What makes American Home Life Insurance different from other Medicare Supplement Carriers?

Not only is AHL not a “woke” corporation like every other carrier they compete against in the Medicare Supplement space, but they offer a package that other Medicare Supplement carriers do not. They offer a Final Expense plan that, if you own a Medicare Supplement plan, you get 20% off. Many seniors bought their life insurance 20-30 years ago and have reached the end of their fixed term, where their policy starts to skyrocket in price, leaving them with no life insurance when they are forced to drop their policy! Final Expense makes sure you get enough insurance for funeral expenses.

Providing your family with tax-free money to cover your funeral is not only an act of love but also personal responsibility. So why not take care of what you need for health insurance and take care of your funeral expense down the road in the Patriot Series product for Patriots like you! You won’t need a phone interview, and underwriting decisions are determined immediately to see if you qualify for a Final Expense policy. Purchasing a Final Expense policy is completely optional. Here are some other benefits of choosing a Medicare Supplement plan with American Home Life.

- 30 Days Free Look – Return your policy within the first 30 days for a full refund.

- 12-month Rate Guarantee – Lock in your rate for 12 months without worrying about inflation. We will provide you with historical rates, so you know what to expect in the future.

- Guaranteed Renewable – Keep paying your premium and your policy won’t be canceled for the life of the policy.

- No Referrals Necessary – All Medicare participating physicians and specialists cover Plans F, G, and N.

- Freedom To Choose – Doctors that accept Medicare accept Plan F, G, and N.

- Portable Coverage – Even if you move or vacation, you can keep your coverage.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Frequently Asked Questions:

How long has American Home Life been in business?

The company was founded in 1909.

Where is American Home Life home office located?

They are headquartered in Topeka, Kansas.

Is American Home Life Insurance a good company?

Aetna Senior Supplemental is the third-party administrator for Medicare Supplement and Final Expense policies. This relationship ensures that policies, claims, and services are delivered with the highest customer satisfaction and that your providers will be paid promptly for any Medicare-approved service for Plans F, G, and N.

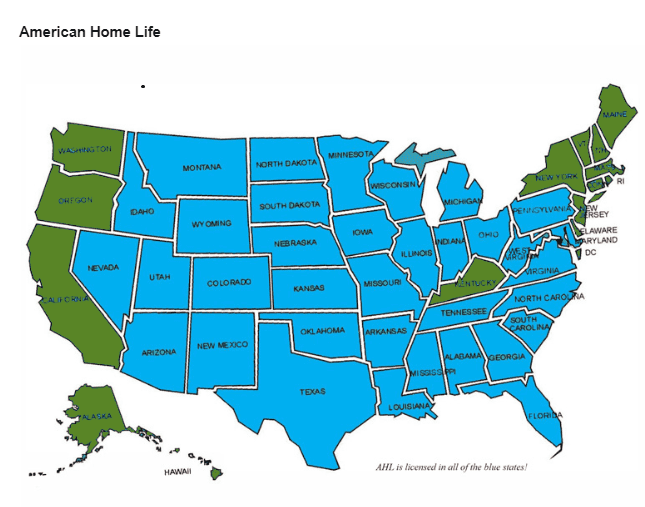

What States offer American Home Life Insurance?

American Home Life Product Availability Map. AHL is licensed in all of the blue states.

What is the American Home Life Patriot Series?

A Final Expense policy is provided at a discount for those approved by a Medicare Supplement policy with AHL.

What is a Final Expense Policy?

It is a whole life insurance policy that remains in coverage for the rest of your life as long as you pay the fixed monthly premium. You don’t have to worry about inflation or rising premium rates. Lock in a monthly rate for a Final Expense plan and receive life insurance coverage also known as a death benefit. Death benefit amounts typically are $10,000.00, $15,000.00 or $20,000.00 to cover funeral expenses (range $1,000-$35,000.) The more life insurance you purchase the higher the death benefit will cover your expenses. Whole life plans accumulate a cash value from the premium contributions if you need to withdraw money later from your policy as an option available to you. That means that you can still access the money you contribute to your policy at a later date.

This Final Expense policy is a simplified issued application. What that means is that you answer nine short questions with no medical exams, tests, or underwriting required. It’s easy! American Home Life offers these plans to ages 50-85.

What is a Medicare Supplement Plan?

