Comparing the Difference between Medicare Supplement Plans: Medicare Supplement Plan F vs Plan G vs Plan N

There are many factors to consider when shopping for a Medicare supplement plan. Understanding the coverage provided by the different supplement offerings can help you determine which plan is right for you. Generally, your Medicare Plan will cover up to 80% of approved healthcare costs. Supplement plans, also known as Medigap, help with any additional costs which have the potential to be substantial or unexpected. Depending on the plan you choose, your Medigap plan will help cover most, if not all, of these additional costs.

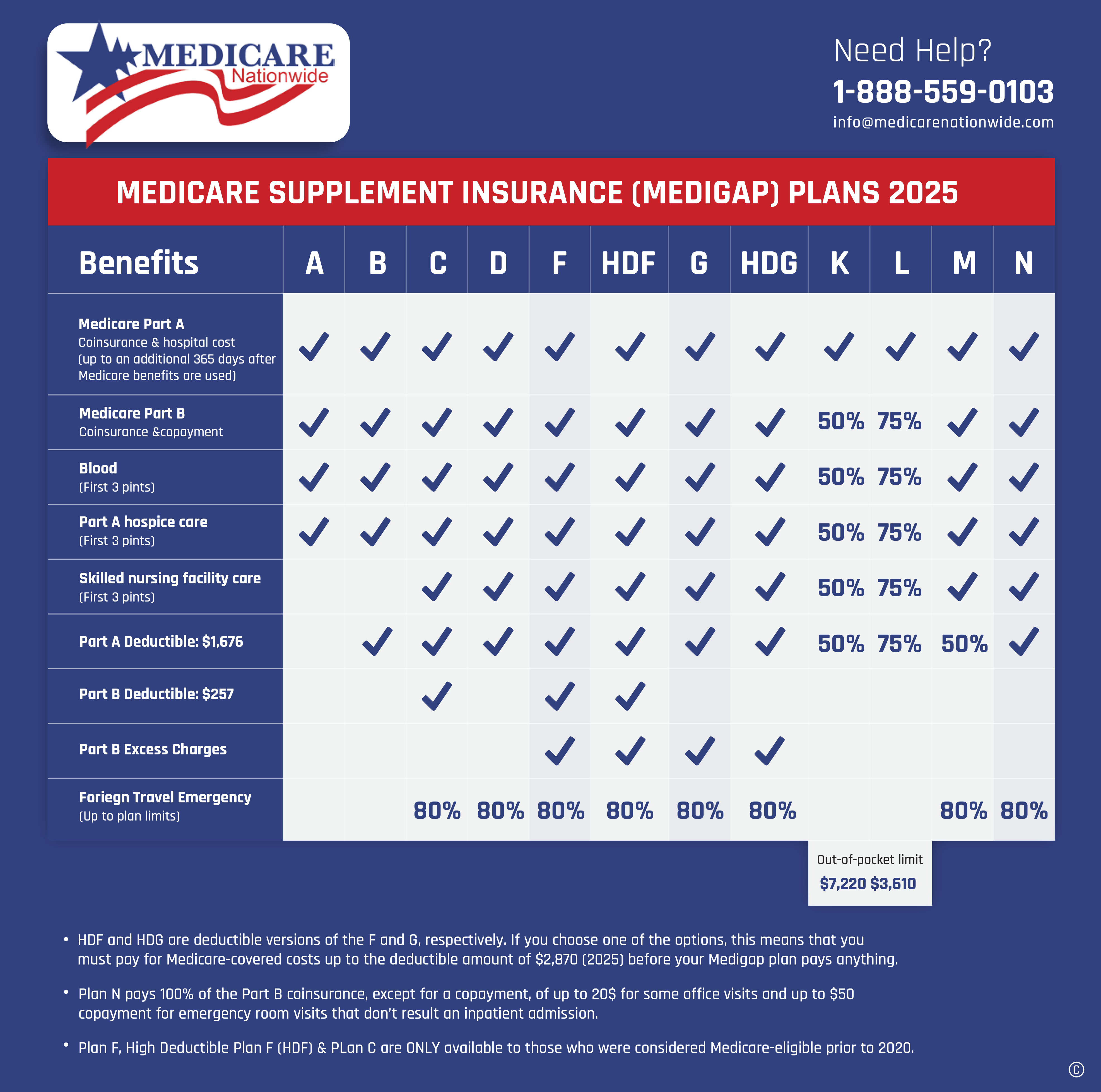

The Standardized Medicare Supplement Plans

Generally, 10 Medigap plans can be offered in most states. (Wisconsin, Minnesota, and Massachusetts each have their own plan rules, they are practically identical with different plan names.)

For customers, this means that Plan A, offered by Company X in State 1, and Plan A, offered by Company Y in State 2, are identical. Benefits and coverage are the same, notwithstanding potential premium variations. That is because Medigap plans are federally standardized. Medicare outlines the coverage rules that the Medigap plans have to adapt and offer.

To summarize,

While private insurance companies offer supplement plans, these Medigap plans are standard across the entire country. That means the basic set of benefits provided by a Medigap plan in one state will provide the same basic set of benefits in another state.

By a significant margin, Plan F is a widely popular Medigap plan—it makes up around 55% of all active Medigap plans. Plan N and Plan G, however, are no less soaring in popularity if you’re searching for a plan with immense enrollment growth, up 33% and 25%, respectively, over last year’s figures.

Since Medicare Plan F was discontinued for newly eligible Medicare recipients as of Jan 1, 2020, its premiums have increased substantially more than Plans G, and N. Plan F is a shrinking group; making the insurance offering more volatile to rate increases. Plan G and N’s premium rate factors in young and healthier 65-year-olds to balance out the insurance risk of the entire group.

Private insurance providers provide Medigap policies but are not required to provide all ten options. It’s best you navigate the fundamentals of every plan and then move on to choosing the perfect carrier in your budget.

