Medicare Supplement Plans Comparison

Compare Medigap Plans

The Medicare Supplement Insurance Plan comparison chart below shows what these plans cover and do not cover.

Don’t be confused with Medigap Plan A and Plan B with Medicare Part A and B. Original Medicare covers Part A, or your Hospital Insurance(Inpatient, Home health, hospice, etc. and Part B, or your Medical Insurance (outpatient care, doctors visit, DME, etc.)

Note: As of January 1, 2020, Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you can keep your plan. If you were eligible for Medicare before January 1, 2020, but are not yet enrolled, you may be able to buy one of these plans (Plan C or F).

How do I Pick Medicare Supplement Plans?

First, review the differences outlined in the Medicare Supplement chart below in the official guide of the Medicare & You Handbook. You will notice the Plan letters with the most checkboxes offer the most coverage. The plans are federally standardized, which means the coverage is the same for each Plan letter, yet the prices vary depending on factors such as location, age, and the insurance carrier. We will go into further detail about the popular plans that have a high enrollment each year.

Medicare Supplements Plans (F, G, N)

Medicare Supplement Plan F

Plan F is the most comprehensive plan and has long been the most popular option. If you are new to medicare and you want to shop and find the best plan, Medicare Supplement Plan F may suit your needs. This plan covers all items at 100% of your Medicare cost-sharing and leaves no out-of-pocket costs for covered services.

The popularity of this plan comes from the peace of mind it provides. Beneficiaries know the plan covers all items approved by Medicare.

There is also a high-deductible plan offered for Plan F and Plan G. The deductible amount is $2,870. However, Medicare still pays claims until you satisfy your deductible. For example, if your Medicare-approved bill is for $1,000.00, Medicare would pay $800.00 (80%) for Part B services, and you would pay $200.00 (20%) towards your deductible.

Note: Medicare Supplement Plan F will be phased out. If you didn’t qualify for Medicare until January 1, 2020 or later, you won’t be able to buy Plan F. This change applies to Medicare Supplement insurance plans that cover the Medicare Part B annual deductible (Plan F and Plan C). If you qualified for Medicare before January 1, 2020, you may still be able to buy Plan F. If you already have Plan F, you can generally keep it. The same applies to Plan C.

Medicare Supplement Plan G

This plan is the second most popular in the menu of all insurance plans you can find today. Plan G benefits are practically identical to Plan F. The only difference is that Plan G does not cover the Medicare Part B deductible.

To compare, if your Plan F premium is $300 monthly, your yearly expense is $3,600.

If your Plan G premium is $150 monthly, your annual cost is $1,800, but you may have to satisfy the Part B deductible. Even if you meet the Part B deductible, you will still save nearly $1,500 in a year by switching plans. But for those who missed eligibility for Plan F, Plan G could be a great alternative if you wish to have comprehensive coverage with a low deductible and a lower monthly premium. Plan G may be a plan to consider.

Medicare Supplement Plan N

Medicare Supplement Plan N is similar to Plan G, except for three main differences. First, Plan N subjects you to co-payments of up to $20 for office visits. Second, there are also co-payments of up to $50 for hospital visits if not admitted. Lastly, there are Part B excess charges for providers that don’t accept Medicare assignments. These providers can charge you 15% more than the Medicare-approved rate. These states do not have Part B excess charges:

- Connecticut

- Massachusetts

- Minnesota

- New York

- Ohio

- Pennsylvania

- Rhode Island

- Vermont

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

What is the Cost of Medicare Plans?

When you compare what each Medigap plan pays, you will notice that every plan has a different average monthly premium and out-of-pocket costs for which the beneficiary is responsible. The following costs are associated with Medigap:

- Medicare Part B Premium – $174.70 is the standard amount in 2024

- Medicare Part A Premium – (if applicable) either $278.00 or up to $505.00 each month in 2024 depending on how long you or your spouse worked and paid Medicare taxes.

- Medigap Premium

- Deductible – All Medicare Supplement plans except Medigap Plan C and Plan F

- Copayments – Not applicable on all plans

- Coinsurance – Not applicable on all plans

The cost of a Medigap varies based on the type of plan you choose. Some of these insurance plans require copayments and deductibles, whereas others only require the beneficiary to pay a deductible before coverage kicks in at 100%.

Yes, all plans offer the same basic benefits, but some also offer additional benefits so you can choose which plan meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap is standardized in a different way.

Each Medicare insurance company decides which Medigap plan it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

Compare Medigap Plans in Massachusetts, Minnesota, and Wisconsin

In 47 of 50 states – plus Washington, D.C. – Medicare supplement plans are standardized using the lettered naming convention described above. However, that is not the case in Massachusetts, Minnesota, and Wisconsin. These three states are using standardized medicare supplements in different ways.

Medigap in Massachusetts

If you live in Massachusetts, you have guaranteed issue rights to buy medicare supplement insurance plans, but the policies are different.

Basic Benefits:

- Inpatient hospital care: covers the Part A coinsurance plus coverage for 365 additional days after Medicare coverage ends.

