Has Medicare Supplement Plan J expired? Is there a replacement? What do you need to do?

Let’s walk you through exactly what Plan J covered, so you will know what you need to do in the future. We will also explain why the government expired it.

What is Medigap Plan J?

If you are new to the world of Medicare Supplements, here’s a brief primer. Once you get close to 65, Medicare is on the horizon. It is great health coverage, but not perfect. There are gaps. Medicare Supplements exist to fill those gaps in coverage. Medicare is a truly beneficial product for seniors. But over time health insurance has evolved and Traditional Medicare is not as comprehensive as the health insurance you have owned. Because Supplements fill those gaps they are often referred to as Medigap policies.

All Plans are built off Plan A, so it’s important to know what Plan A covers.

Plan A Benefits:

- Medicare Part A Coinsurance & hospital cost (up to an additional 365 days after Medicare benefits are used)

- Medicare Part B Coinsurance or Copayment

- First 3 Pints of Blood

- Part A Hospice Care Coinsurance or Copayment

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Medicare Basics

Also, let’s look at some Medicare Basics before we jump into Plan J benefits. As you know, Medicare provides medical coverage to US citizens 65 and older. Medicare has two major parts – Original Medicare Part A & Part B.

Medicare Part A covers:

- Hospital Care

- Skilled Nursing Facility Care

- Nursing Home Care

- Hospice Care

- Home Health Services

Medicare Part B covers:

- Ambulance Services

- Durable Medical Equipment

- Mental Health

-Inpatient

-Outpatient

-Partial Hospitalization - Getting a Second Opinion Before Surgery

- Limited Outpatient Prescription Drugs

Plan J was a comprehensive attempt to cover all the gaps, especially deductibles and co-pays. Those can get rather larger if you need surgery, consultation from several doctors, or long-term treatment.

Medigap High Deductible Benefits of Plan J

Medicare Supplement Plan J was the most comprehensive coverage of any of the supplements prior to its expiration. It filled every gap in Medicare Part A and Part B, including:

- Medicare Parts A and Part B Deductibles

- Medicare Parts A and Part B Coinsurance

- Medicare Part B Excess Charges

- Hospice Care Coinsurance

- Skilled Nursing Care Coinsurance

- Foreign Travel Emergencies

- Prescription Drug Coverage

- Coinsurance and hospital stay up to 365 days after Medicare benefits are used up

- Part B coinsurance or copayment

- Blood (first 3 pints)

- Preventive care ($120 per year)

- At-home recovery ($1600 per year)

It expanded Parts A & B to foreign travel. Preventative care and At Home Recovery were added because they weren’t covered by Medicare. Eventually, Medicare added these features and they are included today.

But the most significant coverage is the Medicare prescription drug benefit. Medicare also adds Part D which provided an option for prescription drug coverage.

There were also certain health conditions not covered by Plan J, and they include the following:

- Dental Care

- Glasses

- Hearing Aids

- Long-term Care in Nursing home

- Nursing care

- Eye Care

- Part of the reason it was canceled?

Why was it Expired

On June 1, 2010, the Government expired the said Medigap policy. You’ve probably guessed some of the reasons by now. Medicare has updated and evolved and many features added by Plan J were made part of Traditional Medicare.

Even though it is expired, the policy remains in force for anyone admitted to it as of June 1, 2010. There is a separate annual deductible for current holders of Plan J.

Reasons Congress Expired Plan J

- The prescription drug benefit was too expensive relative to the benefit. Less than one in 10 Medicare beneficiaries actually purchase a plan with prescription drugs because of the cost.

- The Medicare Modernization Act was passed in 2003 but did not go into effect until 2010. Medicare Part D (Prescription Drug Coverage) was added.

- At-Home recovery care and Preventative Care were added to Medicare.

- Plan J now had duplicate coverage to Traditional Medicare

- Once expired, current enrollees in Plan J were able to keep their coverage. No one could enroll as a new customer into Plan J.

