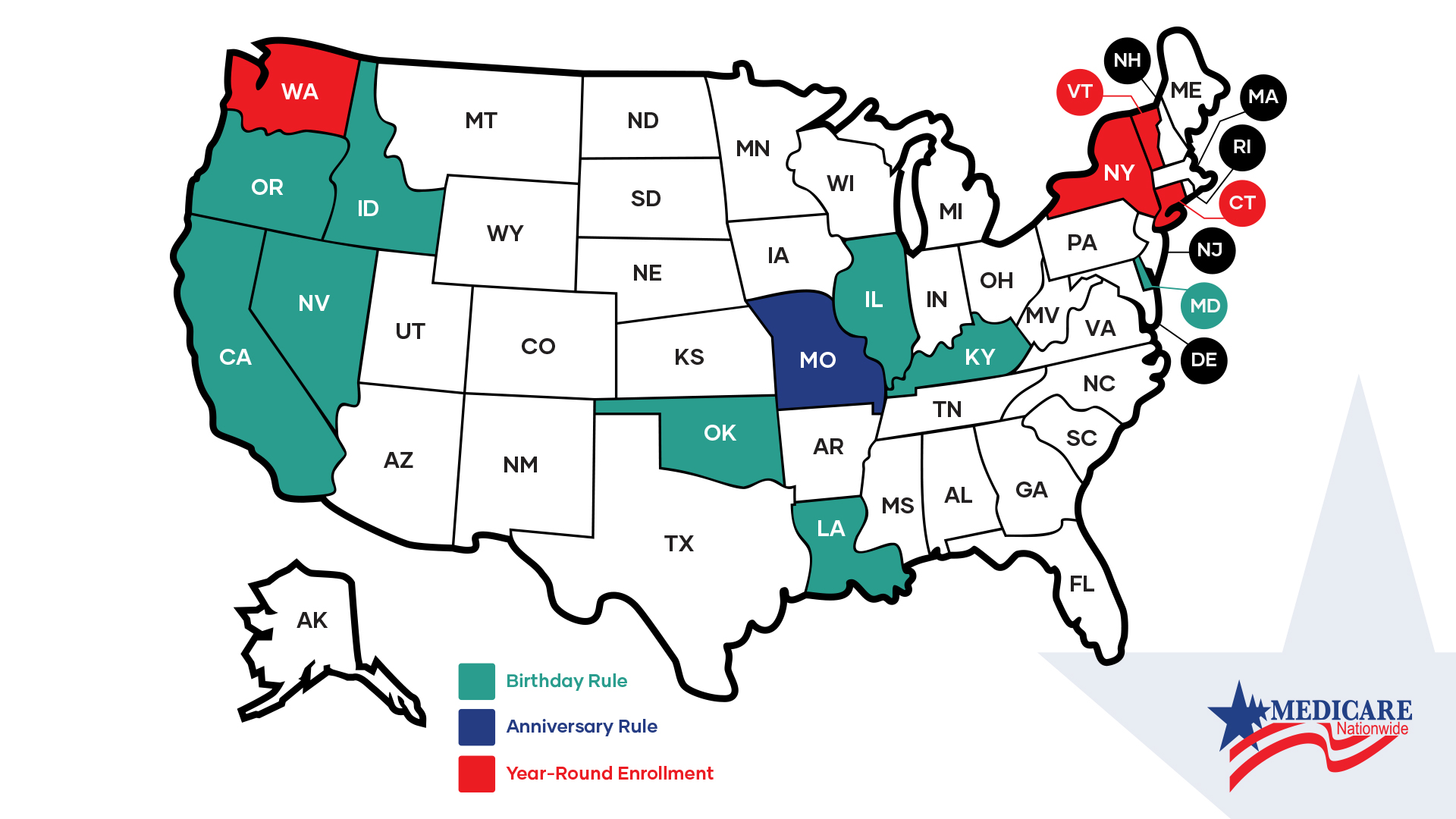

Birthday Rule States:

California Medicare Birthday Rule

California Annual Open Enrollment lasts 90 days, beginning 30 days before and ending 60 days after the individual’s birthday, during which time a person may replace any Medicare supplement policy with a policy of equal or lesser benefits. Coverage will not be made effective prior to the individual’s birthday or beyond 60 days from the application date. If replacing a pre-standardized plan, a copy of the current policy or policy schedule is required.

