What Medico Offers

With its extensive range of Medicare Supplement plans and established presence in the senior market, Medico offers tailored solutions to fulfill customer requirements.

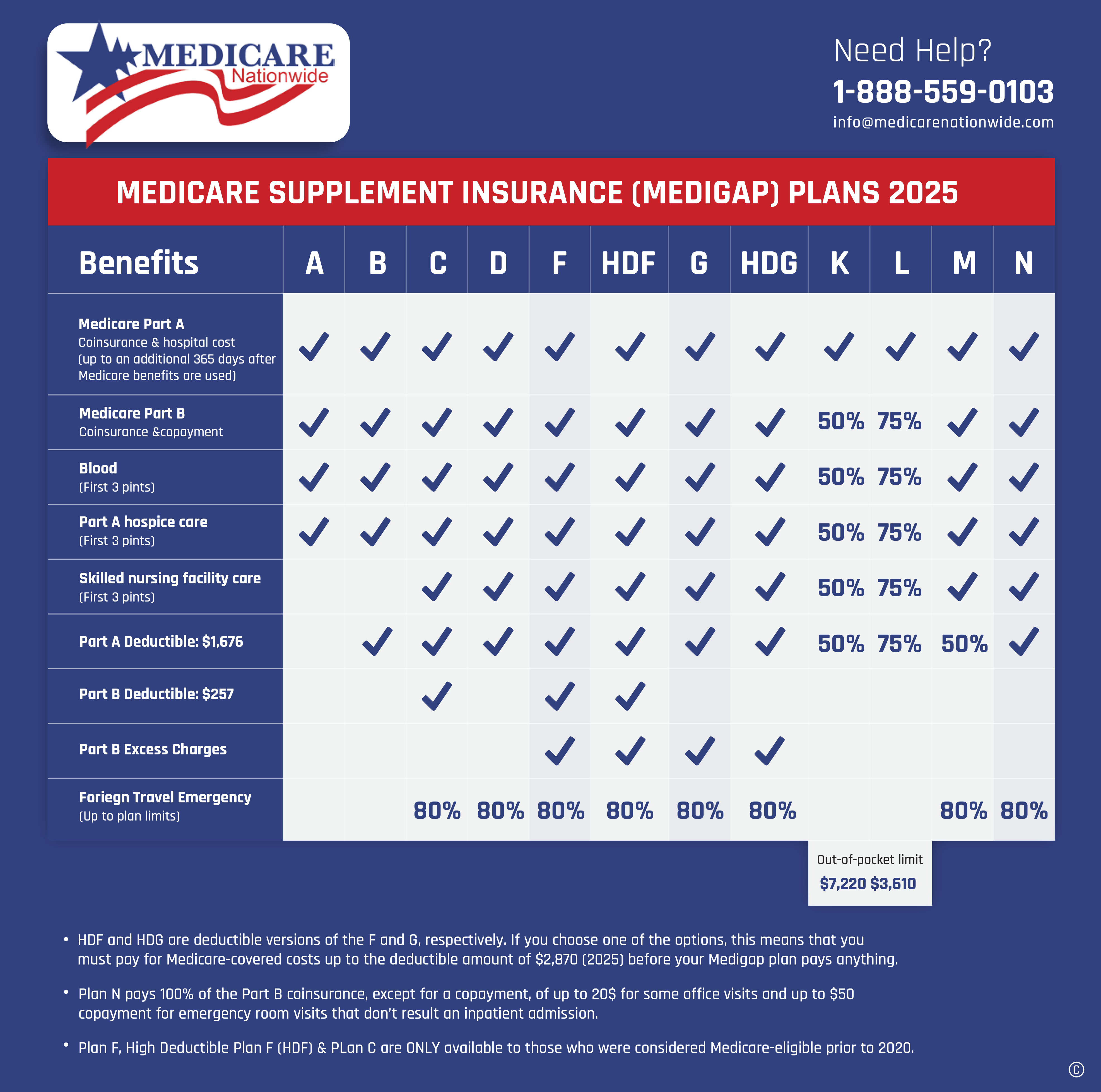

Medico has offered many different Medicare Supplemental Plans (Plan A, Plan G, HD Plan G¹, and Plan N).

These plans not only reduce out-of-pocket expenses but also provide various benefits such as choice of plans, coverage during travel, lifelong guaranteed coverage without pre-existing condition waiting periods, a 30-day return policy, household discounts, and the liberty to choose healthcare providers accepting Medicare.