The three renowned plans earn their popularity from their comprehensive coverage. All three are similar in their coverage but differ in a few distinct ways that may help you decide which plan would work best for you.

- Plan F recently was discontinued, but it is still available for those grandfathered in. It has the highest premium rate as it covers the Part B deductible..

- Due to the fact that Plan G offers more coverage than Plan N, its rates are higher. Largely because Plan G covers copayments and Plan N does not. Copayments are fixed dollar amounts you owe for office visits.

- The more insurance coverage you get, the higher the premium: F, G, and N. Plan N is the least expensive premium rate because it does not cover copayments, the Part B deductible, and sometimes Part B excess charges. Plan G covers all of them, except the Part B deductible. Plan F covers all of them.

Following is a detailed comparison of the three most popular Medicare Supplement plans: Plan F vs. Plan G vs. Plan N.

How Does Medicare Supplement Plan F Work?

Of all the Medicare supplement plan offerings, Plan F has long been the most popular. The simple reason is that Plan F offers the most comprehensive coverage of all the supplement plans.

Medicare Coverage of Medigap Plan F

- Part A Deductible: Medicare Part A does not cover your hospital insurance costs until the deductible for each benefit period is met. Plan F covers your entire Part A deductible, regardless of how many benefit periods you have in the year.

- Part A Coinsurance and Hospital Costs: After you have exhausted your Original Medicare benefits, Part A requires a coinsurance payment for an inpatient hospital stay days 61-90. The coinsurance payment increases if the stay lasts longer than 90 days. Plan F covers all of these coinsurance costs.

- Part B Coinsurance or Copayment: After the Medicare Part B annual deductible has been met, Medicare requires a 20% coinsurance or copayment for all covered services. Plan F covers any Part B coinsurance or copayment costs.

- First Three Pints of Blood: Original Medicare plan alone does not cover the first three pints of blood for use in a medical procedure, such as a blood transfusion. Plan F covers the cost of the first three pints of blood.

