Pros and Cons :

Pros and Cons :

Pros and Cons :

Pros and Cons :

Pros and Cons :

Pros and Cons :

We have carefully selected what we feel are the 3 best articles to guide your decision on Medicare supplement plans. These are often topics that will not be discussed with a typical insurance carrier as it could lead to them losing the sale. For instance, if a rep told you they had an average rate increase of 5%, you’d likely not go with that carrier. At Medicare Nationwide, we strive for unbiased information on Medicare plans and give you all the information you need to make an informed decision when choosing among Medicare supplemental plans.

Top 100 Most Populous Zip Code | Average Monthly Premium | Average Yearly Premium |

|---|---|---|

| 79936 | $140.81 | $1,689.72 |

| 90011 | $183.24 | $2,198.88 |

| 60629 | $155.19 | $1,862.28 |

| 90650 | $267.58 | $3,210.96 |

| 90201 | $183.24 | $2,198.88 |

| 77084 | $169.58 | $2,034.96 |

| 92335 | $162.83 | $1,953.96 |

| 78521 | $146.03 | $1,752.36 |

| 77449 | $160.49 | $1,925.88 |

| 78572 | $146.03 | $1,752.36 |

| 90250 | $183.87 | $2,206.44 |

| 90280 | $183.24 | $2,198.88 |

| 11226 | $418.35 | $5,020.20 |

| 90805 | $183.87 | $2,206.44 |

| 91331 | $181.64 | $2,179.68 |

| 08701 | $167.60 | $2,011.20 |

| 90044 | $183.87 | $2,206.44 |

| 92336 | $156.83 | $1,881.96 |

| 94565 | $159.86 | $1,918.32 |

| 10467 | $412.35 | $4,948.20 |

| 92683 | $184.16 | $2,209.92 |

| 75052 | $152.28 | $1,827.36 |

| 91342 | $181.64 | $2,179.68 |

| 92704 | $184.16 | $2,209.92 |

| 30044 | $162.56 | $1,950.72 |

| 10025 | $412.35 | $4,948.20 |

| 92503 | $162.56 | $1,950.72 |

| 92804 | $181.93 | $2,183.16 |

| 78577 | $146.03 | $1,752.36 |

| 75217 | $155.15 | $1,861.80 |

| 92376 | $156.83 | $1,881.96 |

| 93307 | $155.85 | $1,870.20 |

| 10456 | $412.35 | $4,948.20 |

| 10002 | $412.35 | $4,948.20 |

| 91911 | $160.23 | $1,922.76 |

| 91744 | $178.28 | $2,139.36 |

| 75070 | $154.98 | $1,859.76 |

| 77036 | $171.61 | $2,059.32 |

| 93722 | $146.64 | $1,759.68 |

| 92345 | 156.83 | 1881.96 |

| 60618 | $152.42 | $1,829.04 |

| 93033 | $164.37 | $1,972.44 |

| 93550 | $159.83 | $1,917.96 |

| 95076 | $150.54 | $1,806.48 |

| 11230 | $418.35 | $5,020.20 |

| 11368 | $412.35 | $4,948.20 |

| 37013 | $134.11 | $1,609.32 |

| 11373 | $412.35 | $4,948.20 |

| 79912 | $138.53 | $1,662.36 |

| 37211 | $134.76 | $1,617.12 |

| 30043 | $161.77 | $1,941.24 |

| 11206 | $418.35 | $5,020.20 |

| 10453 | $412.35 | $4,948.20 |

