Health Care Costs for Seniors

Considering options to supplement traditional Medicare is a wise move. Health care costs continue to rise and household spending for people with Medicare can be more than you expect.

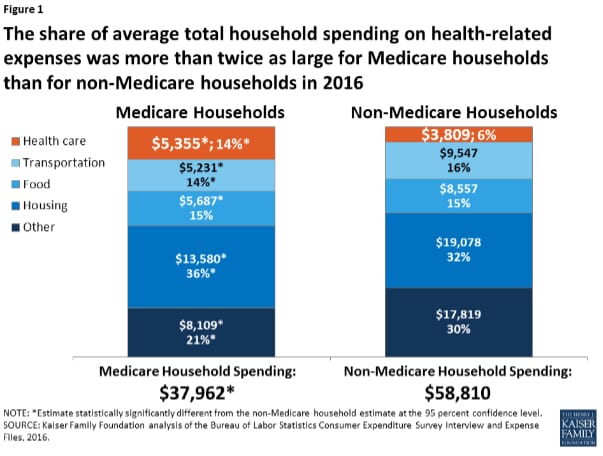

The Kaiser Family Foundation studied the costs between Medicare households and non-Medicare households and the differences are surprising: (1)

This study makes it clear that costs are high and finding ways to supplement those costs even within Medicare is important to most seniors

What is a Medicare Advantage Plan?

If you’ve spent much time on our site, you are probably familiar with Medicare Supplements and how they work. You may even have a Medicare Supplement product. Medicare Advantage might be a new world of information for you. Let’s start there and explain what the Advantage plan is.

Medicare Advantage is also known as Medicare Part C.

This plan allows people with Medicare Part A (hospitalization) and Part B (medical) to receive their Medicare benefits in a slightly different way. The plans are regulated by the federal government but are offered through private insurance companies. These plans will also include Part D coverage, which is prescription drug coverage. Some plans will offer other benefits such as dental or even health benefits such a gym memberships.

Plans are typically run as HMOs or PPOs.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Benefits of Medicare Advantage plans:

- Bigger benefits than you would receive under traditional Medicare.

- Cost Savings. You may find an Advantage plan cheaper than Medicare depending on your situation

- Cost Sharing. Copayments, coinsurance and deductibles may be lower than original Medicare (without a Medigap plan).

- Limitations on out-of-pocket expense. Original Medicare (without a Medigap plan) does not have an out-of-pocket cap.

- Coordination between your health care providers.

Disadvantages of Medicare Advantage plans:

- Providers may be limited under an Advantage plan and be restricted to whatever HMO or PPO you are assigned.

- Referrals and authorizations by doctors and health care providers may be needed to receive care.

- Geography limitations. Most plans have very specific service areas where they operate. If you divide your time among different residences there could be limitations on services.

An Advantage plan offers more coverage than traditional Medicare, but there are restrictions and you must follow the rules of the plan specifics to receive that coverage.

Reasons for Switching from Medicare Advantage to Medigap

There are plenty of good reasons to switch from Medicare Advantage. Coverage can differ from these different options, so it is best to find something that covers you. Everyone’s needs are different, and finding a good plan can be tough.

Here are some possible reasons to switch from Medicare Advantage to Medigap.

- If you are a frequent overseas traveler, Medigap may be a better plan. Many Medigap plans provide extensive overseas emergency coverage.

- Medigap also provides an extra year worth of hospital coverage.

- There are a wider range of doctors available under Medigap.

- Medigap offers lower copays and coinsurance.

While these benefits are nice, it is best to pick what fits your needs. While Medigap provides coverage in these areas that Medicare Advantage does not, you may lose some coverage that only Medicare Advantage offers.

Approval for Medigap is Not Guaranteed

If you are considering switching from Medicare Advantage to Medigap, you are not guaranteed to be approved for some plans.

There are four basic options when it comes to switching from Medicare Advantage to Medigap, and two of them are guaranteed approval.

Guaranteed Approval options:

1.) If you are trying to switch from Medicare Advantage to Medigap during either your first year of enrollment into Medicare Advantage (and 65 years old) or the special enrollment period, then you are guaranteed approved.

