Who is Humana Achieve

Humana has been focused on keeping people healthy since 1961. They offer personalized care from caring individuals who listen to their members and find ways to help them stay healthy.

Humana is also active in communities across the country, working hard to make neighborhoods better and support where their members live. Their main goal is to improve the health of their members and local communities.

Humana is committed to helping everyone they serve achieve better health. They believe in providing fair access to the tools and support needed for good health. This support is customized and easy to use for each person’s needs.

As a healthcare leader, Humana understands the importance of addressing global challenges.

Get to Know More Humana

Humana offers personalized healthcare solutions aimed at improving individual well-being. With a focus on personalized care and community engagement, Humana strives to enhance health outcomes and support local communities.

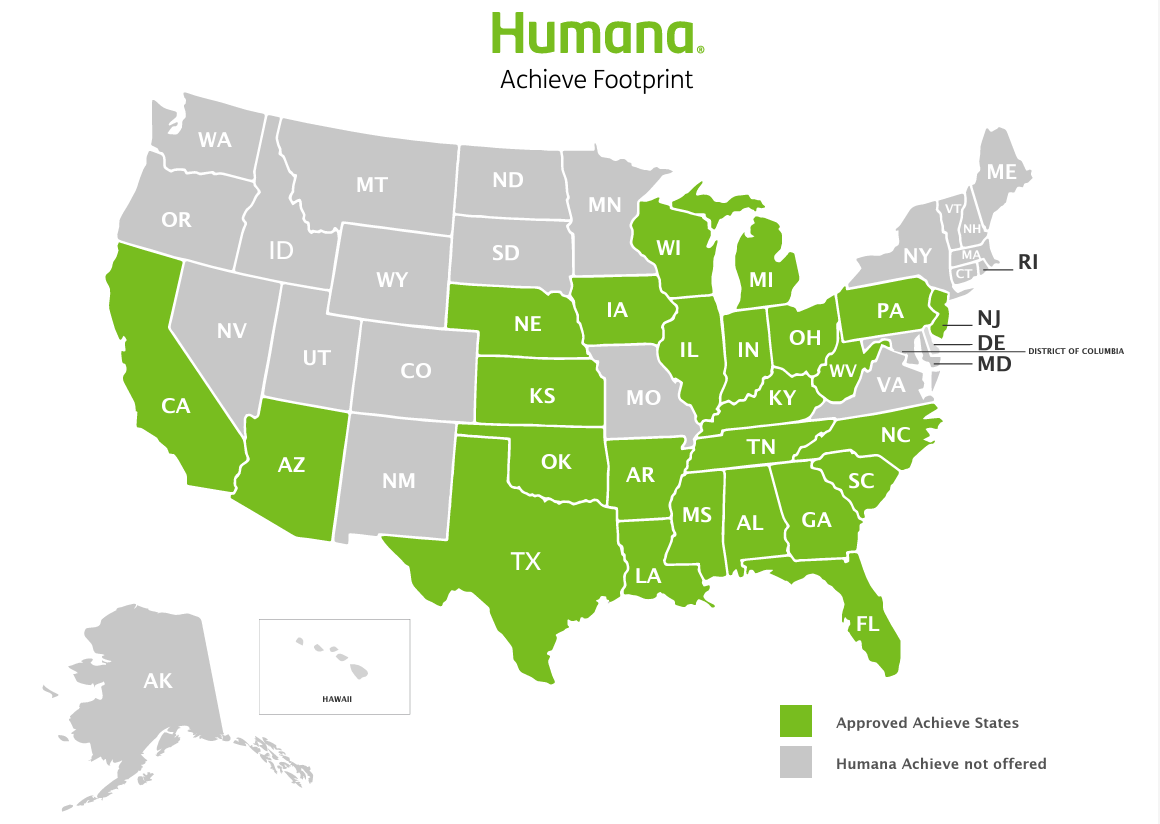

Where Is Humana Being Offered

Not all states offer Humana Achieve Medicare Supplement Plans. There are just 24 states where it is available.

Humana Achieve Medicare Supplement Plans have now expanded to Alabama, Florida, Kansas, Oklahoma, and West Virginia. Check out where you can get Humana Achieve Medicare Supplement plans now!