A Medicare Supplement plan is secondary insurance to Medicare. That means that Medicare remains your primary insurance.

What is Primary Insurance?

It defines who is first responsible for claims payment for medical expenses covered by your insurance. For example, if Medicare is your primary insurance it means that Medicare approves claims. However, if your employer offers you insurance, it might mean that the insurance carrier that your employer offers might review your claims first and be your primary insurance.

Some folks have primary insurance through their employer and Medicare as their secondary insurance. If you have already enrolled in basic Medicare Part A and/or Part B, but still have an employer plan then you might have Medicare as your secondary insurance. Once you leave your employer insurance, Medicare then becomes your primary insurance.

What is Secondary Insurance?

After the primary insurance reviews and approves the claims, they pay their portion of the claim and then send it to the secondary insurance to pay the remaining amount outstanding. Purchasing primary and secondary insurance allows you full coverage for medical claims. For example, if Medicare approves $10,000.00 in medical expenses, they will pay $8,000.00 or 80%, and send it to your secondary insurance carrier like American Home Life, which will pay the remaining $2,000.00 or 20%.

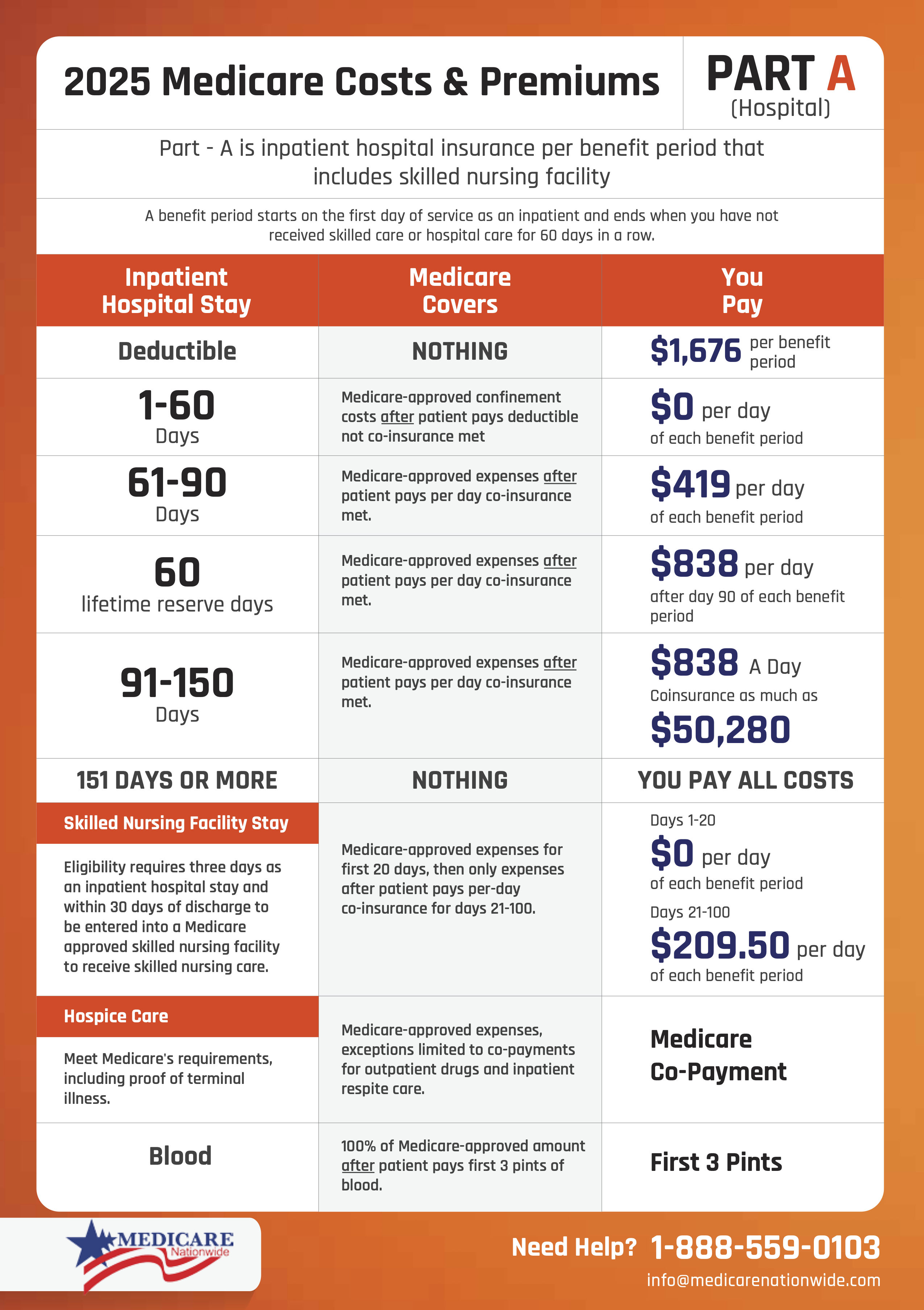

What is Part A and what does it cover?

