Introduction to High Deductible Plan G

You may be asking multiple questions:

- What is Plan G?

- What does the High Deductible option cover? What are my costs?

- Why should I buy a High Deductible plan?

We address those questions and more in the video below:

Average Premiums and Rate Increases for Plan HDG

| Medicare Supplement Plan HDG Average Monthly Cost in Newark, NJ (07102)* | |

| Gender: Female, Age 65 | $55.02 |

| Gender: Male, Age 65 | $61.46 |

| Gender: Female, Age 75 | $73.47 |

| Gender: Male, Age 75 | $82.00 |

| Medicare Supplement Plan HDG Average Monthly Cost in Broken Arrow, OK (74012)* | |

| Gender: Female, Age 65 | $42.16 |

| Gender: Male, Age 65 | $46.94 |

| Gender: Female, Age 75 | $52.27 |

| Gender: Male, Age 75 | $62.12 |

| Medicare Supplement Plan HDG Average Monthly Cost in Pasadena, CA (91104)* | |

| Gender: Female, Age 65 | $55.93 |

| Gender: Male, Age 65 | $55.93 |

| Gender: Female, Age 75 | $83.18 |

| Gender: Male, Age 75 | $83.18 |

Here’s a sample of a Medicare Supplement Plan HDG Premium Comparison.