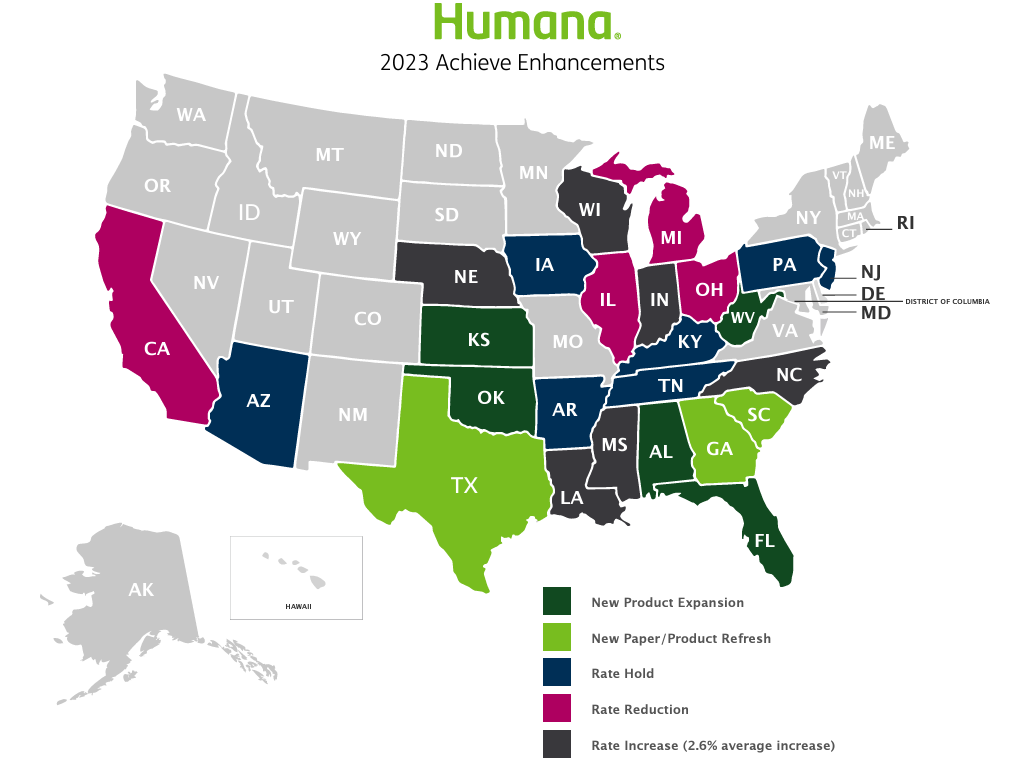

Plan Enhancements of Humana

Humana Achieve plan enhancements provide tailored healthcare solutions to enhance member experiences and outcomes. With a focus on personalized care and improved benefits, Humana Achieve plan enhancements aim to optimize health and wellness for individuals.

Exploring the Benefits of Humana Achieve Medicare Supplement Plans

Humana offers Medicare Supplement plans that are guaranteed to be renewable and competitive. Their Achieve plans include:

- 12% discount on monthly premiums for households

- competitive rates

- no restrictions on networks

This means you can get dependable coverage from a trusted name without worrying about network limitations.

Humana Medicare Plans

Humana Medicare plans provide comprehensive coverage that is personalized to meet the healthcare needs of individuals. With Humana, you can easily access a broad network of healthcare providers and facilities to ensure that you receive high-quality care. Their Medicare plans offer peace of mind by covering essential medical expenses and providing additional benefits to support your well-being.

There are different types of Medicare plans being offered by Humana Achieve. These plans are:

- Medicare Advantage Plans

- Prescription Drug Plans

- Special Needs Plans

- Medicare Supplement

1. Medicare Advantage (MA) Plans

Humana provides Medicare Advantage programs that offer comprehensive healthcare coverage, encompassing hospital, medical, and prescription drug benefits. Their Medicare Advantage plans typically include supplementary benefits like dental, vision, and fitness services that promote overall well-being. With Humana’s Medicare Advantage programs, you can avail network access to healthcare providers and enjoy the convenience of all-in-one coverage.

Discover what Humana’s Medicare Advantage (MA) plans can offer you in terms of benefits, services, and programs. They offer different types of Medicare Advantage Plans as well. These are:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Special Needs Plans (SNPs)

- Private Fee-for-Service (PFFS) plans

2. Prescription Drug Plans

Humana’s Medicare Part D Prescription Drug Plans helps in covering the cost of prescription medications. These plans provide coverage for both generic and brand-name drugs, giving you the flexibility and options to meet your healthcare needs. Take a look at the various plan options and benefits to find the prescription drug coverage that suits you best with Humana.

Humana provides three (3) Medicare Part D prescription drug plans. These are:

- Humana Walmart Value Rx Plan (PDP)

- Humana Premier Rx Plan

- Humana Basic Rx Plan

3. Special Needs Plans

Humana offers Medicare Advantage Special Needs Plans (SNPs) designed for individuals with specific health needs or who qualify for both Medicare and Medicaid. These SNPs provide comprehensive coverage that includes benefits of Original Medicare (Parts A and B) along with prescription drug coverage (Part D) tailored to meet specialized healthcare needs. With Humana’s SNPs, individuals can access coordinated care and additional support to manage their health conditions effectively.

There are 2 types of Special Needs Plans (SNPs) covered by Humana. These are:

- Chronic Condition Special Needs Plans (C-SNPs)

- Dual-Eligible Special Needs Plans (D-SNPs)

4. Medicare Supplement Insurance plans

In various states, Medicare Supplement insurance plans are categorized from A to N, each providing basic benefits with additional benefits that vary depending on the plan.