- Part A Hospice Care Coinsurance or Copayment: Beneficiaries that are in hospice care can face copayments for certain prescription drugs, as well as a 5% coinsurance payment for inpatient respite care. In the event this occurs, Plan F covers any of these copayment or coinsurance costs.

- Skilled Nursing Facility Care Coinsurance: If a beneficiary requires an extended stay in a skilled nursing facility, Medicare requires a copayment for days 21-100 once your Part A deductible has been met. After day 100, Medicare requires that you pay all costs. Plan F covers all skilled nursing care facility coinsurance costs.

- Part B Deductible: Medicare Part B does not cover your medical insurance costs until you meet the deductible amount. These costs come from some of the more expensive hospital services, such as procedures like surgery or chemotherapy, or preventive services like screenings and doctor visits. Plan F covers the cost of your Part B deductible.

- Part B Excess Charge: In the event that you visit a healthcare provider that does not accept Medicare assignment, it is likely you will receive an excess charge of up to 15% of the Medicare-approved amount for any Medicare Part B covered services or products. Plan F covers any excess charge, regardless of the amount.

- Emergency Care for Foreign Travel: While Original Medicare covers some qualifying foreign emergency care, Plan F covers 80% of the costs for qualifying care that you receive outside of the U.S.

Additionally, Plan F offers a high-deductible plan. With this option, you must pay for any Medicare-covered costs up to the deductible amount. The plan will not cover any costs until this amount is reached.

Something important to be aware of for Plan F availability, however, it was discontinued on January 1, 2020. Anyone born after January 1, 1955, will not be eligible to enroll in Plan F. However, if you were born before 1955, Plan F is still available to you.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Let’s understand this better.

Even though Medicare Plan F is being phased out, can you still switch to it?

Your new Medicare effective date will determine this. You might switch to Medicare Plan F if you were eligible for Medicare before January 1, 2020. You are not required to choose a new plan if you are currently on Plan F.

Plan F is an option if, for some reason, you come within the Guaranteed Issue Rights and your Medicare effective date is earlier than January 1, 2020.

On the other hand, you cannot change to Plan F if you are newly eligible for Medicare on or after January 1, 2020. It is possible to enroll in Plan G if you are eligible for Guaranteed Issue Rights. Guaranteed Issue Rights means you are not subject to underwriting outside of the Open Enrollment period.

What Does Medicare Supplement Plan G Cover?

Plan G offers the same coverage as Medigap Plan F except for a single difference: it does not cover the Medicare Part B deductible. As mentioned above, these are your medical insurance costs, which can be some of the more expensive hospital services. For 2025, the Part B deductible is $257 per year. Another way to look at that cost is as a monthly payment of just over $18 a month. Because Plan G does offer the Part B deductible, it likely will cost less than Plan F. However, supplement plan costs vary depending on your location and the insurance company offering it.

If coverage for the Part B deductible is not a crucial aspect to you in a supplement plan, then Plan G may be a good choice. This would especially be true for you if the available Plan F options are at least $18 more expensive per month (the cost of the Part B deductible) than the Plan G option.

What Does Medigap Plan N Cover?

Plan N offers the same coverage as Plan G in that it also does not cover the Medicare Part B deductible like Plan F does. However, it differs from Plan G by not covering Medicare Part B excess charges. As mentioned above, you can incur Part B excess charges when your health care provider does not accept Medicare assignment.

However, in certain states, they waive the Part B excess charges. States that exclude the Part B Excess Charges are Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont.

So, when comparing Plan N to Plan F, Plan N has the same coverage, except that it does not cover the Medicare Part B deductible or Medicare Part B excess charges. Plan N also covers the Medicare Part A deductible at 50% compared to the 100% coverage of Plan F.

Also, it is important to note that Medigap Plan N pays 100% of the Part B coinsurance, except for a co-payment of up to $20 for some office visits and a copayment of up to $50 for emergency room visits that don’t result in inpatient admission.