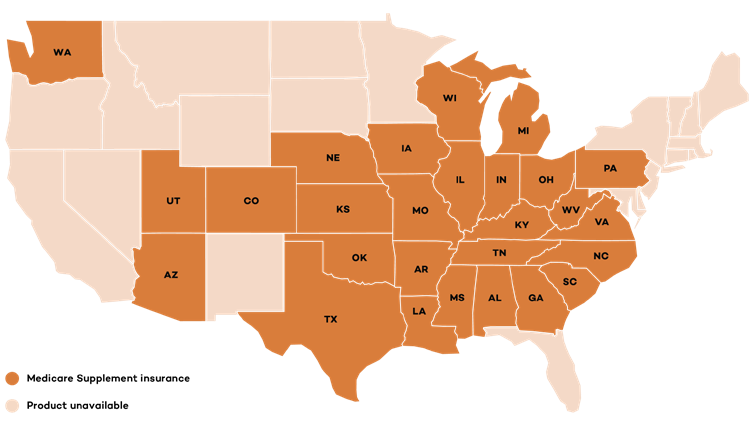

There are 27 states where Medico is offered for Medicare Supplement Plans.

Exploring Medico

Medico is an organization that offers solutions and alternatives to help people ensure their health and financial well-being. They have a trustworthy and reliable reputation, holding an A (Excellent) rating and a stable outlook according to AM Best. Medico has gained a strong reputation over the years for its supplementary products and services, including hospital indemnity plans.

No matter what stage you are at in healthcare or retirement planning, Medico provides supplementary health insurance options that enable you to interact, advocate, and increase trust. Additionally, their products are synergistic, which means they create opportunities for cross-selling.

A Journey Through the History of Medico

Medico, a well-known insurance provider in the United States, has been in service since 1929. They offer reliable and effective solutions for people’s well-being and have built a reputable organization over the years. Their commitment to quality service has earned them a high rating in the industry.

Medico Insurance Company provides high-quality insurance options nationwide. Their Medicare Supplement plans offer additional coverage for expenses not covered by Original Medicare. Medico has also shown remarkable price stability over the years, which reassures customers of consistent and reliable coverage.

In 2023, Wellabe acquired Medico largely due to their brand reputation. For more information, you can visit this article here to learn about Wellabe:

https://medicarenationwide.com/wellabe-medicare-supplement-review/

A Closer Look at Medico’s Coverage

Medico has offered health coverage that you can count on. Although Medicare Supplement insurance plans come in a standardized format, you still have the option to choose the cost and the insurance company that provides the policy. Medico has a well-established history of serving the senior market and offers a wide range of Medicare Supplement plans, making it the perfect option to cater to your customers’ needs.

How to Choose the Right Supplement Insurance Plan

Medicare Supplement insurance plans provide several benefits to the customers. They help in reducing out-of-pocket costs and offer the flexibility to choose from various plan options. Medico offers various Medicare Supplemental Plans, including Plan A, Plan G, HD Plan G¹, and Plan N.

Medicare Supplement Plan Premium Average Cost Monthly

Rates may vary depending on your location. The rates we have provided below are for illustrative purposes only. To check the rates of your location, you can talk to one of our representatives.

- The rates below are based on the generated zip code 75001 in Addison, Texas for males and females aged 65 years old. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | MALE | FEMALE |

Plan F | $197.99 | $186.16 |

Plan G | $168.66 | $150.02 |

Plan N | $131.80 | $117.44 |

- The rates below are based on the generated zip code 66109 in Kansas City, Kansas for males and females aged 65 years old. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | MALE | FEMALE |

Plan F | $186.52 | $171.03 |

Plan G | $165.49 | $151.45 |

Plan N | $113.41 | $101.44 |

- The rates below are based on the generated zip code 60629 in Chicago, Illinois for males and females aged 65 years old. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | MALE | FEMALE |

Plan F | $171.66 | $156.86 |

Plan G | $153.11 | $139.59 |

Plan N | $112.62 | $103.57 |

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

How to Choose the Right Dental Insurance Plan

A good oral health is a reflection of your overall well-being. It is crucial to visit a dentist regularly to avoid dental issues, which can become painful and costly if not addressed on time. With Medico’s Gold and Platinum Dental plans, your clients can choose any dental provider they prefer. They can also save more money if they opt for an in-network dental provider for services such as exams, cleanings, dentures, and root canals.

| PLAN BENEFITS | GOLD $1,000 | GOLD $1,500 | PLATINUM $1,000 | PLATINUM $1,500 |

| Calendar Year Maximum | $1,000 | $1,500 | $1,000 | $1,500 |

Calendar year deductible | $50 for basic and major services | $50 for basic and major services | ||

