Here’s a video on why the Plan G makes sense financially:

How does Medicare Supplement Plan G work and what does it cover?

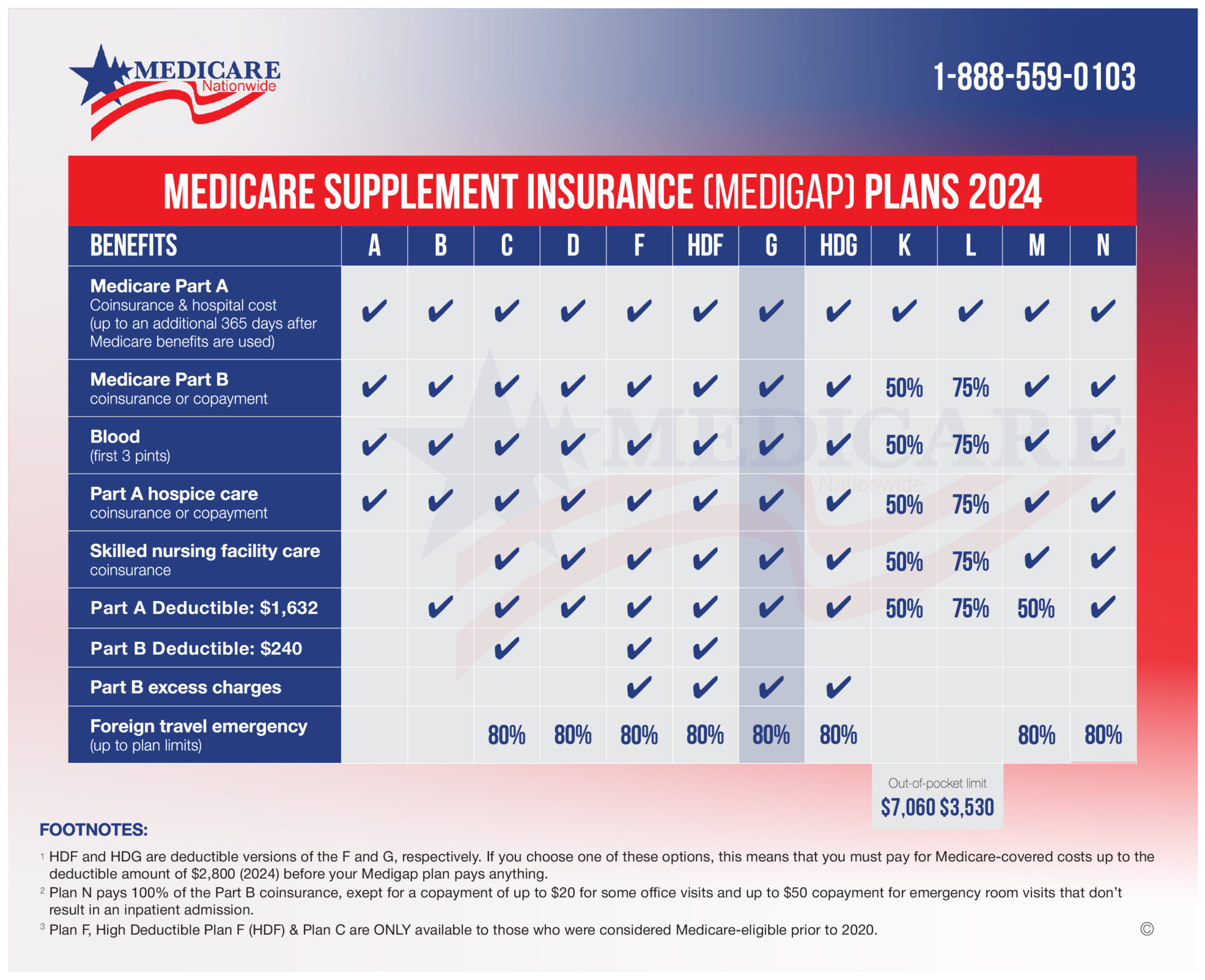

After Medicare pays its approved portion of medical costs, Plan G helps pay for remaining out-of-pocket expenses. You must pay a separate monthly premium for Medigap coverage.

Plan G offers the same comprehensive coverage as Medicare Plan F except for the Medicare Part B deductible. This plan is a good fit for those people who want coverage for hospitalization but are willing to pay the Medicare Part B deductible on their own.

