Introduction- Guaranteed Issue Rights

Millions of Americans entrust a Medicare Supplement Policy to cover all those significant gaps left in their Original Medicare coverage. All your otherwise hefty expenses like coinsurance, copayments and some deductibles that Original Medicare insurance does not cover are taken care of with a Medicare Supplement plan. In many instances, it also offers additional benefits. Now, we know Medicare supplement can be great, but is there a better way to enroll in the plan?

The best time to sign up for a Medicare Supplement plan is during your initial enrollment period, also referred to as a Medigap plan. This term starts when you sign up for Medicare Part B and/or turn 65. You have a “guaranteed issue right” to purchase any Medigap coverage sold in your state during this initial six-month enrollment period.

Before we elaborate on that, let’s do a quick recap of the Medicare Supplement Plan.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

What is Medigap?

Medicare supplemental insurance often referred to as Medigap, is a type of health insurance drafted to work in addition to standard Medicare. Medigap plans assist the out-of-pocket expenses for services covered by Original Medicare Parts A and B. There are ten different federally standardized Medigap Plan types (designated A through N), each with a unique set of benefits that are specified under the outline for each plan.

What do we mean by federally standardized? (And it’s important you understand this before we move on to guaranteed issue rights.)

In order to ensure your protection against Medicare expenses, the federal government has standardized Medigap. In addition to explicitly identifying their coverage details, these plans are regulated as per the norms set by the state government. What this means is that the federal government issues what Medigap plans cover and the state government regulates the insurance offering, setting eligibility for guaranteed issued parameters, reserve requirements, and approving new insurance carriers into the state. So the state does the rest, and the federal government only outlines what a Medigap plan covers. However, the federal government also approves Medicare-approved medical claims as the primary insurance paid for out of the Medicare trust fund. Then the secondary insurance pays the remaining amount directly from the insurance carrier up to the Medicare-approved rate.

Insurance companies can only offer “standardized” plans, known in most states as plans A–D, F–G, and K–N. All plans provide the same fundamental coverage, but some plans, like Plan G and N, are more popular because they offer more coverage for Medicare-approved expenses.

The majority pay all or part of the Part A deductible. A few cover some foreign emergency travel, and some are high-deductible plans with the same coverage but a lower premium and deductible. A deductible is an amount you pay before your insurance starts paying claims. For example, you would pay your medical providers until your deductible is satisfied, and then your secondary insurance would start covering the leftover amount that Medicare, as your primary, has been paying your medical provider.

Through a federal waiver, Massachusetts, Minnesota, and Wisconsin each have their own name for these standardized Medigap plans, but they are basically the same coverage just under a different name. Here’s a glance at what these Medigap plans cover.

- Coinsurance is a percentage you owe after the deductible. It is a percentage; let’s say 20% of Part A and B have to be paid.

- Copayments are fixed payments you make to your medical service provider when you receive their services. E.g., you pay $20 for an office visit.

- Deductible – a deductible is an amount you have to pay for health care before any of your Medicare/ Advantage/ Prescription/ other insurance plans begin their coverage.

Guaranteed Issue Rights- Consumer Protection Rights by Federal Government

The standardization of Medigap by the federal government has made comparing and choosing these plans pretty straightforward. Even though the power of regulation lies with the state governments, following federal law, Medicare supplement (aka Medigap) insurers provide “Guaranteed Issue” insurance to Medicare beneficiaries aged 65 and over if they are eligible for special circumstances that are specific to the individual that is outside the “normal” time to enroll. If you qualify for Guaranteed Issue it means your application is not subject to underwriting to be approved by the insurance carrier.

For example, if you were involuntarily terminated from group coverage and already had Part B, this might be a guaranteed issue period. If you didn’t have Part B, it would just be your standard “Open Enrollment” because you would be getting Part B for the first time. Different states have different rules about whether you would qualify for guaranteed coverage, knowing that you had Part B already.

Under Guaranteed Issue rights, insurance providers must:

- Approve your application for Medicare Supplement Plan.

- Offer complete coverage defined under particular Medigap plans, regardless of any pre-existing conditions, age, or gender.