Preventive Services (NWP) Evaluations, Cleanings, and X-rays | 100% ; $0 deductible | 100% ; $0 deductible | ||

| We pay the following coinsurance percentage after the deductible: | ||||

Basic Services(NWP) Diagnostic X-rays, fillings, and nonsurgical extractions | $50 | $80 | ||

Major Services Bridges, Crowns, Dentures, Implants, Surgical Extractions, Root Canals, and Periodontal Services | 20% within first 12 months; 50% after 12 months | 20% within first 12 months; 50% after 12 months | ||

Optional Benefit to be added in your Dental Insurance

There are 2 additional benefits being offered that you can also enjoy while having any Dental Insurance Plan. Choose one of two optional benefits for an additional fee at the time of application:

- Bayup Benefit

Add $1,000 of coverage (buyup) to maximize policy benefits. For example, the Gold $1,000 plan plus $1,000 buyup is $2,000 of coverage. The buyup is available for both levels in each plan

- Carry-over benefit

The carry-over benefit rider allows unused plan benefit to carry-over for use in the following year. The carry-over amount accumulates until it reaches a max of $3,000. For example, if the Gold $1,000 plan has an unused benefit balance of $500, the unused benefit can roll to the next calendar year.

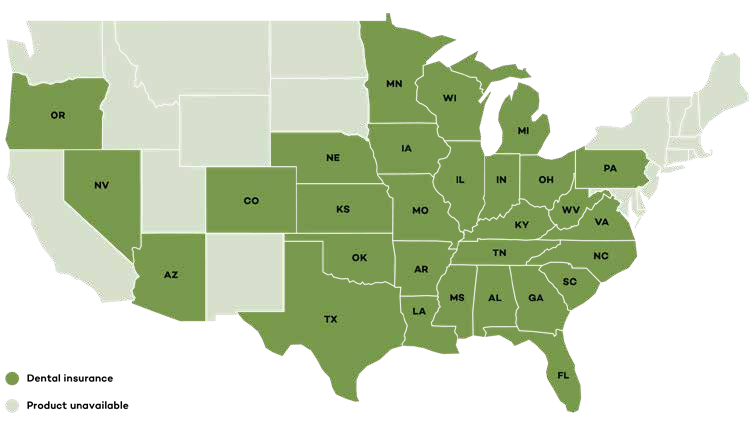

Availability of Dental Insurance

Not all states offer coverage for the Dental Insurance Plan. Below is a photo where the Dental Insurance plan is available.

Exploring the Benefits of Hospital Indemnity Insurance

A Hospital Indemnity insurance plan offers cash benefits to clients who are hospitalized due to an injury or illness. It works well with Medicare Advantage or ACA plans. Whether your clients need a plan that provides hospitalization benefits only, or one that also covers outpatient services and skilled nursing facility benefits, Medico’s Hospital Indemnity plan can provide comfort and security during a difficult time.

PRODUCT OVERVIEW

Hospital Confinement benefit

- $100 to $600 per day (in increments of $25)

- Pays for days 1 through 3,6,7,8,9,10,21,or 31

- Lifetime restoration: 60-days benefit period

Observation unit benefit

- Pays 100% of inpatient benefit for max of 6 days per calendar year

- If traveling a minimum of 50 miles to receive treatment

- No minimum or maximum required hours per stay

Emergency Room benefit

- $150 per day max of 4 days per calendar year for covered injury

Inpatient Mental Health benefit

- $175 per day of confinement for max of 7 days per calendar year for a covered mental or nervous disorder

Transportation and Lodging benefit

- $100 per day (up to $1,000) for max of 10 days per calendar year

- If traveling a minimum of 50 miles to receive a treatment

Optional Benefit to be added in your Hospital Indemnity Insurance

One thing for sure you’ll love about this insurance plan, it also has an add-on benefit being offered which you can also enjoy but with an additional cost.

Ambulance Services benefit rider | $250 per day, up to 4 days per calendar year | Lifetime maximum of $2,500 | N/A |

Outpatient Surgery benefit rider | $250, $500, $750, or $1,000 per day | Up to 2 days per calendar year | N/A |

Lump Sum Cancer benefit rider | $1,000 ; $2,500 ; $5,000 ; $7,500 ; or $10,000 per lifetime | Available up to age 80 | N/A |

Skilled Nursing Facility benefit rider | $100 , $150 or $200 per day, up to 50 days per calendar year | On-time restoration benefit | N/A |

Urgent Care Center benefit rider | $50 per day, up to 4 days per calendar year | N/A | N/A |

Lump Sum Hospital Confinement benefit rider | $250, $500 or $750 | Up to 3 benefit periods per calendar year | N/A |