- Medical costs: covers the Part B coinsurance (generally 20% of the Medicare-approved amount).

- Blood: covers the first 3 pints of blood each year.

- Part A hospice coinsurance or copayment.

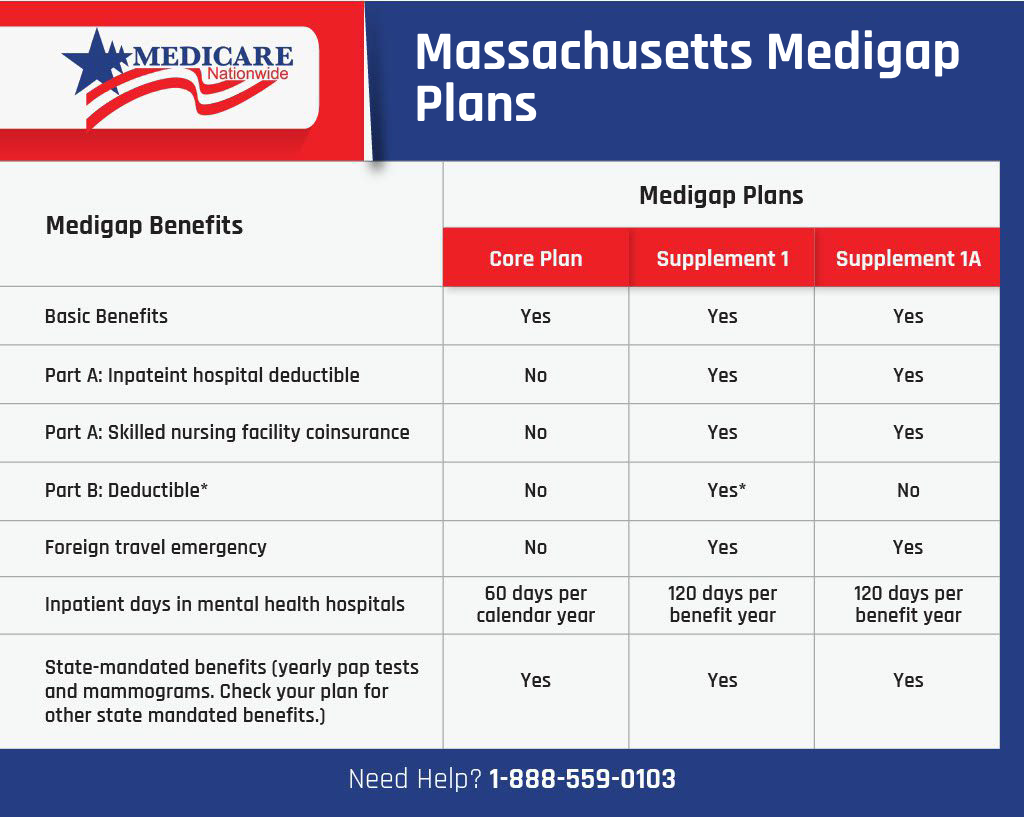

Supplemental plans that are being offered in Massachusetts are the Core Plan, Supplement 1 Plan, and Supplement 1A Plan. See the below Medicare Supplement Insurance Comparison Chart:

*Supplement 1 plan (which includes coverage of the Part B deductible will no longer be available to people who are new to Medicare on or after January 1, 2020. These people can get Supplement 1A Plan. However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to buy Supplement Plan 1.

Medigap in Minnesota

If you live in Minnesota, you have guaranteed issue rights to buy medicare supplement insurance plans, but the policies are different.

Basic Benefits:

- Inpatient hospital care: covers the Part A coinsurance

- Medical costs: covers the Part B coinsurance (generally 20% of the Medicare-approved amount)

- Blood: covers the first 3 pints of blood each year

- Part A hospice and respite care cost sharing

- Parts A and B home health services and supplies cost sharing

Medigap Plans:

The Basic and Extended Basic benefits are available:

- When you enroll in Part B

- Regardless of your age or health problems

You’ll get another 6-month Medigap Open Enrollment Period if both of these apply:

- You return to work.

- You drop Part B to elect your employer’s health plan.

You’ll get this open enrollment period after you retire from that employer when you can elect Part B again

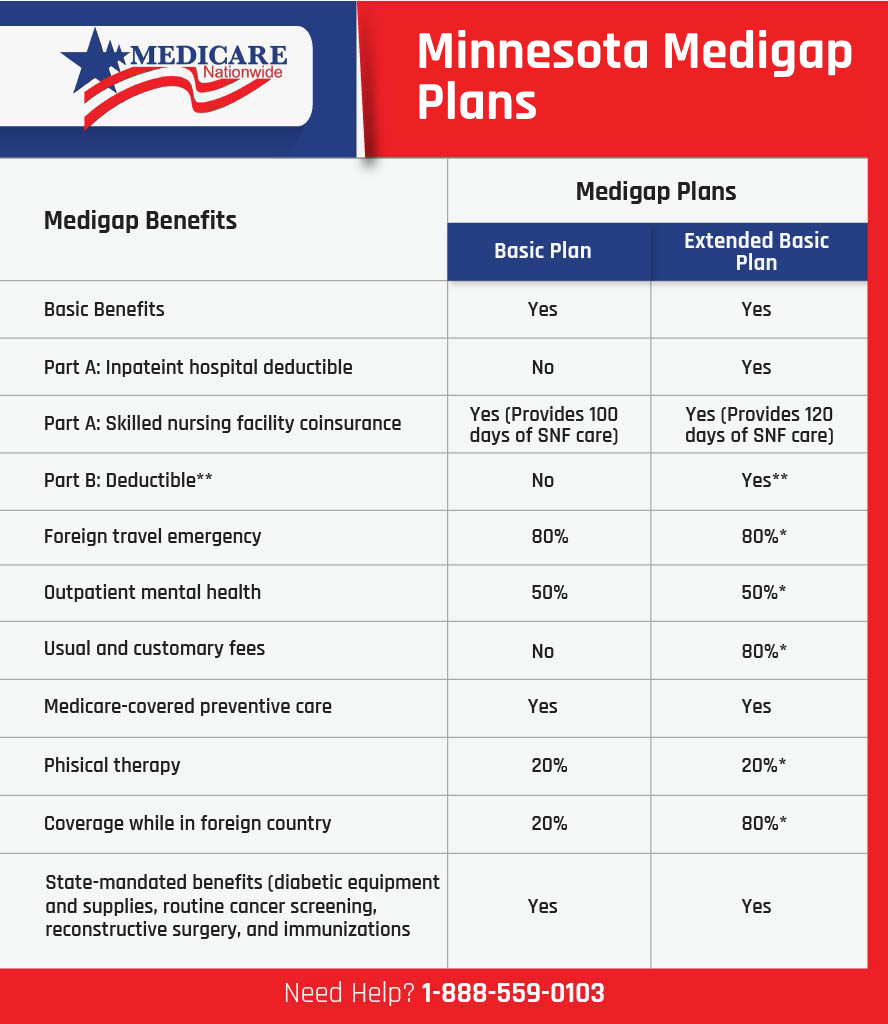

Compare plans in this state by using this chart:

Note: If a “Yes” appears, the plan covers the described benefit 100%. If a row lists a percentage, the policy covers that percentage of the described benefit. If a “No” appears, the policy doesn’t cover that benefit.

* The plan pays 100% after you spend $1,000 in out-of-pocket costs for a calendar year.

**Coverage of the Part B deductible will no longer be available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020, but are not yet enrolled, you may be able to get this benefit.

Important Plan Information

Minnesota versions of Medigap Plans K, L, M, and N are available. Minnesota versions of high-deductible F are available to people who had or were eligible for Medicare before January 1, 2020.

Insurance companies can offer 4 additional riders that can be added to a Basic Plan. You may choose any or all of these riders to design a Medigap policy that meets your needs:

- Part A: Inpatient Hospital Deductible

- Part B: Deductible

- Usual and Customary Fees

- Non-Medicare Preventive Care

Medigap in Wisconsin

If you live in Wisconsin, you have guaranteed issue rights to buy medicare supplement insurance plans, but the policies are different.

Basic Benefits:

- Inpatient hospital care: covers the Part A coinsurance

- Medical costs: covers the Part B coinsurance (generally 20% of the Medicare-approved amount)

- Blood: covers the first 3 pints of blood each year

- Part A hospice coinsurance or copayment

Medigap Plan

Basic Plan Covers:

- Basic benefits

- Part A: skilled nursing facility co-insurance

- 175 days per lifetime in addition to Medicare’s benefit of inpatient mental health coverage

- 40 home health care visits in addition to those paid for by Medicare

- State mandated benefits

Plans known as “50% and 25% Cost-sharing Plans” are available. These medicare plans are similar to standardized Plans K (50%) and L (25%). A high-deductible plan ($2,870) is also available.

Insurance companies are also allowed to offer these riders:

- Part A Deductible

- Additional Home Health Care (365 visits including those paid by Medicare)

- Part B Deductible

- Part B Excess Charges

- Foreign Travel Emergency

- 50% Part A Deductible*

- Part B Copayment or Coinsurance

What is the Best Medicare Supplement Plan?

After comparing medicare supplement policies, the best Medigap Plan depends on you and your healthcare needs. Every Medicare Supplement offers the same basic benefits as the rest. However, it is the additional benefits of a plan and what is offered in your area that will make the difference in your choice, that’s why you really need to compare medicare supplement plans.

No matter which Medigap policy you choose, you can use its coverage at any doctor or hospital nationwide on any day that accepts Original Medicare. A Medicare-accepting doctor can never turn you away because of the carrier you choose for your Medigap plan.

Check out our FAQ section to find more answers about the different types of Medigap plans or you can learn more about these supplement plans by connecting directly with one of our trusted agents. We offer expert advice and honest opinions on all of our available plans. If you’re interested, we can get you started and guide you all the way through enrollment. Have questions? We have answers. Give us a call today!

Prefer to chat by phone? Give us a call at 1-888-559-0103.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.