- Adhere to standard Medigap rates. Your Medicare expenses can’t be raised on account of previous or current health problems, i.e. Medical underwriting. The majority of the time, guaranteed issue rights are triggered when a certain existing form of health insurance undergoes a change or when it is lost. There are other special circumstances, like, when you have a “trial right” for Medicare Advantage art C. Choosing Medigap coverage is still an option if you decide against the Medicare Advantage Plan (Part C), (we’ll discuss this later in the article).

Point to Note: Federal law allows Medigap insurers to impose a six-month waiting period before providing coverage for services connected to pre-existing conditions. This waiting period only applies to those that went through underwriting, not guaranteed issue rights. The exception is in New York, Connecticut, and Maine, where they have expanded well beyond the minimum federal standards by allowing more guaranteed issue acceptance. In those states, you might have a six-month waiting period to cover pre-existing conditions if you did not have six months of continuous creditable coverage. States have the freedom to enact Medigap consumer safeguards that go above and above the minimum federal requirements. Also, Massachusetts prohibits pre-existing condition waiting periods.

When can you exercise Protection of Guaranteed Issue Rights?

You have the guaranteed privilege to buy any of the Medigap policies among Plans* A, B, C, D, F, G, K, or L that are being offered and managed by the insurance carriers in your state.

*On or after January 1, 2020, those who are new to Medicare will no longer be allowed to purchase Plans C and F. However, you could be able to purchase Plan C or Plan F if you were eligible for Medicare before January 1, 2020, but you weren’t yet enrolled. Medicare-eligible individuals have the option to purchase Plans D and G rather than Plans C and F, respectively, beginning on or after January 1, 2020. Your Medigap is subjected to guarantee issue rights under the following situations:

Your Medicare Advantage Plan is ending or you are in the Medicare Advantage “trial right” period.

You will be secured under the guaranteed issue right if you are enrolled in the Medicare Advantage plan and are under any of these circumstances:

- When your Medicare Advantage Plan leaves Medicare.

- When it stops providing treatment in your area.

- When you move outside the plan’s service area while you are still covered by the plan.

However, you can only apply for Medicare supplement as your secondary insurance when you are covered with original Medicare as your primary. Before requesting a Medigap, you need to switch your primary insurance from Medicare Advantage to Original Medicare.

Time of Application:

Federal law guarantees issue rights for Medigap insurance during a one-time, six-month Medigap open enrollment period for policyholders aged 65 and over enrolling in Medicare Part B. You can/must apply:

- 60 days prior to the date your current coverage ends.

- Within 63 calendar days after your coverage has ended. Afterward, you won’t be eligible for the guarantee.

Even when your Medicare Supplement Plan is approved, the coverage doesn’t start until the Medicare Advantage coverage has been terminated.

Additionally, under federal law, if you’re under the Medicare Advantage plan “trial” period, you have the freedom to buy Medigap policies with guaranteed issue rights. The first year that senior citizens sign up for Medicare is one of these trial periods. Seniors can test out a Medicare Advantage plan during that time, but if they decide against it during the first year, they have guaranteed issue rights to a Medigap coverage purchase under federal law.

Medicare enrollees who drop their Medigap coverage in order to sign up for a Medicare Advantage plan are subject to another kind of trial period. If within a year of enrolling in a Medicare Advantage plan, these beneficiaries choose to disenroll to acquire coverage under Original Medicare, they have time-limited guaranteed issue rights to purchase their previous Medigap policy.

Your employer/union health care program is ending.

Guarantee issue rights hold true if your group health plan via your employer (including retiree or COBRA coverage) or through your union health care coverage is about to expire. However, you must have Original Medicare before requesting Medigap.

Since Medigap is secondary insurance only to the Original Medicare.

Your employer’s or union’s insurance is your primary insurance; if you choose to get original Medicare for additional protection, then that becomes your secondary. You need to switch your primary insurance to Medicare for Medigap coverage as your secondary insurance.

Especially, if you have COBRA coverage then you can buy a Medigap plan immediately, or you can wait for the COBRA coverage to end. Assuming you understand that the Medigap coverage will start when you come off COBRA and you are enrolled in Medicare.

Time of application:

You can/must submit an application for a Medigap policy no later than 63 days following the latest of the following three dates:

- When the coverage expires

- The date on the notice that informs you that your insurance is expiring (if you get one)

- If a claim denial is the only way, you can determine when your coverage stopped, note the date there.

Your guaranteed rights might be extended by a period of 12 months under special circumstances. Insurance advisors at Medicare Nationwide can help you determine what the best time for you to apply for Medigap is, and what carrier and plan would suit you the best.

You are moving out of your coverage area for Medicare SELECT.

Medicare SELECT is a form of Medigap policy, secondary to the Original Medicare. It is offered in some jurisdictions where, unless there is an emergency, you must use in-network hospitals and doctors to be eligible for full insurance benefits. If you purchase Medicare SELECT, you have a year to change your mind and go back to regular Medigap.

You have the guaranteed issue right protection with SELECT if you are moving out of the range of SELECT’s service area

Time of Application:

- 60 days prior to the date your current coverage ends.

- Within 63 calendar days after your coverage has ended. Afterward, you won’t be eligible for the guarantee.

- Your insurance company goes bankrupt.

You are eligible for a guaranteed issue right for a Medigap policy if your coverage terminates due to no fault of your own and your Medigap insurance provider files for bankruptcy. You must apply within 63 calendar days from the date of your coverage.

What do I need to claim Guarantee Issue Rights?

Now that we know what situations are subjected to the availability of guarantee issue rights let’s check the requirements we need to keep in handy.

- A copy of any letters, notices, emails, or denials of claims that bear your name as evidence that your coverage has ended.

- These papers arrive in a postage-paid envelope as evidence that they were mailed.

To demonstrate that you have a guaranteed issue right, you might need to submit a copy of some, all, or all of these documents together with your Medigap application.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

When does federal law not offer Medigap protections against Guarantee Issues?

In general, older persons do not enjoy the privileges of federal guarantee issue rights when applying for Medigap after 6 months of joining Medicare Part B, with the exception of the specific qualifying events stated previously.

As a result, in most states, older persons with conventional Medicare who fail to enroll within the open enrollment period may be subject to medical underwriting, denied coverage for a Medigap policy because of pre-existing diseases, or exposed to increased rates because of their health.

Diabetes, heart illness, cancer, and being advised to have surgery, medical tests, treatments, or therapies are a few examples of ailments that insurers mention as grounds for policy denials.

What states require guarantee issue rights for Medigap beyond the scope set by the Federal Government?

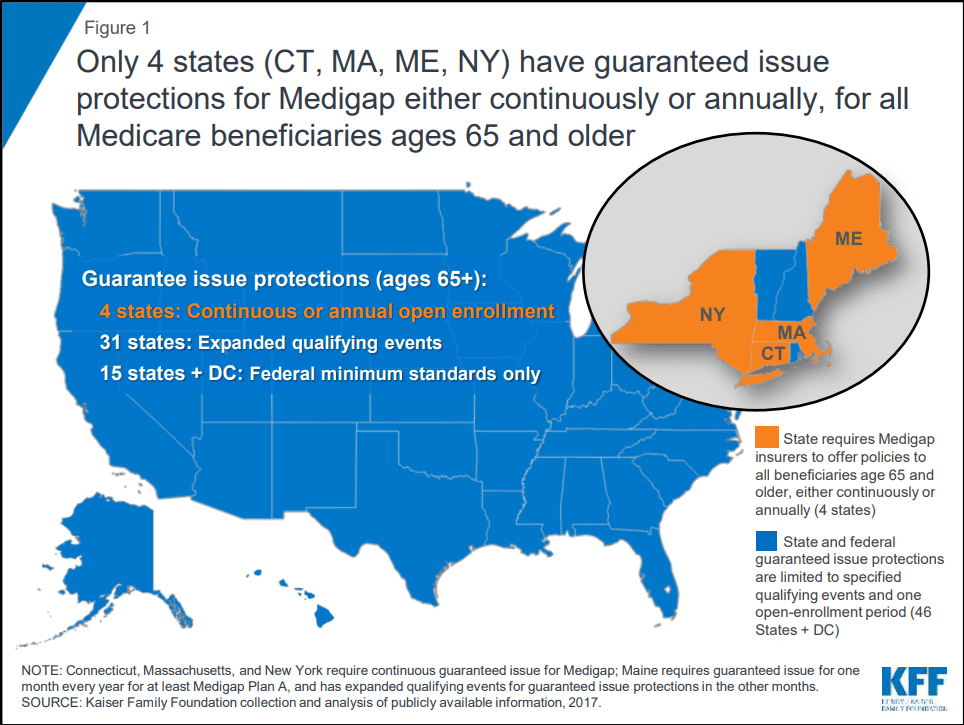

States have the freedom to enact Medigap consumer safeguards that go above and beyond the minimum federal requirements. Although many states have used this freedom to increase Medigap guarantee issue rights in specific situations, 15 states and the District of Columbia chose the conventional path, instead relying solely on the minimal guarantee issue standards set forth by federal law.

Only four states (CT, MA, ME, NY) mandate that Medigap insurers provide Medicare enrollees aged 65 and older with coverage options. One of these states, Maine, mandates that insurers only offer Medigap Plan A (the least worthy Medigap plan with a low price-to-coverage ratio) during an annual one-month open enrollment period. Three of these states—Connecticut, Massachusetts, and New York—have continuous open enrollment with guaranteed issue rights throughout the year.

In accordance with federal law, if an applicant does not have six months of ongoing creditable coverage before purchasing a plan during the initial Medigap open enrollment period, the Medigap insurers in New York, Connecticut, and Maine may impose up to a six-month “waiting period” to cover services related to pre-existing conditions. For Massachusetts’ Medicare supplement insurance policies, pre-existing condition waiting periods are not permitted.

The federal minimum requirements have been narrowly enhanced in several other states by mandating that Medigap insurers issue insurance to qualified applicants during qualifying events, as we have discussed before.

What is a Birthday Rule for Medicare Supplement Plans?

Answer: It means you can change your Medicare supplement plan without being asked to go through underwriting health questions near the time of your birthday month on an annual basis. It is an example of a Guaranteed Issue application.

What states have a Medicare Supplement Birthday Rule? Answer: California, Oregon, Idaho, Illinois, Louisiana, Oklahoma, Maryland, Missouri, and Nevada as of 2024.

New birthday rule for Oklahoma Medicare Supplement plans

“Effective September 1, 2023. The regulation requires Medicare supplement issuers to provide new supplement policies with the same or lesser benefits to current Medicare supplement policyholders—regardless of current issuer—who have had no gap in coverage greater than ninety (90) days since initial enrollment. Medicare supplement issuers that provide these policyholders a sixty (60) calendar day “open enrollment” period beginning on the policyholder’s birthday each year, shall be deemed in compliance with this rule.”

https://content.govdelivery.com/accounts/OKOID/bulletins/3706aeb

Idaho Birthday Rule

Effective March 1, 2022, Medicare Supplement policyholders in Idaho may change their insurance company and/or plan annually, regardless of health conditions, during a 63-day enrollment period beginning on the policyholder’s birthday. These policies would be considered Guaranteed Issue.

Oregon Birthday Rule

Missouri Birthday Rule

Nevada Birthday Rule

As of January 1, 2022, individuals enrolled in a Medicare supplement policy in Nevada may change their plan or insurer during an annual enrollment period of up to 60 days following the first day of their birthday month.

The new plan choice is limited to any Medicare supplement policy that offers benefits equal to or lesser than those provided by the current Medicare Supplement plan. (Examples: Plan F to Plan F, Plan F to Plan A, Plan G to Plan B.)

Applications must be submitted within 60 days from the first day of the applicant’s birthday month, and the chosen effective date must fall within 90 days from the first day of the applicant’s birthday month. (Example: If an applicant has a May 25 birthdate, the effective date must fall between May 1 and July 30.)

