About the Company

The U.S. Dept. of Health and Human Services investigated Humana in 2009 for sending flyers to Medicare recipients that the AARP characterized as deceptive. Humana’s managed care model has also been criticized for ethical lapses and limitations.

The health insurer Aetna said on July 3, 2015, that it had agreed to acquire its smaller rival Humana for $37 billion in cash and stock but walked away from the deal after a court ruling that the merger would be anti-competitive.

Medical coverage is a critical component of our daily lives. With insurance plans, you get security and peace of mind regarding both known and unforeseen needs, especially specialist treatments. For many individuals, having insurance plans, medicare coverage lets you sleep easy, knowing that in case of anything, you get the necessary treatment at a facility of your choosing.

Humana Medicare Supplement Insurance Plans

A closer look at the Medicare Supplement insurance plans being offered by Humana. Compare Medicare supplement policies and find what best suits your needs.

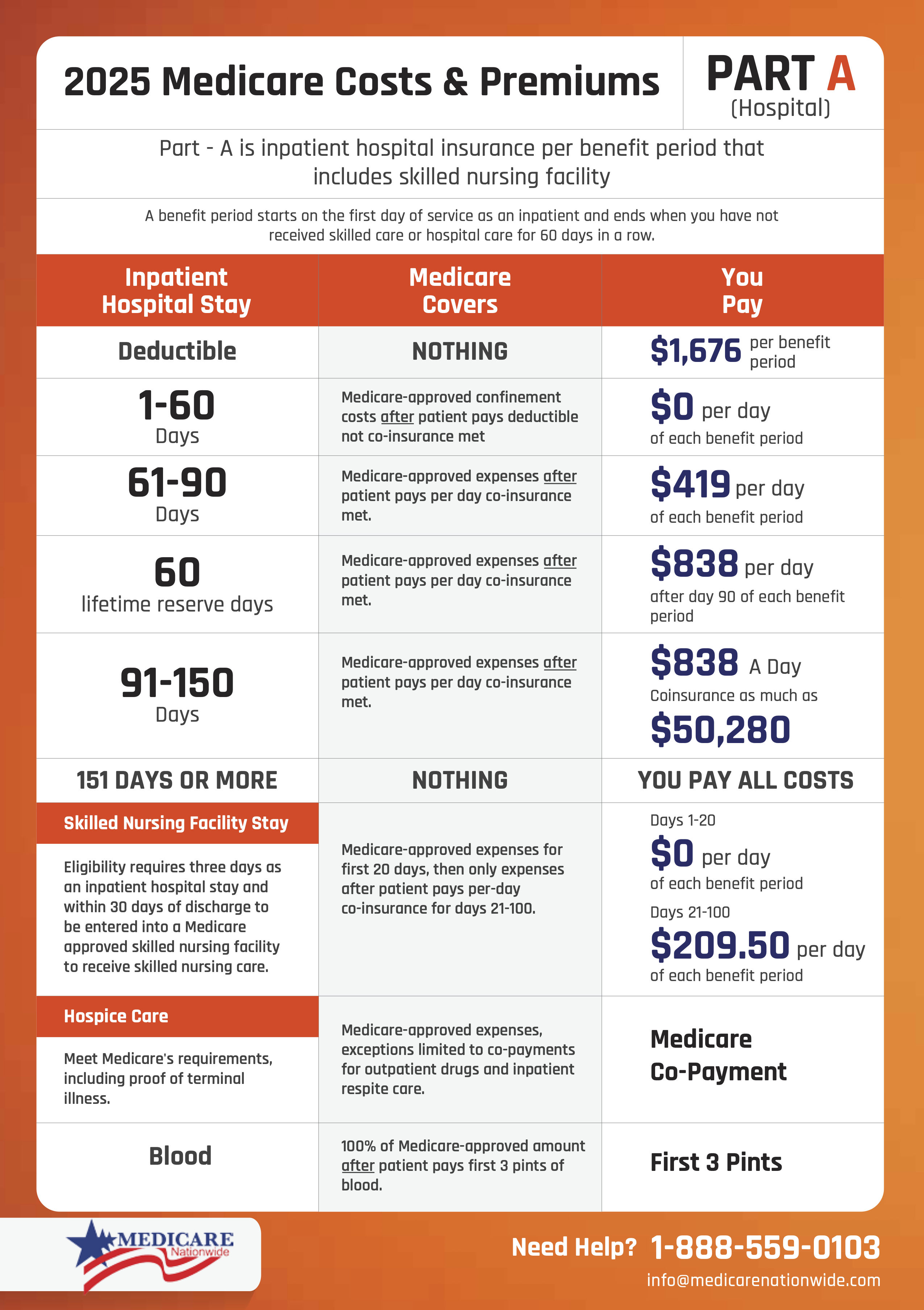

Medicare Part A

This covers the costs of your inpatient care as well as skilled nursing facility costs. Areas such as hospice and home care fall under this section. This program is free for most seniors as far as premium. Part A caters to the costs of your semi-private room as well. In simpler terms, this part pays for your room and board at the hospital as well as outpatient care drug expenses. However, Part A is not free in the sense of out-of-pocket costs for inpatient care. A Medicare supplement plan would cover the gap in coverage for Part A. It would cover what you owe below in the chart (in the blue font on the right.)