Premiums and Costs for Plan G

- Basic Doctor Visits

- Medicare Part A Deductible, Coinsurance, & Hospital Costs (inclusive of hospice care co-payment)

- Medicare Part B Coinsurance, Co-Payment, & Excess Charges

- Foreign Travel Emergency (up to $50,000 but varies by plan)

- Preventative Care Part B Coinsurance

- Skilled Nursing Facility Coinsurance

- This is inclusive of most doctor services when you are a hospital inpatient and also outpatient therapy

- Durable Medical Equipment (DME), Blood Transfusions, Lab Work, X-rays, Surgeries, Ambulance Rides, and much more

Medicare Supplement Plan G does not cover dental care or other services excluded from Original Medicare coverage, like cosmetic procedures or acupuncture. Some Medicare Advantage policies may cover these services. You might have to check further on the particular coverage of the Medicare Advantage Plan in question.

It is worth noting some states have slightly different Medicare supplement insurance benefits. If you or your loved one lives in Minnesota, Wisconsin, or Massachusetts, the uniform medical plan will differ in terms of what they cover, out-of-pocket limits, and premiums, but the differences are very subtle and pretty much the same.

Here’s a look at the premiums for the Medicare Supplement Plan G in the most populous zip codes:

Top 100 Most Populous Zip Code | Average Monthly Premium | Average Yearly Premium |

