Explore Medicare Enrollment Period

The Medicare Enrollment Period refers to specific times during which eligible individuals can sign up for Medicare or make changes to their existing coverage. There are several enrollment periods within the Medicare program:

For newcomers to Medicare, these are the important enrollment periods:

1. Initial Enrollment Period (IEP): Your first opportunity to join Medicare, typically beginning three months before your 65th birthday and extending for seven months.

2. Special Enrollment Period (SEP): If you missed your IEP or couldn’t enroll initially due to specific circumstances like continued employment with employer coverage, you might be eligible for an SEP.

3. General Enrollment Period (GEP): If you missed your IEP and don’t qualify for an SEP, you can enroll during the GEP from January 1 to March 31 each year. However, coverage might not start until July 1, and late enrollment penalties may apply.

For current Medicare beneficiaries looking to modify their coverage, here are the relevant periods:

1. Open Enrollment Period (OEP): Also known as the Annual Enrollment Period, it runs from October 15 to December 7 annually. During this period, you can switch between Original Medicare and Medicare Advantage, change your Medicare Advantage plan, or join, switch, or drop a Medicare Part D prescription drug plan.

2. Medicare Advantage OEP: From January 1 to March 31, if you’re enrolled in a Medicare Advantage plan, you have a one-time opportunity to switch to another Medicare Advantage plan or return to Original Medicare.

3. Open Enrollment Period for Institutionalized Individuals (OEPI): Specifically for those living in institutions like nursing homes, allowing changes to Medicare coverage once per quarter during the first three quarters of the year.

4. Special Enrollment Period (SEP): Under certain circumstances like moving out of your plan’s service area or losing other coverage, you may qualify for an SEP to modify your Medicare coverage outside of standard enrollment periods.

Initial Enrollment Period (IEP)

This is the first opportunity for most people to enroll in Medicare. It typically starts three months before the month of your 65th birthday, includes the month you turn 65, and continues for three months after your birthday month, totaling a seven-month period.

The Initial Enrollment Period (IEP) is the first opportunity for most people to enroll in Medicare. Here’s a more detailed overview of the Initial Enrollment Period:

- Timing: The IEP typically begins three months before the month of your 65th birthday, includes the month you turn 65, and continues for three months after your birthday month. This totals a seven-month period.

- Eligibility: Most individuals become eligible for Medicare when they turn 65, regardless of whether they’re already receiving Social Security benefits. However, some people may become eligible earlier if they have a disability or certain medical conditions.

- Coverage Options: During the Initial Enrollment Period, you have several coverage options:

- Medicare Part A (Hospital Insurance): Helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Medicare Part B (Medical Insurance): Helps cover services from doctors and other healthcare providers, outpatient care, durable medical equipment, and some preventive services.

- Medicare Advantage (Part C): This is an alternative to Original Medicare (Part A and Part B) and is offered by private insurance companies approved by Medicare. Medicare Advantage plans often include additional benefits such as prescription drug coverage and routine dental or vision care.

- Medicare Prescription Drug Coverage (Part D): Helps cover the cost of prescription drugs. You can enroll in a standalone Part D plan if you have Original Medicare or choose a Medicare Advantage plan that includes prescription drug coverage.

- Medicare Part B (Medical Insurance): Helps cover services from doctors and other healthcare providers, outpatient care, durable medical equipment, and some preventive services.

- Enrollment Options: You can enroll in Medicare through the Social Security Administration (SSA). You can apply online at the SSA website, visit your local SSA office, or call the SSA’s toll-free number to enroll.

- Automatic Enrollment: If you’re already receiving Social Security or Railroad Retirement Board (RRB) benefits when you turn 65, you’ll typically be automatically enrolled in Medicare Part A and Part B. You’ll receive your Medicare card in the mail about three months before your 65th birthday.

- Late Enrollment Penalty: If you don’t enroll in Medicare during your Initial Enrollment Period and you’re not eligible for a Special Enrollment Period, you may have to pay a late enrollment penalty when you do enroll. This penalty can increase your Medicare premiums for Part B and, if applicable, Part D coverage.

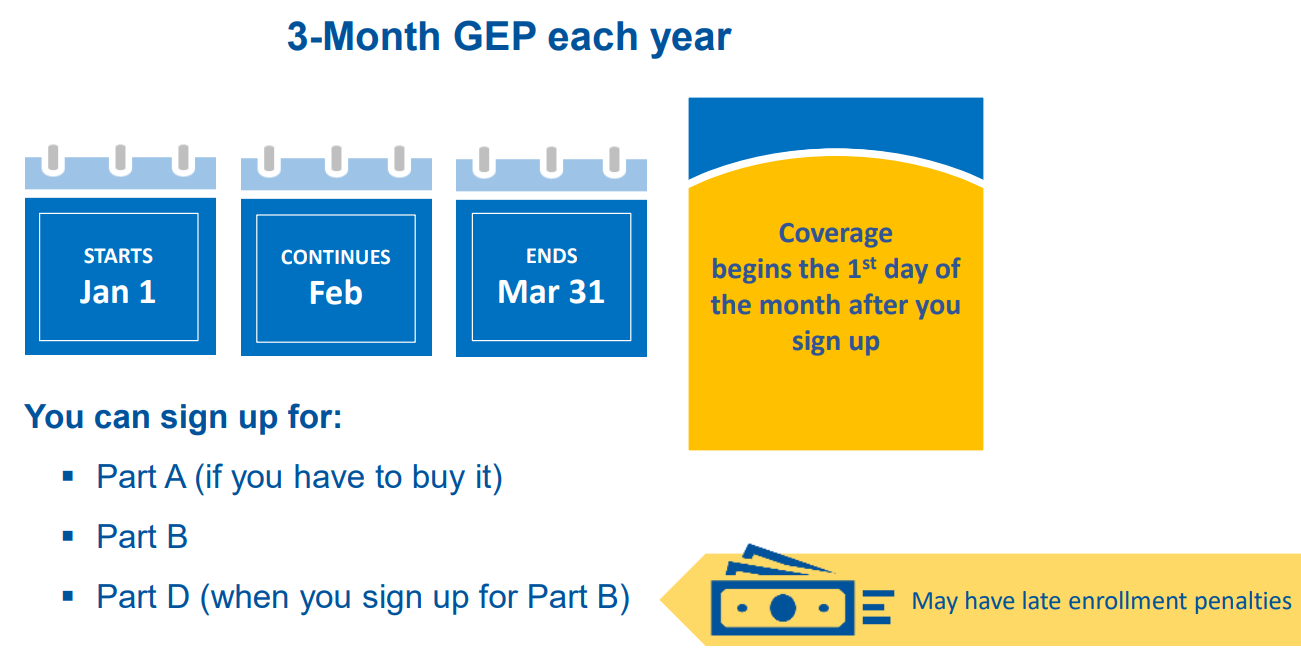

General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, you can sign up during the General Enrollment Period, which runs from January 1 to March 31 each year. Keep in mind that if you enroll during this period, your coverage may start later, and you could be subject to penalties.

The General Enrollment Period (GEP) is another important enrollment period within the Medicare program. Here’s an expanded overview:

- Timing: The General Enrollment Period runs from January 1 to March 31 each year. It’s an opportunity for individuals who missed their Initial Enrollment Period to sign up for Medicare.

- Eligibility: Anyone who didn’t sign up for Medicare during their Initial Enrollment Period and isn’t eligible for a Special Enrollment Period can enroll in Medicare during the General Enrollment Period.

- Coverage Options: During the General Enrollment Period, you can enroll in:

- Medicare Part A (Hospital Insurance)

- Medicare Part B (Medical Insurance)

- Late Enrollment Penalty: If you didn’t enroll in Medicare during your Initial Enrollment Period and you’re not eligible for a Special Enrollment Period, you may have to pay a late enrollment penalty when you do enroll. This penalty can increase your Medicare premiums for Part B, and if applicable, Part D coverage.

- Effective Date of Coverage: If you enroll in Medicare during the General Enrollment Period, your coverage typically starts on July 1 of the same year. This means there may be a gap in coverage if you enroll during the General Enrollment Period, so it’s essential to consider your healthcare needs and coverage options carefully.

- Special Considerations: While the General Enrollment Period is available each year, it’s generally advisable to enroll in Medicare during your Initial Enrollment Period if you’re eligible. This helps avoid any potential gaps in coverage and late enrollment penalties.

- Enrollment Process: You can enroll in Medicare during the General Enrollment Period by visiting your local Social Security Administration (SSA) office, calling the SSA’s toll-free number, or applying online through the SSA website.

Understanding the General Enrollment Period and its implications can help ensure timely enrollment in Medicare and avoid any penalties or gaps in coverage. If you miss your Initial Enrollment Period, the General Enrollment Period provides another opportunity to enroll in Medicare Part A and/or Part B. However, it’s important to be aware of the potential consequences of delaying enrollment.

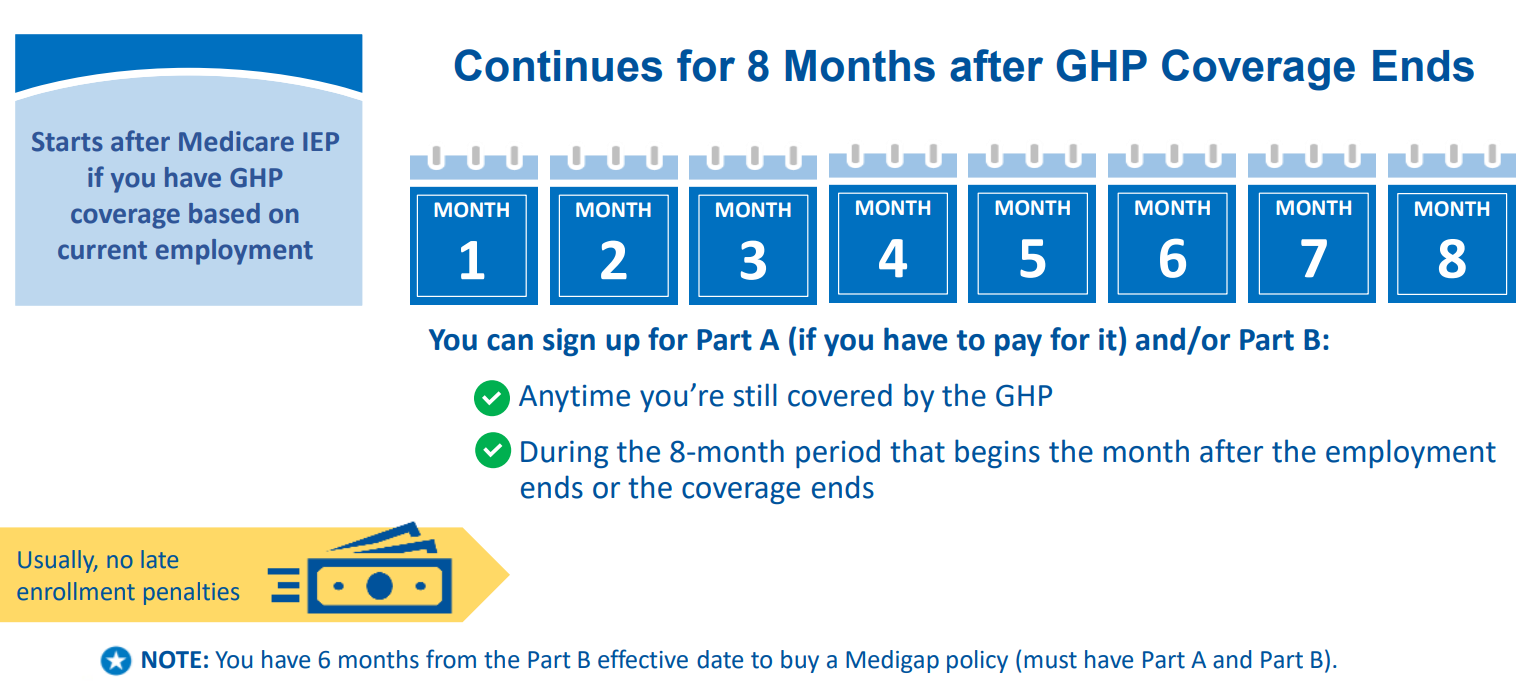

Special Enrollment Period (SEP)

Certain life events may qualify you for a Special Enrollment Period. These events include things like moving to a new area that isn’t covered by your current plan, losing other health coverage, or changes in your Medicaid eligibility. SEP allows you to enroll in or change your Medicare coverage outside of the standard enrollment periods.

The Special Enrollment Period (SEP) provides an opportunity for individuals to enroll in or make changes to their Medicare coverage outside of the standard enrollment periods. Here’s a more detailed overview:

- Qualifying Life Events: SEP eligibility is based on certain qualifying life events that may affect your healthcare coverage. These events include, but are not limited to:

- Moving to a new area that isn’t covered by your current Medicare plan.

- Losing employer-sponsored health insurance coverage, either through job loss or retirement.

- Losing coverage from a Medicare Advantage plan or prescription drug plan due to reasons such as plan termination or moving out of the plan’s service area.

- Qualifying for Extra Help with Medicare prescription drug coverage.

- Becoming eligible for other types of insurance coverage that affect your Medicare options, such as Medicaid or employer-sponsored coverage.

- Gaining dual eligibility for Medicare and Medicaid.

- Enrollment Options: During a Special Enrollment Period, you can enroll in or make changes to various parts of Medicare, including:

- Enrolling in Medicare Part A and/or Part B if you previously declined coverage.

- Enrolling in or switching Medicare Advantage plans (Part C).

- Enrolling in a Medicare Prescription Drug Plan (Part D) or switching to a different plan.

- Applying for a Medicare Special Needs Plan (SNP) if you meet the eligibility criteria.

- Timing: The timing and duration of Special Enrollment Periods can vary based on the specific qualifying event. In most cases, you have a limited window of time after the event occurs to enroll in or make changes to your Medicare coverage. For example, if you lose employer-sponsored health insurance coverage, you typically have an eight-month SEP to enroll in Medicare.

- Documentation: In some cases, you may need to provide documentation of your qualifying life event to be eligible for a Special Enrollment Period. This documentation helps verify that you experienced a qualifying event that entitles you to the SEP.

- No Late Enrollment Penalty: One advantage of enrolling in Medicare during a Special Enrollment Period is that you generally won’t face late enrollment penalties for Part A, Part B, or Part D coverage.

- Enrollment Process: To take advantage of a Special Enrollment Period, you typically need to contact Medicare or your plan provider directly to initiate the enrollment process. Depending on the qualifying event, you may need to provide documentation to support your eligibility for the SEP.

Understanding the Special Enrollment Period and its eligibility criteria is essential for individuals experiencing qualifying life events that may affect their Medicare coverage options. Taking advantage of SEP ensures timely enrollment and appropriate coverage adjustments based on changing circumstances.

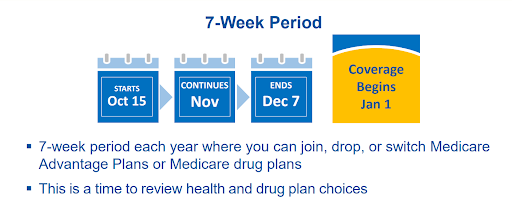

Yearly Open Enrollment Period (OEP) for People with Medicare

The OEP typically occurs from October 15 to December 7 each year. Coverage changes made during this period take effect on January 1 of the following year.

Here are some important details about the OEP:

1. Coverage Changes: Beneficiaries can make changes to their Medicare coverage options, such as switching between Original Medicare and Medicare Advantage, or changing prescription drug plans.

2. Date of Enrollment: The OEP runs from October 15 to December 7 annually. Changes made during this period become effective on January 1 of the following year.

3. Enrollment Options: Beneficiaries have various options during the OEP, including enrolling in new plans, switching plans, or dropping existing coverage altogether.

4. Coverage Review: It’s a good idea for beneficiaries to review their current coverage each year during the OEP to ensure it still meets their needs. Changes in health status, prescription drug needs, or financial circumstances may warrant adjustments to their Medicare coverage.

5. Special Circumstances: In addition to the OEP, there are other periods during which Medicare beneficiaries may be able to make changes to their coverage, such as the Medicare Advantage Open Enrollment Period (MA OEP) and Special Enrollment Periods (SEPs) triggered by certain life events, like moving or losing other coverage.

Understanding and taking advantage of the Yearly Open Enrollment Period can help Medicare beneficiaries ensure they have the most suitable coverage for their healthcare needs and budget.

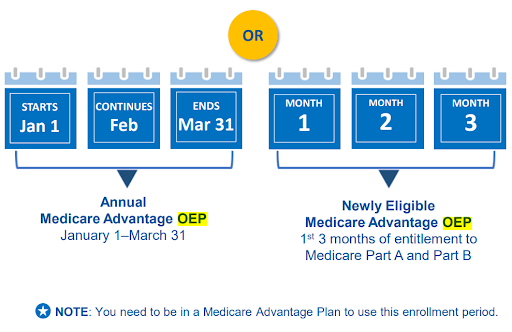

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is a period during which individuals enrolled in a Medicare Advantage plan (Medicare Part C) have the opportunity to make changes to their coverage. This period typically occurs annually and allows beneficiaries to switch to a different Medicare Advantage plan or revert to Original Medicare (Parts A and B). Here are some key details about the MA OEP:

1. Coverage Changes: During the MA OEP, beneficiaries can make the following changes to their coverage:

- Switch from one Medicare Advantage plan to another.

- Enroll in a Medicare Advantage plan if they’re currently enrolled in Original Medicare (Parts A and B).

- Disenroll from their Medicare Advantage plan and return to Original Medicare.

2. Date of Enrollment: The Medicare Advantage Open Enrollment Period typically runs from January 1st to March 31st each year. However, it’s essential to check the specific dates each year as they may vary.

3. Important Information:

- Changes made during the MA OEP will take effect on the first day of the month following the month in which the plan receives the enrollment request.

- Beneficiaries can only make one change during this period. For example, they can switch from one Medicare Advantage plan to another or return to Original Medicare, but they cannot switch back and forth multiple times during the MA OEP.

4. Coverage Considerations: Before making any changes to their coverage during the MA OEP, beneficiaries should carefully review their current plan’s benefits, premiums, provider networks, and prescription drug coverage. They should also compare these aspects with the options available in other Medicare Advantage plans or Original Medicare to ensure they choose the best coverage for their needs.

Overall, the Medicare Advantage Open Enrollment Period provides beneficiaries with an opportunity to review and adjust their Medicare Advantage coverage to better suit their healthcare needs and preferences. It’s crucial for individuals to understand the timeline, options, and implications of any changes they make during this period.

Open Enrollment Period for Institutionalized Individuals (OEPI)

The Open Enrollment Period for Institutionalized Individuals (OEPI) is a special enrollment period designed to allow individuals who are living in an institution, such as a nursing home or long-term care facility, to enroll in or switch their Medicare Advantage (Part C) or Medicare Prescription Drug Coverage (Part D) plans.

Here are some key details about OEPI:

1. Purpose: The OEPI is aimed at providing individuals residing in institutions with the opportunity to review and change their Medicare coverage options if necessary.

2. Coverage: OEPI allows individuals to enroll in, disenroll from, or switch Medicare Advantage or Medicare Prescription Drug plans. This means they can join a new plan, leave their current plan, or change their existing plan during this period.

3. Date of Enrollment: OEPI typically occurs at the same time as the Medicare Advantage Open Enrollment Period (MA OEP) and the Medicare Open Enrollment Period (OEP), which usually runs from October 15 to December 7 each year. However, OEPI can also occur at other times depending on the individual’s circumstances.

4. Important Information: During OEPI, individuals should carefully review their current Medicare coverage and consider any changes in their health needs or preferences. It’s essential to compare different plans available in their area to ensure they choose the one that best meets their needs. Additionally, individuals should be aware of any deadlines associated with OEPI to avoid gaps in coverage.

5. Enrollment Process: Individuals can enroll in or make changes to their Medicare Advantage or Medicare Prescription Drug plans during OEPI by contacting Medicare directly or by using the Medicare Plan Finder tool on the official Medicare website.

Overall, the OEPI provides institutionalized individuals with a valuable opportunity to ensure they have the most suitable Medicare coverage for their unique circumstances, helping them access the care and medications they need while residing in a long-term care facility.

Special Enrollment Periods (SEP) for Exceptional Situations

Special Enrollment Periods (SEPs) for Exceptional Situations are provisions within healthcare insurance plans that allow individuals to enroll in coverage outside of the regular open enrollment period. These exceptional situations typically involve life events or circumstances that significantly impact an individual’s ability to obtain or maintain health insurance coverage.

1. Eligibility: Individuals facing specific circumstances such as emergencies, incarceration, misinformation, loss of Medicaid coverage, or other exceptional conditions. Here are some common situations that may qualify for a Special Enrollment Period:

- Loss of Previous Coverage: If an individual loses their existing health coverage due to reasons such as job loss, aging off a parent’s plan, expiration of COBRA coverage, or loss of eligibility for Medicaid or CHIP, they may qualify for a Special Enrollment Period.

- Changes in Household: Events such as marriage, divorce, birth, adoption, or placement for adoption can trigger a Special Enrollment Period. This allows individuals to enroll themselves and eligible family members in a new health insurance plan.

- Relocation: If an individual moves to a new area where different health insurance plans are available, they may qualify for a Special Enrollment Period to enroll in a new plan.

- Changes in Citizenship or Lawful Presence: If an individual gains citizenship or lawful presence in the U.S., they may qualify for a Special Enrollment Period to enroll in health coverage.

- Exceptional Circumstances: Other exceptional circumstances not listed above may also qualify for a Special Enrollment Period. These circumstances are typically evaluated on a case-by-case basis.

2. Duration: Individuals qualifying for an SEP after signing up for Part A and/or Part B have 2 months to join a Medicare Advantage Plan or Medicare drug plan.

3. Coverage Starts: The 1st day of the month after the plan receives the enrollment request.

Quick Guide for Medicare Enrollment

Here’s a brief overview of the steps for enrolling in Medicare:

1. Understand Eligibility: Determine if you’re eligible for Medicare based on age (65 or older), disability status (under 65 with certain disabilities), or specific medical conditions.

2. Choose Enrollment Period: There are different enrollment periods: Initial Enrollment Period (IEP), General Enrollment Period (GEP), Special Enrollment Period (SEP), and Open Enrollment Period (OEP). Choose the one that applies to your situation.

3. Decide on Parts: Decide if you want Original Medicare (Part A and Part B) or a Medicare Advantage Plan (Part C), which includes both Part A and Part B coverage and often additional benefits like prescription drug coverage (Part D) and dental or vision coverage.

4. Apply for Coverage: You can apply online through the Social Security Administration website, by phone, or in-person at a local Social Security office. If you’re opting for a Medicare Advantage Plan or a Part D plan, you can also enroll through private insurance companies.

5. Review and Confirm: Double-check your enrollment choices to ensure they meet your healthcare needs and budget.

6. Receive Confirmation: After you’ve submitted your application, you’ll receive confirmation of your enrollment, along with details about your coverage start date.

7. Stay Informed: Keep track of important Medicare deadlines, coverage changes, and any updates to your plan’s benefits to ensure you’re making the most of your coverage.

In Summary

Understanding the various enrollment periods within the Medicare program is crucial for individuals to ensure timely enrollment and appropriate coverage adjustments. The Initial Enrollment Period (IEP) provides a critical window for new Medicare beneficiaries to sign up, while the General Enrollment Period (GEP) offers another opportunity for those who missed their IEP.

Knowing when to enroll can prevent late enrollment penalties and coverage gaps. Special Enrollment Periods (SEPs) cater to exceptional situations, offering flexibility outside standard enrollment periods. Additionally, the Open Enrollment Periods (OEPs) allow for yearly reviews and adjustments to Medicare coverage.

By following the guide for Medicare enrollment and staying informed about available options, individuals can make informed decisions to meet their healthcare needs effectively.

DISCLAIMER: Please verify the information provided here with the primary source to ensure accuracy. We strive to present information correctly. It is advisable to confirm details directly from the primary source for accuracy and reliability