| 92154 | 161.32 | 1935.84 |

| 11355 | $412.35 | $4,948.20 |

| 95823 | $145.90 | $1,750.80 |

| 77479 | $157.74 | $1,892.88 |

| 91706 | $178.28 | $2,139.36 |

| 10458 | $412.35 | $4,948.20 |

| 92553 | $162.56 | $1,950.72 |

| 90706 | $183.24 | $2,198.88 |

| 23464 | $142.53 | $1,710.36 |

| 11212 | $418.35 | $5,020.20 |

| 60617 | $152.42 | $1,829.04 |

| 91709 | $172.30 | $2,067.60 |

| 11214 | $418.35 | $5,020.20 |

| 11219 | $418.35 | $5,020.20 |

| 91910 | $160.48 | $1,925.76 |

| 22193 | $144.81 | $1,737.72 |

| 77429 | $155.13 | $1,861.56 |

| 93535 | $158.60 | $1,903.20 |

| 66062 | $156.62 | $1,879.44 |

| 93257 | $146.12 | $1,753.44 |

| 30349 | $162.29 | $1,947.48 |

| 60647 | $152.42 | $1,829.04 |

| 77584 | $166.61 | $1,999.32 |

| 10452 | $412.35 | $4,948.20 |

| 77573 | $167.18 | $2,006.16 |

| 11377 | $412.35 | $4,948.20 |

| 11207 | $418.35 | $5,020.20 |

| 77494 | $147.68 | $1,772.16 |

| 75211 | $150.08 | $1,800.96 |

| 11234 | $418.35 | $5,020.20 |

| 28269 | $128.58 | $1,542.96 |

| 11235 | $418.35 | $5,020.20 |

| 94544 | $158.45 | $1,901.40 |

| 10029 | $412.35 | $4,948.20 |

| 60625 | $152.42 | $1,829.04 |

| 89110 | $169.59 | $2,035.08 |

| 92509 | $162.56 | $1,950.72 |

| 77083 | $166.40 | $1,996.80 |

| 91335 | $181.64 | $2,179.68 |

| 85365 | $158.02 | $1,896.24 |

| 87121 | $136.26 | $1,635.12 |

| 10468 | $412.35 | $4,948.20 |

| 90255 | $183.24 | $2,198.88 |

| 93065 | $164.41 | $1,972.92 |

| 91710 | $225.35 | $2,704.20 |

| 10462 | $412.35 | $4,948.20 |

| 11385 | $412.35 | $4,948.20 |

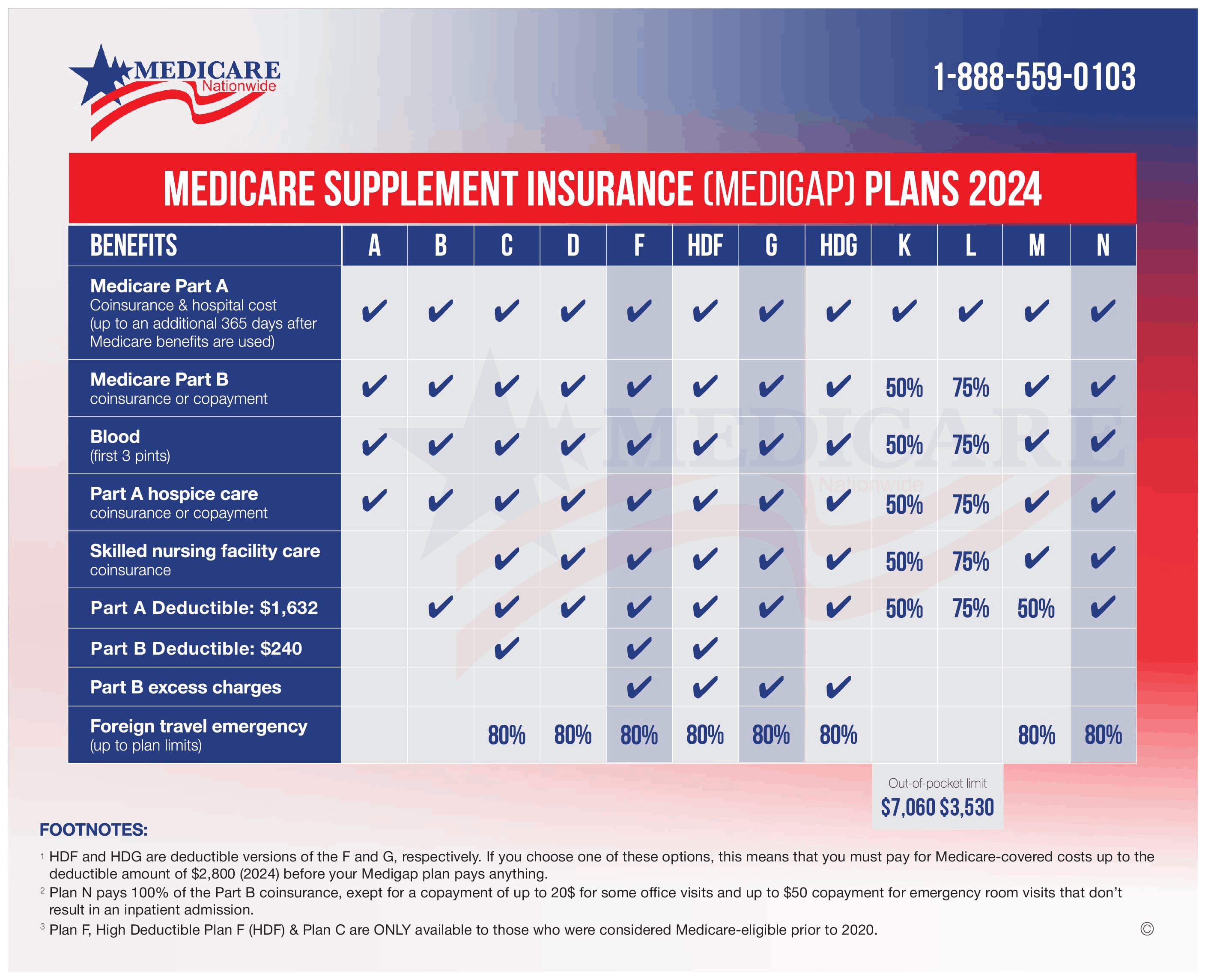

For detailed explanations of each plan, see our comprehensive article on Medicare Supplement Plan Comparison.

Once you’ve decided to purchase a Medicare supplement plan, the following decisions are what type of Medicare supplement plan to buy and what company you should choose. There are hundreds of companies operating in the United States selling supplement plans. Many of those companies have already filled your mailbox with information about their Medicare Advantage plans. At this point, you are probably just trying to find an independent, unbiased source of information. Let’s get something clear right out of the gate, Medicare supplement plans are not Medicare Advantage plans. That’s key and we have a whole article about the differences here: Medicare Advantage vs Medigap

