Disclaimer:We would like to inform our readers that our top ten recommended carrier list has been updated since it was released last year. In light of recent industry volatility, many insurance carriers have significantly raised their rates—or exited the Medigap market altogether. As a result, we’ve temporarily narrowed our recommendations to a carefully selected the best medigap carriers.

Best Medigap Plan Providers

Due to recent market volatility, many insurance carriers have increased their rates or exited the Medigap space altogether. In light of these changes, we’ve temporarily narrowed our recommendations to a carefully curated list of just five standout providers.

After evaluating hundreds of companies and running them through the same rigorous tests we’ve outlined in previous reviews—including financial strength, product offerings, customer satisfaction, and real-world interactions—we’ve identified the Top 5 Medigap insurance carriers that continue to offer exceptional value and reliability in today’s shifting landscape.

The best Medicare supplement insurance companies are solid and easy to recommend. But even among these insurance carriers. Please read below how we came to determine our ranking.

Top Tier Highly Recommended MedSupp Carriers:

1. Mutual of Omaha

Mutual of Omaha consistently garners the highest customer service ratings within its industry cohort. Additionally, its sister company, GPM, occasionally offers favorable deals for individuals under 65 on disability. You can find a comprehensive review of GPM in this article: GPM Medicare Supplement Company Review.

Among its numerous customer benefits, Mutual of Omaha boasts the most flexible billing methods, significant household discounts, and a wide array of plan selections. Their innovative online tools further contribute to their esteemed reputation for customer satisfaction. While some carriers might have experienced extraordinary price increases, Mutual of Omaha remains competitive in the market. Moreover, as a mutual company, Mutual of Omaha prioritizes policyholders over stockholders, enabling them to maintain a long-term perspective without the distractions of short-term earnings reports. In a recent CEO podcast, Mutual of Omaha reiterated its commitment to enhancing Medicare supplement competitiveness, diverging from other carriers that are redirecting resources towards Medicare Advantage. Although Mutual of Omaha may not have been the cheapest carrier during periods of loose credit, their fiscal responsibility and focus on pooling resources for Medicare Supplement may ensure resilience even during economic contractions.

2. Medico

Medico has emerged as a favored choice, particularly in Washington, for its competitive pricing, often offering the cheapest rates in the region. Beyond Washington, it maintains an appealing pricing structure in other states as well. Renowned for its ancillary products, such as hospital indemnity plans, Medico has cultivated a strong reputation over the years. Notably, the carrier has demonstrated remarkable price stability, reassuring customers of consistent and reliable coverage. For those considering Medico, it’s advisable to inquire about their pricing in your area and assess their stability in recent years, ensuring a well-informed decision regarding your insurance needs.

3. Humana

Headquartered in Louisville, KY, boasts a substantial customer base, having served over 13 million individuals by 2014. In 2018, they secured the 56th spot on the esteemed Fortune 500 list.

Humana’s product portfolio is notably diverse, offering a range of options to cater to varying needs. In select states, customers can benefit from up to 12% household discounts. Additionally, certain states offer perks such as gym memberships and participation in the Silver Sneakers program, although availability may vary by location and should be confirmed with one of our agents. It’s worth noting that the “Humana Achieve” plan does not include the Silver Sneakers program. Particularly renowned in New York is their High Deductible G plan.

While Humana excels in many areas, there are opportunities for improvement in internal processing of applications and underwriting procedures. Despite a significant premium rate decrease in many regions in 2023, recent earnings reports from 2024 reveal that Humana may have underestimated medical costs, signaling potential challenges ahead. They recently introduced the ability to pay your premium by credit card, joining Mutual of Omaha as the only other carrier on this list to allow for such method of payment. This move is a major win for credit card points enthusiasts.

4. Bankers Fidelity Life

Bankers Fidelity Life Insurance Company (BFLIC), based in Atlanta, Georgia, has been serving seniors across the U.S. since 1955 with a wide range of reliable insurance products. Licensed in 46 states and D.C., BFLIC offers Medicare Supplement (Medigap) plans, short-term care, cancer, hospital indemnity, and final expense insurance. It holds an A- (Excellent) rating from A.M. Best, reflecting strong financial stability and a consistent reputation for fair claims and customer service. Medicare Supplement plans are available through Bankers Fidelity Assurance Company—one of three underwriting subsidiaries under the Bankers Fidelity brand—offering options like Plans A, F, G, High Deductible G, K, and N in select states to help seniors manage healthcare costs not covered by Original Medicare.

