Exploring Medicare at 65

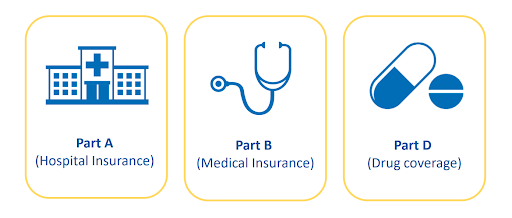

Navigating the intricacies of healthcare can be daunting, especially when it comes to Medicare. In this comprehensive guide, we delve into the fundamental components of Medicare Parts A, B, and D, shedding light on what each part covers and how they work together to provide vital healthcare coverage for millions of Americans. Whether you’re approaching Medicare eligibility for the first time or seeking to deepen your understanding of the program, this article serves as your roadmap to unlocking the benefits and complexities of Medicare Parts A, B, and D.

Your Medicare Option

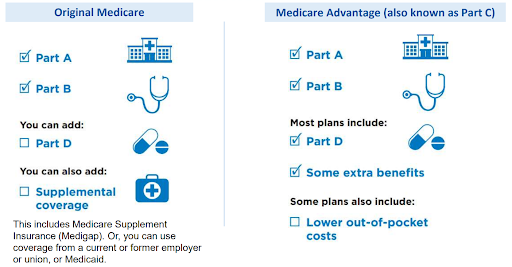

In the complex realm of healthcare, it’s crucial to grasp your Medicare choices. As you set out on this voyage, two main routes come into focus: Original Medicare and Medicare Advantage. Each presents distinct advantages, expenses, and factors to weigh. Let’s explore the core of this comparison:

Considerations for Medicare Enrollment

Medicare Part A (Hospital Insurance)

- Most individuals are not charged a premium for Part A.

- Your monthly premium could increase by 10% if you delay enrollment beyond your initial eligibility period.

- Enrollment in Medicare Part A renders you ineligible to contribute to a Health Savings Account (HSA).

- Marketplace premium tax credits and cost-sharing reductions are not available if you have Part A.

- Part A qualifies as health coverage.

Medicare Part B (Medical Insurance)

- Part B typically requires a monthly premium, deducted from Social Security or Railroad Retirement Board benefits.

- If not receiving Social Security or RRB benefits, payment options include online payment through a secure Medicare account, bank online bill payment services, Medicare Easy Pay, or mailing payment to Medicare.

- Although enrollment in Part B is optional, delaying enrollment may result in a lifetime late enrollment penalty.

Deciding on Part D Plan Membership

- Evaluate costs and coverage of creditable drug coverage compared to Medicare drug coverage.

- Consider the potential loss of current health coverage by joining a Medicare drug plan.

- Compare out-of-pocket drug costs with Medicare drug plan costs.

- Assess changes in costs with Extra Help for Medicare drug plan expenses.

- Verify the comprehensiveness of current drug coverage.

- Without creditable drug coverage, consider joining early to avoid future late enrollment penalties or qualify for Extra Help without penalty.

Medicare Supplement Insurance (Medigap)

- Offered by private insurance companies to bridge gaps in Original Medicare coverage, such as copayments, coinsurance, and deductibles.

- Standardized Medigap policies provide uniform basic benefits but may differ in costs.

- Medicare SELECT, an alternative Medigap policy, is available in select states.

- Unique Medigap plans exist in Minnesota, Massachusetts, and Wisconsin.

Deciding on Medigap Policy Necessity

Deciding whether you need a Medigap policy depends on various factors, such as whether you have other supplemental coverage and your ability to afford Medicare deductibles and copayments compared to the monthly Medigap premium costs.

Special Medicare Notice for Consumers Turning 65

What you need to know:

- Notifies individuals of Medicare eligibility upon turning 65 and the option to modify health coverage.

- Provides information on various methods to enroll in Medicare.

- Highlights potential late enrollment penalties for failing to enroll when first eligible.

- Advises that Marketplace plans may be canceled upon Medicare enrollment.

Medicare Enrollment

Enrollment in Medicare is automatic for those receiving Social Security or RRB benefits. Expect a “Get Ready for Medicare Package” three months before turning 65 or 25th month of disability benefits, including your Medicare card.

If you’re not receiving Social Security four months before turning 65, sign up during your Initial Enrollment Period (IEP), starting three months before and ending three months after your birthday month. Coverage starts based on enrollment month.

If you have End-Stage Renal Disease (ESRD), you might qualify for premium-free Part A without mandatory Medicare enrollment.

Missing your IEP means waiting for Medicare’s General Enrollment Period (GEP) from January 1 to March 31 annually. Late enrollment beyond 12 months after turning 65 could incur a lifetime penalty. You may qualify for a Medicare Special Enrollment Period (SEP).

Transitioning from the Marketplace to Medicare involves several important considerations.

Here’s a breakdown of key points:

Medicare Part A Eligibility

Once eligible for Medicare Part A (Hospital Insurance), you lose eligibility for premium tax credits and other cost savings from your Marketplace plan.

Signing Up for Medicare

Enroll during your Initial Enrollment Period (IEP) to avoid potential lifetime late enrollment penalties. Connect with your state’s Marketplace via HealthCare.gov before your Medicare enrollment begins to gather more information.

Canceling Marketplace Coverage Due to Medicare Eligibility

Self-only Household: You can request immediate termination or choose a future termination date. Coverage may not cease immediately in certain cases. End your Marketplace coverage by logging into your HealthCare.gov account or calling the Marketplace Call Center.

Household Plan: Call the Marketplace Call Center on the day Medicare starts; coverage ends the previous day. Avoid changing or terminating Marketplace coverage online unless it applies to everyone on the plan.

Choosing Marketplace Coverage Instead of Medicare

If you have Medicare Part A and Part B but are paying a Part A premium, you can switch to a Marketplace plan. Similarly, if you only have Part B and would need to pay a premium for Part A, you can opt for a Marketplace plan. Eligible individuals who haven’t enrolled in Medicare yet can get a Marketplace plan under specific circumstances, such as having to pay for Part A, having a qualifying medical condition, or being in the 24-month disability waiting period.

Considerations

- Marketplace plans may not cover claims that would be included in Part B coverage.

- Delaying Medicare enrollment may result in lifetime Part B late enrollment penalties.

- Retroactive termination of Medicare requires repayment of any claims paid during that time.

- Generally, there’s little benefit to opting for Marketplace coverage over Medicare. If already enrolled in Medicare, you likely cannot enroll in the Marketplace.

By understanding these aspects, individuals can smoothly transition from the Marketplace to Medicare without unexpected complications or penalties.

Medicare & Small Business Health Options Program (SHOP) Coverage

Small employers seeking to offer health and/or dental insurance to their employees can access coverage through the Small Business Health Options Program (SHOP). This coverage is obtainable from issuers, agents, and brokers. Having SHOP coverage allows for a delay in enrolling in Medicare Part B (Medical Insurance).

Upon the conclusion of SHOP coverage, individuals are granted a Special Enrollment Period (SEP) to enroll in Part B without facing penalties. This SEP remains valid as long as one is covered by a group health plan (GHP) through their own or their spouse’s current employment. It extends for an 8-month period following the termination of current employment or SHOP coverage, whichever comes first.

Failure to enroll during this (SEP) may result in a Part B late enrollment penalty, applicable for the duration of Part B coverage. Enrollment outside of this period is limited to Medicare’s General Enrollment Period (GEP).

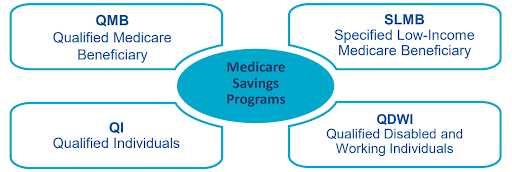

Transitioning from the Health Insurance Marketplace to Medicare can raise concerns about expenses, particularly if you’ve been receiving premium tax credits that don’t apply to Medicare. State assistance is available to help cover Medicare costs for individuals with limited income and resources, often with higher thresholds than full Medicaid.

Medicare Savings Programs (MSP)

- Qualified Medicare Beneficiary (QMB)

- Specified Low-Income Medicare Beneficiary (SLMB)

- Qualified Individuals (QI)

- Qualified Disabled and Working Individuals (QDWI)

Additionally, there’s Extra Help available for Medicare drug costs, known as Part D, or the low-income subsidy (LIS). This program assists with premiums, deductibles, and copayments based on income and resources. Special Enrollment Periods (SEP) allow quarterly changes to Medicare drug plans for qualifying individuals.

Automatic qualification for Extra Help is extended to those receiving:

- Full Medicaid coverage

- Supplemental Security Income (SSI)

- Assistance from Medicaid with Medicare Part B premium (MSP)

If an application is necessary, avenues include online submission, calling Social Security, contacting the State Medical Assistance (Medicaid) office, or engaging with local assistance programs.

To assess eligibility for assistance with Medicare costs, review income and resource guidelines, and gather personal documentation. Reach out to the State Medical Assistance (Medicaid) office or local assistance programs for further information.

Medicare Periodic Data Matching (PDM) periodically verifies eligibility for individuals receiving tax credits for Marketplace plans. Dual enrollment in Medicare and a Marketplace plan may disqualify individuals from financial assistance through the Marketplace, potentially requiring repayment of tax credits and cost-sharing reductions.

Marketplaces are mandated to periodically review data sources to identify such cases and notify affected individuals. Failure to respond to notices may result in the termination of Marketplace coverage or financial assistance.

Initial and final notices are issued to inform individuals about their dual enrollment status and the consequences thereof. Failure to act within the specified timeframe may lead to the termination of Marketplace coverage or financial assistance.

In Summary

Navigating the transition from the Marketplace to Medicare involves understanding the intricacies of each program and making informed decisions. Whether you’re exploring Medicare at 65 for the first time or seeking to optimize your coverage, it’s essential to grasp the fundamentals of Medicare Parts A, B, and D, as well as consider options like Medicare Advantage and Medigap policies.

Enrolling during the Initial Enrollment Period is crucial to avoid penalties, and understanding the implications of dual enrollment is vital to prevent loss of financial assistance. By utilizing available resources and considering individual circumstances, individuals can navigate this transition smoothly and access the healthcare coverage they need.

DISCLAIMER: Please verify the information provided here with the primary source to ensure accuracy. We strive to present information correctly. It is advisable to confirm details directly from the primary source for accuracy and reliability