Medicare Supplement Chart for Part A

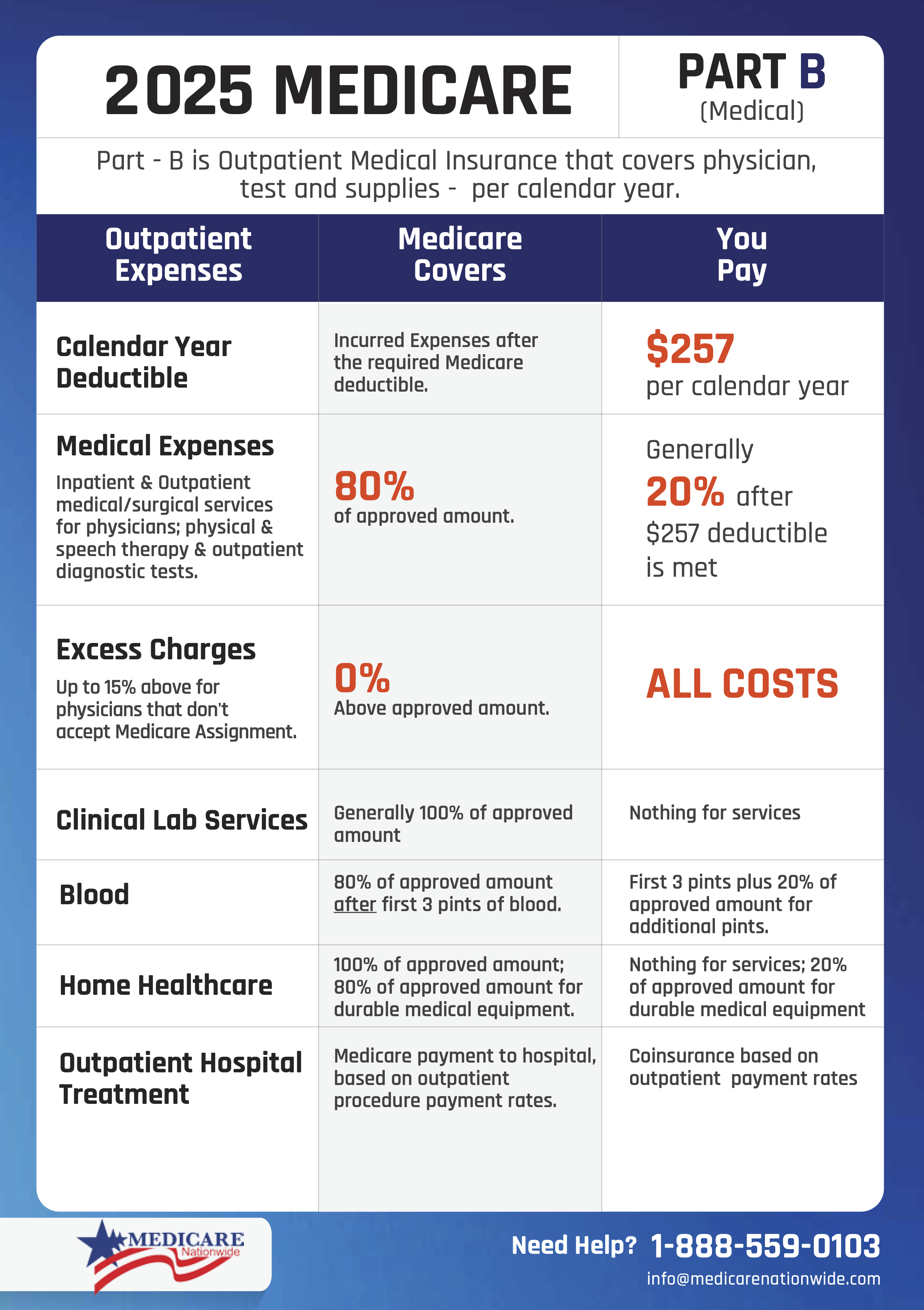

Medicare Part B

This segment covers your outpatient expenses. Part B insurance also keeps you covered on all your visits to the hospital. It pays expenses for preventive services, lab work, and surgeries. This part is crucial because it includes both kidney dialysis and cancer therapy. Without supplemental plans, these treatments would cost a fortune. After you satisfy your Part B deductible, you will owe 20% for Medicare-approved services. That is why you need a Medicare supplement plan otherwise known as a Medigap, that pays the gap in coverage.

Medicare Supplement Chart for Part B

General Medicare consists of Part A and Part B, commonly referred to as Original Medicare. This cover leaves a few notable areas out, leading to a considerable amount of copayments, charges, coinsurance, as well as deductibles. To fill the void, you need Medicare Supplement insurance coverage.

Once you sign up for Medicare Supplement insurance plans, you are in a position to pick any doctor, clinic, or hospital that accepts Medicare as a means of payment for services rendered. The cover brings about benefits such as:

- Portable coverage, allowing you to remain covered across state lines. In some cases, you enjoy medical coverage anywhere in the world in all facilities that accept Medicare.