As one of the three subsidiaries of Bankers Fidelity Insurance Company — alongside Bankers Fidelity Life Insurance Company and Atlantic Capital Life Assurance Company—Bankers Fidelity Assurance Company plays a key role in delivering tailored Medigap coverage. The company also offers supplemental products like lump-sum cancer policies, hospital indemnity insurance, and final expense plans to help policyholders prepare for unexpected costs. With more than 60 years of experience and a customer-first underwriting philosophy, Bankers Fidelity remains a trusted and accessible option for seniors seeking dependable, affordable Medicare coverage.

5. Healthcare Service Corporation – Cigna

Recent acquisition of Cigna marks a significant development in the healthcare industry, likely driven by strategic considerations, particularly in the Medicare Advantage sector. This move suggests a deeper focus on expanding their presence and offerings within this lucrative market segment. However, the acquisition of a major player like Cigna also underscores Healthcare Service Corporation’s financial strength and competitive positioning. Such a substantial acquisition wouldn’t occur without careful consideration of the financial implications and strategic alignment between the two entities. Healthcare Service Corporation’s decision to acquire Cigna signifies their commitment to growth and innovation in the ever-evolving landscape of healthcare services.

Cigna with roots traced back to the INA corporation established in 1792, is potentially the oldest among healthcare insurers and has evolved into a global entity with over 95 million customers worldwide.

Cigna stands out in the Medicare supplement market, offering policies at highly competitive prices while strategically selecting areas where it can excel. Notably, they provide discounts of up to 20% and often present attractive pricing for Plan N. Their high ranking is also attributed to their accommodating underwriting practices.

Recently, Cigna has introduced subsidiaries to enhance price competition in the Medicare supplement arena. However, the sale of their business to Health Care Service Corporation (HCSC) introduces uncertainty regarding its impact on existing Cigna members. HCSC, known for offering BCBS Medicare supplements in states such as Illinois, Texas, New Mexico, and Oklahoma, adds another dimension to this evolving landscape.

Cigna has a focus on call centers and has neglected independent brokers, which is a disservice to consumers and mostly steers folks into Medicare Advantage plans that don’t belong in them.

Note: We have removed some carriers that were on this list before for reasons we cannot disclose publicly. Some carriers do not want to be mentioned in this article, so we have respected their wishes. This list is not ranking Medicare Advantage carriers. We will not be making such a list due to stringent rules of compliance. Additionally, this list is not meant to be true in each state, as insurance carriers allocate their resources differently from state to state. To find out how we would rank carriers in your state, please contact us at 1-888-55-0103.

Medicare Supplement Plan Simplified

By typically covering the 20% of costs that Medicare does not cover, Medicare Supplement insurance, often known as Medigap, supplements your standard Medicare coverage.

There are ten federally standardized Medigap policies, but most Medicare recipients only pay attention to three of them. The other ones provide less coverage and do not receive a healthy enrollment. That is important when speaking of insurance plans; the more Medicare recipients on a plan, the more stable the rate in the future. Insurance works off of the law of large numbers. The larger the group, the more it washes out of adverse risks. Adverse risks are expensive for the plan because they submit claims to the insurance carrier.

Medicare Supplement Programs are straightforward in certain ways:

- In contrast to Medicare Advantage plans, Medigap plans don’t choose which benefits to offer they are federally standardized to offer the same benefits.

- You can visit any medical facility or doctor who accepts Medicare, and even if your provider only accepts cash, you can file for reimbursement with Medicare and the supplement plan.

- Reimbursement is not allowed with a Medicare Advantage plan because Medicare would no longer be your primary insurance.

- The deductibles, coinsurance, and copays associated with your medical expenses that Medicare does not cover are covered by Medicare supplement plans. There are no questions as long as they are Medicare-approved expenses. For example, if Medicare pays its 80%, your supplement plan will cover the remaining 20%

Although all Medicare Supplement policies provide the same fundamental benefits, prices vary greatly, and some businesses provide extra perks that may entice you to choose their plans.

The procedures for enrolling in and changing insurance coverage are intricate.

Because you have the perfect chance to acquire the best supplement policy when you originally signed up, pick a Medicare Supplement plan with your future in mind, your current state of health is irrelevant at that point.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Prior Consideration for Comparing Supplement Insurance Plans

The Medicare Supplements are federally standardized, as we have discussed.