|---|---|---|

| 79936 | $140.81 | $1,689.72 |

| 90011 | $183.24 | $2,198.88 |

| 60629 | $155.19 | $1,862.28 |

| 90650 | $267.58 | $3,210.96 |

| 90201 | $183.24 | $2,198.88 |

| 77084 | $169.58 | $2,034.96 |

| 92335 | $162.83 | $1,953.96 |

| 78521 | $146.03 | $1,752.36 |

| 77449 | $160.49 | $1,925.88 |

| 78572 | $146.03 | $1,752.36 |

| 90250 | $183.87 | $2,206.44 |

| 90280 | $183.24 | $2,198.88 |

| 11226 | $418.35 | $5,020.20 |

| 90805 | $183.87 | $2,206.44 |

| 91331 | $181.64 | $2,179.68 |

| 08701 | $167.60 | $2,011.20 |

| 90044 | $183.87 | $2,206.44 |

| 92336 | $156.83 | $1,881.96 |

| 94565 | $159.86 | $1,918.32 |

| 10467 | $412.35 | $4,948.20 |

| 92683 | $184.16 | $2,209.92 |

| 75052 | $152.28 | $1,827.36 |

| 91342 | $181.64 | $2,179.68 |

| 92704 | $184.16 | $2,209.92 |

| 30044 | $162.56 | $1,950.72 |

| 10025 | $412.35 | $4,948.20 |

| 92503 | $162.56 | $1,950.72 |

| 92804 | $181.93 | $2,183.16 |

| 78577 | $146.03 | $1,752.36 |

| 75217 | $155.15 | $1,861.80 |

| 92376 | $156.83 | $1,881.96 |

| 93307 | $155.85 | $1,870.20 |

| 10456 | $412.35 | $4,948.20 |

| 10002 | $412.35 | $4,948.20 |

| 91911 | $160.23 | $1,922.76 |

| 91744 | $178.28 | $2,139.36 |

| 75070 | $154.98 | $1,859.76 |

| 77036 | $171.61 | $2,059.32 |

| 93722 | $146.64 | $1,759.68 |

| 92345 | 156.83 | 1881.96 |

| 60618 | $152.42 | $1,829.04 |

| 93033 | $164.37 | $1,972.44 |

| 93550 | $159.83 | $1,917.96 |

| 95076 | $150.54 | $1,806.48 |

| 11230 | $418.35 | $5,020.20 |

| 11368 | $412.35 | $4,948.20 |

| 37013 | $134.11 | $1,609.32 |

| 11373 | $412.35 | $4,948.20 |

| 79912 | $138.53 | $1,662.36 |

| 37211 | $134.76 | $1,617.12 |

| 30043 | $161.77 | $1,941.24 |

| 11206 | $418.35 | $5,020.20 |

| 10453 | $412.35 | $4,948.20 |

| 92154 | 161.32 | 1935.84 |

| 11355 | $412.35 | $4,948.20 |

| 95823 | $145.90 | $1,750.80 |

| 77479 | $157.74 | $1,892.88 |

| 91706 | $178.28 | $2,139.36 |

| 10458 | $412.35 | $4,948.20 |

| 92553 | $162.56 | $1,950.72 |

| 90706 | $183.24 | $2,198.88 |

| 23464 | $142.53 | $1,710.36 |

| 11212 | $418.35 | $5,020.20 |

| 60617 | $152.42 | $1,829.04 |

| 91709 | $172.30 | $2,067.60 |

| 11214 | $418.35 | $5,020.20 |

| 11219 | $418.35 | $5,020.20 |

| 91910 | $160.48 | $1,925.76 |

| 22193 | $144.81 | $1,737.72 |

| 77429 | $155.13 | $1,861.56 |

| 93535 | $158.60 | $1,903.20 |

| 66062 | $156.62 | $1,879.44 |

| 93257 | $146.12 | $1,753.44 |

| 30349 | $162.29 | $1,947.48 |

| 60647 | $152.42 | $1,829.04 |

| 77584 | $166.61 | $1,999.32 |

| 10452 | $412.35 | $4,948.20 |

| 77573 | $167.18 | $2,006.16 |

| 11377 | $412.35 | $4,948.20 |

| 11207 | $418.35 | $5,020.20 |

| 77494 | $147.68 | $1,772.16 |

| 75211 | $150.08 | $1,800.96 |

| 11234 | $418.35 | $5,020.20 |

| 28269 | $128.58 | $1,542.96 |

| 11235 | $418.35 | $5,020.20 |

| 94544 | $158.45 | $1,901.40 |

| 10029 | $412.35 | $4,948.20 |

| 60625 | $152.42 | $1,829.04 |

| 89110 | $169.59 | $2,035.08 |

| 92509 | $162.56 | $1,950.72 |

| 77083 | $166.40 | $1,996.80 |

| 91335 | $181.64 | $2,179.68 |

| 85365 | $158.02 | $1,896.24 |

| 87121 | $136.26 | $1,635.12 |

| 10468 | $412.35 | $4,948.20 |

| 90255 | $183.24 | $2,198.88 |

| 93065 | $164.41 | $1,972.92 |

| 91710 | $225.35 | $2,704.20 |

| 10462 | $412.35 | $4,948.20 |

| 11385 | $412.35 | $4,948.20 |

| Medicare Supplement Plan G Average Monthly Cost in Columbus, OH (43085)* | |

| Gender: Female, Age 65 | $143.42 |

| Gender: Male, Age 65 | $160.37 |

| Gender: Female, Age 75 | $185.23 |

| Gender: Male, Age 75 | $207.76 |

| Medicare Supplement Plan G Average Monthly Cost in Clarksville, TN (37042)* | |

| Gender: Female, Age 65 | $149.89 |

| Gender: Male, Age 65 | $166.81 |

| Gender: Female, Age 75 | $184.20 |

| Gender: Male, Age 75 | $205.08 |

| Medicare Supplement Plan G Average Monthly Cost in Nampa, ID (83686)* | |

| Gender: Female, Age 65 | $203.22 |

| Gender: Male, Age 65 | $203.22 |

| Gender: Female, Age 75 | $203.22 |

| Gender: Male, Age 75 | $203.22 |

What do Medigap Plans don’t cover?

All Medigap health insurance plans, including Plan G, sold to new Medicare members don’t cover the following:

- Part B deductible. (Since 2020, new Medicare members can’t buy any plan that covers the Part B deductible, although existing members are grandfathered in.)

- Prescription drugs.

- Long-Term Care (like non-skilled care you get in a nursing home).

- Dental Care

- Vision Care

- Private-Duty Nursing

High-Deductible Plan G

One of the most recent standardized Medicare Supplement plans is the Medicare Supplement High Deductible Plan G. Medicare beneficiaries who want the advantages of the conventional Medicare Supplement Plan G but would prefer lower monthly premiums can choose the Medicare Supplement High Deductible Plan G.

A High Deductible Plan G provides the same protection as a regular Medicare Supplement Plan G. Compared to the standard Medicare Supplement Plan G, the premiums for the Medicare Supplement High Deductible Plan G are lower. However, members must pay a larger deductible before their coverage begins to pay out fully. The high deductible amount is affected by both the Medicare Part B deductible and any cost-sharing you pay out-of-pocket.

Who Can Opt for an HDG Plan?

If you make the cut for Medicare eligibility and are in an Open Enrollment, Guaranteed Issue, or can pass underwriting if eligible to switch plans.

Medicare Supplement High Deductible Plan G is the best option for those who feel comfortable paying a larger deductible in exchange for reduced monthly premiums.

What does Medicare Plan G cost?

Premiums for Medicare Supplement policies are set by the private health insurance company that sells it, even though the plans are regulated by the government. Prices of Medicare plans vary depending on age, location, tobacco use, and other factors.

Some states also offer a Medicare Supplement high-deductible Plan G, which provides the same benefits, after a deductible is paid.

Medicare Plan G’s Lower Premiums

The one item that Plan G does not cover is the Medicare Part B deductible. Medicare Nationwide specialty agents are standing by to help you pocket the difference of a lower premium by switching to G plans. We want you to save and still have outstanding coverage. Medigap Plan G premiums can be significantly lower than Plan F premiums, and Plan G still covers all of your hospital expenses by paying the hospital deductible.