Part A is hospital insurance, otherwise known as inpatient hospital and skilled nursing care. Here is a Medicare Supplement Part A Chart that shows what is covered without supplemental insurance secondary coverage.

Note: Federal government offers Part A, not an insurance company.

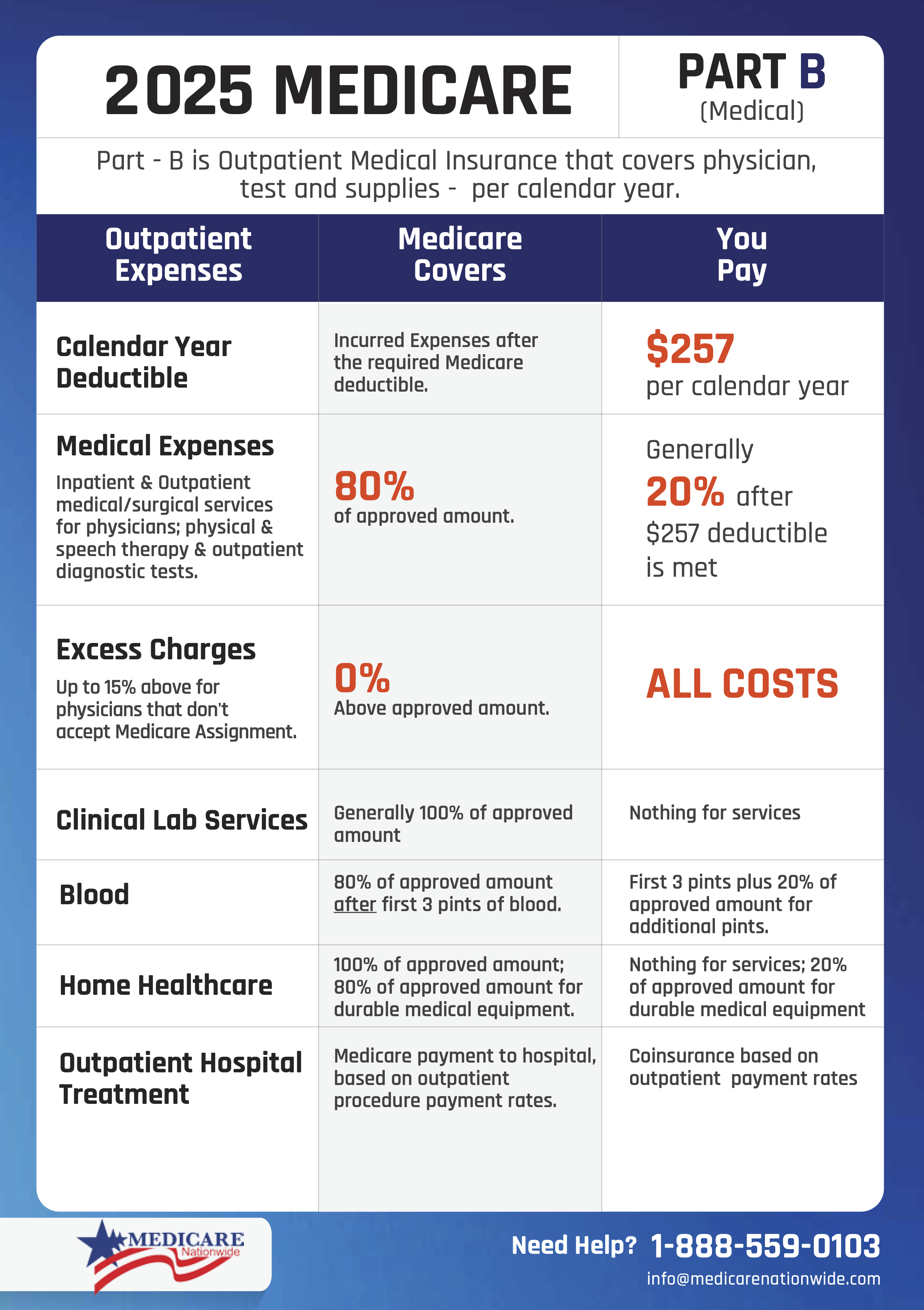

What is Part B and what does it cover?

