Understanding Medicare Supplement Plan D

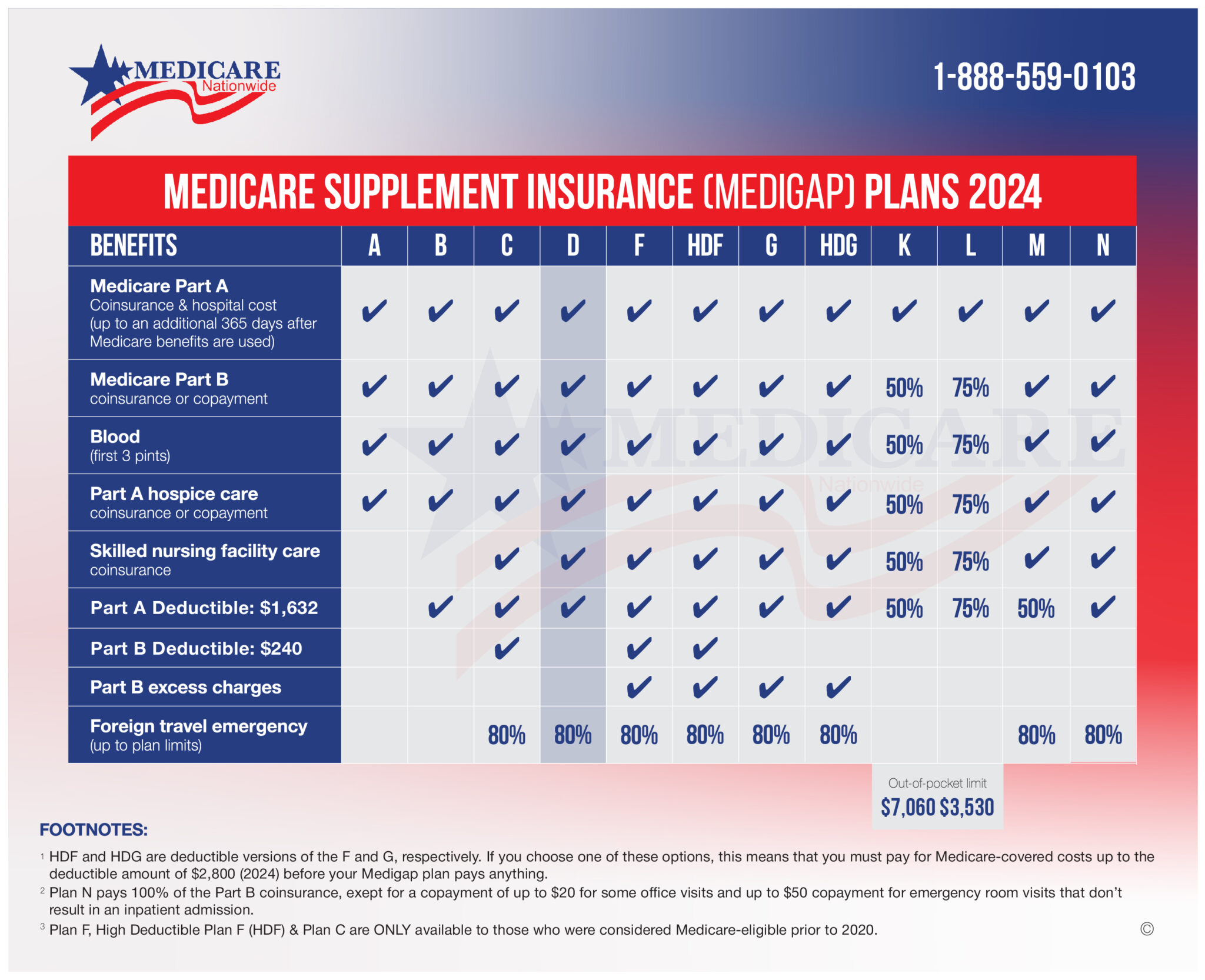

Medicare Supplement Plan D is one of the standardized Medigap plans offered by private insurance companies. It is often confused with Medicare Part D which is your prescription drug plan. Like other Medigap plans, Plan D is designed to complement Original Medicare (Part A and Part B) by covering certain out-of-pocket costs, such as deductibles, copayments, and coinsurance. While Plan D offers robust coverage, it’s essential to understand the specific benefits included:

Medicare Part A Coinsurance and Hospital Costs: Plan D covers Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

Medicare Part A Hospice Care Coinsurance or Copayment: Plan D covers coinsurance or copayment for hospice care under Medicare Part A.