Generally, plans A to G have higher premiums but lower out-of-pocket costs than plans K to N. Plans K to N have lower premiums but higher out-of-pocket costs. Some companies may offer extra benefits alongside these standard plans.

Typically, Medicare Supplement plans do not cover:

- Long-term care, such as nursing home care

- Vision or dental care

- Hearing aids

- Private-duty nursing

- Prescription drugs

Medicare Supplement Plan Premium Average Cost Monthly

Rates may vary depending on your location. The rates we have provided below are for illustrative purposes only. To check the rates of your location, you can talk to one of our representatives.

- The rates below are based on the generated zip code 68102 in OMAHA, NE, for males and females aged 65 years old. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | MALE | FEMALE |

Plan F | $160.07 | $161.58 |

Plan G | $153.51 | $152.09 |

Plan N | $115.99 | $117.42 |

- The rates below are based on the generated zip code 77568 in LA MARQUE, TX for Females aged 65 years old. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | MALE | FEMALE |

Plan F | $214.09 | $212.58 |

Plan G | $171.04 | $166.91 |

Plan N | $139.52 | $128.56 |

- The rates below are based on the generated zip code 96161 in TRUCKEE, CA for Females aged 65 years old. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | MALE | FEMALE |

Plan F | $197.24 | $197.24 |

Plan G | $164.22 | $160.66 |

Plan N | $132.14 | $132.14 |

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Savings and Discounts

Humana offers savings and discounts on Medicare Supplement plans to help reduce out-of-pocket costs for healthcare services. Medicare Supplement Plan members can save:

- In selected states, a household discount lowers premiums for eligible members.

- Enroll in autopay for a $2 monthly premium savings.

- Enjoy discounts and services on medications, vision care, and hearing aids.

- Savings on Lifeline products and other offerings

- Access the HumanaFirst 24-hour nurse line for free medical advice on specific issues.

You should explore Humana’s Medicare Supplement options to discover potential savings and benefits tailored to your healthcare needs.

Discounts in Action

The table below illustrates how qualifying Humana Achieve policyholders may benefit from the discounts.

Premium Without Discount | $125.29 |

Premium with a $2 ACH discount only | $123.29 |

Premium with the 12% enhanced household discount only* | $110.26 |

Premium with both enhanced household discount and ACH discount | $108.26 |

Total served per year with both discounts | $17.03 |

Total served per year with both discounts | $204.36 |

The Merger Between Cigna and Humana

Cigna has decided not to go ahead with its planned merger with Humana, which was expected to create a healthcare company worth $140 billion. The merger was aimed at helping Cigna compete with UnitedHealth Group, a leading healthcare company valued at around $500 billion.

The deal between Cigna and Humana fell through because they couldn’t agree on the price and other financial terms. Instead of merging, Cigna is now focusing on smaller acquisitions. Although Cigna mainly serves larger employers with health plans, joining forces with Humana could have strengthened its position in the Medicare Advantage market for people aged 65 and older.

Choosing the Right Plan For You

If you’re seeking predictability and savings, Humana Achieve Medicare Supplement plans are an excellent choice. Here are reasons why you should consider choosing Humana:

- Choose Any Doctor: With Humana Achieve Medicare plans, you can see any doctor who accepts Medicare patients without needing networks, referrals, or pre-authorization.

- Wide Coverage: These plans cover expenses that Original Medicare doesn’t pay for.

- Easy to Budget: Most policyholders only need to budget for a monthly premium since there are usually no copays or deductibles.

- Control Costs: Humana offers different plan options to help minimize out-of-pocket expenses and manage financial risks.

- Keep Your Policy: Your policy remains active as long as you pay the premiums, providing guaranteed renewal.

- Extra Benefits: Enjoy additional services that promote healthy living and well-being.

- Save on Premiums: Take advantage of premium savings like the Enhanced Household Discount (varies by state) and discounts for recurring electronic payments.

In conclusion

Discovering the benefits of Humana Achieve Medicare Supplement plans, offering predictability and savings. These plans provide coverage without any network restrictions, referrals or pre-authorization requirements, allowing you to choose any Medicare-accepting doctor of your choice. With Humana Achieve, you can enjoy wide coverage that includes expenses not covered by Original Medicare, and you only need to budget for a monthly premium, as most plans have no copays or deductibles. Moreover, Humana offers various plan options to help you control out-of-pocket expenses and manage financial risks. Your policy stays active as long as you pay the premiums, and you can save on premiums with discounts like the Enhanced Household Discount and autopay savings.

For more detailed information about Humana Achieve, please reach out to our representatives at 1-888-559-0103. They can provide you with comprehensive details and assist you in choosing the right plan for your healthcare needs.