What if you are still an enrollee in Plan J? Should you consider a different Plan, and risk losing Plan J forever?

Most people have moved away from Plan J, mostly due to consistent rate increases. Pricing on J continues to increase, and you are not getting any benefit from the increase. Everything you are paying extra for is already included in Traditional Medicare or another available Plan.

Rates will continue to increase on Plan J

From the perspective of an insurance company, the costs of prescription drugs for an aging population create consistent losses. The rates increase to offset the drug coverage increases the insurance company sees every year. Expenses to operate the plan are also increasing, and rates must follow for insurance companies to remain profitable.

Medicare Part D has a more robust prescription drug plan than the former Plan J drug coverage. Medicare filled the gaps that Plan J was created for.

Calculation of the Deductible Amount for Plan J

Section 1882(p)(11)(C)(i) of the Social Security Act is used to establish the deductible for plans F, G, and J.

In accordance with this clause, the Medigap high deductible was set at $1,500 for 1998 and 1999, and it was mandated that it rise annually by a percentage equal to the CPI-U, all items, and the US city average.

According to section 1882(p)(11)(C)(ii) of the Social Security Act, the appropriate CPI-U rise from 2021 to 2022 is 8.26%, which results in a deductible of $2,700 after rounding to the nearest $10.

What Plan Should I Switch To?

That depends on your healthcare needs. We can help you analyze your current needs and recommend supplement plans, medicare carriers, and the perfect time that helps you meet your healthcare and budget goals.

The closest current Plan to J is Medicare Supplement Plan F.

Plan F has the same benefits coverage as Plan J, minus the Preventative Care and At-Home Recovery services. Now that Medicare Supplement Insurance covers those two line items, the plans perform equally, in terms of coverage.

However, you need to remember that Plan F will not be available for those born after January 1, 1955. This isn’t a reason to avoid Plan F, but there are other options.

Medicare Supplement Plan G is one of those options. Plan G is almost identical to F except the Part B deductible is not covered. However, you may save enough in your premium to cover the deductible.

Here’s a good way to see if switching to G is a wise financial move:

- Take your current monthly premium for Plan J

- Subtract the monthly premium for Plan G

- Multiply that by 12

- Then add the current Part B deductible of $257 to the result since you have to pay that

- Now, compare the annual total of Plan G and your current Plan J. Is Plan G cheaper? Most likely.

If you don’t need full coverage, and you have specific budget restraints, there are other Medigap Plans that could fit your needs. Plans range from A,B,C,D,F,G,K,L,M, and N.

