Medicare Advantage

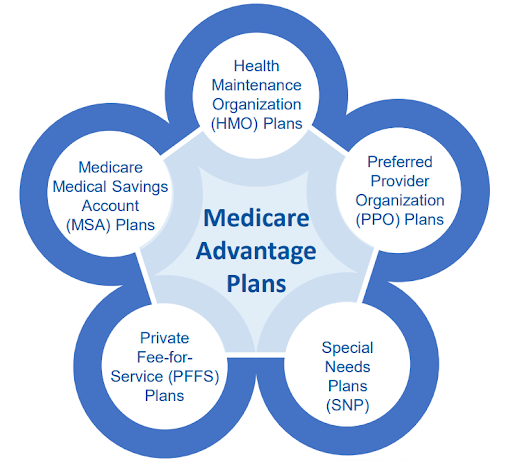

Medicare Advantage (Part C) offers a comprehensive alternative to Original Medicare, providing beneficiaries with an array of options tailored to their healthcare needs. These plans, administered by private insurance companies approved by Medicare, offer various features and benefits beyond those of Original Medicare. Here’s a breakdown of what Medicare Advantage entails and other Medicare health plan options available:

Medicare Advantage Plans Features:

- Yearly Maximum Out-of-Pocket Cost: Medicare Advantage plans come with a cap on yearly out-of-pocket expenses, providing financial protection for beneficiaries.

- Provider Network: Typically, these plans require the use of doctors within their network, ensuring coordinated care and often offering additional benefits for in-network services.

- Extra Benefits: Many Medicare Advantage plans include supplementary benefits such as vision, hearing, and dental services, enhancing overall coverage beyond what Original Medicare provides.

How Medicare Advantage Plans Work:

- Beneficiaries retain all Medicare rights and protections while enrolled in a Medicare Advantage Plan.

- Out-of-pocket costs may differ from Original Medicare, with a cap on yearly expenses.

- Certain services, like chemotherapy or skilled nursing facility care, cannot be charged at a higher rate than Original Medicare.

Other Medicare Health Plans

Health Maintenance Organization (HMO)

Health Maintenance Organization (HMO) plans are a type of health insurance plan that typically requires individuals to choose a primary care physician (PCP) from a network of healthcare providers. The PCP serves as the main point of contact for all medical needs and coordinates referrals to specialists within the network when necessary.

Here are some key features of HMO plans:

- Primary Care Physician (PCP): Members of an HMO plan are required to select a primary care physician from within the plan’s network. The PCP acts as the first point of contact for all medical services and coordinates any necessary referrals to specialists.

- Network Restrictions: HMO plans usually have a network of healthcare providers, including doctors, hospitals, and other medical facilities. In most cases, members are required to use healthcare providers within the network to receive coverage for medical services. Visits to out-of-network providers may not be covered except in emergencies or special circumstances.

- Referrals: If a member needs to see a specialist, they typically need a referral from their primary care physician in order for the visit to be covered by the HMO plan. This helps ensure that care is coordinated and unnecessary specialist visits are minimized.

- Preventive Care Emphasis: HMO plans often emphasize preventive care and wellness programs aimed at keeping members healthy and catching potential health issues early. Many preventive services, such as vaccinations and screenings, are typically covered at little to no cost to the member.

- Cost Structure: HMO plans often have lower premiums and out-of-pocket costs compared to other types of health insurance plans, such as Preferred Provider Organization (PPO) plans. However, members may be required to pay copayments for office visits and other services, and there may be limits on coverage for out-of-network care.

- Managed Care: HMO plans are a form of managed care, meaning that the insurance company works closely with healthcare providers to manage costs and ensure quality care for members. This can involve various cost-containment measures and quality improvement initiatives.

Overall, HMO plans can be a cost-effective option for individuals and families who are willing to receive their healthcare services within a specified network of providers and who are comfortable with the coordination of care through a primary care physician.

Preferred Provider Organization (PPO)

Preferred Provider Organization (PPO) plans are a type of health insurance plan that offers a network of healthcare providers, including doctors, specialists, hospitals, and other healthcare facilities. PPO plans give members the flexibility to choose their healthcare providers, whether they’re in or out of the network, without requiring a referral from a primary care physician. Here are some key features of PPO plans:

- Provider Network: PPO plans have a network of preferred providers with whom they have negotiated discounted rates. Members can choose to receive care from any provider within this network.

- Out-of-Network Coverage: Unlike Health Maintenance Organization (HMO) plans, PPO plans typically provide coverage for out-of-network care, although at a higher cost to the member through coinsurance and higher deductibles.

- No Referrals Required: PPO plans generally do not require referrals from a primary care physician to see a specialist. Members can typically see any specialist within the network without prior authorization.