After the outpatient deductible is met, you typically pay 20% of the Medicare-approved portion of most doctor services. Medicare.gov does not openly list Medigap prices, and insurance companies do not post prices publicly online. Medicare Nationwide has done this work for you and captured the best possible options for your selection. Contact our dedicated agents to discuss the very best plan in your area given your budget and needs.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Compare Medicare Supplement

Is Medicare Plan G Better Than Medicare Plan F?

Medicare Plan G is better than Plan F if a Plan G premium in your area is $16 per month lower than Plan F. That’s when it makes sense to go for a Plan G instead of an F plan. Plan F has been phasing itself out for seniors since January 1, 2020. Hence, we have seen Plan F rates rise much quicker than those of Plan G.

Plan G statistics show that its rates appear to be more stable year over year. When you compare Medicare supplement Plan G on the parameters of usability, it is perfect for those who want the most bang for their buck with the added freedom to visit their own doctor without the need to receive a referral to specialists.

At the same time, Plan G seniors can be grouped in the future with young 65-year-olds who are newly eligible to join them on the same plan. This should keep rates more stable than with other plans.

Click here to find out more about Plan F going away and select which plan is right for you today.

Possible Plan F vs Plan G scenarios:

- If the Plan G premium in your area comes back as $110 per month while the Plan F premium is $130, then you save enough money to make Plan G a financially wise decision.

- If the Plan G premium comes back as $110 per month in your area while the Plan F premium is $120, then it makes sense to be on Plan F.

We at Medicare Nationwide normally see Plan G rates about $240 to $480 per year cheaper than that of Plan F.

Considering the only difference in coverage and price is the Part B deductible, you can save money by simply paying the $257 deductible. Imagine if the difference between Plan F and Plan G in your area was $480 in premiums. This would be a no-brainer cost saver – $480 minus the $257 deductible comes out to $223 in savings per year.

“Numerous times, we will find clients that will be paying upwards of $300/month on their Plan F, and we drop their premium down to around $100 a month,” said Jackson Edwards, owner of Medicare Nationwide.

Contact us for exact quotes for premiums in your area, and we will help you make an informed decision on plans Medicare Supplement and other similar policies in the health insurance industry. Is there a Preferred Time to Enroll in Plan G?

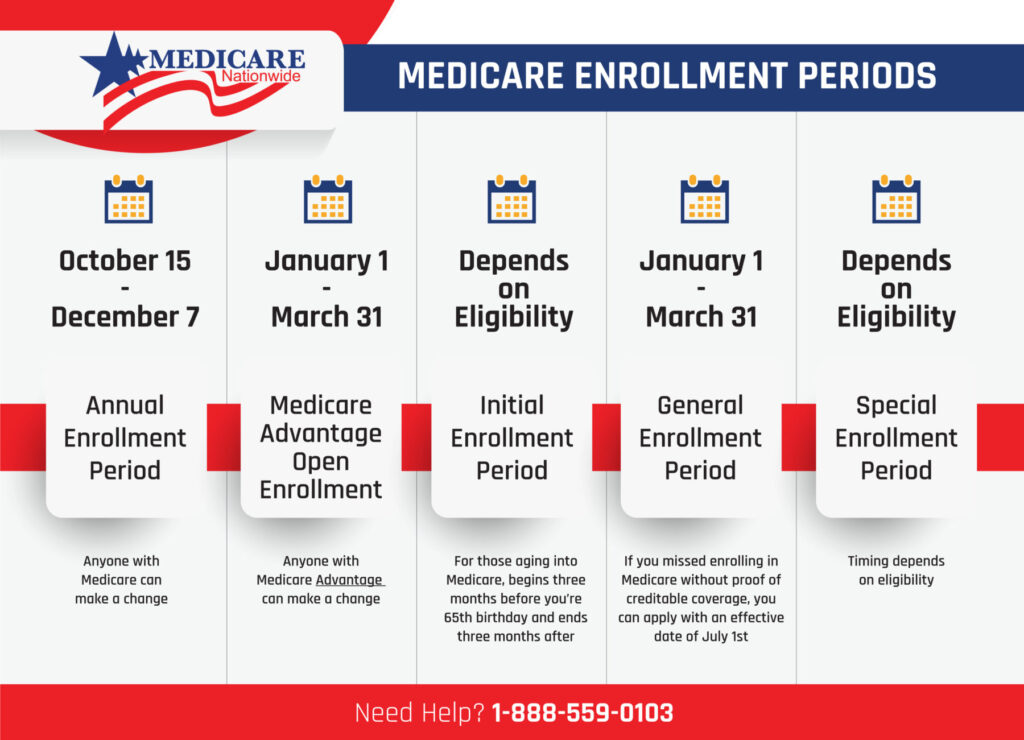

The six-month Medigap Open Enrollment Period (OEP) is the perfect time for Medicare enrollment; it begins the first month you obtain Medicare Part B and are 65 years of age or older. Companies are not permitted to raise your charges while you are an existing member based on your health or medical history.

