What does Medigap do?

Medigap plans pay the “gaps” in coverage for Original Medicare benefits (Parts A and B). Part A is hospital insurance. Part B is medical outpatient insurance. These “Parts” are only partially covered by the federal government. That’s why you should consider a Medicare supplement “Plan” to cover the gap in coverage that the government doesn’t fully cover.

The goal is to have peace of mind to go to the doctor or hospital and not have to worry about networks or out-of-pocket costs since you are enrolled in both primary and secondary insurance. Your primary insurance would be Medicare which would approve your claim first and then your secondary Medigap plan would pay the balance of your Medicare-approved claims. Together it would leave you with very little out-of-pocket expenses for medical expenses.

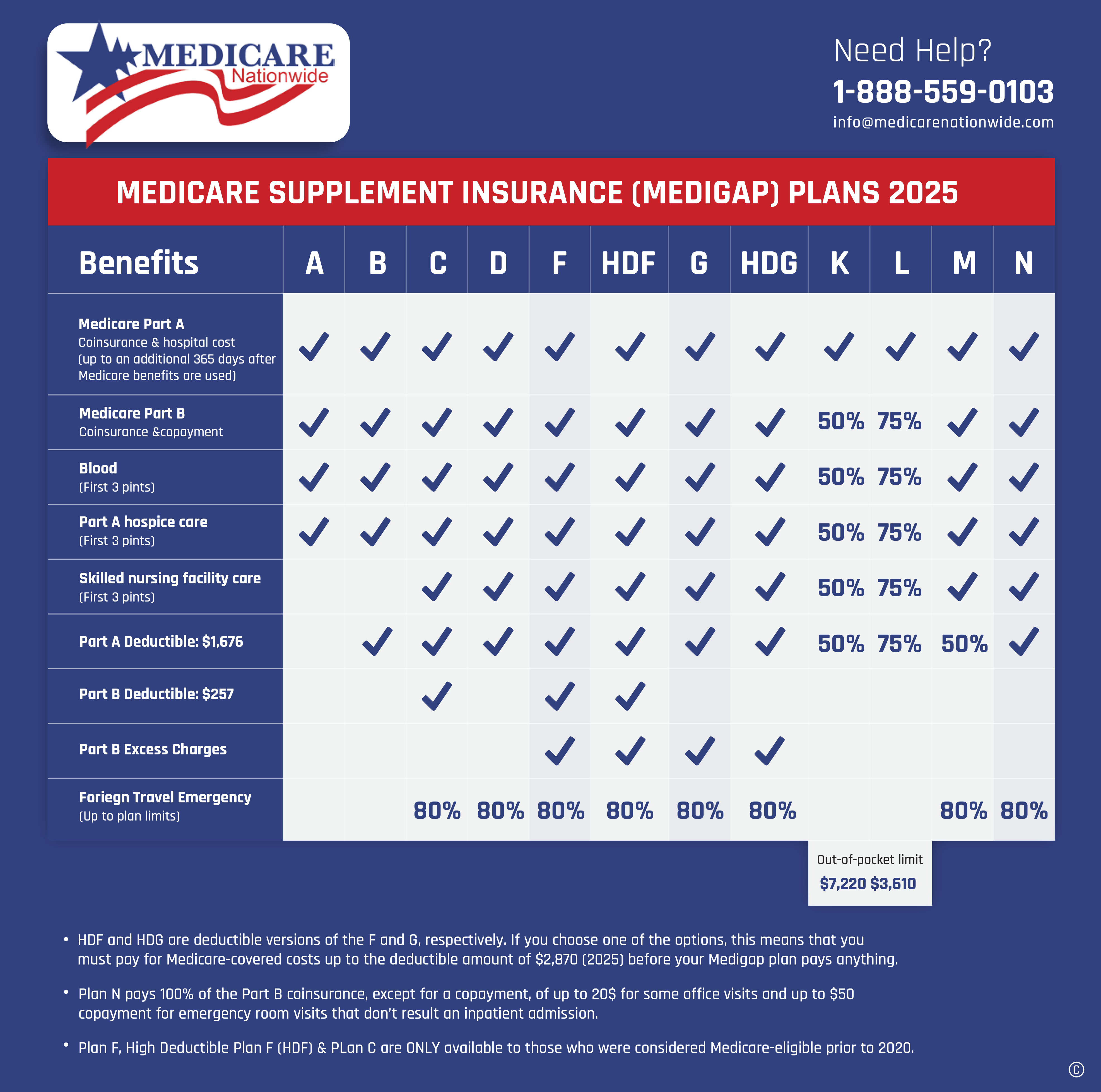

Each supplement insurance plan comes with different benefits. However, each lettered plan guarantees certain standardized benefits regardless of your location or the insurance company offering it. For example, Medicare Supplement Plan F must provide the same standard benefits wherever you purchase your plan. The three most popular plans are Plan F, Plan G, and Plan N.

Medicare Supplement Basics:

- If you are purchasing Medicare Supplement insurance, here are some basic points to know about your policy:

- To purchase a Medicare supplement, you must enroll in Medicare Part A and Medicare Part B.

- The monthly premium that you will pay for your Medigap policy will be in addition to the monthly Part B premium you pay for Medicare.

- Medigap plans are available for purchase from any insurance company licensed to sell in your state.

- A Medigap plan covers a single person. If you and your spouse both need Medigap coverage, you will each have to buy your policy.

- If you already have a Medicare Advantage plan, you cannot purchase a Medigap policy. This is only an option if you switch to Original Medicare coverage and are willing to drop your Medicare Advantage plan. You can’t be on both plans at the same time.

- In the past, some Medigap plans covered prescription drugs. Since 2006, this has been no longer allowed. If you would like prescription drug coverage, you must join a Medicare Part D Plan. Part D is for prescription drugs only that you take to your pharmacy.

Understand Your Plan’s Additional Benefits:

Understanding a Medicare Supplement plan’s additional benefits is crucial when it comes to deciding which plan is best for you. For example, Medigap Plan G, which is the most popular supplement plan, offers coverage of several additional benefits:

- Medicare Part A Deductible

- Part B Excess Charges

- Part B Preventive Care Coinsurance

- Skilled Nursing Facility Care Coinsurance

- Foreign Travel Emergency Care

Medicare Supplement plans are offered by agents that represent the private insurance provider and are not offered by anyone that works for the government or any nonprofits. Independent agents are free to work with and they can help determine the suitability of what plan is right for you and what insurance carrier to choose. Insurance companies may charge different premiums for the same policies, so it is beneficial to understand your available options in your area.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Medicare Supplement Enrollment & Eligibility

The ideal time to purchase Medicare Supplement insurance occurs during the Medicare Supplement Open Enrollment Period (also known as Medigap Open Enrollment Period). This is a six-month period that starts on the month of your 65th birthday and extends an additional five months. During this period, you have a guaranteed right to purchase any Medicare supplement plan available to you in your state, regardless of your current health status. For more information on Medicare enrollment and eligibility, click here.

If you choose not to enroll during this period, you can still purchase coverage later. However, the guaranteed right to purchase may no longer apply. Purchasing later may subject you to higher premium charges or possibly the denial of coverage due to your health status.

To learn more about the different Medicare supplements available, view the Medicare Supplement Plan Comparison.

Medigap plans are different from Medicare Advantage Plans. After reading this article, you might want to read about the differences between a Medigap and Medicare Advantage plan here: Medigap vs Medicare Advantage

Conclusion

With so many supplement plans to choose from, enlisting the service of a licensed agent can ensure you pick the one that’s right for you. Connect directly with one of our trusted agents to start. Or prefer to chat by phone? Give us a call at 1-888-559-0103.