For example, a Plan G offered by one company offers the same coverage as a Plan G offered by a different company. The history of rate increases and financial ratings, however, will differ.

Ask your agent or whoever is assisting you in finding a supplement plan to look for positive reviews and stable rates. This research will help determine which Medicare supplement insurance is best for YOU. Prices and rate increase history vary depending on where you live. We are licensed in 48 states and appointed with most insurance carriers, so we have many options to find you the right plan. Local agents tend to offer fewer plans and, most times, are not independent, so they can only represent one carrier. You get the most objective advice from an independent broker.

Most Popular Standardized Medicare Supplement Plans

Also, you should be aware that while there are ten different plans out there, the three most popular are Plans F, G, and N. That’s because they offer some of the most comprehensive coverage. Most people who buy Medicare Supplements do so because they want to have little or nothing out-of-pocket when they use healthcare services. So, it’s not all that surprising the three best-sellers are the three most comprehensive plans.

You’ll find then that Plan F usually has the highest premiums, followed by Plan G and then Plan N. While there are seven other Medicare Supplement plans for sale, they seldom get requested because they cover less. Hence, beneficiaries just have less interest in them.

Tips for Choosing the Best Medicare Supplement

The government mandates and structures the various Supplement Plans to be federally standardized. Plan F, N & G coverage is the same no matter what insurance carrier you choose. However, insurance carriers distinguish themselves through competitive pricing and by adding benefits. A free gym membership or vision discounts may be attractive, but there are other critical items you need to consider before deciding on what Medicare insurance to purchase.

Monthly Premium Cost

Since there are ten different forms of Medicare supplement insurance, all insurers are required to provide the same basic coverage. Make sure you are comfortable with the value and that you can afford the monthly costs. Determine the overall out-of-pocket expenses. Include a breakdown of Part D drug coverage, which is not covered by Medicare supplement plans, as well as your monthly premium.

Extra Incentive Plans

Look at the third-party discounts the Medicare supplement plan may offer you. Such as a discount on dental, hearing, or vision. They might also provide free or inexpensive gym memberships. However, these discounts are not insurance. The insurance itself is federally standardized to offer the same coverage. For example, heart surgery covers the same for any Plan G, but one plan might give you $100 off dental once a year. The discount for dental is not insurance.

Financial Ratings

If companies are not financially stable, they will be slow to act and cut costs with customer service. Financial rating companies examine insurance companies for stability. Pay attention to these companies and their rating scale, and it will help you make good decisions. Moody’s, AM Best, and Comdex are the standards for insurance quality ratings. Moody’s top rating is Aaa. AM Best is A++. Comdex is a combined score of many rating agencies. They rate on a scale of 1-100. An excellent company will score between 85-100.

Longevity

Health Insurance is a new product in the insurance world compared to life and property companies. Many health companies were established inside of life companies. Company longevity is a great indicator the company will be around when you need them.

Company Size

Size is an indicator of financial strength and stability. Be wary of very small companies or startup health companies. They may be a great company, but it is a red flag, and you should ask more questions.

Customer Feedback

Most state departments of insurance store customers’ complaints about insurance companies. Double-check with your state to see if the company you consider has a higher-than-average number of complaints. This could be a great indicator of whether they are difficult at claim time. Good customer service is what sets Medicare supplement plans apart. Asking friends and neighbors who subscribe is a way to rate customer service in your area.

Other Issues to Consider Before Choosing the Top Medicare Supplement Supplier

Plan F was the most popular plan, but it is not anymore. Plan G covers everything Plan F outside of the Part B deductible. Medicare recipients find that they save more in premiums that paying for the Part B deductible on Plan F makes no sense. The Medicare supplement plans offer foreign travel for emergencies. They pay 80% of the deductible within a few months abroad. The lifetime reserve for foreign travel is $50,000.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

How Can Medicare Supplement Policies Be Purchased and Comparable?

Getting coverage requires doing your research to get the best plan for you. Depending on your state, the coverage you want, and the cost, each plan offers particular perks.