Part B is outpatient medical insurance. Here is a Medicare Supplement Part B chart that shows what is covered without supplemental insurance secondary coverage.

Note: Federal Government offers Part B, not an insurance company.

Why do I need Medicare Supplement insurance to cover the gaps in coverage for Part A and Part B?

As you can see from the charts in the above questions the federal government cannot cover all Medicare-approved expenses at 100%. That means that the patient is self-insured and paying claims as secondary to Medicare. To avoid the risk of being responsible for paying claims secondary to Medicare, if you purchase a Medicare Supplement plan, the secondary insurance carrier covers the cost of claims and removes that liability and risk away from you, the patient.

What is the difference between a Medicare Supplement plan and a Medicare Advantage plan?

Medicare Advantage is a managed care plan. Medicare is no longer the primary insurance in this case. Your medical providers will file claims with the Medicare Advantage insurance carrier for claims review. The insurance carrier becomes your primary insurance, and you no longer have secondary insurance. A Medicare Advantage plan is a direct relationship with an insurance carrier rather than a direct relationship with Medicare. Medicare Advantage plans include premium payments, co-payments, co-insurance, deductibles, and max-out-of-pocket expenses for doctors restricted to a network. A Medicare Supplement plan typically covers all those out-of-pocket costs with limited exceptions. This article goes further into depth with the difference between a Medicare Supplement plan and a Medicare Advantage plan.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

What is not covered by Medicare Part A, Part B, and a Medicare Supplement plan?

Medicare Part A and B are coverage for hospital, skilled nursing, and outpatient medical care. It does not cover pharmacy prescription drugs, dental, vision, and acupuncture, among other services that are not Medicare-approved. We can provide you with a brochure and go further in-depth about what Medicare covers once you decide to communicate with one of our licensed agents that serves the State you live in.