Medicare Part B Coinsurance or Copayment: Plan D covers 50% of the coinsurance or copayment for Medicare Part B services, excluding preventive care services, which are covered at 100%.

Blood: Plan D covers the first 3 pints of blood needed for a medical procedure.

Skilled Nursing Facility Care Coinsurance: Plan D covers coinsurance for care received in a skilled nursing facility.

Foreign Travel Emergency: Plan D provides coverage for emergency medical care received during travel outside the United States, up to the plan’s limits.

Average Premiums and Rate Increases for Plan D

| Medicare Supplement Plan D Average Monthly Cost in Stamford, CT (06902)* | |

| Gender: Female, Age 65 | $351.73 |

| Gender: Male, Age 65 | $351.73 |

| Gender: Female, Age 75 | $351.73 |

| Gender: Male, Age 75 | $351.73 |

| Medicare Supplement Plan D Average Monthly Cost in Newark, DE (19702)* | |

| Gender: Female, Age 65 | $152.20 |

| Gender: Male, Age 65 | $170.01 |

| Gender: Female, Age 75 | $227.20 |

| Gender: Male, Age 75 | $256.83 |

| Medicare Supplement Plan D Average Monthly Cost in Royal Palm Beach, FL (33411)* | |

| Gender: Female, Age 65 | $292.76 |

| Gender: Male, Age 65 | $317.92 |

| Gender: Female, Age 75 | $374.26 |

| Gender: Male, Age 75 | $409.65 |

Here’s a sample of a Medicare Supplement Plan D Premium Comparison.

Benefits of Medicare Supplement Plan D

Medicare Supplement Plan D offers several benefits that make it an attractive option for retirees seeking comprehensive coverage:

Comprehensive Coverage: Plan D provides coverage for a wide range of healthcare services, including hospital stays, doctor visits, and skilled nursing facility care. With Plan D, beneficiaries can have peace of mind knowing that many of their healthcare expenses are covered.

Predictable Costs: Unlike Medicare Advantage plans, which may have varying copayments and deductibles, Medigap plans like Plan D offer predictable costs. Beneficiaries can budget more effectively for their healthcare expenses since they know what their out-of-pocket costs will be.

Freedom to Choose Providers: With Medicare Supplement Plan D, beneficiaries have the flexibility to choose any healthcare provider that accepts Medicare assignment. There are no provider networks, allowing retirees to seek care from the providers they trust.

Guaranteed Renewability: Medicare Supplement plans are guaranteed renewable, meaning the insurance company cannot cancel your coverage as long as you pay your premiums on time. This provides stability and continuity of coverage, even if your health needs change over time.

Considerations Before Enrolling

Before enrolling in Medicare Supplement Plan D, it’s essential to consider various factors to ensure it aligns with your healthcare needs and budget:

Coverage Needs: Evaluate your current healthcare needs and anticipate any future medical expenses. Consider whether Plan D’s coverage aligns with your healthcare priorities and preferences.

Cost Analysis: Compare the premiums, deductibles, and out-of-pocket costs associated with Plan D from different insurance companies. Choose a plan that provides comprehensive coverage at a reasonable cost.

Enrollment Period: The best time to enroll in a Medicare Supplement plan, including Plan D, is during your Medigap Open Enrollment Period, which begins when you’re 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed-issue rights, meaning you cannot be denied coverage or charged higher premiums due to pre-existing conditions.

Medigap Plan Eligibility: To enroll in a Medicare Supplement plan like Plan D, you must be enrolled in Medicare Part A and Part B. Additionally, you cannot have a Medicare Advantage plan if you want to enroll in a Medigap plan.

Conclusion

Medicare Supplement Plan D offers comprehensive coverage and financial protection to Medicare beneficiaries seeking additional healthcare benefits. By understanding its coverage, benefits, and important considerations, retirees can make informed decisions about their healthcare coverage in retirement. Whether you’re looking for predictable costs, freedom of choice, or stability in coverage, Plan D provides a compelling option that meets diverse needs and preferences. As always, consult with a licensed insurance agent or Medicare advisor to explore your options and select the best plan for your individual circumstances. With Medicare Supplement Plan D, you can embrace retirement with confidence, knowing that your healthcare needs are well taken care of.

Additional Resources:

- Medicare.gov: https://www.medicare.gov/medigap-supplemental-insurance-plans/

- National Association of Health Underwriters (NAHU): https://welcometonahu.org/

- State Health Insurance Assistance Programs (SHIPs): https://www.shiphelp.org/