Medicare Flex Card for Seniors

You might have come across Medicare Flex Cards advertisements on your television, mobile device, or computer promoting “Medicare Flex Cards,” which are free Flex Cards for seniors, and perhaps leaves you wondering if it’s genuine or a fraud. Before deciding, let’s inspect the matter what a Medicare Flex Card for Seniors actually is.

This article will resolve the ambiguity about the Medicare flex card for seniors. People often ask whether the Medicare Flex Card provides the $2,880 amount for seniors. Let’s dig more about these Medicare Flex Cards for seniors.

Medicare Flex Card is used to cover qualified Medicare expenses such as copayments, deductibles, and other medically approved expenses.

An Overview of Medicare Flex Cards

People can use debit cards known as Medicare “Flex Cards” to buy medical items and supplies. These cards, which are connected to flexible spending accounts, are a perk offered by approved healthcare plans across the country. There are no transaction fees or pin codes, so you can slide the Medicare card through the supplier location scanner using the “credit/credit card” option. Cash is instantly withdrawn from your account once you swipe your Flex Card.

Only specific plans are compatible with these cards, which are provided by private insurance services. The cards also have spending caps, which change based on the package and provider. Although the flex card service is not a typical aspect of Medicare Advantage plans, you may locate them in a few around the country.

We can search which plans offer the Medicare Flex Card in your area in under 3 minutes. Give us a call! *Note you must be on Medicare in order to qualify.

What is an FSA or Flexible Spending Account for Seniors?

Using tax-advantaged flexible spending accounts, the Federal Flexible Spending Account Program (FSAFEDS) permits Federal employees to save money on qualified health care (HCFSA) and dependent care (DCFSA) expenditures. By paying for their family’s out-of-pocket costs for health, dental, vision, and childcare with pre-tax payroll deductions rather than with post-tax wages, individuals often save an average of 30%.

Under the employer-imposed limit, you can pick the amount you want to deposit into an FSA. FSAs are also referred to as flexible spending arrangements. There is no tax on this money. The employer can select from the two options if some of this cash is remaining by the end of the year:

- He can have an additional 2.5 months to spend the funds.

- He can transfer some funds, around $500, to the following plan year.

How Does the Medicare Free Flex Card Work?

The advertised plan for Medicare flex cards includes claims that lead beneficiaries to believe that Medicare will transfer up to $2,880 to their flex cards, but this is not the truth. Even though some providers offer this benefit, it is unlikely to receive such a large amount. A typical flex card will have a $500 pre-loaded credit.

Flex Cards are used for qualified Medicare expenses. They are helpful to seniors with Medicare plans to cover the expense of medical supplies, co-payments and deductions, prescription and over-the-counter drugs, dental, eye, and auditory care, diagnostic tools, and any other medically essential expenses.

Applying for the Seniors Flex Card

In November and December each year, during the Federal Benefits Open Season, qualified applicants can apply for FSAFEDS.

Qualified employees may join outside of Open Season within 60 days of a qualifying life event (QLE), like a marriage or childbirth. But the deadline for completion is September 30. The newly qualified QLE employees can join during Open Season if they have missed the September 30 enrollment deadline. If you want to take part in the event, visit the FSAFEDS website or get in touch with them using their mentioned contact details.

To be eligible for the Medicare flex card, you need to be eligible for an FSAFEDS account.

Eligibility for the FSAFEDS Account

A health care Medicare flexible spending account is only available to:

- A person who is working for a company that takes part in FSAFEDS.

- A person who is eligible for participating in Federal Employees Health Benefits Program (FEHB) program.

Your eligibility to use funds will be valid from January 1 through December 31. By the end of the year, if you still have money in your healthcare account, FSAFEDS will automatically transfer $500 of unused funds into your healthcare FSAFEDS account for the upcoming year.

Eligibility for Medicare Card

Flex cards are a bonus of Medicare advantage programs. You should be registered in a health insurance program with a Medicare flexible spending account to be eligible for a flex card.

This feature is not available in every Medicare advantage program. Only a few plans that are offered countrywide include this benefit. Therefore, you must live in a region that provides at least one of these plans for cards and register during the Medicare enrollment period. For more on qualifying for a Flex Card, you can check out our article “How to qualify for Flex Card?”

Medicare Flex Card Benefits

The main benefit of a flex card is the additional funds to pay for the expenses of medical supplies. Therefore, if the Flex card has a $500 allowance and the Medicare plan offers, let’s say, $1000 in dental benefits, your total benefit for the year would be $1500. It is usually an annual benefit that can be used for dental, eye, or hearing care.

Some plans for cards may also provide additional benefits like those for groceries, utilities, and over-the-counter medicines.

Based on your income and health requirements, you may sometimes need to register for that kind of plan or benefit like qualifying for support programs like Medicaid.

Additional Advantages of Medicare Advantage Plans

It’s crucial to be aware of the many august benefits you might receive with the private Medicare program besides the appealing feature of flex cards. Among the popular advantages provided by Medicare Advantage Plans are:

- Discounts on over-the-counter medicines plan

- Free meals upon hospitalization plan

- Free transportation for medical emergencies plan

- Dental protection plan

- Vision protection plan

- Hearing protection plan

- Benefits of telehealth plan

You can also look for Medicare Advantage plans with Zero-premium plans, gym memberships, access to medical facilities, and health programs are among the additional features that Medicare Advantage often provides. For more information on the benefits of the Flex Card, you can check out our article “What are the benefits of a flex card?”

Do Medicare Supplement Plans Include Senior Flex Cards?

Medicare Supplement Insurance plan does not provide the feature of flex cards. Private insurance companies that provide Medigap plans effectively extend the benefits of Original Medicare. Medigap plans help users reduce out-of-pocket costs by covering the gaps left by the Original Medicare part.

Since participants of Medigap or Medicare plans also look for Medicare Advantage plans that are often paid less out-of-pocket than those of advantage Medicare part, Flex cards are not a compulsory benefit of a Medicare Supplement program.

We can search which plans offer the Medicare Flex Card in your area in under 3 minutes. Give us a call! *Note you must be on Medicare in order to qualify.

Are Flex Cards Free?

Flex cards shouldn’t be regarded as a free extra reward for Medicare members, even though they may be a practical benefit for seniors flex cards vs the benefit of Medicare supplements and Medicare advantage plans on cards.

To access this benefit, Medicare Advantage members need to pay additional charges besides their monthly Part A and Part B payment plans.

A $2,880 flex card is advertised in Part A as a “free flex card” in some Medicare Advantage Plan flex card advertisements; however, the premium cost often covers the cost of this feature. While a flex card could be the best option for some, you should always conduct research before deciding.

The Validity of Senior Flex Cards

Many people want to know whether the flex card is a legit offer or an obvious scam. The most detailed, valid flex plan discovered included a $1,000 flex card and a $50 monthly debit card for additional out-of-pocket payments for $1,600 annually. That is far less than the $2,880 opening bid.

You should closely examine any Medicare Advantage plan, even if you are eligible for that plan. Even though the Medicare Flex Card is a great offer, you should be sure that getting it won’t come at the expense of other crucial healthcare benefits. If you don’t carefully read the fine print, you can end up paying the cost or plan in other areas of your program of Medicare plans.

Finally, how much cash you can get on a flex card depends on your area and the plan you choose. Flex cards are not accessible in every county, and not every service offers them. It is best to speak with your provider directly to determine. Medicare.gov also allows you to look up the features of your plan.

Watch out for Medicare Fraud

There are flex card benefits posts but mostly, scammers take advantage of the open registration period for Medicare. Since it is when seniors can update their medical coverage, the registration period between October and December has been a great time for scammers to target seniors. Seniors expect to get questioned for personal details like their identity, social security number, Healthcare details, and even banking information during the process, making it even easier for scammers to get your details.

Various websites for the card have affiliated agreements, even on Facebook, with various Medicare advantage providers, which implies they are rewarded if they convince you to make a purchase. A few of them don’t mind being dishonest in their advertisements for Medicare, even though they aren’t scammers. Look for news, insurance plans, and Monique Curet.

Ways To Avoid Medicare Fraud

The primary aim and plans of the card flex cards are to persuade seniors to sign up for new Medicare Advantage plans during the annual registration period. But sometimes, you can be enticed by a fraud that can take all your cash. Following are the three ways to avoid these Medicare frauds:

Avoid Sharing Personal Details Online

As a general guideline for Medicare, you should never provide personal/private details online to unknown businesses. Never divulge your private information to anyone acting as a Medicare salesperson. If they come up to you or get in touch with you first, don’t respond. Most reputable services will request you to get in touch with them first; they won’t do so without your consent.

Anyone who calls you and then wants the details of your Medicare card is flashing red flags. We often succumb to our fear and provide them with our personal information. But it’s essential to maintain your calm and avoid danger.

Avoid Following Risky Advice

You should exercise caution in all situations, not just online. In-person counselors with hidden agendas are another thing to be cautious about. Always be mindful of your environment and stay away from anyone who approaches you without your consent.

Make sure they provide programs/plans for Medicare from a variety of providers if you must engage with someone who has a monetary interest in persuading you to sign up so that you have a better chance of finding a plan that works for you. Captive agents only work with one or two providers, whereas independent agents operate with various suppliers. Avoid captive agents at all costs.

Find a Reliable Medicare Advisor

The ideal method or plan for locating a reliable Medicare expert is to contact your local area agency on Aging. To help you manage the intricate benefits, several states offer health insurance counseling and advocacy programs.

Elderly Call 1-800-Medicare or use the online chat service at Medicare.gov to connect with a Medicare agent directly.

You should always consult with a knowledgeable, impartial Medicare specialist before changing your health insurance.

FAQs

How Do you Get a Card?

Flex Cards come along with the plans of healthcare coverage for Medicare. To qualify for a flex card, you must be registered in a health insurance program with a flexible spending account. Typically, the Medicare Advantage plan offers the flex card benefit These optional plans develop personalized healthcare bundles for senior citizens by combining Medicare with extra services. Therefore, you must be eligible for Medicare during a valid Medicare registration process and live in a place where any of these plans is offered to get the senior flex card.

What is the $2800 Senior Flex Medicare Card?

The $2800 flex card for seniors is a stored-value card that stores the balance of a flexible spending account or medical Medicare and dependent care reimbursement account. It works exactly like a debit card to pay for some medical costs, doctor visits, prescription drugs, over-the-counter medicines, and other associated medical costs.

The Medicare Advantage advertising campaign uses the senior flex card to draw seniors to particular Medicare Advantage plans.

How Does the Flex Card Work?

One may assume that they might get a Medicare Flex Card in the type of cash card. However, it is not workable since you can not use a flex card to receive free money or a money refund. Just like a Visa or Mastercard, this card is a prepaid debit card. The expense of dental, vision, and hearing services that are not insured by your health insurance plan can then be readily covered with it.

You can use this card to purchase healthy foods at selected supermarkets. Furthermore, you can use this card to make eligible purchases at Amazon by connecting it to an Amazon account. For more on buying food with a Flex Card, you can read more in our “Can you buy food with Medicare Flex Card?” article.

We can search which plans offer the Medicare Flex Card in your area in under 3 minutes. Give us a call! *Note you must be on Medicare in order to qualify.

Sentiments from the Founder – Medicare Nationwide

Before choosing to go with a Medicare Advantage plan just to get the benefits of the Flex Card, we’d like you to zoom out a bit and remember what insurance is designed to do. It’s there to protect in case something catastrophic happens. This is where the Medicare Advantage plans begin to break down. If you were to get a major illness, like say, Cancer. It’s important to know your out-of-pocket costs and limitations.

First of all, Medicare Advantage takes over your Medicare and puts you under its rules and regulations. You no longer have Medicare as your primary. This means you must go to their hospitals, and their doctors, receive referrals for specialists and require approval for procedures. You also have in-network costs and out-of-network costs assuming you have a PPO. HMOs have no outside network.

With a Medicare Supplement or Medigap (synonymous) policy, you keep Medicare as your primary, and your secondary covers all Medicare-approved expenses. Since Medicare remains your primary, you can go to any Medicare doctor or facility in the country without the need for referrals.

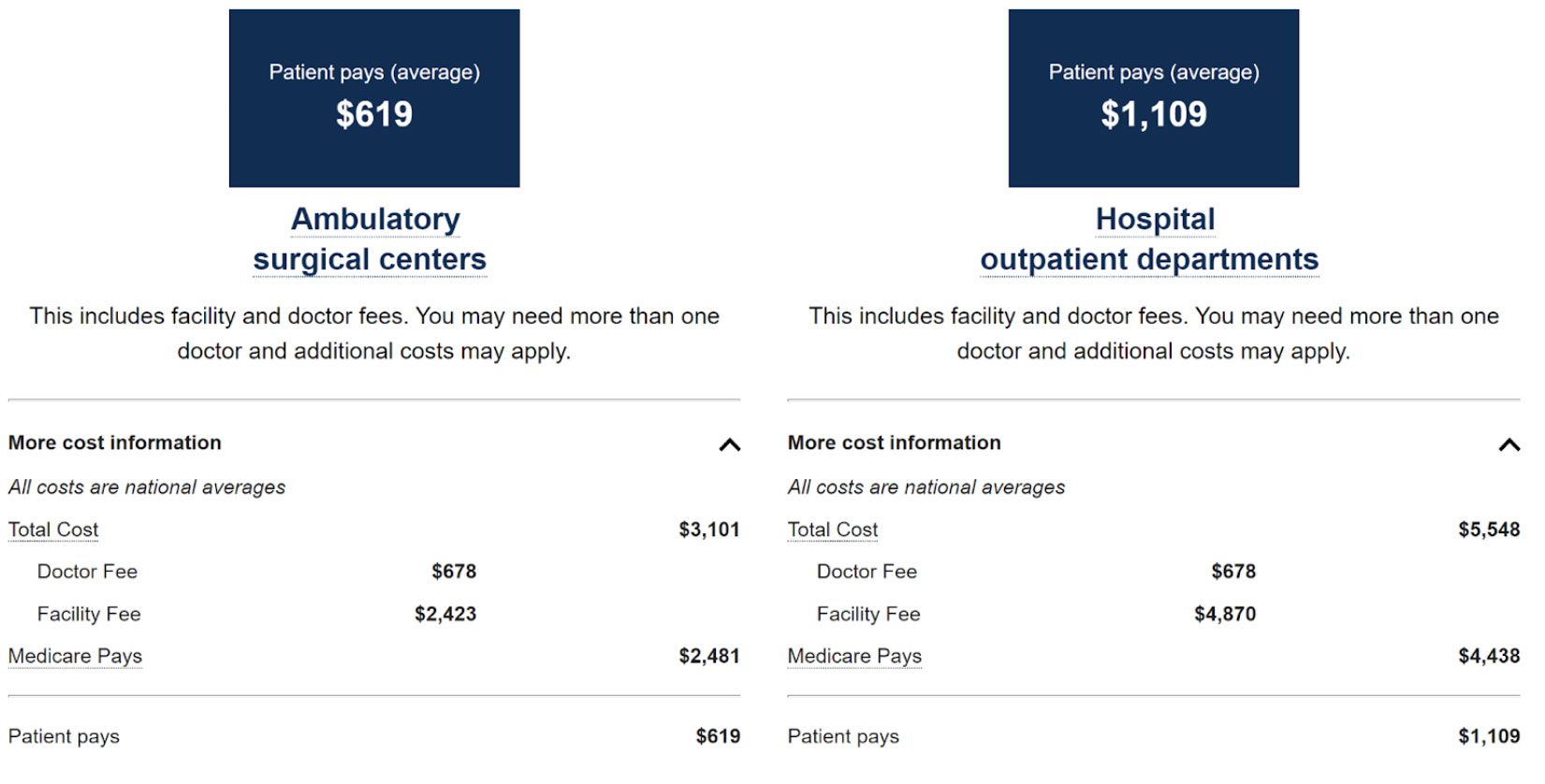

Here’s a look at chemo costs on the Medicare website.

Now that we have a baseline of the two insurance types, let’s take a look at the break of costs if a Medicare beneficiary were to receive 8 chemotherapy treatments.

| Insurance Type | Medicare Supplement Plan G | Medicare Advantage |

| Network | No | Yes |

| Referral Needed | No | Yes |

| Out-of-pocket max | $233 | $10,000 IF procedure AND facility are approved by the plan |

We can’t undermine the hindrance of requiring referrals to see a specialist or facility with a Medicare Advantage plan. These referrals could take weeks or months to receive. If you are diagnosed with something such as cancer or any other serious illness, you want the best care possible and you want it immediately to give you the best chance at life.

Furthermore, let’s take a look at arguably the top 2 cancer facilities in the country, Sloan Kettering. Sloan Kettering accepts “most” Emblem or Empire Medicare Advantage plans. And, chances are, these plans are not offered in your area. MD Anderson accepts exactly ONE plan and this plan is only available to you if you live in California. While both facilities accept all Medicare supplement plans. This should give you an idea of the strict limitations of Medicare Advantage plans as a whole. For more information regarding the two insurance types available to seniors, we encourage you to read our Medicare Supplement vs Medicare Advantage article.

Conclusion

It’s crucial to prioritize your needs and well-being. The Medicare flex cards might help you cover medical expenses. Working with a certified broker will assist you in learning all the details, including coverage details about your physician visits, facility co-pays, prescribed drug rates, and other medical fees. As part of scams, they can prompt you to provide the financial or personal information of your cards to an unidentified source. Therefore, proceed with caution when dealing with senior Flex Cards.

Prefer to speak to us directly? Give us a call at 1-888-559-0103