American Home Life Insurance

American Home Life (AHL) is a well-established life insurance company and Medicare supplement carrier respected by conservatives and Patriot Americans. Nevertheless, with so many various alternatives to select from, it can be challenging.

This article will shed light on some of the fundamentals of American Home Life Medicare supplements and explain how to select the best plans for yourself.

If you’re reading this, you’re likely looking for guidance to determine the best alternatives for your specific situations as they correspond to your health insurance options.

Many seniors understand that Medicare insurance already covers a lot, but without additional supplemental coverage to your Medicare, you’ll still be required to pay for many expenditures when you go to your doctor.

The great news is that several private health insurers, such as American Home Life insurance company, offer some of the lowest supplemental health insurance plans for those who qualify and are enrolled in Original Medicare.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

American Home Life Insurance Coverage

The basic concept behind all Medicare supplement American Home Life plans is to pick an insurance policy that covers the expenditures you would be liable for under Original Medicare. Most citizens would like to avoid paying as much cash out of pocket as possible, and selecting the ideal insurance policy will help them do just that.

What is a Medicare Supplement?

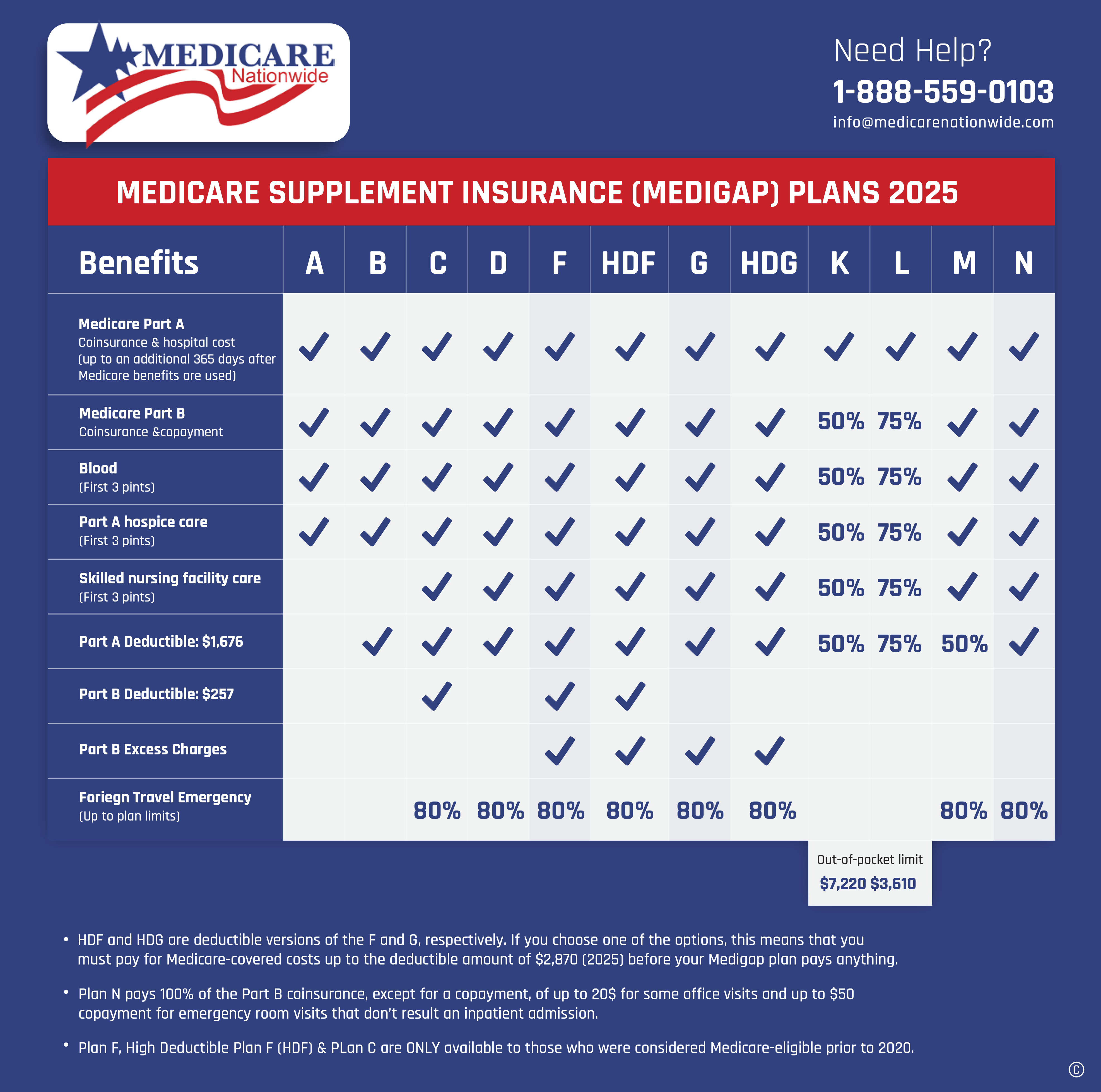

Medigap, also recognized as a Medicare Supplement policy, is a form of private health insurance that pays for any expenditures that cover the “gap” in coverage that Medicare is unable to fully cover up to the Medicare-approved rate that your providers are willing to accept. Like copays, coinsurance, and deductibles that are outstanding after Medicare pays first as your primary insurance. Your secondary insurance is the Medicare supplement policy that covers this gap in coverage. The state controls 11 normalized Medigap plans, denoted by the letters A through N. where Plans F, G, and N have the highest enrollment each year as they have the most coverage.