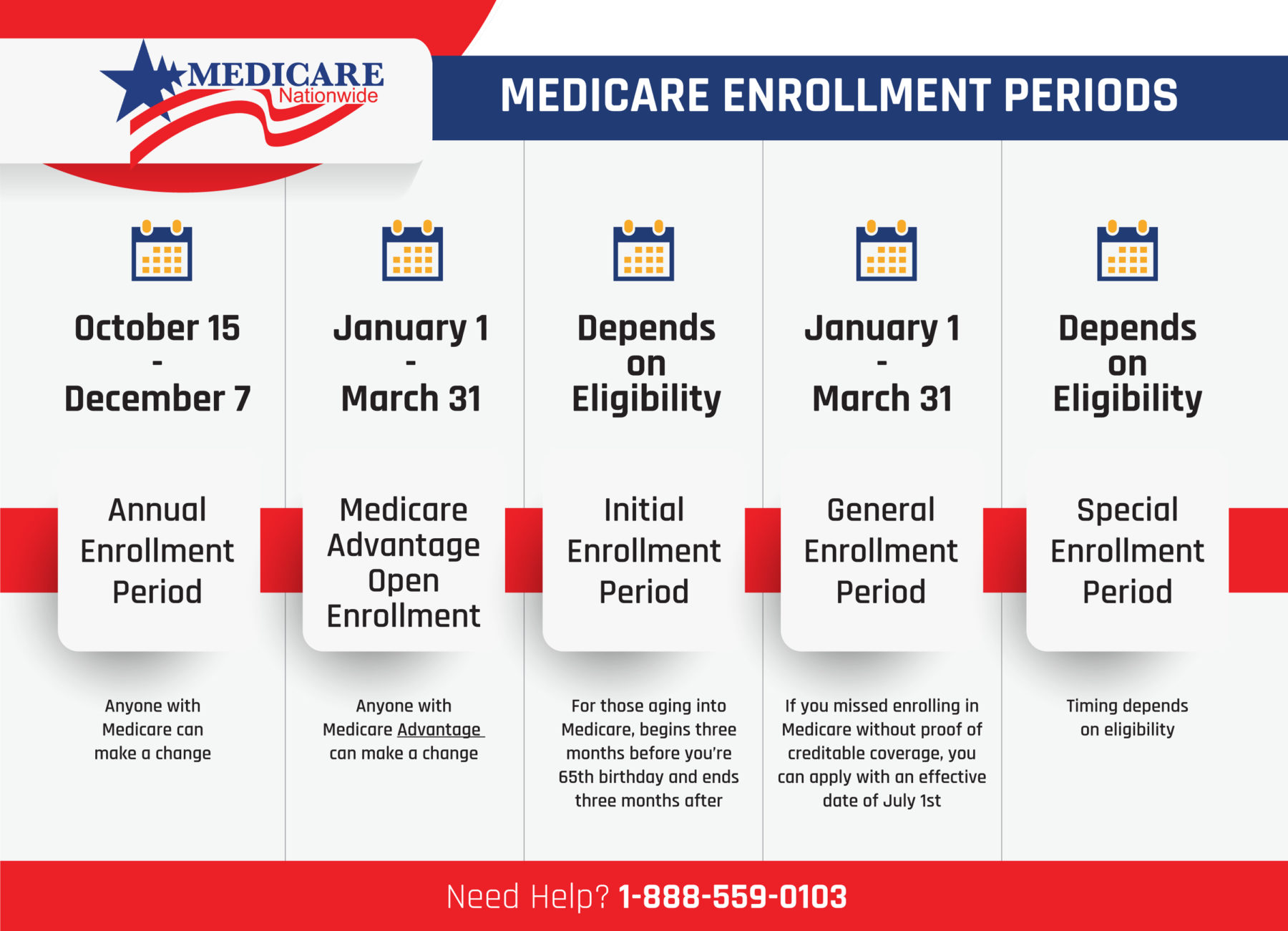

Determine Your Eligibility for Enrollment.

In general, you are eligible for Medicare’s Open Enrollment when you turn 65 years old or if you delayed Part B due to creditable coverage when you leave your employer or union plan.

The initial Medicare Open Enrollment Period is the ideal time to purchase a Medicare Supplement policy. Federal law permits you to enroll in any Medicare Supplement policy sold in your state during this once-only, six-month period. During this time, preexisting conditions are allowed, and you cannot be charged extra or be denied a Medicare Supplement policy because of current or prior health issues. Make sure you are aware of the beginning of your open enrollment period.

