Comprehensive Coverage

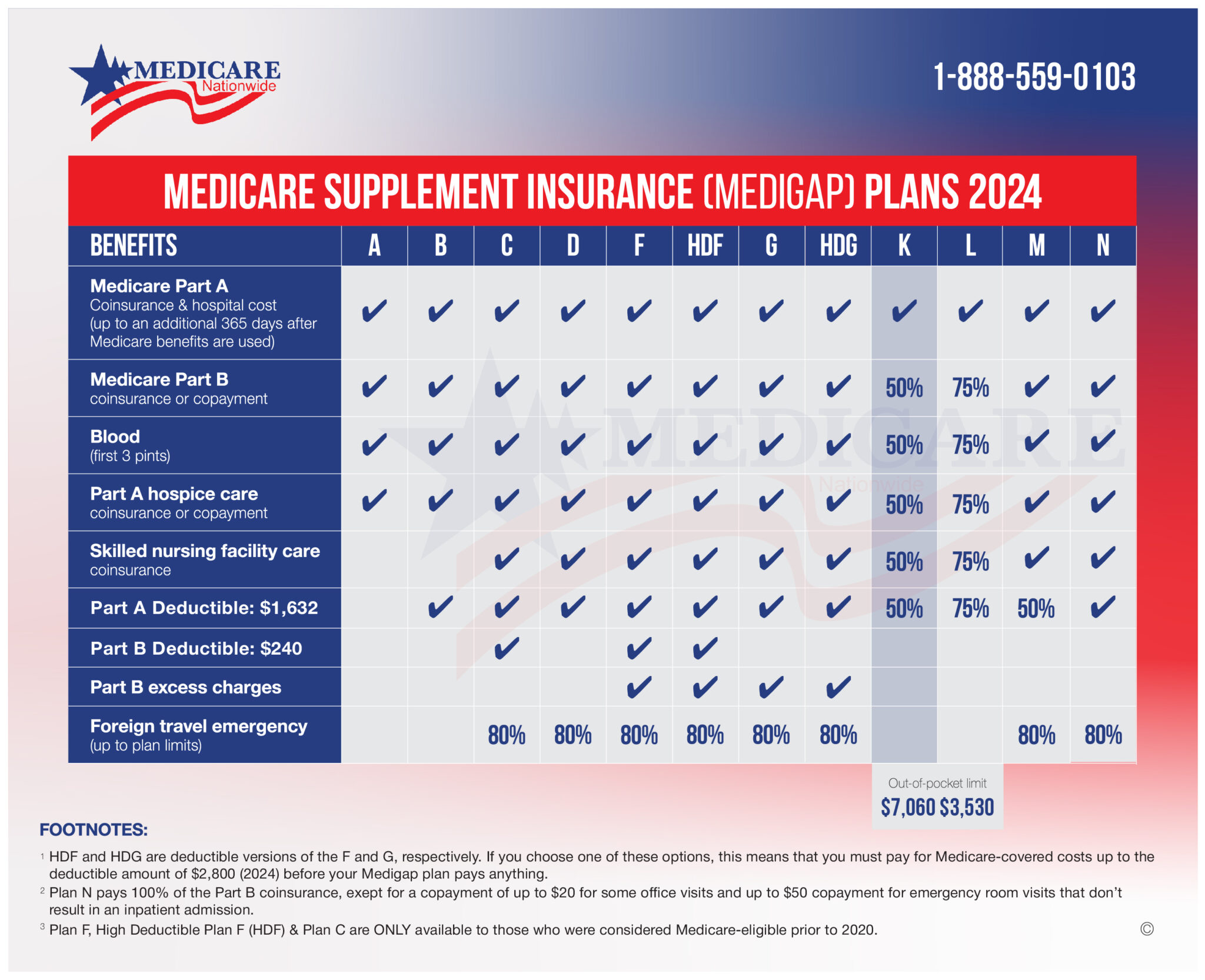

Medicare Supplement Plan K serves as a reliable companion to Original Medicare (Part A and Part B), filling in the gaps and offering additional benefits to ensure comprehensive coverage. While Plan K offers robust protection, it’s essential to understand its specific provisions:

Medicare Part A Coinsurance and Hospital Costs: Plan K covers 50% of the Medicare Part A coinsurance and hospital costs, including an additional 365 days of hospital coverage after Medicare benefits are exhausted.

