Navigating Medicare and its associated costs can be complex, but Medicare Supplemental Insurance, also known as Medigap, is designed to provide additional coverage and peace of mind. Understanding the essentials of Medigap policies is crucial for ensuring comprehensive healthcare coverage during retirement. In this guide, we’ll delve into the fundamentals of Medigap, exploring what these policies cover, how they work alongside Medicare, and key considerations when choosing a plan. Whether you’re approaching Medicare eligibility or considering switching plans, this article will empower you to make informed decisions tailored to your healthcare needs. Let’s explore the essentials of Medicare Supplemental Insurance (Medigap) policies together.

What are Medigap Policies?

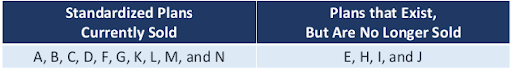

Medigap policies are designed to cover the costs that Original Medicare doesn’t cover, such as deductibles, coinsurance, and copayments. These policies are offered by private insurance companies, and they have standardized plans named by letters from A to N in most states. To be eligible for a Medigap policy, you must have both Part A and Part B of Medicare.

NOTE: The main difference between Medigap policies that have the same plan letter from different insurance companies is usually the cost.

Medigap Plans

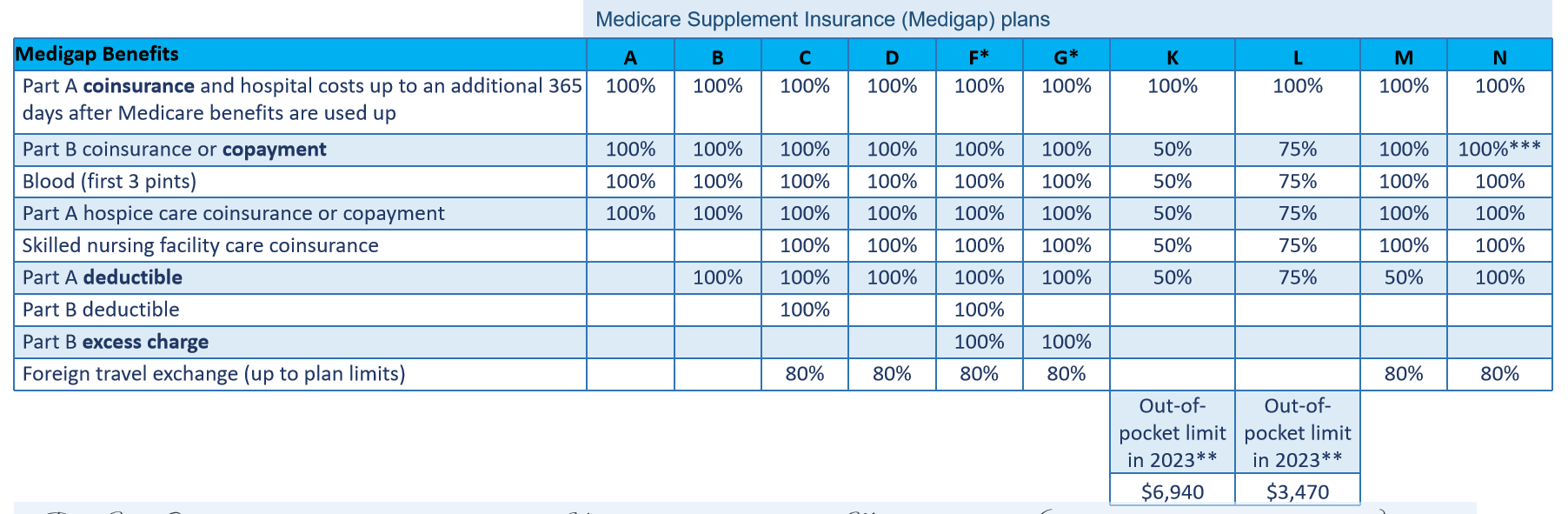

Medigap plans are policies that are sold by insurance companies as standardized plans in most states. However, it’s important to note that these companies are not required to offer every Medigap plan. Plans C and F are no longer available to those who enrolled in Medicare after January 1, 2020. Moreover, in waiver states such as Massachusetts, Minnesota, and Wisconsin, the standardization of Medigap plans is done differently.

- Plans F and G offer a high-deductible option in certain states. This means you will have to pay out-of-pocket for Medicare-covered costs, such as coinsurance, copayments, and deductibles, until you reach a deductible amount of $2,870 in 2025. After you reach this amount, your insurance will start paying for the costs. It’s important to note that Plans C and F are not available to those who started Medicare after January 1, 2020.