2.) Special enrollment periods cover a few circumstances. If you have lost your insurance that was provided by an employer, or if you moved away from your coverage area (Medicare Advantage only), then you are in a special enrollment period.

Medical Approval Options:

3.) The annual election period.

4.) The Medicare Advantage disenrollment period.

During these two periods, you will need to answer medical questions that could lead to approval or disapproval.

You Cannot Have Both, so Choose Wisely

When switching from a Medicare supplement to another plan, it is easier to switch within programs rather than switch programs altogether. You cannot have an Advantage plan and a Medicare Supplement plan simultaneously, so you need to make an informed decision based upon your needs.

For instance, Medicare Advantage provides both part A and B benefits, and some of part D, which sounds great, but there are some drawbacks. According to Investopedia:

“Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers. Since Medicare Advantage Plans can’t pick their customers (they must accept any Medicare-eligible participant), they discourage people who are sick by the way they structure their copays and deductibles.”

If you are someone who has chronic illness, or just tends to be ill more often, then Medicare Advantage may not be for you because of their copay structure. That does not mean it is a bad plan, it just is not for everyone.

Medigap coverage tends to cost more than most Advantage plans, but Medigap has a wider network of physicians covered.

Is Changing Medicare Advantage Plans Allowed?

There are misconceptions in the marketplace that you are stuck with a Medicare Advantage plan. One misconception is that whatever you chose when you originally signed up for Medicare is where you have to be for the remainder of your life.

Another common belief is that there are penalties and fees if you choose to switch plans, whether you are switching from an Advantage plan or within Medigap plans.

These are not true.

If you are already enrolled in Medicare Advantage, there are some options that allow for easier switching within the program. Medicare Advantage has its own open enrollment periods that can apply depending on your situation. The first of which is the annual Jan. 1 through March 31 period in which it is open to everyone under Medicare Advantage. During this period you can disenroll in your Medicare Advantage plan and return to Original Medicare.

How Do You Change Medicare Plans?

As stated previously, there are many ways to reevaluate and change Medicare plans throughout the year. You may decide to change because of coverage, cost or just the convenience of it. No matter what your reason is, you are always able to change.

The Medicare Annual Election Period, which happens annually from Oct. 15 to Dec. 7, is the designated time to switch plans within the Medicare and Medicare Advantage program. During this period, recipients can switch to and from Medicare Advantage and Original Medicare, join or leave the part D prescription drug plan, and switch between Medicare Advantage and Original Medicare.

Recipients of Medicare Advantage can also switch or disenroll during the Medicare Advantage Open Enrollment Period. The Open enrollment is from Jan. 1 to March 31. During this period, Medicare Advantage recipients can return to Original Medicare. However, the time to switch drug plans was during the Annual Election Period.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

The Gaps in Medigap

Medicare is the primary insurance for a Medigap plan. That means that if Medicare approves the claim, your Medigap policy will cover it as your secondary insurance. However, if Medicare does not approve the claim, your Medigap will not cover it as well. Medigap is a great way to fill in many gaps in Medicare parts A and B, but it’s not all-encompassing. If you are looking to get Medigap, it’s good to know where you will not be covered to make an informed decision.

Medigap will not cover any regular eye care or eyeglasses. This only includes regular visits to the optometrist and new prescriptions. Dental care is also not covered by Medicare. These visits will be out of pocket rather than just a copay, so if you regularly visit the dentist, Medigap will not cover you.

Finally, hearing aids will also not be covered by Medicare. This may not be important to some, and you can always change if this becomes an essential need in the future. Companies that sell Medigap policies will generally have a separate vision and dental policy available. They can be affordable and will provide comprehensive coverage you might not find with certain Medicare Advantage plans.

So What Should You Do?

Because of the variety of options and potential costs you might incur, it is a good idea to regularly review your coverage. This is especially true if you have had your plan for several years. After a thorough review, you may discover you are exactly where you need to be.

Our agents have years of experience with the wide varieties of plans in the marketplace throughout the United States. We can review your coverages and present multiple options that meet your health and financial needs. We may find you should stay right where you are and we will tell you that as well.

Whatever you do, don’t let the amount of information out there overwhelm you. You could be putting your retirement savings as well as your health at risk.

Prefer to chat by phone? Give us a call at 1-888-559-0103.