Medicare Part B Coinsurance or Copayment: Plan K covers 50% of the coinsurance or copayment for Medicare Part B services, excluding preventive care services, which are covered at 100%.

Blood: Plan K covers 50% of the cost for the first three pints of blood needed for a medical procedure.

Skilled Nursing Facility Care Coinsurance: Plan K covers 50% of the coinsurance for care received in a skilled nursing facility.

Hospice Care Coinsurance or Copayment: Plan K covers 50% of the coinsurance or copayment for hospice care under Medicare Part A.

Foreign Travel Emergency: Plan K provides coverage for emergency medical care received during travel outside the United States, up to the plan’s limits.

Average Premiums and Rate Increases for Plan K

| Medicare Supplement Plan K Average Monthly Cost in Fort Myers, FL (33901)* | |

| Gender: Female, Age 65 | $83.34 |

| Gender: Male, Age 65 | $86.62 |

| Gender: Female, Age 75 | $108.50 |

| Gender: Male, Age 75 | $112.67 |

| Medicare Supplement Plan K Average Monthly Cost in Conway, AR (72034)* | |

| Gender: Female, Age 65 | $119.41 |

| Gender: Male, Age 65 | $119.41 |

| Gender: Female, Age 75 | $119.41 |

| Gender: Male, Age 75 | $119.41 |

| Medicare Supplement Plan K Average Monthly Cost in Pomona, CA (91766)* | |

| Gender: Female, Age 65 | $96.03 |

| Gender: Male, Age 65 | $96.03 |

| Gender: Female, Age 75 | $134.17 |

| Gender: Male, Age 75 | $134.17 |

Here’s a sample of a Medicare Supplement Plan K Premium Comparison.

Affordability and Financial Empowerment

One of the most remarkable aspects of Medicare Supplement Plan K is its affordability, offering comprehensive coverage at a fraction of the cost of other plans. While beneficiaries are responsible for sharing some of the costs through copayments and coinsurance, Plan K typically comes with lower monthly premiums compared to other Medigap plans with more extensive coverage. This affordability empowers retirees to manage their healthcare expenses efficiently while still enjoying the benefits of supplemental coverage.

Moreover, Plan K’s cost-sharing features provide a sense of financial empowerment, allowing beneficiaries to have more control over their healthcare spending. By sharing costs with the insurance company, retirees can enjoy comprehensive coverage without feeling burdened by high premiums, making Plan K an attractive option for those looking to maintain financial stability in retirement.

Important Considerations

Before enrolling in Medicare Supplement Plan K, it’s crucial to consider various factors to ensure it aligns with your healthcare needs and financial situation:

Healthcare Needs Assessment: Evaluate your current and anticipated healthcare needs to determine if Plan K’s coverage is sufficient to meet your requirements. Consider factors such as prescription medications, anticipated medical procedures, and frequency of healthcare services.

Cost Analysis: Compare the premiums, deductibles, and out-of-pocket costs associated with Plan K from different insurance companies. Take into account your budget and financial goals when selecting a plan.

Guaranteed Renewability: Like all Medigap plans, Plan K offers guaranteed renewability, ensuring that your coverage cannot be canceled as long as you pay your premiums on time. This provides peace of mind and stability in your healthcare coverage.

Enrollment Period: The best time to enroll in a Medigap plan, including Plan K, is during your Medigap Open Enrollment Period, which starts when you’re 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed-issue rights, meaning you cannot be denied coverage or charged higher premiums due to pre-existing conditions.

Conclusion

Medicare Supplement Plan K shines as a beacon of comprehensive coverage and financial empowerment in the realm of Medicare Supplement plans, offering retirees the opportunity to enjoy robust protection at an affordable price. By understanding its coverage, affordability, and important considerations, beneficiaries can make informed decisions about their healthcare coverage in retirement. Whether you’re seeking to minimize monthly premiums or maximize financial stability, Plan K provides a wonderful option that caters to diverse needs and preferences. As always, consult with a licensed insurance agent or Medicare advisor to explore your options and select the best plan for your individual circumstances. With Medicare Supplement Plan K by your side, you can embrace retirement with confidence and assurance, knowing that your healthcare needs are well taken care of.

Additional Resources:

- Part of Medicare: https://www.medicare.gov/medigap-supplemental-insurance-plans/

- National Association of Health Underwriters (NAHU): https://welcometonahu.org/

- State Health Insurance Assistance Programs (SHIPs): https://www.shiphelp.org/