Idaho Medicare Birthday Rule

Birthday Window: The Idaho Medicare Birthday Rule allows beneficiaries to switch Medigap plans within 63 days beginning on an individual’s birthday. This two-month window offers individuals the opportunity to reassess their healthcare needs annually and adjust their coverage accordingly. Coverage will not be made effective prior to the individual’s birthday or beyond 60 days from the application date.

No Medical Underwriting: One of the significant advantages of this rule is that individuals can change plans without undergoing medical underwriting. In typical scenarios, insurers may assess an individual’s health and charge higher premiums or deny coverage based on pre-existing conditions. The Idaho Medicare Birthday Rule allows beneficiaries to switch plans without these concerns.

Same or Lesser Benefit Level: Beneficiaries can switch plans during their birthday window, but they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage. The new Medigap plan becomes effective on the first day of the month following the birthday month.

Illinois Medicare Birthday Rule

Illinois Annual Open Enrollment lasting 45 days: beginning on an individual’s birthday, during which time a person may replace a Medicare supplement within the same insurance company to a policy of equal or lesser benefits. An individual must be between the ages of 65 through 75 to be eligible. Coverage will not be made effective prior to the individual’s birthday or beyond 60 days from the application.

No Medical Underwriting: A significant advantage of this rule is that individuals can change plans without undergoing medical underwriting. In standard circumstances, insurers may assess health conditions and charge higher premiums or deny coverage based on pre-existing conditions. The Illinois Medicare Birthday Rule allows beneficiaries to switch plans without these concerns.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage. The new Medigap plan becomes effective on the first day of the month following the birthday month.

Kentucky Birthday Rule

Birthday Window: The Kentucky Medicare Birthday Rule permits beneficiaries to switch Medigap plans starting the day after their birthday lasting 60 days. This 2 month-long window provides individuals with an annual opportunity to review and modify their healthcare coverage to better meet their needs.

No Medical Underwriting: A significant advantage of this rule is that individuals can change plans without undergoing medical underwriting. In standard circumstances, insurers may assess health conditions and charge higher premiums or deny coverage based on pre-existing conditions. The Kentucky Medicare Birthday Rule bypasses these concerns.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage.

Louisiana Birthday Rule

Birthday Window: The Louisiana Medicare Birthday Rule permits beneficiaries to switch Medigap plans within 63 days beginning on an individual’s birthday. This 2 month-long window provides individuals with an annual opportunity to review and adjust their healthcare coverage to better meet their needs. An individual person may replace any Medicare supplement within the same carrier to one of equal or lesser benefits. Coverage will not be made effective prior to the individual’s birthday or beyond 60 days from the application date.

No Medical Underwriting: A significant advantage of this rule is that individuals can change plans without undergoing medical underwriting. In standard circumstances, insurers may assess health conditions and charge higher premiums or deny coverage based on pre-existing conditions. The Louisiana Medicare Birthday Rule allows beneficiaries to switch plans without these concerns.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage. The new Medigap plan becomes effective on the first day of the month following the birthday month.

Maryland Birthday Rule

Birthday Window: The Maryland Medicare Birthday Rule allows beneficiaries to switch Medigap plans within 30 days starting on their birthday. This month-long window offers individuals an annual opportunity to review and modify their healthcare coverage to better suit their needs.

No Medical Underwriting: A significant advantage of this rule is that individuals can change plans without undergoing medical underwriting. In standard circumstances, insurers may assess health conditions and charge higher premiums or deny coverage based on pre-existing conditions. The Maryland Medicare Birthday Rule circumvents these concerns.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to select a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage. The new Medigap plan becomes effective on the first day of the month following the birthday month.

Nevada Birthday Rule

Birthday Window: The Nevada Medicare Birthday Rule allows beneficiaries to switch Medigap plans lasting 60 days starting on their birthday. This 2 month-long window provides individuals with an annual opportunity to review and modify their healthcare coverage to better meet their needs.

No Medical Underwriting: An important aspect of this rule is that individuals can change plans without undergoing medical underwriting. In standard circumstances, insurers may assess health conditions and charge higher premiums or deny coverage based on pre-existing conditions. The Nevada Medicare Birthday Rule bypasses these concerns.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs. Coverage will not be made effective prior to the individual’s birthday or beyond 60 days from the application date.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage. The new Medigap plan becomes effective on the first day of the month following the birthday month.