Medicare Supplement Category

American Home Life Medigap Plan F

This health insurance policy covers all coinsurance, copayments, and deductibles not covered under Medicare insurance, including Part A and Part B. It is a good choice if you have high healthcare expenses and want to avoid as many out-of-pocket financial costs as possible. However, it is not offered to newly eligible Medicare recipients since January 1, 2022 (unless grandfathered in.)

American Home Life Medigap Plan G

This insurance policy covers exactly what Plan F covers, with one exception. Plan G doesn’t cover Medicare’s Part B deductible of $233/yr that Plan F would otherwise cover. This insurance policy suits those who want to minimize their monthly health insurance premium payment by switching from Plan F to Plan G to save more than what they would owe for the Part B deductible amount.

American Home Life Medigap Plan N

This insurance policy covers exactly what Plan G covers, with only a few exceptions. Plan N and Plan G both don’t cover the Part B deductible of $233/yr. The main difference between the plans is that Plan N doesn’t cover copayments up to $20 for Part B and $50 for Part A that Plan G would cover. Also, Plan N does not cover Part B excess charges for providers that don’t accept Medicare Assignment up to 15% of the Medicare-approved rate. Plan G would cover Part B’s excess charges. It is a good choice for someone who wants to minimize their monthly health insurance premium payment and has low health care expenses.

Before moving forward, let’s clearly discuss the fundamental difference between Medicare Supplement and Medicare Advantage plans.

Medicare Advantage vs. Medicare Supplement Plans

There are a few differences between Medicare Supplement and Medicare Advantage plans.

Medicare Supplement plans complement Original Medicare by covering the gap in coverage with minimal out-of-pocket expenses.

Medicare Advantage policy is designed to be an all-in-one choice with low premium costs. However, you are restricted to a managed care plan where the insurance carrier is your primary insurance, not Medicare. You are leaving Medicare and contracting with a private plan.

If you are willing to pay higher premium costs in exchange for less out-of-pocket expenses. In that case, Medicare Supplement plans are the best.

What are the Different Types of Medigap Insurance Plans?

There are typically ten plan types available in most states, and each plan is labeled with a separate letter according to coverage.

Plan A

This insurance policy covers the coinsurance and initial deductible payments for all Medicare health insurance offers, including prescription drugs.

The premium insurance for this insurance is $499 per month.

Plan B

This insurance policy covers the coinsurance and initial deductible payments for all Medicare available health-saving services except prescription drugs.

Series final expense is about $170 per month.

Plan C

This insurance policy only covers the coinsurance and initial deductible payments for inpatient hospital care. The premium health insurance for this policy is $200 per month.

Plan D

This insurance covers the coinsurance for outpatient hospital care only. The premium insurance for this policy is $32 per month.

Plan F

It covers the coinsurance and initial deductible payments for all Medicare insurance services except prescription drugs. The premium for this policy is $172 per month.

Plan G

It covers the coinsurance and initial deductible payments for inpatient hospital care. The series final expense is $120 per month.

Plan N

This insurance policy only covers the initial coinsurance and deductible payments for inpatient hospital care. The premium insurance for this policy is nearly $120 per month.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

What is the Best American Home Life Medicare Supplement Plan?

Luckily, the two most common insurance policies, Medicare Supplement Plan G and Medicare Supplement Plan N have been used widely and are relatively simple to compare.

Their coverage differs in two ways, and these differences may be enough to help you decide. Indeed both plan G and plan N helps to cover a more significant amount of financial cost than your basic medicare health insurance coverage.

They both cover Medicare part A and medicare part B.

Medicare insurance part A covers:

- Coinsurance and hospital expenses.

- Highly trained nursing facility.

- Emergency Foreign travel.

Medicare insurance part B covers:

- Blood (first 3 pints).

- Covers other services, including regular checkup visits to the doctor.

Things to keep in mind while choosing a Health Insurance Company

- When deciding on the company and the best insurance policy for you, the critical point to remember is that the most “expensive” plan isn’t necessarily the finest.

- You should pick an insurance product that accommodates the final expense offers you expect to incur. You will be able to avoid spending high out-of-pocket costs due to this.

- Moreover, you should not select a proposal with a limited premium payment that will leave you without proper health insurance.

- The best approach to this choice is to sit, take some time and carefully evaluate your expected healthcare cost needs for the upcoming year.

Once you’ve ascertained your projected medical health costs, you can compare American Home Life insurance offers and decide which one suits you best. It may also be advantageous to discuss this with a trusted friend or any individual from your family who has experience with Medicare and supplemental health insurance.

The Final Call for a Medigap Plan

Choosing the ideal health insurance company can be challenging for you, especially for an American. Still, now that you know the fundamentals of Medigap plans and American Home Life supplemental coverage, you should better understand where to start.

You will have a significantly higher chance of selecting the plan that corresponds to your life requirements and budget if you accurately evaluate your healthcare costs.

Moreover, keep in mind that Medigap health plans do expire, so assure to refresh your life insurance on time. If you don’t, you’ll lose your existing plan and may not be able to apply for new coverage until the upcoming Open Enrollment Period expires!

Indeed we are dedicated to securing your health, but choosing a better health insurance company will always be your choice.

We are available 24/7 for your help.

Please be free to contact us at 1-888-559-0103.