- For Plans K and L, after you reach your yearly out-of-pocket limit and Part B deductible, the Medigap plan will cover 100% of the covered services for the rest of the year. As for Plan N, it covers 100% of the Part B coinsurance, except for a copayment of up to $20 for certain office visits and up to $50 for emergency room visits that don’t lead to hospital admission.

Waiver States

In waiver states like Massachusetts, Minnesota, and Wisconsin, they have different kinds of Medigap policies that are not labeled with letters like in other states. These policies offer benefits that are comparable to standardized plans, with basic (“core”) benefits and optional (“rider”) benefits that you can choose to add on.

NOTE: States that waive Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) changes must implement them.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Medicare SELECT Policies

Medicare Select policies require you to use hospitals and doctors within their network (in certain cases) to receive full benefits, except during emergencies. These policies can be any of the standardized Medigap plans. Usually, Medicare Select policies cost less than other Medigap policies.

If you have a Medicare SELECT policy and you move out of the policy’s area, you have options:

- You can buy a standardized Medigap policy from your current insurance company that provides the same or fewer benefits as your current Medicare SELECT policy.

- You can use your guaranteed issue right to purchase any Medigap Plan A, B, C, D, F, G, K, or L that’s available for sale by any insurance company in most states.

Medigap Costs

Medigap insurance rates can change based on several variables, such as the particular plan you select, where you live, which insurance provider offers the plan, how old you are, and perhaps even your health.

Exploring the Optimal Time to Buy a Medigap Policy

When you’re 65 years of age or older and enrolled in Medicare Part B, you have a six-month period starting on the first day of the month in which you meet both requirements. This is the ideal time to purchase a Medigap policy. This period is known as your Medigap Open Enrollment Period (OEP).

One of the benefits of purchasing a Medigap policy during your Open Enrollment Period is:

- Because of your guaranteed issue rights, you are not able to be refused coverage by insurance companies or have your premiums increased because of your health.

- You will not need to take a medical exam or answer any questions about your health to be eligible for coverage because you are not subject to medical underwriting.

- You may select the Medigap policy that best fits your demands and budget thanks to the largest selection of options at your disposal.

What Are the Rights of Buying a Medigap Policy?

You have several significant rights when purchasing a Medigap policy that safeguards you as a customer. These rights guarantee that insurance companies treat you properly and give you access to the coverage you require.

When you buy a Medigap policy, you have the following important rights:

- Insurance providers are required to sell you any Medigap coverage they offer during your Open Enrollment Period (OEP), irrespective of your health status or pre-existing illnesses.

- You cannot be denied coverage for pre-existing conditions by insurance carriers if you sign up for a Medigap policy during your Open Enrollment Period. During this time, they are also unable to impose waiting periods for pre-existing condition coverage.

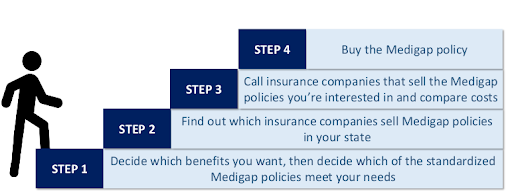

Multitudinous Steps to Buy a Medigap Policy

There are multiple steps involved in buying a Medigap policy to make sure you select the appropriate level of coverage. Here’s a detailed how-to:

Guaranteed Issued Rights

Guaranteed Issue Rights (sometimes called “Guaranteed Issue Protections”) are legal protections that guarantee people to get certain insurance policies, such as Medigap plans, without facing exclusion from coverage or increased premiums because of their medical problems. These rights are intended to shield Medicare recipients from any obstacles while trying to get additional insurance.

Guaranteed Renewal

One important component of Medigap (Medicare Supplement) insurance coverage is guaranteed renewal policies. As long as premiums are paid, policyholders may rest easy knowing that their coverage will automatically renew annually thanks to these policies.

Policy Suspension Rights

Medicaid qualifying does not allow you to revoke your Medigap policy; in fact, having two kinds of coverage can assist in guaranteeing that you have access to the services you require and complete healthcare coverage. To optimize your benefits and reduce your out-of-pocket expenses, you must coordinate your Medigap and Medicaid coverage.

In Summary

In conclusion, Medicare Supplemental Insurance Policies Essentials focuses on the Medigap policies and plans available to you. The expenses that Original Medicare does not cover, such as deductibles, coinsurance, and copayments, are intended to be covered by Medigap coverage. Medigap also provides standardized plans and plans that are available but are no longer provided.

Furthermore, the page offers instructions on how to get a Medigap policy. The purpose of this article is to provide patients with additional coverage and peace of mind.