- Cost Flexibility: While PPO plans offer lower costs for in-network care, they also provide coverage for out-of-network care, albeit at a higher cost to the member. This flexibility can be advantageous for individuals who prefer more choices in their healthcare providers.

- Higher Premiums: PPO plans often come with higher monthly premiums compared to HMO plans due to the increased flexibility and broader provider networks.

- Deductibles and Coinsurance: PPO plans typically have deductibles that must be met before the insurance starts covering costs, and they often involve coinsurance, where the member pays a percentage of the cost of care even after the deductible is met.

- No Gatekeeper: Unlike HMO plans, which often require a primary care physician to act as a gatekeeper for accessing specialist care, PPO plans allow members to directly schedule appointments with specialists without referrals.

- Coverage for Travel: PPO plans may offer coverage for medical care received while traveling, although specific details may vary depending on the plan.

Overall, PPO plans offer a balance between cost and flexibility, making them a popular choice for individuals who want the freedom to choose their healthcare providers while still having some coverage for out-of-network care. However, it’s essential for members to understand the details of their specific plan, including provider networks, deductibles, and out-of-pocket costs, to make informed decisions about their healthcare.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are a type of Medicare Advantage plan specifically tailored to individuals with certain chronic conditions or specific needs. These plans are designed to provide targeted and coordinated care for those who require specialized medical services. SNPs must provide all Medicare Part A and Part B benefits, and many offer additional benefits such as prescription drug coverage, vision, dental, and hearing services.

There are three main types of SNPs:

- Chronic Condition SNP (C-SNP): These plans are for individuals with certain chronic conditions such as diabetes, heart failure, or end-stage renal disease (ESRD).

- Dual Eligible SNP (D-SNP): These plans are for individuals who are eligible for both Medicare and Medicaid. They provide benefits that coordinate between the two programs to ensure comprehensive coverage.

- Institutional SNP (I-SNP): These plans are for individuals who live in institutions such as nursing homes or long-term care facilities. They are designed to provide specialized care for those residing in institutional settings.

SNPs typically have networks of doctors, hospitals, pharmacies, and other healthcare providers who have experience in treating the specific conditions or needs of the SNP’s members. This focused approach aims to improve health outcomes and quality of care for individuals with complex medical needs.

Private Fee-for-Service (PFFS)

Private Fee-for-Service (PFFS) plans are a type of Medicare Advantage plan offered by private insurance companies. These plans combine the benefits of Original Medicare (Part A and Part B) with additional coverage options, such as prescription drug coverage (Part D) and sometimes additional benefits like dental or vision coverage. Here are some features of PFFS plans:

- Flexibility: PFFS plans offer flexibility in choosing healthcare providers. Unlike some other Medicare Advantage plans that require you to use a network of doctors and hospitals, PFFS plans typically allow you to see any healthcare provider who accepts the plan’s payment terms and agrees to treat you. However, it’s essential to confirm that your provider accepts the plan’s terms before seeking treatment.

- Cost Structure: PFFS plans have a fee-for-service payment structure. This means that the plan determines how much it will pay for covered services, and you may also have cost-sharing responsibilities, such as copayments, coinsurance, and deductibles. The amount you pay out-of-pocket can vary depending on the services you receive and the terms of your specific plan.

- Coverage: Like other Medicare Advantage plans, PFFS plans must provide at least the same level of coverage as Original Medicare (Part A and Part B). Some PFFS plans also include additional benefits not covered by Original Medicare, such as prescription drug coverage, dental, vision, and hearing benefits, and fitness programs.

- Out-of-Network Coverage: PFFS plans may offer out-of-network coverage, allowing you to see any Medicare-approved healthcare provider who agrees to the plan’s terms and conditions. However, it’s crucial to understand that out-of-network providers may charge more than what the plan pays, and you may be responsible for paying the difference.

- Plan Rules and Regulations: Each PFFS plan has its own rules and regulations, including provider networks, coverage limitations, and costs. It’s essential to review the plan’s Summary of Benefits and other materials to understand how the plan works and what it covers.

- Prescription Drug Coverage: Some PFFS plans include prescription drug coverage (Part D), while others may require you to enroll in a separate Part D plan for prescription drug coverage. If your PFFS plan includes Part D coverage, you’ll typically pay a monthly premium for this coverage, along with any applicable copayments or coinsurance for your medications.

Overall, PFFS plans can offer flexibility and additional benefits compared to Original Medicare, but it’s essential to carefully review the terms and costs of each plan to determine if it meets your healthcare needs and budget.

