What makes a Medicare Supplement Plan N a hit among the other Medigap Plans?

Medicare Supplement Plan N is a Great Value for Smart Shoppers.

Are you a smart shopper? Then you know that the best value is often not the most expensive product available. Neither is it typically the cheapest product either. The best value depends on your specific needs, the features you want, and how well the product fits your unique circumstances and budget.

Needs and wants are individual, yes, but’s that especially true when it comes to health insurance? It’s very personal. People have widely differing health conditions, they take different prescriptions, and they see different doctors and specialists. And most people are on a budget. That’s an important factor, sometimes the most important one.

So, if you like smart shopping, this article will help. It will discuss the reasons why millions of people, good shoppers, who have been looking around for Medicare Supplement insurance, have purchased Medicare Supplement Plan N. It’s certainly not the most expensive option available, and it is not the cheapest one either. But your overall healthcare costs, over time, might indeed be the lowest with a Plan N. Curious to see how Medigap plans complement your coverage as secondary insurance to Medicare. It’s high time we look into the plethora of possibilities these Medigap policies afford us.

Deciding what Medicare Expenses worry you the most.

Doctor visits or hospital bills; which would be the biggest expense for you? Or rather, how much can you rely on your health insurance plan to have your back?

It’s hospital bills, to be sure. Your doctors and even your specialists typically don’t charge much for routine office visits. But just two days in a hospital can generate a bill in the tens of thousands of dollars. That scares some people.

The worry of big hospital bills scares many people into buying a Supplement Plan F or a Plan G. Both of those plans give you 100% hospital coverage. If Medicare approves the bills, then Plans F & G will pay all the co-pays on them for you. Simple. Life gets just a tad bit easier. Doesn’t it?

Medicare Supplement Plan N Costs and Premium

| Medicare Supplement Plan N Average Monthly Cost in Raleigh, NC (27603)* | |

| Gender: Female, Age 65 | $96.91 |

| Gender: Male, Age 65 | $109.26 |

| Gender: Female, Age 75 | $129.64 |

| Gender: Male, Age 75 | $146.63 |

| Medicare Supplement Plan N Average Monthly Cost in Oklahoma City, OK (73160)* | |

| Gender: Female, Age 65 | $113.59 |

| Gender: Male, Age 65 | $126.55 |

| Gender: Female, Age 75 | $147.11 |

| Gender: Male, Age 75 | $164.06 |

| Medicare Supplement Plan N Average Monthly Cost in Los Angeles, CA (90011)* | |

| Gender: Female, Age 65 | $154.04 |

| Gender: Male, Age 65 | $154.04 |

| Gender: Female, Age 75 | $225.90 |

| Gender: Male, Age 75 | $225.90 |

Here’s a sample of a Medicare Supplement Plan N Premium Comparison.

1. Plan N Has the Exact Same Hospital Coverage as the Most Expensive Supplement Insurance Plans Available.

Here’s the value. Plan N gives you the same 100% coverage for hospital bills that the two more expensive plans give you. You will save a lot on the monthly price of the insurance with a Plan N but still enjoy the same 100% hospital coverage as people who own Plans F & G. Nice, right?

You actually get more benefits than that. Part A expenses under Medicare relate to hospital stays, time in rehabilitation facilities following hospital stays of three days or longer, and other items as well. The good news is that the co-pays and deductibles on those benefits are paid for you identically under Medicare Supplement Insurance Plans F, G, and N. It’s too much to list here, but we will be happy to discuss all your Part A benefits in detail with you.

What states don’t allow Part B Excess Charges?

| State | CT | MA | MN | NY | OH | PA | RI | VT | All others |

| Part B Excess? | No | No | No | 5% cap | No | No | No | No | Yes |

Do You Have Doctors You Want to Keep Seeing? Medigap Helps!

Every shopping decision is not about money. By the time we reach Medicare age (that’s a nice way of saying ‘senior citizen,’ don’t you agree?), we probably have several doctors that we see. Naturally, we want insurance that all those doctors will take. It’s no fun looking for new doctors because some don’t accept our insurance.

If you have been looking at Medicare Advantage plan C, like HMO and PPO plans, you know that most of them cost less per month than supplement plans. Some HMOs are even zero premium, depending on where you live.

Here’s the catch. With Advantage Plans, you have to see doctors who take that health insurance. If you go out of network, you could pay much more. If you go to doctors who don’t even take that insurance (it happens), then you would have to pay the entire bill yourself, then try to get reimbursed (partially at best) from the insurance company. Not good. HMOs typically pay nothing towards your out-of-network bills – you pay the entire bill, with a few exceptions. Ouch!

2. Plan N Gives You A Greater Choice of Doctors Compared to Advantage Plans

So that’s the point. People who don’t like networks and who value the freedom to go to any doctor who takes Medicare usually prefer to own a Supplement. There is no network – all doctors who take Medicare have to accept all supplements. For those shoppers who are budget conscious, too, Plan N gives a lower-cost way to have that freedom than Plans F & G.