Oklahoma Birthday Rule

Birthday Window: The Oklahoma Medicare Birthday Rule permits beneficiaries to switch Medigap plans within 60 days starting on their birthday. This 2 month-long window provides individuals with an annual opportunity to review and modify their healthcare coverage to better meet their needs.

No Medical Underwriting: A significant advantage of this rule is that individuals can change plans without undergoing medical underwriting. In standard circumstances, insurers may assess health conditions and charge higher premiums or deny coverage based on pre-existing conditions. The Oklahoma Medicare Birthday Rule bypasses these concerns.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs. An individual must stay within the same carrier.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage.

Oregon Birthday Rule

Oregon Birthday Window: Annual Open Enrollment lasting 60 days, beginning 30 days before and ending 30 days after the individual’s birthday, during which time a person may replace any standardized Medicare supplement policy with a policy of equal or lesser benefits. Coverage will not be made effective prior to 30 days before the individual’s birthday or beyond 60 days from the application date.

No Medical Underwriting: A significant advantage of this rule is that individuals can change plans without undergoing medical underwriting. In standard circumstances, insurers may assess health conditions and charge higher premiums or deny coverage based on pre-existing conditions. The Oregon Medicare Birthday Rule bypasses these concerns.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs.

Coverage Continuity: During the transition period, beneficiaries will not experience a lapse in coverage. The new Medigap plan becomes effective on the first day of the month following the birthday month.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Year Round Enrollment States:

Connecticut

Year-Round Flexibility: Connecticut’s Medicare year-round enrollment means that beneficiaries are not confined to specific windows for making changes to their plans. This flexibility is particularly advantageous for those who experience life events or changes in healthcare needs outside the AEP.

No Waiting Period: Unlike some states that may have waiting periods or restrictions on plan changes outside of the AEP, Connecticut allows beneficiaries to make immediate changes to their coverage. This means that individuals won’t experience lapses in coverage during the transition period.

New York

Year-Round Flexibility: The New York Year-Round Enrollment Medicare Rule means that beneficiaries are not confined to specific enrollment periods. Unlike the AEP, individuals in New York can make changes to their Medicare supplement plans at any time throughout the year.

No Waiting Period: Beneficiaries can make immediate changes to their coverage without waiting for specific enrollment periods. This ensures that individuals won’t experience lapses in coverage during the transition period.

Vermont

Year-Round Flexibility: Unlike some states that adhere strictly to specific enrollment periods, the Vermont Year-Round Enrollment Medicare Rule allows beneficiaries to make changes to their Medicare supplement plans at any time throughout the year.

No Waiting Period: There is no waiting period for individuals to make changes to their coverage. Beneficiaries can make immediate adjustments to their plans without waiting for specific enrollment periods, ensuring continuous access to healthcare coverage.

Washington

Year-Round Flexibility: The Washington Year-Round Enrollment Medicare Rule sets the state apart by allowing beneficiaries to make changes to their Medicare Supplement plan at any time throughout the year.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Anniversary Rule States:

Missouri Anniversary Rule

Missouri Anniversary Date Flexibility: Individuals who terminate a Medicare supplement policy within 30 days of the annual policy anniversary date may obtain the same plan with no health questions asked for a period of 63 days after the termination of their existing policy, from any issuer that offers that plan.

No Medical Underwriting: An essential aspect of this rule is that individuals can change plans without undergoing medical underwriting. This means beneficiaries can make adjustments to their coverage without concerns about pre-existing conditions affecting premiums or coverage eligibility.

Same or Lesser Benefit Level: While beneficiaries can switch plans, they are required to choose a plan with an equal or lesser benefit level than their current plan. This ensures that individuals maintain a level of coverage consistent with their healthcare needs.This would include Medicare supplement and SELECT plans. For policies with an effective date of June 10, 2010 or after, individuals with existing Plans E, H, I and J can convert to one of the following Plans: A, B, C, F, K or L.

Coverage Continuity: Beneficiaries will not experience a lapse in coverage during the transition period. The new Medigap plan becomes effective on the anniversary date of the existing plan.

Conclusion:

New states are constantly being added to the birthday, anniversary and year-round enrollment rules. Knowing the details of your specific rules can drastically increase your savings over the life of your policies. It makes shopping based on premium a lot more appealing since you have the option to switch every year anyway. If you wish to be notified when you’re in your enrollment window then be sure to join our mailing list and never miss out on the opportunity to save.