Outpatient Therapy/ Chiropractic Services benefit rider | $50 per day | 15 or 30 days per calendar year for 4 outpatient therapy | Up to 5 days per calendar year for chiropractic services |

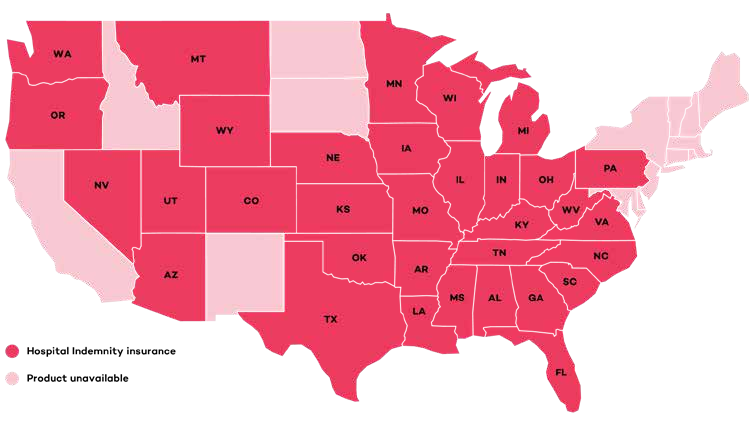

Availability of Hospital Indemnity Insurance

Not all states here in US also offer this insurance plan. There are few states that don’t offer this plan but majority of the states here in US provide Hospital Indemnity Insurance.

A Closer Look to First Diagnosis Cancer Insurance Plan

It’s unfortunate that cancer has become so common these days. Even with medical insurance, cancer patients can face many unexpected expenses. Medico’s First Diagnosis Cancer plan provides a lump sum payment to your client directly, which is tax-free. This benefit is given in addition to any other coverage that your client may already have, such as their current major medical, Medicare Supplement, or Medicare Advantage plans. Your clients can use this payment to cover the direct and indirect costs of cancer.

| Plan Benefits | |

| Benefit | Coverage for the first diagnosis internal cancer or malignant melanoma |

| Lump-sum cash benefit | $10,000 ; $15,000 ; $20,000 ; or $25,000 |

| Guaranteed renewable coverage | Guaranteed renewable coverage as long as payments are made on time |

| Household discount | A 10% discount for members of the same household over 18 years old if both are issued coverage at the same time |

| Optional Benefit Rider | |

| Inflation Protection benefit | Automatically increases the cash benefit amount by 5% of the original amount each year for the life of the policy |

| Policy Highlights | |

| Issue Ages | 18-79 years old |

| Easy Applciation | Answer 3 questions |

| Unisex Rates | The same rates for men and women |

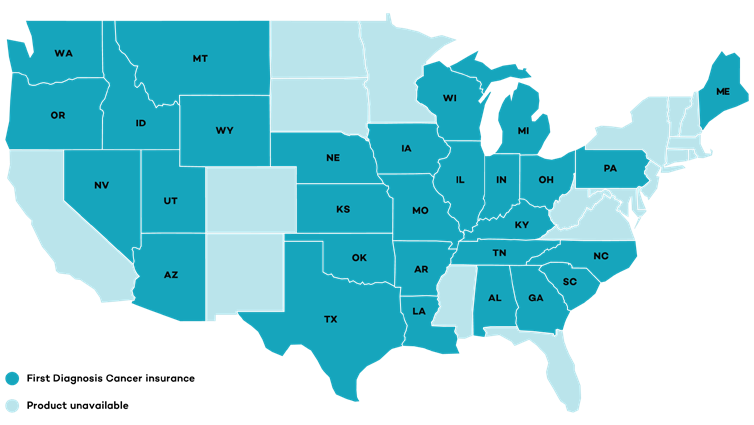

Availability of First Diagnosis Cancer Insurance Plan

Not all states cover these First Diagnosis Cancer Insurance plans, just like some of the insurance stated above. Here is the list where this insurance plan is being offered.

Short-Term Care Insurance: What You Need to Know

Short-term Care insurance can help your clients maintain an active lifestyle while aging in place and ensure that their retirement savings are protected. With Medico’s Short-term Care plan, they can do more and worry less. This plan covers both medical and non-medical care, whether received at home or in a facility. It’s an indemnity-based plan, which means that the full benefit is paid per day, regardless of the service received. The plan options are reflexive, based on the answers to 11 health questions on the application.

DIFFERENT PLANS OFFERED

Essential Care

- Daily benefit up to $150 a day for up to 360 days of in-home health care

- 20-day elimination period

- Less restrictive underwriting

Essential Care Plus

- Daily benefit up to $300 a day for up to 360 days of in-home health care

- 0- or 20-day elimination period

- Standard underwriting

- Benefits can be restored one time

PLAN HIGHLIGHTS

Household Improvement

- $500 indemnity benefit

- Home modifications, such as installing ramps, widening doorways or hallways, modifying a bathroom, etc.

Care Coordination

- $500 indemnity benefit

- Help setting up a care plan when needed

Household Discount

- 7% one applicant who lives with someone over 40 years old

- 14% two people over 40 years old apply and are issued Short-term Care policy

- 5% policy issued with Limited Benefit Rider

Multiple Policy Discount

- 5% if also apply for or already have a Medicare Supplement policy with any Medico company

Optional Rider Benefit to be added in your Short-Term Care Insurance

Nursing Facility Care rider

- Daily benefit up to $500 per day for up to 360 additional days of care in a facility

- 0- or 20-day elimination period

- 21-day bed reservation benefit

- Eligible for one-time benefit restoration

Adult Day Care rider

- Pays $50 per visit up to 20 visits

- Eligible for one-time benefit restoration

Inflation Protection rider

- Add to either Home Health Care Benefit, Nursing Facility Care rider, or both

- Increases daily benefit amount by 5% of the original daily benefit on each policy anniversary

Return of Premium rider (minus any claims paid at time of termination)

- After 10 years: 25% of premium

- 15 years: 35% of premium

- 20 years: 50% of premium

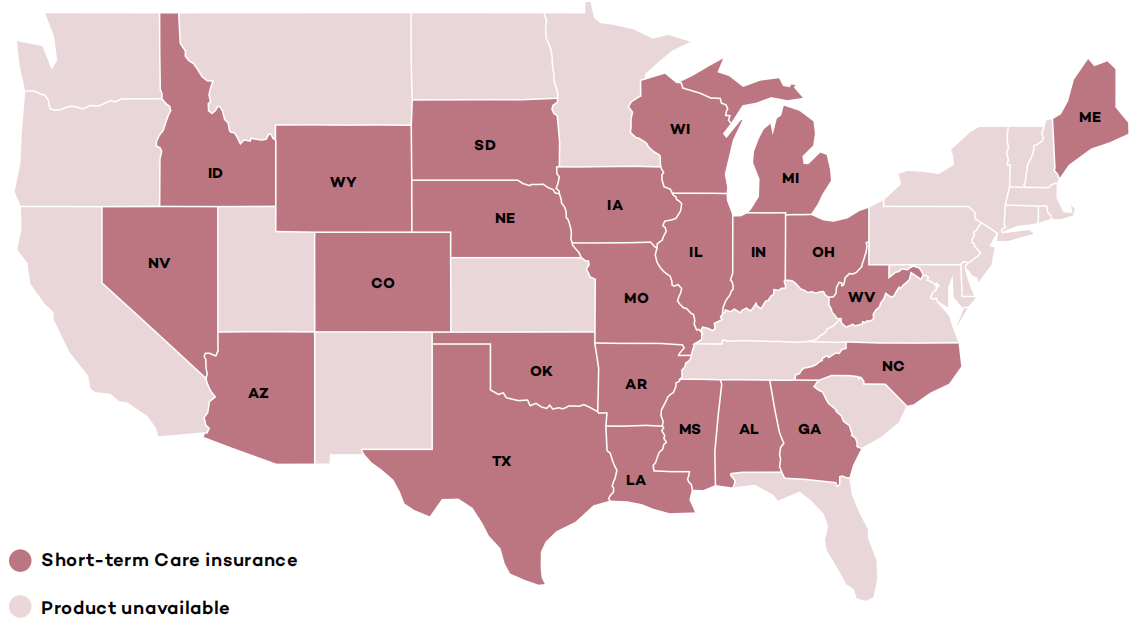

Availability of Short-Term Care Insurance Plan

The policy providing Short-term Care is known as Home Health Care Insurance Policy in Iowa. However, this coverage is not available as a discount in Ohio. The policy provides coverage for up to 270 days in Idaho, but the limited benefit rider is not available in Ohio. Some states offer this coverage.

Summary

Medico Insurance Company offers high-quality insurance options to beneficiaries across the United States. Medico Medicare Supplement plans provide additional coverage that helps pay for expenses not covered by Original Medicare.

In today’s world, it is important to put one’s well-being first. Medico stands out by offering various benefits such as freedom of choice of healthcare provider, guaranteed renewal and discounts on healthcare related services. Medico is committed to providing exceptional customer service and a wide range of coverage.

To learn more about Medico Medicare Supplement Insurance Plans, please contact one of our trusted representatives directly at 1-888-559-0103.