Medicare Supplement Plans

If you have qualified for Medicare, you quickly learn you need a supplement to cover the gaps that Medicare does not cover. Medicare is a truly beneficial product for seniors, but as health insurance has evolved over time, Medicare is not as comprehensive as a traditional health plan you may be used to.

Supplements make up that gap. In fact, they are often referred to as Medigap policies rather than the expanded term Medicare supplements.

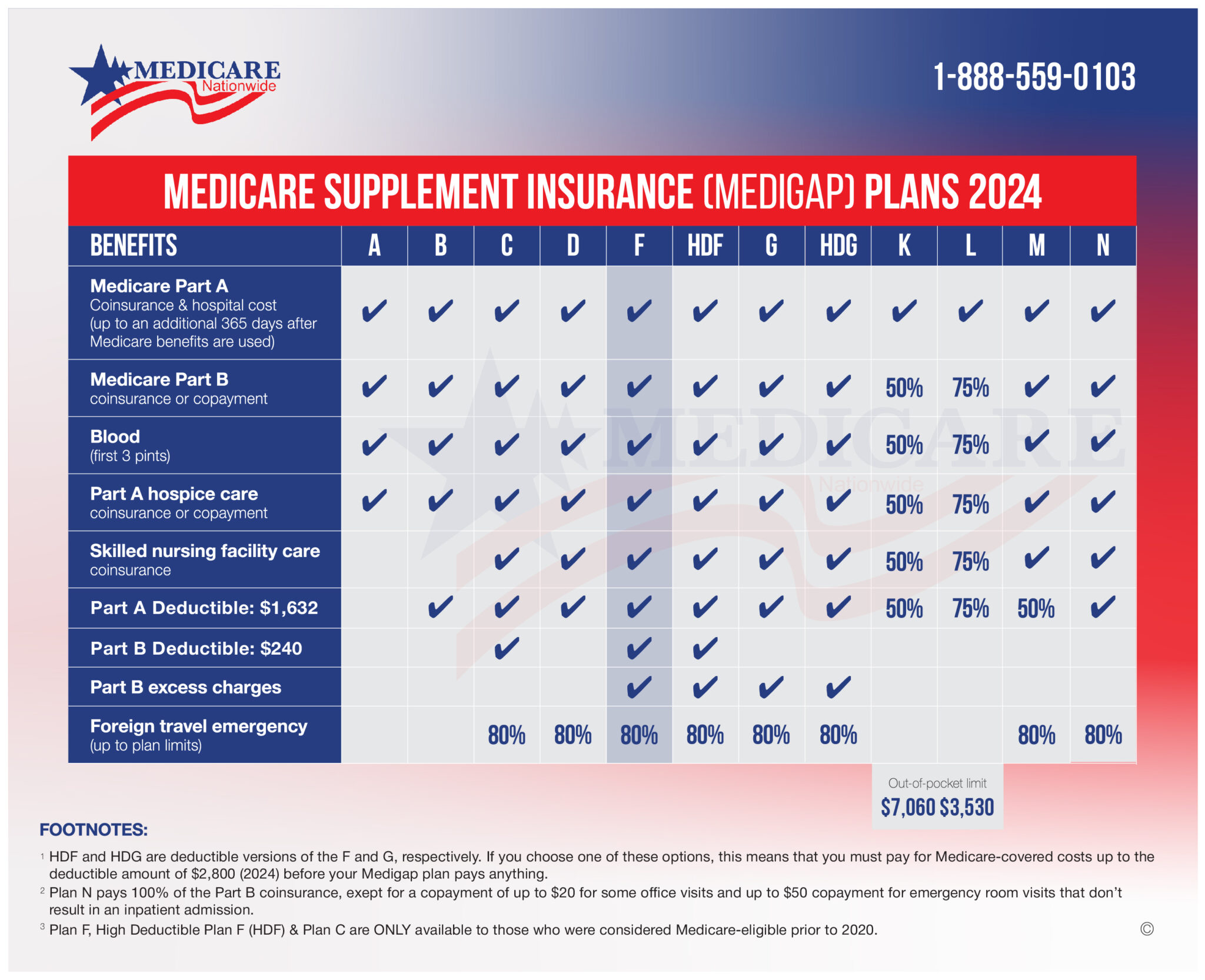

Once you enter the world of Medicare Supplement framework, you quickly learn there are multiple options you must consider. You have to choose from various plans such as Plan N, Plan G, Plan F, etc.