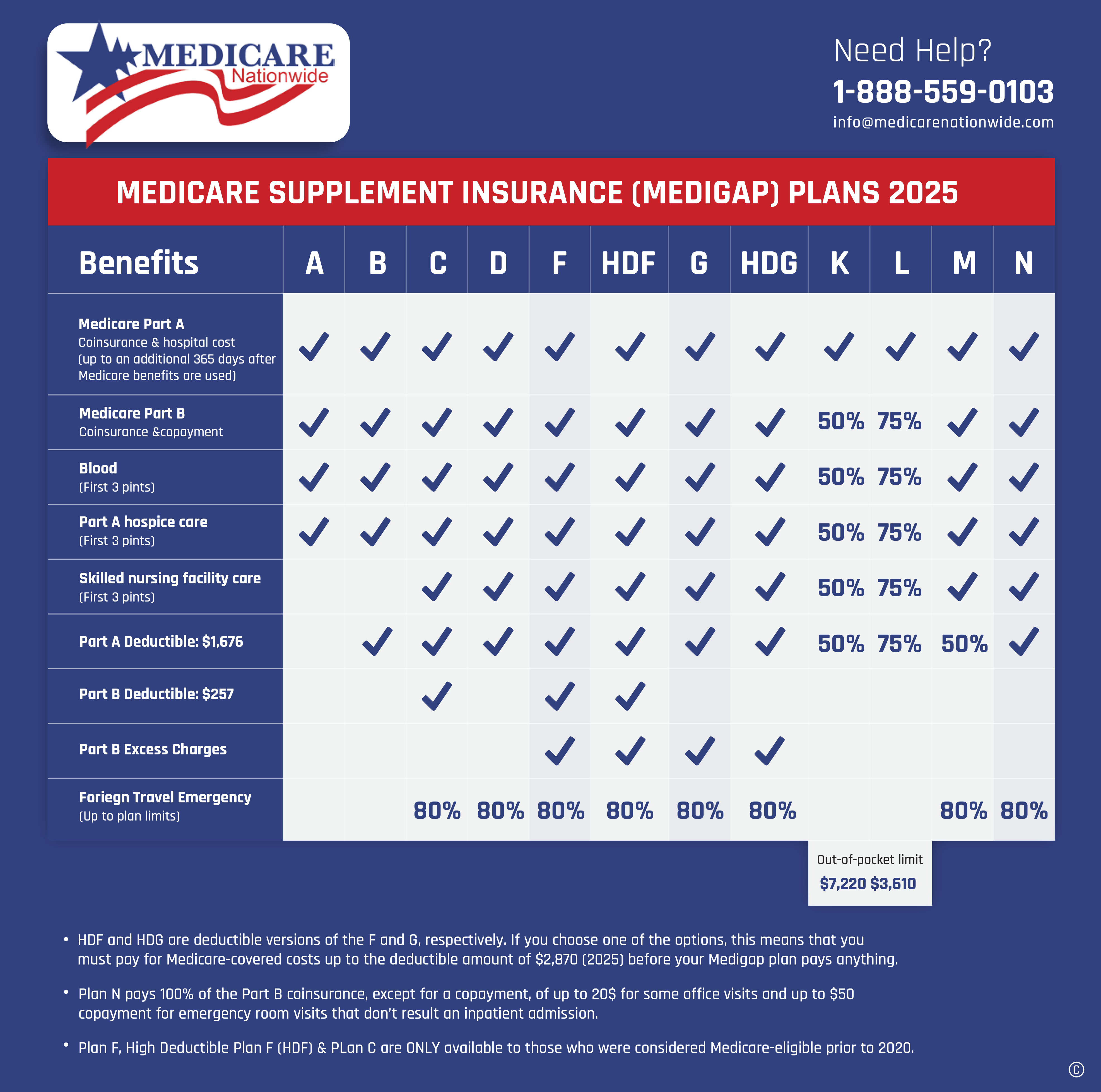

What does a Medicare Supplement plan cover?

Here is our Medicare Supplement Review Chart to see the most popular plans cover. Those plans are Plan F, G, and N.

You can see in this chart the check marks that correspond with the Plans listed on the columns and the services listed on the rows covered by the different plans. Plans F, G, and N cover more expenses than the other plans with a much lower enrollment for Medicare recipients each year.

What is the Best Way to choose a Medicare Plan?

Insurance is a choice. Some folks are willing to take more risks to lower their premiums, such as adopting co-payments for office and specialist visits. Others are very conservative with risk and want a plan that covers more and gives them peace of mind. Finding the right plan for you has to do with determining your health, and your risk tolerance, and working with a professional like one of our agents that can confirm you are making the right choice for your budget and health. There are short-term and long-term considerations when choosing a plan depending on your age, where you live, and the freedom to make plan changes down the line. We can help you determine your options as it is on a case-by-case basis.

Am I Eligible for a Medicare Supplement Plan?

You qualify for a Medicare Supplement plan if you are a Medicare recipient or are becoming eligible for Medicare. The first 3-6 months of eligibility is your Open Enrollment period, where you can have a Medicare Supplement plan without being declined due to pre-existing conditions. Your Open Enrollment period is when you turn 65 years old, or if you delayed your Part B enrollment because you have creditable coverage elsewhere; it is when you become eligible for Part B enrollment. We assist folks in coming off their employer plan and enrolling in Part B. Please note that you may be penalized or taxed if you are either late to enroll in Medicare or your income is high and you don’t report your current income to Medicare for reassessment. We can walk you through that process as well and clear up any confusion.

How much does a Medicare and Medicare Supplement Plan cost?

Costs fluctuate based on location, age, and tobacco use, among other factors. The secondary insurance carrier determines the rates, never the agent. What this means as an example, is that if you are a 65-year-old male, a non-tobacco user in the state of Nebraska with a household partner applying with you, you would be eligible for a 7% household discount, and the stated premium rate for that zip code, age, and the preferred rate for a non-smoker. To have a quote provided to you, you can click the “Set Appointment” button. Otherwise, you can join our Facebook Group, where members have access to a rating tool to see all the insurance carriers and quotes for themselves: https://www.facebook.com/groups/medicareqa

What are the next steps? Medicare supplement plans seem interesting to me!

If you have any questions or concerns about Medicare Supplement plans or deriving a quote, please call us at 1-888-559-0103, and we will be happy to assist you!