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

The Differences Between Medicare Supplement Insurance Plan N and F & G

Compare Medicare Supplement N, G, and F.

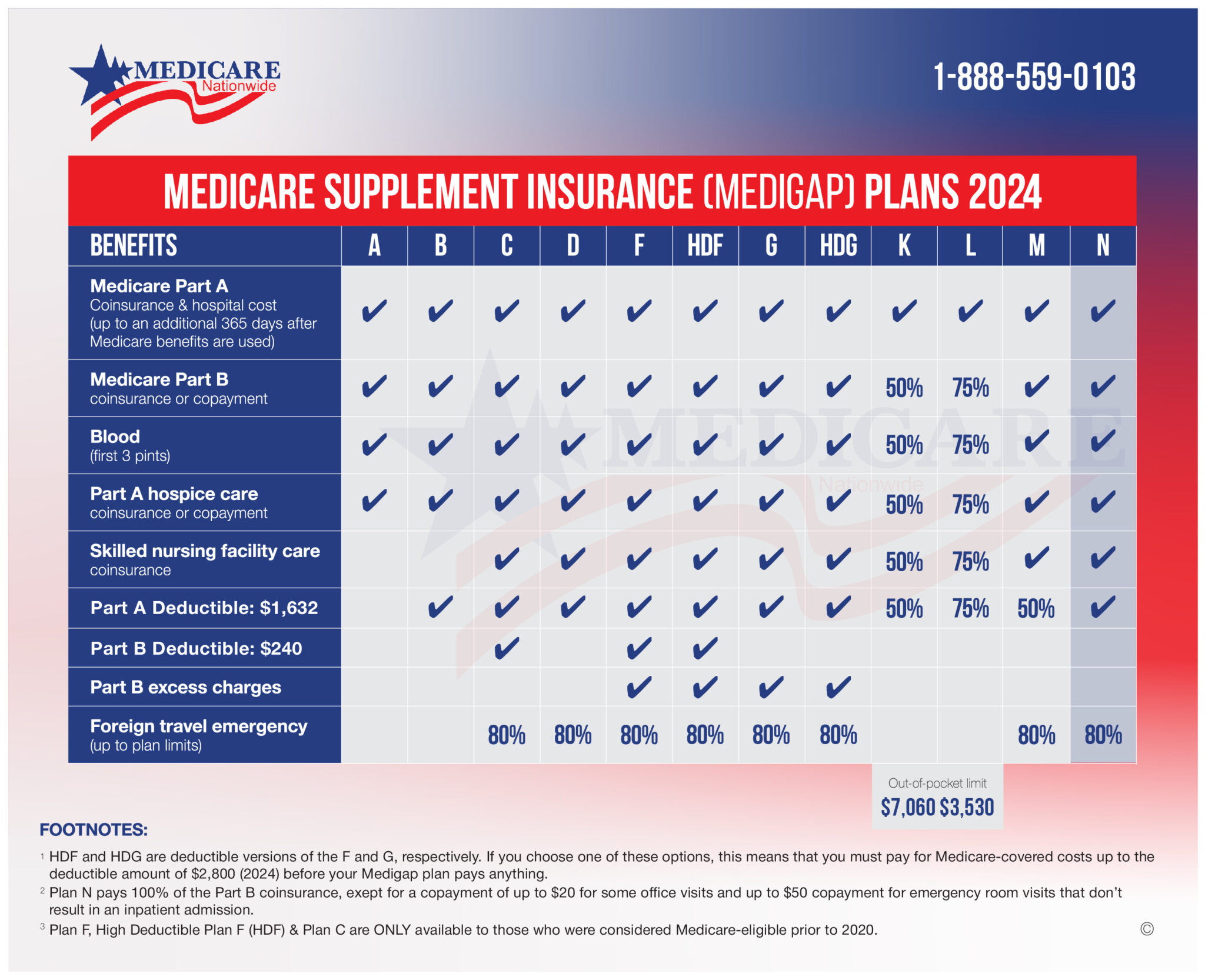

- Plan F is often referred to as the 100% plan. If Medicare approves a hospital, doctor, or medical bill, then Plan F will pay your copay for it. Simple.

- Plan G is identical to Plan F except for one small charge; the annual Part B deductible.

- Plan N has some co-pays built into the structure. In exchange for paying a much lower monthly premium than you would if you purchased a Plan F or G, you would have some small co-pays to deal with.

- Click here for more information on the differences between Medicare Supplement F, G & N.

Are You Comfortable with Small Co-pays?

The co-pays with a Plan N are:

- You pay the annual Medicare Part B deductible, the same as with a Plan G.