How do you choose the top Medicare supplement carrier that will be easy to work with and pay your claims promptly? Which companies are best for pricing, and have automatic claims filing, where the secondary insurance company automatically pays the claim after Medicare approves first as your primary insurance? In this article, we will give you the top ten best Medicare Supplements and tips on choosing the best companies to consider. How do you choose the top Medicare supplement carrier that will be easy to work with and pay your claims promptly? Which companies are best for pricing, and have automatic claims filing, where the secondary insurance company automatically pays the claim after Medicare approves first as your primary insurance? In this article, we will give you the top ten best Medicare Supplements and tips on choosing the best companies to consider. Read more

Medicare supplemental Plan G, also known as Medigap Plan G. Medicare Plan G is now the most popular supplemental insurance plan for today’s seniors after Plan F became no longer eligible to those born after January 1, 1955 (with few exceptions.) Why would anyone choose to go with Medicare Plan G? Medicare Supplement Plan G offers very good coverage with lower premiums than that of Medicare Supplement Plan F. The only difference when you compare both Medicare supplement plans is that Medicare Plan G does not pay for Medicare Part B deductible, but Medicare Plan F does. Plan G offers significant saving options for seniors. Read more

Original Medicare is used by around 50 million people, that includes Medicare Part A and Part B. A Medigap or Medicare Supplement insurance plan provides supplementary coverage for more than 11 million of those customers. Beneficiaries who seek a Medigap plan frequently struggle with deciding between Medicare Plans F, G, and N. These top three Medicare Supplement plans are available for 2024. Read more

If you already have Original Medicare, you might be considering getting a second Medicare Supplement coverage. To better comprehend the coverage possibilities of Medigap policies, Medicare guide helps to become familiar with it beforehand. Read more

You might feel stressed and confused doing the research needed to find the best company for your Medicare supplement product. There are dozens of companies and plans in the United States. Plans can vary from state to state. And, even the ZIP code where you live may change the pricing and availability of plans. Underwriting guidelines change continually. Companies change focus and get bought and sold. The research can be overwhelming.

Here’s how we can help: