In the intricate landscape of healthcare, understanding your Medicare options is paramount. As you embark on this journey, two primary pathways emerge: Original Medicare and Medicare Advantage. Each offers its own set of benefits, costs, and considerations. Let’s delve into the heart of this comparison:

Original Medicare

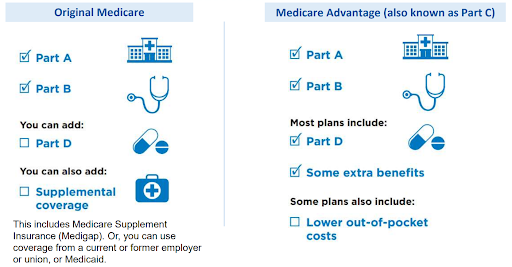

Original Medicare comprises Part A and Part B. Additionally, you have the option to include Part D for prescription drug coverage and Supplemental Coverage, such as Medicare Supplement Insurance (Medigap). Alternatively, you may opt for coverage provided by a current or previous employer or union, or utilize Medicaid.

Medicare Advantage (Also known as Part C)

Medicare Advantage comprises PART A and PART B, with many plans incorporating PART D alongside additional benefits. Some plans offer reduced out-of-pocket expenses.

Original Medicare vs. Medicare Advantage

When considering your Medicare options, understanding the differences between Original Medicare and Medicare Advantage is crucial. Here’s a detailed comparison to help you make an informed decision:

Discover Original Medicare

Foreign Travel Coverage

- Original Medicare generally doesn’t cover medical care outside the U.S.

- Options include purchasing a Medicare Supplement Insurance (Medigap) policy that covers emergency care abroad.

Coverage

- Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other healthcare facilities.

- Exclusions include benefits like eye exams, most dental care, and routine exams.

- Options to supplement coverage include Medigap, employer or union coverage, or Medicaid.

Cost

- Premiums: Part B requires a monthly premium, and joining a Medicare drug plan (Part D) incurs a separate premium.

- Coinsurance: Typically, 20% of the Medicare-approved amount for Part B-covered services after meeting the deductible.

- Out-of-pocket limit: No yearly limit unless supplemented by Medicare Supplement Insurance (Medigap).

Doctor & Hospital Choice

- No need for approval for Original Medicare services or supplies.

- No referral is typically needed to see a specialist.

- Flexibility to choose any doctor or hospital nationwide that accepts Medicare.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

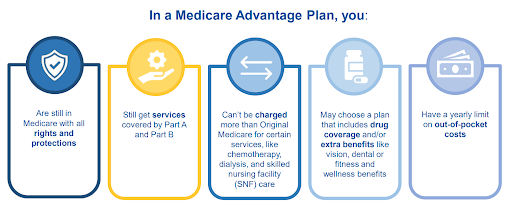

Discover Medicare Advantage

Foreign Travel Coverage

- Most Medicare Advantage plans do not cover non-emergency medical care outside the U.S.

- Some plans may offer supplemental benefits for emergency and urgently needed services during foreign travel.

- However, coverage for foreign travel is typically limited and may vary between plans.

Coverage

- Medicare Advantage plans generally require the use of doctors and providers within the plan’s network and service area for non-emergency care.

- Some plans may offer out-of-network coverage for non-emergency care at a higher cost.

- Plans must cover all medically necessary services that Original Medicare covers, but they may also offer additional benefits such as vision, hearing, and dental services.

- Approval of the plan may be necessary for certain services or supplies.

Cost

- Out-of-pocket costs vary between Medicare Advantage plans.

- Plans may have lower or higher out-of-pocket costs for certain services.

- You typically pay the monthly Part B premium and may also have to pay the plan’s premium.

- Some plans may have a $0 premium and may help pay all or part of your Part B premium.

- Plans have a yearly limit on out-of-pocket expenses for services covered by Medicare Part A and Part B. Once you reach this limit, you’ll pay nothing for the rest of the year.

- Medicare drug coverage (Part D) is usually included in most Medicare Advantage plans.

Doctor & Hospital Choice

- Medicare Advantage plans often require the use of doctors and providers within the plan’s network and service area for non-emergency care.

- Referrals may be needed to see specialists.

- Some plans may offer flexibility in choosing doctors and hospitals, but typically at a higher cost.

- Most types of Medicare Advantage Plans do not allow enrollment in a separate Medicare drug plan.

In Summary

In summary, when weighing the options between Original Medicare and Medicare Advantage, several key factors come into play.

Original Medicare, consisting of Part A and Part B, offers flexibility in choosing healthcare providers and facilities nationwide without the need for referrals. However, it lacks coverage for non-emergency medical care outside the U.S., and there is no yearly limit on out-of-pocket expenses unless supplemented by additional insurance like Medicare Supplement Insurance (Medigap).

On the other hand, Medicare Advantage (Part C) plans often have lower out-of-pocket costs and may include additional benefits like vision, hearing, and dental services. However, they typically require the use of providers within the plan’s network, and coverage for non-emergency care outside the U.S. is limited. Medicare Advantage plans also come with a yearly limit on out-of-pocket expenses, and most include Medicare drug coverage (Part D).

Ultimately, the choice between Original Medicare and Medicare Advantage depends on individual healthcare needs, preferences for provider flexibility, budget considerations, and the importance of additional benefits like prescription drug coverage and extra services. Consulting with a knowledgeable advisor can help individuals navigate these options and make an informed decision based on their specific circumstances.