- Qualification for Medicare guarantees your insurability, even in the event of unforeseen injury or sickness in the future.

- Medicare Supplement has a 30-day money-back guarantee. If after the set duration you decide against continuing with the program, you get a premium refund.

- When another member of your household opts for Medicare supplement, you get to save five percent on monthly premiums

- Medicare insurance holders may file claims conveniently through an online platform

- Holders get discounts when they make monthly payments via bank drafts or credit cards.

Humana Medicare Supplement Premiums

*The above rates are from zip code 79835 in El Paso, TX for females age 65. Rates vary based on zip code, gender, age, and, in some areas, health. Rates are illustrative in nature and subject to change.

- Plan A: $103.17

- Plan F: $123.05

- Plan G: $104.29

- Plan N: $81.78

It’s important to keep in mind that all Medicare supplements are federally standardized. Meaning that they must cover the same exact benefits. This makes shopping around a critical step in the Medicare supplement decision process. Be sure to check out the other important factors that should be driving your Medicare supplement decision.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Humana Medigap Plan F

This supplement provides the most comprehensive cover with the widest variety of benefits. The vast scope of the supplement, in turn, attracts some high premiums in return. You may purchase a high-deductible Plan F, however, the lower premiums only materialize upon satisfaction of a specific degree of deductibles. For uniformity, all Plan F covers from different insurers have similar features.

The benefits in a typical Medicare Supplement Plan F consist of the following:

- Part A coinsurance as well as hospital costs for up to 365 days after exhaustion of Medicare Benefits

- The first Three Pints of Blood

- Part B Copayment or Coinsurance

- Part A Hospice Care

- Coinsurance for Skilled Nursing Facility

- Part B Medicare Deductible and Excess Charges

- Up to $50k Foreign Travel Emergency

Despite its comprehensive scope, this cover shall end in 2020. However, if you are born prior to Jan 1, 1955, you will be grandfathered in.

Humana Medigap Plan G

This Medicare Supplement is one of the most comprehensive options you can find. It bears all the features and benefits of Plan F, except the Part B annual deductible. This Medicare supplement, however, has lower monthly premiums, which sufficiently levels the difference. For lower monthly payments, Plan G gives you a relatively pocket-friendly option compared to F.

One of the two main advantages that Plan G has over Plan F is the lower monthly premiums, which are often more than $30 monthly. Switching from Plan F to Plan G, therefore, saves you between $400 and $700 annually. Considering that both plans provide similar services with the only difference being the annual deductible of less than $200 in Plan F, you save money by migrating to G. Supplement Plan G also covers your hospital deductible, amounting to over $1400. For its many benefits and great value for money, as well as its coverage you can keep for the long term.

The second advantage is that the Medicare Supplement Plan G offers a long-term solution for your medical insurance. With plan F offering similar features and coming to an end in 2020, you are better suited to get Plan G. Another factor to consider is that Medicare Supplement Plan G historically has smaller rate increments compared to F. Plan N has even more stable rates.

Humana Medigap Plan N

Some individuals are comfortable with the idea of copayment for workplace visits, as well as visits that don’t necessitate hospital admission. For such preference, the Medicare Supplement Plan N is a perfect option. With a limited scope of cover, monthly premiums are lower as a result. The critical difference between Plan N and F or G is the absence of Medicare Part B deductible and excess charges.

Humana Managed Care Plans

Getting Humana Medicare Supplement cover makes you eligible for the Silver Sneakers program in certain states. Not available for many of their Humana Medicare Supplement plans. This fantastic add-on makes you a primary wellness center member, granting you access to equipment and group exercise classes. This unique opportunity allows you to work with qualified trainers. The Silver Sneakers Steps bridges the gap in case you don’t have access to a wellness center, employing a pedometer-based program to keep up your activity levels through walking.

Humana offers fantastic options, availing flexible options to accommodate a range of individual needs. Medicare Supplement plans give a variety of discounts with great benefits, allowing you to access health insurance and enjoy some much-needed peace of mind in the process.

Humana Medicare Dental Insurance

If you decide to choose a Medicare supplement plan, you might be aware that dental, vision, and hearing are not included in these plans. There are third-party discounts available with the welcome package delivered to you after you enroll in a plan. Many folks that choose a Medicare Supplement need a stand-alone dental plan. If you live in Florida, Georgia, Illinois, Louisana, Missouri, Ohio, Tennessee, or Texas, ask us about Humana’s Dental Value plan. Rates are as low as $12-$16 dollars a month! The coverage is comparable to other dental plans on the market. Shop Humana and dental vision plans here: Humana Dental and Vision Quote Self Enrollment Tool

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Our Opinion

We feel Humana is a solid choice for your Medicare supplement needs. You can enjoy stable rates (subject to area) and solid customer service. Their Medicare Advantage plans, stand-alone policies, and other prescription drug plans are also worth looking into. If you’d like to explore Humana as your perfect place to shop Medicare Supplement or to view their rates, please reach out to us!

Prefer to chat by phone? Give us a call at 1-888-559-0103.