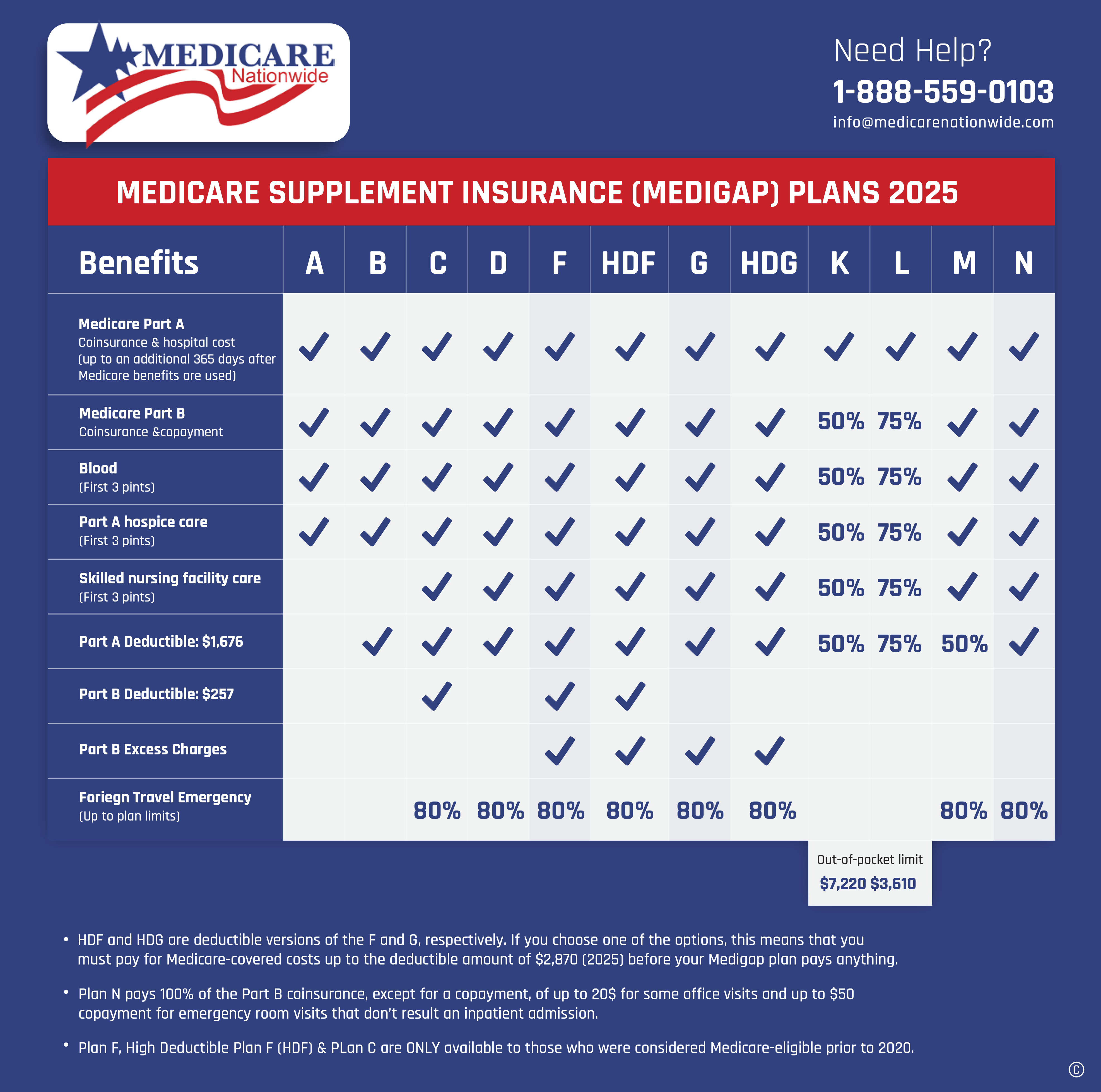

This chart will give you a breakdown of the coverage of the various plans.

Tips on choosing an appropriate plan:

- Look at your past health history and your family history. If your family has a poor health history, especially as they age, you should consider a plan with more coverage.

- Reduce your Risk Factors. Begin implementing healthy habits into your life such as diet change and exercise. Those habits will improve your health and prevent you from greater medical expenses over time. If you have good health habits, you may be able to pick a plan with less coverage.

- Look at your finances. Do you have enough money set aside to self-insure against health issues? If so you don’t need a robust plan full of coverage options. You can pick something with higher deductibles and co-pays because you have the finances to handle those costs.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

How to Switch Medigap Plans

Switching plans is easy. Deciding is hard. We can help with both. The chart above provides the differences in all the current Plans.

We can help you realistically analyze what you need in a plan based on your current budget and healthcare needs. Remember, supplement insurance plans do not differ between the various companies we represent. The differences are in the rates between private insurance companies and the extra services they offer. Once you pick a plan you are comfortable with, it will be time to choose the company.

We do the comparison shopping for you and provide those options to you, so you can make the best possible decision.

Contact us today and we can walk you through a series of questions to find the best plan. Then we will shop for the best pricing in your geographic area.

Prefer to chat by phone? Give us a call at 1-888-559-0103