Medicare Medical Savings Account (MSA) Plan

A Medicare Medical Savings Account (MSA) Plan is a type of Medicare Advantage Plan that combines a high-deductible health insurance plan with a medical savings account. Here are some key features of MSA Plans:

- High-Deductible Health Insurance: MSA Plans typically have a high deductible, meaning you’ll have to pay a certain amount out-of-pocket before your coverage kicks in. This deductible amount can vary depending on the specific plan.

- Medical Savings Account (MSA): With an MSA Plan, a portion of your Medicare Advantage premium is deposited into a special savings account. This account is used to help you pay for your Medicare-covered expenses before you meet your deductible.

- Medicare Coverage: Like all Medicare Advantage Plans, MSA Plans must cover all Medicare Part A (hospital insurance) and Part B (medical insurance) services. Some plans may also offer additional benefits like prescription drug coverage or dental and vision care.

- Provider Network: MSA Plans may have a network of doctors and hospitals that you must use to receive coverage, although some plans may offer out-of-network coverage at a higher cost.

- Flexibility: MSA Plans offer flexibility in how you use your medical savings account funds. You can use the funds to pay for Medicare-covered services or qualified medical expenses, even if they aren’t covered by Medicare.

- No Prescription Drug Coverage: Most MSA Plans do not include prescription drug coverage (Part D). If you enroll in an MSA Plan, you’ll need to purchase a standalone Medicare Part D plan if you want prescription drug coverage.

- Cost Savings: MSA Plans can offer cost savings for beneficiaries who don’t expect to use a lot of medical services and are comfortable with a high deductible. The funds in your medical savings account can help offset the cost of your deductible and other out-of-pocket expenses.

It’s important to carefully review the details of any Medicare Advantage Plan, including MSA Plans, to understand its specific features, costs, and coverage limitations before enrolling.

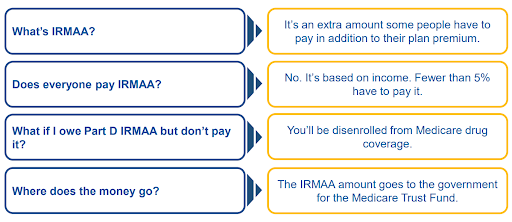

Income-Related Monthly Adjustment Amounts (IRMAA): Medicare Drug Coverage (Part D)

What Determines the Expenses of a Medicare Advantage Plan?

The expenses you incur with a Medicare Advantage Plan can fluctuate based on several factors, including:

- Premiums: The amount you pay each month for coverage.

- Deductibles: The sum you must pay out of pocket before your coverage begins.

- Copayments or Coinsurance: Your share of the cost for covered services after you’ve paid your deductible.

- The type and frequency of healthcare services you utilize.

- Additional benefits or premium features are included in your plan.

- Annual out-of-pocket expenses: The maximum amount you’ll pay for covered services in a year.

- Whether you’re enrolled in Medicaid.

These factors collectively influence the total expenses you’ll face with your Medicare Advantage Plan.

Who Is Eligible to Join a Medicare Advantage Plan?

To enroll in a Medicare Advantage plan, you need to meet the following criteria:

- Medicare Part A and Part B Enrollment: You must already have both Medicare Part A and Part B coverage.

- Residency in the Plan’s Service Area: You must reside within the geographical service area of the Medicare Advantage plan you wish to join.

- U.S. Citizenship or Lawful Presence: You must be a U.S. citizen or lawfully present within the United States.

- Not Incarcerated: You cannot be currently incarcerated to be eligible for enrollment.

Additionally, to join a Medicare Advantage plan, you must:

- Provide Necessary Information: Agree to provide all necessary information required by the plan for enrollment purposes.

- Adhere to the Plan’s Rules: Agree to abide by the rules and regulations set forth by the Medicare Advantage plan.

- Enroll in Only One Plan at a Time: You can only be a member of one Medicare Advantage plan at any given time.

In summary

In conclusion, understanding Medicare Advantage and other Medicare health plans is crucial for making informed decisions about healthcare coverage. Medicare Advantage plans, including HMOs, PPOs, SNPs, PFFS, and MSAs, offer a variety of options tailored to different needs and preferences. These plans often provide additional benefits beyond Original Medicare, such as vision, dental, and prescription drug coverage.

Factors affecting expenses include premiums, deductibles, copayments or coinsurance, healthcare utilization, plan features, and annual out-of-pocket limits.

Eligibility criteria for joining a Medicare Advantage plan include enrollment in Medicare Part A and Part B, residency in the plan’s service area, U.S. citizenship or lawful presence, not being incarcerated, providing necessary information for enrollment, and adhering to the plan’s rules. It’s essential to carefully review plan details to choose the best option for individual healthcare needs and circumstances.

DISCLAIMER: Please verify the information provided here with the primary source to ensure accuracy. We strive to present information correctly. It is advisable to confirm details directly from the primary source for accuracy and reliability.