Understanding Medicare Supplement Plan A

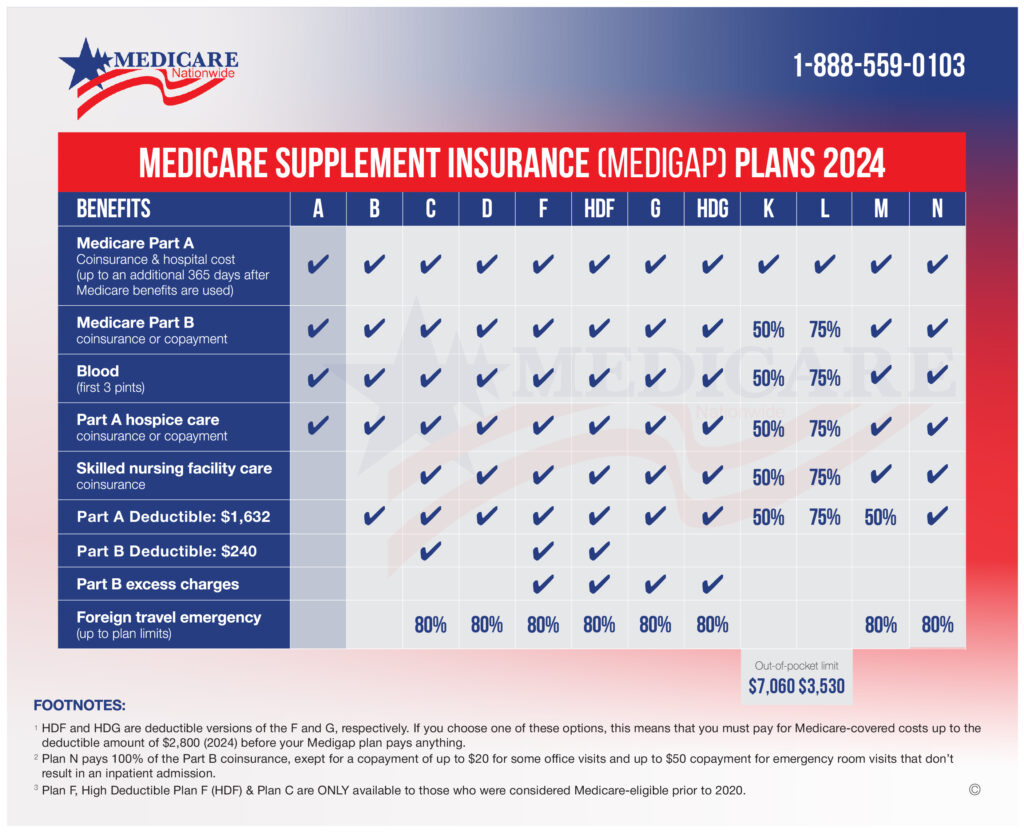

Medicare Supplement Plan A, a standardized Medigap plan, is meticulously crafted to complement Original Medicare (Part A and Part B). It serves as a safety net, covering a multitude of out-of-pocket expenses that may not be fully addressed by Original Medicare alone. Let us unravel the layers of coverage offered by Plan A:

Medicare Part A Coinsurance and Hospital Costs: Medicare Supplement Plan A covers the coinsurance and hospital costs under Medicare Part A, extending coverage for an additional 365 days after Medicare benefits are exhausted.

Medicare Part B Coinsurance or Copayment: Plan A offers comprehensive coverage by shouldering the entire portion of coinsurance or copayment for Medicare Part B services, including doctor visits, outpatient care, and durable medical equipment.

Blood: Plan A ensures peace of mind by covering the first 3 pints of blood needed for a medical procedure, alleviating the financial burden associated with unexpected medical needs.

Skilled Nursing Facility Care Coinsurance: Beneficiaries of Plan A are provided with coverage for coinsurance associated with skilled nursing facility care, facilitating access to essential post-hospitalization services.

Hospice Care Coinsurance or Copayment: Plan A extends compassionate coverage by alleviating coinsurance or copayment for hospice care received under Medicare Part A, ensuring dignified end-of-life care without added financial strain.

Foreign Travel Emergency: Plan A offers a safety net even beyond national borders, providing coverage for emergency medical care during travel outside the United States, offering peace of mind for adventurers and globetrotters alike.

Premiums for Medicare Supplement Plan A

| Medicare Supplement Plan A Average Monthly Cost in Charlottesville, VA (22904)* | |

| Gender: Female, Age 65 | $116.05 |

| Gender: Male, Age 65 | $130.93 |

| Gender: Female, Age 75 | $140.40 |

| Gender: Male, Age 75 | $158.58 |

| Medicare Supplement Plan A Average Monthly Cost in New York, NY (10151)* | |

| Gender: Female, Age 65 | $315.50 |

| Gender: Male, Age 65 | $315.50 |

| Gender: Female, Age 75 | $315.50 |

| Gender: Male, Age 75 | $315.50 |

| Medicare Supplement Plan A Average Monthly Cost in Orlando, FL (32821)* | |

| Gender: Female, Age 65 | $166.80 |

| Gender: Male, Age 65 | $193.44 |

| Gender: Female, Age 75 | $201.00 |

| Gender: Male, Age 75 | $235.45 |

Benefits of Medicare Supplement Plan A

Medicare Supplement Plan A offers several benefits that make it an attractive option for retirees:

Comprehensive Coverage: Plan A provides comprehensive coverage for various out-of-pocket expenses, ensuring beneficiaries have access to essential healthcare services without facing exorbitant costs.

Financial Security: By covering significant portions of coinsurance and copayments, Plan A offers financial security and peace of mind, allowing retirees to budget effectively for healthcare expenses.

Freedom of Choice: Plan A empowers beneficiaries with the freedom to choose any healthcare provider that accepts Medicare assignment, offering flexibility and convenience in accessing healthcare services.

Guaranteed Renewability: Like all Medicare Supplement plans, Plan A offers guaranteed renewability, providing stability and continuity of coverage, regardless of changes in health status.

Considerations Before Enrolling

Before enrolling in Medicare Supplement Plan A, beneficiaries should consider the following factors:

Coverage Needs: Assess individual healthcare needs to ensure that Plan A’s coverage aligns with priorities and preferences.

Cost Analysis: Compare premiums, deductibles, and out-of-pocket costs associated with Plan A from different insurance companies to find the most cost-effective option.

Enrollment Period: Enroll in Plan A during the Medigap Open Enrollment Period to take advantage of guaranteed-issue rights, ensuring coverage without being denied or charged higher premiums due to pre-existing conditions.

Conclusion

Medicare Supplement Plan A stands as a cornerstone of healthcare coverage, offering comprehensive benefits and financial security for retirees. By understanding its coverage, benefits, and important considerations, beneficiaries can make informed decisions about their healthcare coverage in retirement. Consultation with a licensed insurance agent or Medicare advisor can provide further guidance in selecting the best plan for individual circumstances.

Additional Resources:

- Part of Medicare: https://www.medicare.gov/medigap-supplemental-insurance-plans/

- National Association of Health Underwriters (NAHU): https://welcometonahu.org/

- State Health Insurance Assistance Programs (SHIPs): https://www.shiphelp.org/