Illinois Birthday Rule

Starting January 1, 2022, individuals between 65 and 75 years old who have an existing Medicare supplement plan can choose a Medicare Supplement policy from the SAME carrier that offers benefits equal to or lesser than their existing plan for a period of at least 45 days from their birthday.

The chosen effective date must fall within the 90-day time period beginning on the applicant’s birthdate. (Example: If an applicant has a May 25 birthdate, the effective date must fall between May 25 and August 25.)

California Birthday Rule

Maryland Birthday Rule

Annual Open Enrollment lasting 30 days, beginning on an individual’s birthday, ending 30 days from that date, during which time an individual may replace any Medicare supplement policy with a policy of equal or lesser benefits.

Louisana Birthday Rule

As of August 1, 2022, there is a new guaranteed issue window available for policyholders in Louisiana. As related to the guaranteed issue of Medicare supplement policies. Enacts R.S. 22:1112. Requires an annual Open Enrollment Period to begin on the birthday of an individual who has an existing Medicare supplement policy. Requires the annual Open Enrollment Period to last for 63 calendar days, during which time the individual may purchase any Medicare supplement policy offered in this state by the same insurer.

Provided that if during the annual open enrollment period, the individual purchases a standardized Medicare supplement policy identified by a plan letter that indicates benefits equal to or less than the benefits indicated by the plan letter of the individual’s previous Medicare supplement policy, the issuer of the chosen Medicare supplement policy is prohibited from denying or conditioning the issuance or effectiveness of the coverage, or discriminating in the pricing of the coverage due to the individual’s health status, claims experience, receipt of health care, or medical condition.

What is a Medicare Guaranteed Issued Policy?

Answer: It is a policy that a Medicare supplement carrier can approve without needing to approve the applicant’s health through an underwriting process.

What is the difference between an Open Enrollment Policy and a Guaranteed Issue Policy?

Answer: Open Enrollment is a qualified time to enroll for newly eligible Medicare recipients, without being subjected to pre-existing conditions. Guaranteed Issue policies are granted outside of the initial enrollment period for those eligible to submit an application without needing to be underwritten.

What states have a Guaranteed Issue Policy that exceeds the Federal Minimum Standard?

The Medicare Birthday Rule application can be considered in some respects both an Open Enrollment and a Guaranteed Issue policy. Since it’s during an eligible time to switch each year, but at the same time, not the initial enrollment period when first enrolling in Medicare Part B. However, we will consider it strictly Open Enrollment.

Other examples of being eligible for Medicare Guaranteed Issue: There are many other Guaranteed Issue periods that are outside of the Birthday Rule. They include being involuntarily (sometimes voluntarily) disenrolled from creditable coverage through an employer or union plan. Your Medicare Advantage or Medicare Select plan stops providing you coverage or you leave your service area. You are within your first year of a Medicare Advantage plan and 65 years old and have a trial right to return to Medicare. Among other examples you can read on Medicare’s government website here: https://www.medicare.gov/supplements-other-insurance/when-can-i-buy-medigap/guaranteed-issue-rights

“Only four states (CT, MA, ME, NY) require either continuous or annual guaranteed issue protections

for Medigap for all beneficiaries in traditional Medicare ages 65 and older, regardless of medical

history (Figure 1). Guaranteed issue protections prohibit insurers from denying a Medigap policy to

eligible applicants, including people with pre-existing conditions, such as diabetes and heart disease (Keiser, 2018.)”

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Conclusion

Guarantee issue rights were established for the welfare of beneficiaries who could use some help getting Medicare supplemental protection. Medicare Nationwide has helped hundreds of insurance seekers to exercise their rights and make smart Medicare decisions. And the best part? Talking to us is free!

Medigap has been a significant addition to your traditional Medicare. Minimizing the final exposure brought by out-of-pocket expenses under Original Medicare.

Our insurance advisors help you choose the perfect plan and carrier and guide you through the application process within just the right period that suits your case. Contact one of our agents today or get a quick competitive Medicare supplement quote.

Give us a call at 1-888-559-0103.