If you are an applicant seeking this insurance outside of OEP, depending on your health or medical history, you might have to pay more or be turned down for coverage.

Some states allow insurance providers to sell Medigap plans to those under 65 who have a disability and qualify for Medicare.

Is Plan G a Good Fit for me?

- Individuals who favor convenience and simplicity: You do not pay much else under Plan G outside your premiums. Aside from two expenses, almost all of your out-of-pocket expenses are covered. The Part B deductible will continue to be paid by you and 20% of any emergency medical care you obtain overseas is something to count extra.

- Individuals who desire the freedom to access any doctor without incurring additional costs: The Part B excess charges (additional costs from non-participating doctors) are covered by Plan G, one of just two supplement plans that do so.

- Those who visit foreign nations

After you pay a $257 deductible, Plan G pays 80% of the costs of emergency medical care while you are abroad.

Medicare Supplement Plan G Frequently Asked Questions (FAQs)

You may have never considered Plan G before because of the comprehensive nature of Plan F. However, after learning of the potential cost savings, Plan G seems like a viable option. You still may have questions. These are the most common questions we hear from our customers about Plan G.

- What is the Medigap Plan G deductible in 2025? Only $257.00

- Does Medigap Plan G cover dental and prescriptions? No, it does not cover dental. Plan G will pay for the coinsurance on any Medicare Part B medication. These drugs are usually given at a doctor’s office such as chemotherapy or autoimmune disease drugs. It does not cover retail prescriptions as one would need Medicare Part D. However, many companies that offer Plan G will have both affordable Prescription Drug and Dental options.

- Does the G plan offer a stable rate year after year? Yes, Plan G does offer a stable rate plan that comes with immediate cost savings with the only difference being the $257 Medicare part B deductible. Plan G has historically been much more stable than Plan F, and this is one reason Plan F will disappear in the future.

- Does Plan G come with a guarantee issue? Seniors will no longer be in a position to guarantee issue into Plan F, so they will need a Plan G to qualify for full coverage with Medigap insurance.

- Which is better Plan G or Plan F? Well, it depends. Plan F does cover more but in many cases, Plan G is more financially responsible due to the cost savings in premiums. We will run the numbers with you for your particular zip code and walk through the pros and cons as well as other options!

- Would Plan G cover the prescription drugs? Only covered expenses under Part A and Part B are covered by Medicare Supplement Plans. Prescription drug coverage is often excluded from Original Medicare, and Medicare Plan G doesn’t offer any further protection. Part D prescription drug costs cannot be covered by Plan G. The good news is that you can still acquire all of your Medicare coverage in one spot because the majority of companies who sell Plan G also sell Part D insurance.

- Does Plan G include SilverSneakers? In contrast to Medicare Supplement plans, SilverSneakers is frequently included with the Medicare Advantage plans. Similar additional advantages, like discounted gym memberships or fitness benefits, are provided by several insurance carriers. Examine the brochure for more details.

Medicare Nationwide’s Top Recommended Plan G Plan Carriers

- Cigna

- Aetna

- Humana

- Accendo

- Mutual of Omaha

- And many others depending on your geolocation

Ready to Learn More about Medicare Plan G Options?

Here’s how we can help you make a good Medicare supplement decision. Medicare Nationwide offers hundreds of plan options that have been selected by thousands of American seniors since 2012. Medicare Nationwide is a boutique medical insurance agency focusing on one-to-one connections to ensure seniors select the correct plan for them.

Because of our broad industry connections, we can help find you a tailored product designed for your budget and health needs. Medicare Nationwide is a highly trusted industry leader in the space and is authorized to offer many different carriers and plans to suit your needs.

Medicare Nationwide has been operating in the individual medical insurance industry since 2012 and is the trusted go-to source to compare medical supplement policies. Friendly Medicare Nationwide agents are standing by to give you a no-hassle quote and answer your questions so that you can plan medical plans the right way. Our customers rate us as Excellent 100% of the time. We are ready to find the right plan for you to ensure you have the proper coverage when you need it all at the lowest possible cost.

Prefer to chat by phone? Give us a call at 1-888-559-0103.