- You have a copay at each doctor visit. How much is that? Up to $20 (often less). What about specialists? The same amount, up to $20. Notice how favorably this compares to Advantage Plan co-pays. With Advantage Plans, the specialists’ co-pays would typically cost you about $40 per visit, and often even more. So, if you have a lot of specialist visits each year, the Plan N can indeed be your overall lowest cost of healthcare, as we said. See how that works?

- A $50 emergency room copay, unless the ER visit leads to a hospital inpatient stay. In that case, there would be no ER copay.

- You will have a possible $50 copay for outpatient services like outpatient surgery. We are listing this separately, but it works exactly like the emergency room ‘possible’ copay. If you are not admitted to the hospital after the procedure or service, that’s great. But you would have to pay $50. Yes, we know it seems counter-productive from Medicare’s point of view. They reward you for going to the hospital and make you pay $50 if you don’t.

- There is no coverage for Medicare Part B Excess charges. Since most people never pay this charge, indeed, they don’t even know it exists, and it’s a bit complicated to understand; we’ll cover it later in its own section.

3. Copays Are Small with Plan N

As you can see, routine copays are small with a Plan N, and they compare very favorably with copays under Advantage Plans. Besides, advantage plans have big deductibles and copays for hospital stays. With a Plan N, all that is paid for you. Remember, we’re looking for the lowest overall cost of health care, all things considered, like copays, deductibles, the price of insurance, and the cost of prescriptions as well.

How to Avoid Part B Excess Charges?

In some situations, doctors can add 15% to their bill and ask you to pay it. That’s called the Part B Excess Charge. You can avoid those charges in two ways.

- Understand how Medicare Plans Medicare Supplement works. If your doctors take Medicare Assignment, then they are prohibited from charging you the extra 15%.

- Some doctors take Medicare but are not on ‘Medicare Assignment.’ In that case, they can charge you the extra 15%. Ask your doctor’s office before your service if they charge the extra 15%. If they do, then you can select another doctor. Remember, there are no networks with supplement plans.

- In some states, you don’t even have an excess charge with Plan N! They include Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont.

Do You Travel Extensively?

Some people have two homes. Perhaps they winter in the south and spend summer up north. They need doctors in both cities. Others are constantly traveling. Either way, if that is you, you probably don’t want to be limited to finding doctors ‘in network’ who will take your insurance every time you get sick. Plan N is popular for avoiding that trouble.

4. Plan N Gives You Coast-To-Coast Nationwide Coverage

For people who travel a lot, Medicare supplement plans really shine. Any doctor who takes Medicare has to accept your Plan N as payment, minus your small copay.

Do You Have Expensive Prescriptions? Do Medicare Supplement Plans Help?

For many people, the biggest healthcare expense is the price of their prescriptions. If you have a typical Advantage Plan, drug insurance is an integral part of the plan. You can’t remove it for something better. While exceptions do exist, most Advantage Plans are like that. You can’t change your Rx coverage for something better without changing your entire insurance package.

That puts you right back into the problem of finding doctors who will take the insurance. That could become a vicious cycle, especially if the number of Advantage Plans sold in your geographic area is limited to only a few choices.

5. Plan N Lets You Have a Separate Prescription Plan

It’s no secret that many people can save hundreds of dollars per year, sometimes even thousands, by choosing a different Medicare Rx plan. That is often their biggest potential source of savings.

You Can Change Your Rx Plan as Your Needs Change

Depending on the prescriptions you take, you might save enough money on Rx costs to pay for your N Plan. You would have to choose the prescription plan that best covers your particular medications. And as your prescriptions change, you can shop for a better Rx plan each year. It’s nice to know that you have that freedom, isn’t it?

In A Nutshell – Freedom from Worry, More Choices, More Control, Lower Overall Costs

Let’s recap the reasons that millions of people own a Medicare Supplement Plan N. It combines the best parts of several medicare supplement plans into one easy-to-use package:

- Lower cost than a Medigap Plan F or G, but with the same identical hospital coverage

- No networks. Greater choice of doctors than Advantage Plans

- Small co-pays that compare very favorably to Advantage Plan co-pays

- Coast-to-coast nationwide coverage; great if you travel

- A separate prescription plan can give you a lower cost of prescriptions

Set Appointment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Make the Best Medicare Decision

Learn More about Medicare. Compare Medicare Supplement Policies & Carriers. Let’s talk it over. If you are a smart shopper and pride yourself on finding the best values in business, then Medicare Plan N might be a good fit. Here’s how we can assist you in choosing a quality Medicare supplement.

Since 2012, thousands of senior citizens in the United States have chosen from among the hundreds of plan alternatives offered by Medicare Nationwide.

Medicare Nationwide is a full-service Medicare insurance agency, and there is no cost to work with us. Give us a call today to know in detail about all the Medigap plans, compare their benefits, and lock in the best discount deals. Our extensive network also helps us find the most reliable and beneficial health insurance policy in your area. There is no cost to work with us.

Prefer to chat by phone? Give us a call at 1-888-559-0103.