Let’s jump straight into the details of Plan F.

What is Medicare Supplement Insurance Plan F?

Medicare Supplement Plan F is known for offering the most complete coverage among Medigap policies. It covers nearly all out-of-pocket costs after Original Medicare pays its share. This includes deductibles, coinsurance, and excess charges.

It’s a top choice for those who want peace of mind and predictable healthcare expenses. Although it’s no longer available to new Medicare enrollees after 2020, existing beneficiaries may still qualify. Understanding how Medicare Supplement Plan F works helps you decide if it’s the right fit for your needs.

Medicare Supplement Plan F is the most comprehensive of all the supplement plans. Because of the broad amount of coverage it provides, it is also the most expensive of the plans. Even though it costs more than the other plans, it continues to be one of the most popular plan options. About 57% of all Medicare supplement plans in force are a Plan F policy.

Enrollees in the plan will have the least amount of out-of-pocket hospital and doctor expenses after Original Medicare has paid its portion of the cost.

Like other supplement plans, you must be enrolled in Medicare Part A and Medicare Part B to be eligible for a Supplement product. These plans are not a substitute or alternative to Medicare but an extension of the traditional Medicare product covers.

What does Medicare Plan F cover?

Here’s a summary of all the benefits with details given below:

- Part A Deductible

- Part B Deductible

- Part B Excess Charges

- Preventative Care Part B co-insurance

- Part A hospital and co-insurance costs up to an additional 356 days after Medicare benefits are exhausted

- Co-insurance or copays Medicare Part B

- First three pints of blood used in an approved medical procedure (annually)

- Part A Hospice Care co-payment or co-insurance

- Skilled Nursing Facility (SNF) co-insurance

- Foreign Travel Emergency

What part does Plan F NOT cover?

The Medigap Plan F coverage is the most comprehensive plan when compared to other Medigap plans of the same category (Except for Plan G, which is pretty wholesome in terms of coverage and is comparable to Plan F). Still, it is a worthy point to note that even the most extensive plans have certain limitations to their scope of coverage. Since Medigap plans are secondary to basic Medicare, if your primary insurance doesn’t approve coverage, your supplement insurance won’t approve it either.

The following are not covered by Medigap Plan F or any Medigap Plans marketed to new Medicare participants.

- Prescription Drug

- Hearing Care

- Dental Care

- Vision Care

- Surgeries that are considered “cosmetic”

Is Medicare Supplement Plan F being discontinued?

Many of our customers wonder if Plan F is being discontinued. People are afraid of signing up for a plan with great benefits that they will eventually lose.

Yes, plan F is disappearing. In 2020, the government started to phase out Medicare Supplement Plan F. New customers were no longer be able to purchase this comprehensive product. The reason it was phased out was that Congress passed legislation barring supplement policies from covering the Medicare Part B deductible. A lot of folks get confused because they think it is insurance deductible, it is Medicare’s deductible.

This shouldn’t keep you from considering Medicare Supplement Plan F if you were born before 1955. The plan will only be offered to those born before 1954 as of January 1st, 2020.

Here’s a video explaining Medicare Supplement Plan F ‘s removal in 2020.

Plan F Benefit Details

First, with Medicare Supplement Plan F, you are free from doctor’s office co-pays!

The sum that you would normally pay under deductible Medicare Part A and B, is picked up under Plan F. This Medicare plan includes your hospital and outpatient deductible, along with the 20% that Medicare Part B does not cover.

These benefits alone explain why we like Medicare Supplement Plan F and it has become the most popular option among Medicare recipients.

- First Dollar coverage: In the health insurance world, this term is often tossed around as a benefit without much explanation. This means that after Medicare pays its portion of your medical expense, Plan F picks up the rest. You will have $0 out-of-pocket expenses.

- Part A and Part B Deductibles: Part A requires a hospital deductible. Part B requires an outpatient deductible. Plan F covers both.

- 20% Part B Coinsurance: Under Medicare, you must pay this co-insurance. Plan F picks this up. Here’s an example of what this covers. Suppose you are having issues with your hip. Your regular physician sends you to an orthopedic specialist to be examined. Medicare would pay 80% of the specialist visit. Plan F picks up the 20% cost. The specialist then sends you to an imaging center to further examine your hip issues. The cost of MRIs and other imaging technologies can be high. Medicare will pay 80% of this cost, and plan F will pick up the 20%

- Excess charges: Under traditional Medicare, doctors are allowed to charge an extra 15% to the patient beyond the portion that Medicare reimburses. Plan F will pick up any of that extra 15% charge.

- Doctor choice: Many plans restrict your choice of doctor. Plan F allows you to choose any doctor you want. You are not forced to develop a new relationship with a doctor you have never seen, because a particular plan won’t allow it.

- No referrals: If you need to see a specialist, you don’t need to go through the referral process with your normal doctor. Under Plan F, all you have to do is pick up the phone and contact the specialist yourself.

Here’s a sample of a Medicare Supplement Plan F Premium Comparison.

| Medicare Supplement Plan F Average Monthly Cost in Pittsburg, CA (94565)* | |

| Gender: Female, Age 65 | $217.45 |

| Gender: Male, Age 65 | $217.45 |

| Gender: Female, Age 75 | $310.76 |

| Gender: Male, Age 75 | $310.76 |

| Medicare Supplement Plan F Average Monthly Cost in West Lafayette, IN (47906)* | |

| Gender: Female, Age 65 | $181.12 |

| Gender: Male, Age 65 | $203.04 |

| Gender: Female, Age 75 | $233.14 |

| Gender: Male, Age 75 | $305.96 |

| Medicare Supplement Plan F Average Monthly Cost in Milwaukee, WI (53215)* | |

| Gender: Female, Age 65 | $155.32 |

| Gender: Male, Age 65 | $173.39 |

| Gender: Female, Age 75 | $198.09 |

| Gender: Male, Age 75 | $222.59 |

What is the Total Cost?

We’ve mentioned that Plan F is the most costly of the supplemental plans. With all these benefits offered, you are wondering, “What is the cost?”. Cost can vary by where you live, and what insurance company you choose. We can do a quick quote based on your specifics to give you an idea of monthly costs and the best provider to choose.

Here are the elements that go into determining the price of your policy:

- Geography: Because of various state regulations as well as risk factors in certain parts of the country, where you live can affect how much you will pay.

- Gender: With most carriers, we represent males on average will pay more than females. There are exceptions, but this is a general rule.

- Tobacco Use: Health coverage, especially Medicare supplements, is rated similar to life insurance. Tobacco use is always seen as a negative. It will have an impact on how much you pay for any supplement plan.

One way to receive the benefits of Plan F but lower the cost is to choose the high deductible option. In 2025, the high deductible option allows the enrollee to pay the first $2,870.00, thus lowering their overall premium cost.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

What if you currently have Plan F, can you find it cheaper?

Many people worry if they currently have Plan F, they can not change their Medicare plan because they will lose coverage or will not be renewed. This is not true. Medicare Supplement plans are regulated, and coverage remains the same regardless of what company you choose. The only difference between companies is the price. It pays to shop your Medicare supplement plan periodically to find the best price.

We represent a wide variety of insurance companies, so we can do Medigap policy shopping for you. When we review your current coverages, we receive quotes from multiple companies to find the best one for you. This not only saves you money, but it saves you time spent gathering quotes, sorting out details, and comparing costs.

Besides price, what is different between companies for Plan F?

Each company has certain risk profiles it likes and bases its pricing on those characteristics. The rules they use are called underwriting guidelines. Just because you find a company with a very competitive rate doesn’t mean you can access it. You may not fit their guidelines.

We can help you navigate these underwriting rules and match you with the company that fits your profile competitively.

The other differences in companies are:

- Customer Service

- Claims Processing

- Financial Stability

These factors are all important as well. If you have concerns about how easy a carrier is to work with, we can guide you. Each company has different features that help you interact with them. You don’t want a company that is competitive but makes you jump over multiple hurdles to have your claims paid. Good services are as crucial as a good product.

You also don’t want a company with shaky financial ratings because they will find reasons to deny claims.

If Not Medigap F, then What?

Plan G is the closest substitute if you are not grandfathered into Medigap Plan F but want a comparable choice.

Medicare Plan F covers the Part B deductible and Plan G does not.

Medigap plans are federally standardized to offer the same coverage. So a Plan F is a Plan F, it is the same coverage, no matter what company offers it. Prices may vary depending on what carrier is available in your area. Most major carriers offer third-party discounts on vision, hearing, and dental. However, these discounts don’t qualify as insurance and are subject to availability.

Plans are subject to governmental regulation, but private insurers are responsible for selling them and determining their prices.

If you enroll in a Medigap plan during your Medigap Open Enrollment Period, you may get the greatest discount and the easiest enrollment process.

This time frame only occurs once. Once you turn 65 and sign up for Medicare Part B, it begins and lasts for six months.

However, if you decide to keep your employer coverage, you can delay your Medicare Part B when you turn 65 and your Open Enrollment Period will be available to you when you come off creditable coverage through your employer or union plan.

Some insurance carriers lock in your premium rate for an entire year. If you are enrolled outside of Open Enrollment or didn’t meet the requirements for Guaranteed Issued insurance you could be denied coverage if you did not pass underwriting health questions.

Some insurance carriers lock in your premium rate for an entire year. If you are enrolled outside of Open Enrollment or didn’t meet the requirements for Guaranteed Issued insurance, you could be denied coverage if you did not pass underwriting health questions. For more information on what is Guaranteed Issue here is an article: https://www.medicare.gov/supplements-other-insurance/when-can-i-buy-medigap/guaranteed-issue-rights

A crucial choice is whether to enroll in a Medicare Advantage plan, which combines Parts A, B, and D, or a supplement plan that helps cover part of the out-of-pocket costs.

If you decide to purchase a Medicare supplement insurance policy, often known as Medigap, you will have to enroll individually in Part D if you want drug coverage, which is not included in the currently offered supplement plans.

We have an entirely different section dedicated to explaining the fundamentals of Advantage plans. You can read that article here: https://medicarenationwide.com/medicare-advantage-vs-medigap/

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Is Medicare Supplement Plan F the Best?

Compare Medicare Supplement and Make the Best Choice.

Medicare Supplement Plan F is the best if it meets your needs. We like Plan F because of its comprehensive nature. But it may not make the most financial sense for you. Other plans of Medicare supplement insurance, Medicare Prescription Drug Plans, Health Insurance, or Medicare Advantage plans might fit your needs better. Medicare Supplement Plan G, for example, is cheaper but doesn’t cover the Part B deductible. The premium savings by switching to Plan G are typically a lot more than the cost for the Part B deductible that Plan F covers. Don’t be surprised to save hundreds if not thousands of dollars in premiums.

Let us review your current coverages, compare Medicare supplement plans, and provide you with multiple options to make the best choice for your health and pocketbook.

For more information, please contact us. We’d be happy to shop available Plan F, G or N carriers in your area!

Prefer to chat by phone? Give us a call at 1-888-559-0103