Locate a list of Medicare Supplement Plans in Your State or ZIP Code.

We can provide you with rates in your area and information on all the carriers and plans. It is entirely free to work with an independent broker. We are licensed in 48 states; unlike most local agents, we represent almost all the carriers and can provide you with objective advice about the best plans available in your area.

Select the Coverage Aspects That Are Most Crucial to You.

Consider the differences between a Medicare supplement plan and a Medicare Advantage plan. A Medicare supplement plan allows you to see any doctor who accepts Medicare, and a Medicare Advantage plan restricts you to a network of doctors. However, if you can’t afford the Medicare supplement plan premium, you might need to find a Medicare Advantage plan that accepts your doctors. We can assist in finding the right plan for you. For more information, please read our article on the differences between the two types of plans: Medicare Advantage vs Medicare Supplement (Medigap)/

Evaluate the Cost Variations amongst Medicare Supplement Plans.

Compare prices between Medicare Supplement plans as the prices vary depending on demographics and geographics.

Massachusetts, Minnesota, and Wisconsin offer equivalent plans to the rest of the country, but they have different names. For example, MedSupp1A is Plan G, but in Massachusetts, they call it MedSupp1A; everywhere else, they call it Plan G.

The core benefits are the same for all Medicare Supplement plans, beginning with the same letter, regardless of which insurance provider provides them. For instance, regardless of the firm that provides the plan, all Plan G insurance has the same coverage.

Take into account speaking with a consultant or looking up a reputable site.

You can read our five-star reviews on Google, Facebook, and Trustpilot. Our independent brokers are licensed in 48 states, and we don’t have any agents that have been working for us for less than three years. It is entirely free to work with an independent broker, and they tend to work with more carriers and offer more plans than a local agent. Local agents tend to be new to insurance and try to promote the single company they represent.

Medicare, federal programs, and non-profits do not represent the insurance carriers and their products. So, only insurance brokers have pricing information and can enroll you in a plan.

Signing up.

When a plan that meets your needs has been satisfied, enroll by getting in touch with an independent broker. We hope you choose us! There aren’t many independent brokers licensed in 48 states where you know you can speak to someone that is not a newbie. Below is our Medicare Eligibility Chart.

Choosing an Agent

Choosing a company is essential, but choosing the right agent is critical. It would help if you had an expert who has spent the time and resources to determine the best carriers and products available. It would be best if you had someone who has access to a vast number of options, so he can help you find the best product for your needs and budget.

Not all agents are equal. Just like insurance companies, here are questions to ask when choosing an agent.

Does the agent represent a wide variety of companies?

Be concerned if an agent only represents one or two companies. They may not be able to find you the best company for your needs. Because they represent a few companies, they may be more concerned about their needs and not yours.

Does the agent have certifications?

Insurance certifications and designations are essential. They demonstrate that the agent is committed to being an expert in his industry. They have spent their own money learning more about the products they sell. Also, most designations have a binding code of conduct or ethics statement. Agents who carry those designations are committed to bringing value to their customers. CFP® (Certified Financial Planner) is an excellent designation to keep your eye out for.

Are they involved in an insurance association?

Similar to designations and certifications, an agent who belongs to an association is committed to his business for the long term and not looking for short-term sales.

Does the agent have positive testimonials and reviews?

Nothing indicates how beneficial an agent can be apart from what other customers are saying about them. The quality of reviews and testimonials an agent gets is a perfect window into how they will perform for you.

Understanding the Distinction between a Medicare Supplement Plan and a Medicare Advantage Plan

A different Medicare plan is Medicare Advantage Plan. The majority of prescription drugs are covered through Medicare Advantage, which has a low or no monthly cost but may have fewer options for doctors and network locations.

It is prohibited for anyone to try to sell you a Medicare Supplement policy while you are enrolled in an Advantage plan unless you are going back to your Original Medicare. A Medicare Supplement plan cannot be utilized to recoup expenses from an Advantage plan. You can become qualified to receive Supplement insurance if you decide that you don’t like your Advantage plan and immediately switch to a Medicare Original Plan (which you’re able to do within a year of signing up for the Advantage plan).

Conclusion

Each company in this review will provide excellent coverage and service. Because markets and products change, let us be your long-term partner in helping you find the best possible coverage. Contact us today to compare the entire supplement framework. It is entirely free to work with us, so why navigate this maze alone?