bundle your drug or dental plan. However, you can still get them separately.

Coverage of Medicare Supplement Plans

Similarities between Medigap and Medicare Advantage

- Prescription Drug Donut Hole. Prescription drug coverage or Part D can be covered under both plans. Both Medicare Advantage and Medigap plans have the donut hole coverage gap. This is where you spend more after the initial co-payments for your drugs. They both comply similarly with the Medicare drug formulary.

- Both can provide extra benefits, such as a discounted gym membership.

- You will need to pay your Part B premium regardless (with some rare exceptions.) For example, Medicaid covers Part B if you qualify for welfare benefits.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

A Quick Overview

- Original Medicare offers adequate basic health coverage, but it only covers around 80% of the costs for hospitals, physicians, and medical procedures. In addition, it frequently excludes coverage for the cost of prescription drugs and common dental operations.

- Medigap supplemental insurance plans fill coverage gaps in Original Medicare, Part A, and Part B. Medicare recipients should enroll in Medicare Part A (hospital insurance) and Part B (medical insurance) three months before they turn 65. Complete the enrollment within three months after your 65th birthday to avoid future enrollment penalties.

- Medicare Advantage, commonly known as Medicare Part C programs, frequently offers services above and beyond those provided by Medicare Parts A and B. These plans are provided by private, Medicare-approved health insurance providers.

- Even if you don’t take prescription drugs, failing to enroll in a Medicare Part D plan can cause future enrollment penalties. So it is typically recommended to purchase a standalone Part D plan or choose a Medicare Advantage plan that covers drugs (you can’t select both.)

- When choosing your Medicare ( Medigap, Medicare Advantage ) coverage, take into account the costs, the doctors, the ease of accessibility, your lifestyle, travel plans, your current health condition, and any other perks. Medicare supplement plans allow you more flexibility since you are not restricted to a network of doctors. Medicare Advantage plans are more restrictive, so you need to be more careful when choosing a plan.

What to Take Into Account When Choosing Your Additional Plan?

Whether regular Medicare with Medigap or a Medicare Advantage plan is ideal for you depends on your lifestyle, health, and financial situation.

Here are a few things to think about:

The Pricing

Medicare Advantage programs may result in cost savings for you if you can see your network of doctors easily, but be careful to confirm that they cover prescription drug benefits.

Compare the prices of your chosen Medicare Advantage plan to standalone Medicare Part D prescription medication policies and Medigap insurance. Determine the premiums and any possible out-of-pocket costs (deductibles, copays, coinsurance) associated with the policies. Yes, these numbers might be challenging, but an insurance advisor can assist by performing the computations and offering suggestions for ways to cut costs.

Your Consulting Physicians

Any U.S. physician or hospital that accepts Medicare is acceptable under Original Medicare, and the majority of them do. The majority of Medicare Advantage plans force you to use the doctors in their network and may pay less or nothing for services from out-of-network and distant providers.

The fact that care is coordinated and your primary care doctor is informed of the findings of specialists is a benefit of Medicare Advantage managed care plans.

Traditional Medicare doesn’t require a referral to see a specialist or prior authorization for procedures. Still, you will need to make sure that your doctors are communicating with one another and that your care is coordinated for a speedy and healthy recovery. Frequently, the easiest way to achieve this is to establish a rapport with your primary care doctor and ask them to recommend you to experts.

Conditions and Accessibility in the Local Area

It’s crucial to research the provider network of Medicare Advantage plans to see who accepts the managed care plan. Are new patients accepted by the medical center?

Will you have to make a long trip to a doctor’s office or an emergency room to receive care?

You can identify Medicare Advantage plans that operate in the area you are living in by asking local experts, neighbors, and authorized insurance brokers for advice. Comparing plans will help you choose one that might work for you.

Your Lifestyle

Regular Medicare may be a wise choice if you frequently travel, have two residences, and have existing doctors you would like to keep. Inquire with your existing doctors about if they accept traditional Medicare or any Medicare Advantage plans. Regular Medicare combined with a Medigap insurance plan that provides emergency care abroad may be a wise choice for frequent travelers.

Similar to this, individuals who travel for a portion of the year may find it challenging to maintain in-network status for medical care and may fare better with traditional Medicare plus Medigap insurance coverage.

Your Current Health Condition

People with chronic illnesses and those who suffer major medical conditions ought to learn more about their options. If among all the plans, Medicare Advantage shields you from hefty costs with an out-of-pocket maximum, that plan might be a better alternative. You often have more options for where you receive care when you combine regular Medicare with a Medigap insurance plan. Check to see if your Medicare prescription drug plan, whether it’s a standalone one or a component of a Medicare Advantage plan, will cover any pricey medications or equipment (such as supplies for persons with diabetes).

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Other Considerations

You can not purchase both. In fact, it is illegal for an insurance company to try to sell both to you. You have to pick one or the other. To be eligible for either Advantage or Medigap, you must first be enrolled in Medicare. For each option, you will want to shop around. Pricing and benefits can vary from company to company. Medigap policy’s benefits are standardized by the federal government, but each company may price its products differently.

You may be able to save on premiums with a Medicare Advantage plan, but there are many considerations for choosing such a plan. Such as the choice of doctors/hospitals that the insurance carrier approves. A Medigap plan typically has a comparable premium, so it is still worth discussing the rate and coverage differences in your area.

With a Medigap plan, as long as the doctor/hospital accepts the Medicare Assignment, you can deal with Medicare directly. Your supplement plan will pay the gap in coverage once you reach your deductible (if any deductible at all.)

Frequently Asked Questions (FAQs)

- Are Medicare Advantage plans equivalent to Original Medicare in terms of coverage?

All Medicare-covered services are covered under Medicare Advantage plans, including both Part A and Part B benefits. There are some Medicare Advantage plans that also include Part D prescription medication coverage. They provide extra services that Original Medicare doesn’t cover.

- Is it possible for me to have multiple Medigap plans at once?

Medigap insurers are prohibited from offering more than one Medigap plan to the same customer by law.

- What is the most crucial variable when purchasing Medigap insurance?

Timing is arguably one of the most critical variables. You are enrolled in Parts A and B and have a one-time, six-month Medigap Open Enrollment Period that begins the month of your 65th birthday. You have a guaranteed right to purchase any Medigap policy offered in your state during these months, regardless of your health. Your preexisting medical condition cannot be a reason for coverage denial.

And as long as you continue to pay the premiums, the insurer must renew the policy each year, regardless of your age or any potential future health issues.

If you are 65 or older and purchase a Medigap insurance policy within 63 days of losing health insurance from a prior employer or union, moving out of your Medicare Advantage plan’s coverage region, or both, the same guaranteed rights are applicable.

Further, there are circumstances where a change in your health insurance will trigger the guaranteed right to purchase Medigap coverage. To know more, feel free to contact our insurance specialist anytime.

Final Thoughts

There is never one size fits all to choosing a Medigap or Medicare Advantage plan. We do want you to be on the most suitable plan for yourself. There are more considerations than outlined here, such as where you live, pre-existing conditions, current medication, etc.

Let us help you sort through your options. We represent numerous carriers that can provide both products, and can find the plan that fits your health and budget perfectly.

Prefer to chat by phone? Give us a call at 1-888-559-0103.

Source: