Medicare covers the COVID-19 vaccine shot

Medicare.gov announced on its website that it is covering the coronavirus vaccine shot, but provides a warning against potential scammers:

“Medicare covers the vaccine at no cost to you. Be sure to bring your Medicare card so your healthcare provider or pharmacy can bill Medicare.”

“Be alert for scammers trying to steal your Medicare Number. Medicare covers the vaccine at no cost to you, so if anyone asks you for your Medicare Number to get early access to the vaccine, you can bet it’s a scam.”

You also are not required to pay the Part B deductible or any coinsurance related to the test.

This is good news, but just remember these facts:

- You can’t pay to put your name on a list to get the vaccine. Scammers bilk unsuspecting people out of money by promising this shortcut.

- You can’t pay to get early vaccine access.

- Whatever you do, don’t share personal and financial info with someone calling offering early vaccine access.

Medicare coverage for COVID-19 related expenses and services

Medicare covers many aspects and costs of COVID-19. Here are the primary costs and coverages:

- Lab tests for COVID-19. You will not pay any out-of-pocket costs for testing.

- Antibody tests for COVID-19. If you were diagnosed with COVID or suspect you had the virus, you can be tested for antibodies. Speak to your doctor, because the presence of the antibodies may allow you to postpone the vaccine.

- Vaccines. COVID vaccines will be covered.

- Medically Necessary Hospitalizations. According to Medicare.gov, “This includes if you’re diagnosed with COVID-19 and might otherwise have been discharged from the hospital after an inpatient stay, but instead, you need to stay in the hospital under quarantine. You’ll still pay for any hospital deductibles, copays, or coinsurances that apply.”

Coverage for COVID-19 treatment or hospitalizations

Medicare will pay for necessary hospitalizations due to COVID-19, but as mentioned earlier you will pay any deductibles, copays, or coinsurances that apply. Those extra coronavirus costs can be significant and you would need a Medicare Supplement policy or Medicare Advantage plan to pick up any gaps so you don’t get stuck with all the out-of-pocket health costs.

As the medical community continues to understand the COVID-19 virus, treatment services continue to emerge and improve. Because coronavirus treatment is evolving, the Center for Medicare & Medicaid Services continues to issue updates. At the end of 2020, they issued the following statement and guidance:

“CMS issued an Interim Final Rule with Comment Period (IFC) that established the New COVID-19 Treatments Add-on Payment (NCTAP) under the Medicare Inpatient Prospective Payment System (IPPS), effective from November 2, 2020, until the end of the public health emergency (PHE) for COVID-19. To mitigate potential financial disincentives for hospitals to provide new COVID-19 treatments during the COVID-19 PHE, the Medicare program will provide an enhanced payment for eligible inpatient cases that involve use of certain new products with current Food and Drug Administration (FDA) approval or emergency use authorization (EUA) to treat COVID-19.”

To give a sense of the ongoing nature of coronavirus treatment services, here are some updates:

- August 23, 2020: FDA allowed the use of COVID-19 plasma for treatment

- October 22, 2020: FDA approved remdesivir (Veklury) as a treatment

- November 19, 2020: FDA approved the combination of barictinib and remdesivir.

Because these health treatment services are approved, they will be covered by Medicare but again deductibles and co-pays may apply toward hospitalization.

Skilled nursing facility or nursing home coverage related to COVID-19?

Original Medicare Part A covers skilled nursing care, but only in certain conditions. You must have days left in your benefit period and have a qualifying hospital stay. The good news is that during the COVID-19 pandemic some people may be able to renew their skilled nursing facility coverage without having to start a new benefit period.

There are costs related to skilled nursing under Original Medicare:

- Days 1-20: $0 for each benefit period.

- Days 21-100: $209.50 coinsurance per day.

- Days 101+: You incur all costs.

You see the advantage of being able to renew the coverage without having to start a new benefit period. It is also helpful to have some kind of extra coverage such as an Advantage Plan or Medicare Supplement policy to pick up those out-of-pocket costs.

COVID-19 & Medicare Supplements

Medigap plans can help cover the cost of certain out-of-pocket Medicare costs like deductibles, copayments and coinsurance. As you’ve seen already, even in the midst of the COVID-19 pandemic, hospitalization out-of-pocket can be high.

There are a wide variety of Medicare Supplement Plans available. Each of these plans covers different amounts of out-of-pocket costs. Supplements such as Plan F & G tend to be the most comprehensive in what they cover. We’ve created several charts and tutorials to understand the coverages of each Medicare Supplement Plans: Comparison.

Let’s look at a hypothetical example of how Medicare Supplement (Medigap) plans cover COVID-19 expenses:

Bob has Medicare and a Medicare Supplement Plan F. If Bob has to go to the doctor because of suspected COVID-19, the plan will pay the full coverage of the Medicare Part B deductible and coinsurance. He will have no out-of-pocket costs for the trip to the doctor. If the doctor prescribes medication for at-home coronavirus treatment, any over-the-counter drugs would not be covered under Medicare or a Supplement Plan. Bob would need a prescription drug plan (Part D) to cover the medication.

Let’s pretend Bob’s symptoms worsen and he goes to the emergency room. The Supplement plan covers the Part B coinsurance in full and he will pay nothing for the visit. While in the emergency room, the doctors determine he needs in-patient care. The Supplement plan provides full coverage of the Medicare Part A deductible which means he will pay nothing for the hospital stay.

Each Medicare Supplement plan is different in the health coverage they afford. If you have questions about your current plan, please talk with one of our agents and they will explain what will be covered.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

How does Medicare Advantage cover COVID-19?

If you have a Medicare Advantage Plan (Part C), you have access to the same benefits as traditional Medicare. Many plans will also offer other benefits such as tele-health, meal delivery, and medical transport. Check your plan for the coverage specifics or contact your agent to help understand the details.

Let’s do another hypothetical example, this time using John who has a Medicare Advantage Plan:

John goes to the emergency room as well because of COVID. Under his Advantage plan he would be responsible for the Part A and Part B deductible along with the Part B coinsurance. Some Medicare Advantage plans are waiving costs related to the COVID-19 pandemic. To determine if your plan is covering this, speak with an agent or consult your policy. For any prescriptions John would have for coronavirus treatment, his Medicare Advantage plan covers prescription drugs.

How are prescription drug costs related to COVID-19 covered by Medicare?

If you have Medicare and/or a Medicare Supplement plan, prescription drugs are not covered unless you have a Prescription Drug Plan (Part D). Some Medicare Advantage Plans do provide and bundle prescription drug coverage. Please check your policy or speak to one of our agents to determine coverage. One benefit of Prescription Drug Plans related to the COVID-19 is that prior authorization of medication may be waived or relaxed when related to COVID-19.

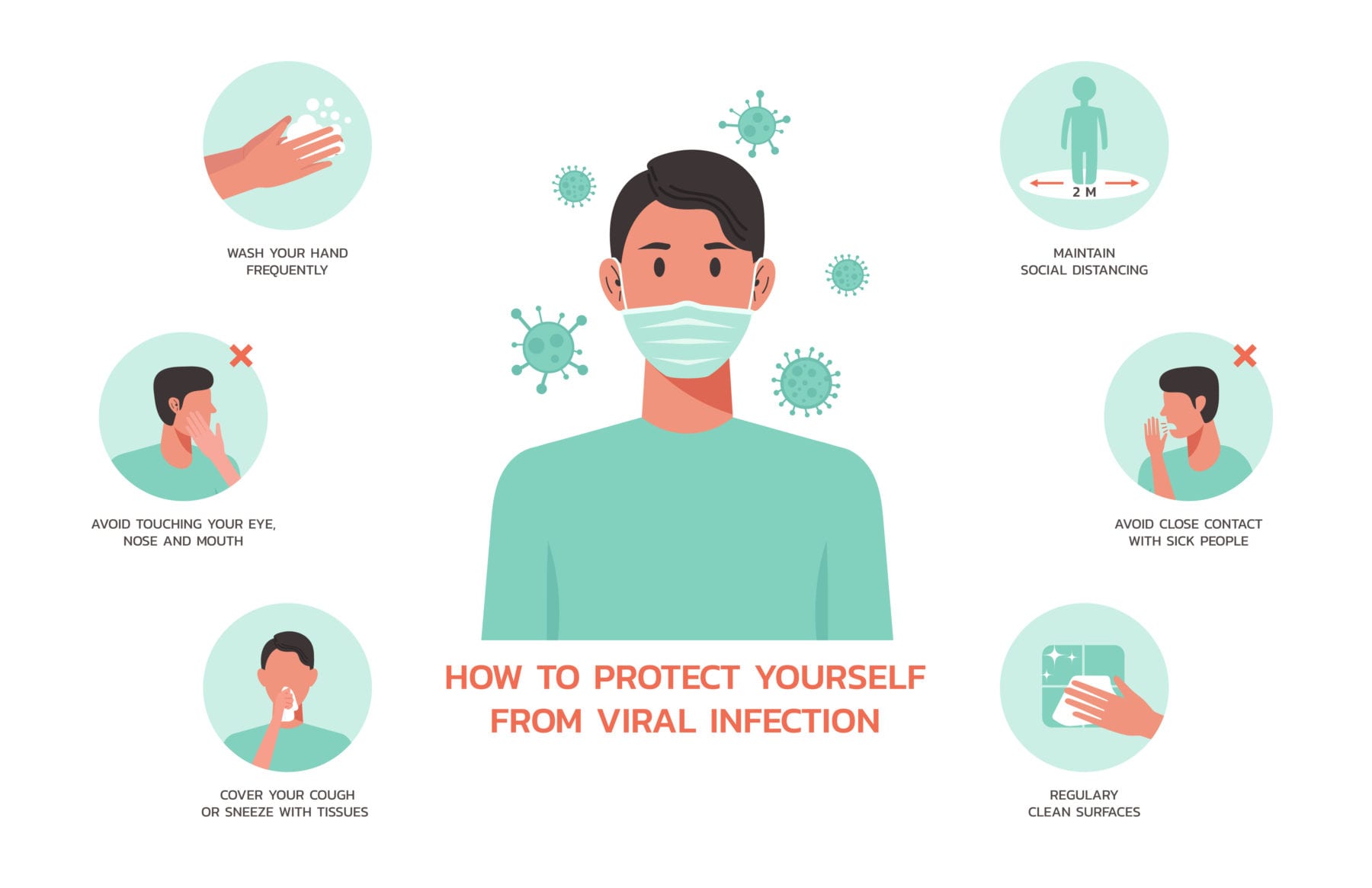

How to protect yourself from Coronavirus?

Costs related to COVID-19 have been expanded, but there are still gaps depending on your policy. One of the best courses of action is to protect yourself from the coronavirus.

Medicare follows the CDC guidelines on recommendations to protect yourself from the coronavirus. Many of these steps you have heard and probably follow.

- Wear a mask that covers both your nose and mouth.

- Socially distance at least 6 feet from others who don’t live with you.

- Avoid crowds, especially ones that aren’t well-ventilated.

- Wash your hands

- Watch for symptoms

- Avoid people if you think you have been exposed and contact a medical professional

Throughout 2020, these recommendations have been drilled into us, so you are probably following the guidelines today. Just make sure you stay vigilant and follow good health practices. COVID-19 has presented numerous challenges to society and Medicare has responded.

Many treatments and coverage plans have expanded. But as you have seen there are still potential gaps. Make sure you examine your health coverages.