Because it lacks some of the coverage of Plan F, Plan N is typically a less expensive plan. It may be a worthwhile option for those who would prefer paying less for their premium but with the potential for more out-of-pocket medical expenses. Also, if you are in good health with minimal trips to the doctor, Plan N may be a good choice.

What is the best time to Enroll in a Medicare Plan?

The Medigap Open Enrollment Period, which lasts for six months and starts on the first day of the month you turn 65 and enroll in Medicare Part B, is the ideal time to purchase your Medicare Supplement plan. Private insurers cannot refuse you insurance for those six months for any reason, and you have more options and better prices. Depending on your circumstances, you might also have other choices for acquiring a Medigap policy in the future. A policy cancellation, a loss of insurance, or bankruptcy of the insurance company, among other events, might qualify.

However, outside of Open Enrollment, insurers may decide to provide insurance based on medical underwriting, which may take into account factors such as your age, gender, region of the country, and prior health issues.

This implies that there is a chance you won’t get a policy, that you’ll pay more in premiums or have fewer alternatives than if you signed up during the Open Enrollment Period, and that you might have a waiting period for up to six months after your policy starts that your preexisting condition could be contested by the supplement insurance carrier if they believe it was not disclosed properly at the time of application.

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

How do you find the Best Plan from the Medicare Menu?

It’s critical to compare the difference between Medicare Supplement plans. Here are some essential ideas to bear in mind:

- Learn which insurance companies provide Medigap plans in your state.

- Compare different insurance to find one that best suits your needs, and search for any added benefits.

- Be aware that different insurance companies may charge different premium rates for the same Medigap policy.

- Choose wisely because changing Medigap policies later may not be an option.

Choosing the Best of all Medigap Plans

For starters, be mindful of your enrollment options in Supplement Plans Medicare. Make sure you are set to enroll during your Open Enrollment Period. As soon as you are readying enrollment in Medicare Part B, you should also look at your Medigap plan options. Once you have enrolled in Part B, you have a 6-month window to find Medicare Supplement, in which insurance companies cannot turn you down due to a preexisting condition.

Choosing the right Medigap plan will likely come down to your specific health insurance needs or the breadth of coverage you feel most comfortable with. Medigap Plans F, G, and N offer the same basic benefits as one another with only minor distinctions in coverage. However, a difference like the Medicare Part B deductible and whether or not your plan covers it might be the deciding factor for you as you balance it against your financial and healthcare needs. Your address may also help you find Medicare supplements, as some plans may not be available to you in your area or may vary in cost.

A Quick Medicare Review of the Three Plans:

- For those who become officially eligible for Medicare on or after January 1, 2020, Plan F, which pays the Medicare Part B deductible, is not an option. If you currently have Plan F or its high-deductible variant, you may continue to enjoy the plan.

- High-deductible options are available with Plans F and G, albeit not all carriers provide them. You’ll be responsible for paying Medicare coinsurance, copays, and deductibles.

- Plan G covers copayments up to $20 for office visits and up to $50 for emergency department visits, plus Part B excess charges (where applicable.) Plan N does not cover these copayments or excess charges (where applicable.) Plan G and Plan N do not pay the Part B deductible.

- The most comprehensive plan is Plan F. It covers the Part B deductible, yet, you end up paying more premiums than the deductible affords; that doesn’t make sense. Plan G and N are now more attractive insurance offerings.

- Since Plan G offers more coverage than Plan N, its rates are higher. However, if you are healthy, you can save on premiums by choosing Plan N, which can go towards future copayments should they arise.

- Medigap premium prices vary by state and insurer.

Your Perfect Partner for Medicare Advisory

Learn more about these Medicare supplement plans by connecting directly with one of our trusted agents. If you’re interested, we can guide you all the way through your enrollment. As a Medicare Supplement specialist, we lay out the entire framework of only the most suited Medicare policies and the best carrier companies ahead of you. We offer professional advice and honest recommendations on all of our available plans. It is free to work with us.

Give us a call!

Prefer to chat by phone? Give us a call at 1-888-559-0103.