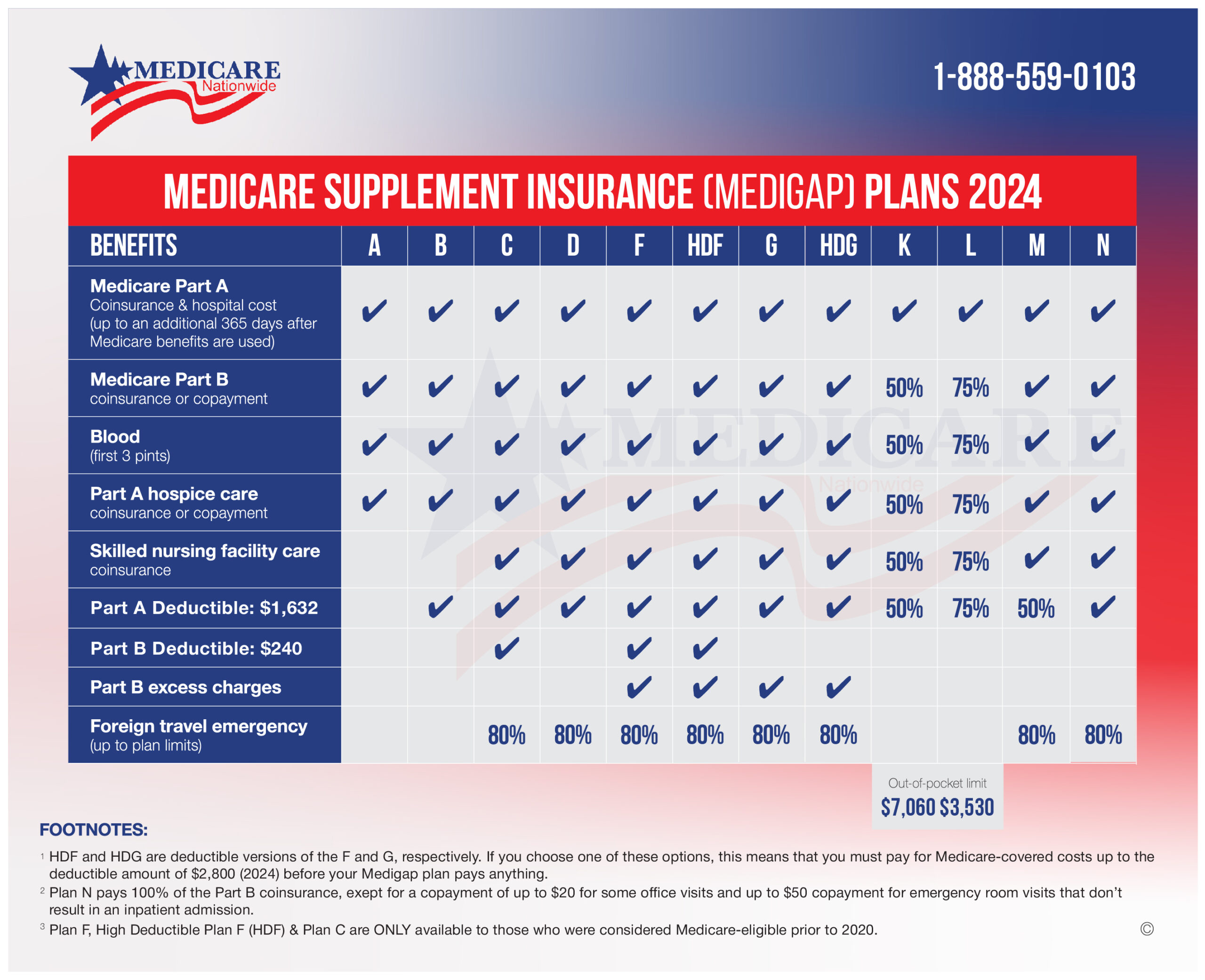

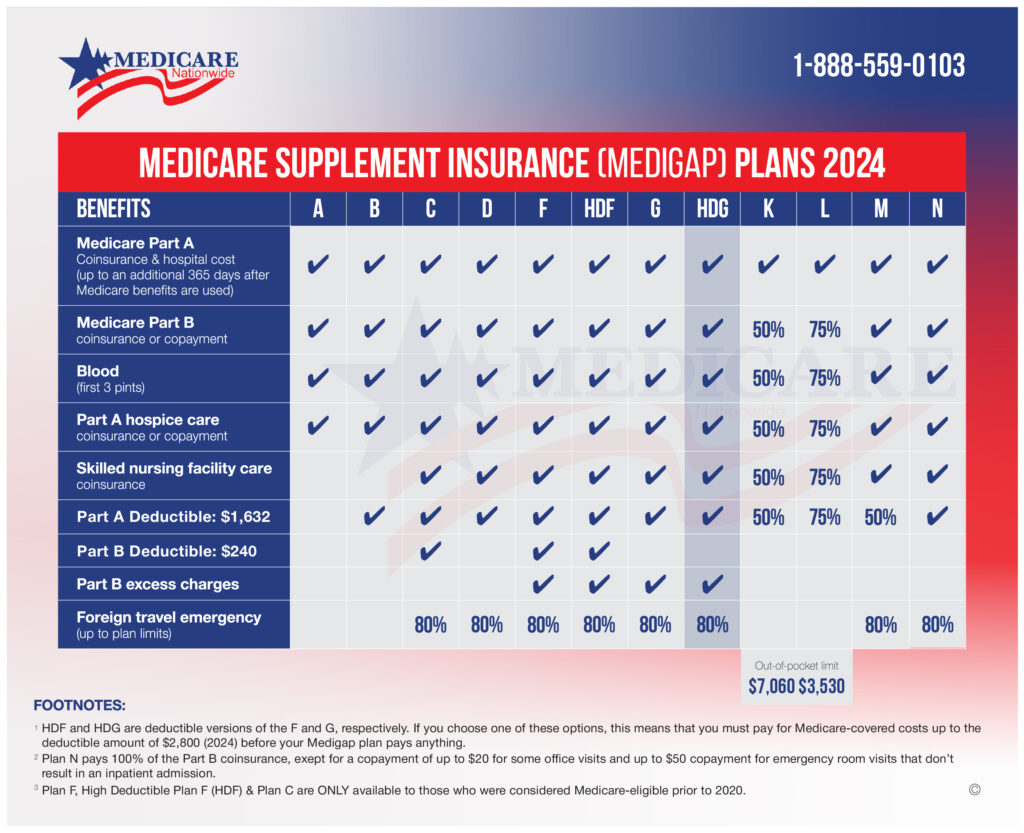

Medicare Supplement Insurance Plans – What is Plan G?

In this section let’s discuss Plan G because it helps to understand what Plan G is before you understand the High deductible Plan G.

Medicare Supplement Plan G has become the most popular Medicare supplement insurance plan. It’s very similar to Plan F, with one exception. The Medicare Part B deductible is not covered.

Here are examples of what Plan G Covers:

- Medicare Part A deductible, coinsurance, & hospital costs

- Medicare Part B coinsurance, co-payment, & excess charges

- Preventative care

- Part B coinsurance

- Basic doctor visits

- Foreign travel emergency expenses

- Skilled nursing facility coinsurance

- Durable medical equipment (DME), blood transfusions, lab work, X-rays, surgeries, ambulance rides, etc.

Simply put Plan G covers ALL of Part A and Part B expenses approved by Medicare.

Medicare pays as your primary insurance. Plan G pays as your secondary insurance. If you have $1,000 in Medicare-approved expenses, Medicare would pay first and leave you a balance. Let’s say that balance is now 20% as it was a Part B expense, Plan G would cover $200 or 20%, so that way you owe NOTHING for your Medicare-approved claim of $1,000.

Here is something key to understanding, the Part B deductible is Medicare’s deductible, not Plan G’s deductible! Plan G just doesn’t cover Medicare’s Part B deductible. What that means is that both Medicare and your medical provider are waiting for you to pay your doctor the Part B deductible before your primary (Medicare) and secondary (Plan G) cover you completely for Medicare-approved claims.

Here’s what the Plan G deductible looks like in action.

Bob goes to the doctor for routine blood work on March 1. In April, he gets a bill from the doctor for $240. That $240 is his Part B deductible. Once he pays that bill, he will no longer incur any more out-of-pocket costs when he visits the doctor for Medicare-approved charges.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

I’ve heard about Plan F, what is the difference between Plan F and Plan G?

Both plans are federally standardized by Medicare to offer the same insurance coverage no matter what carrier you choose. Plan F is a Plan F no matter if you choose Aetna, Cigna, Mutual of Omaha, etc. A Plan G is a Plan G just the same. The only difference between all Plan F’s and all Plan G’s is that Plan F covers the Part B deductible, but Plan G does not. That is seriously the only difference. So it is all about determining if you are OVERPAYING just to cover the small once-a-year deductible that Plan F covers.

If you are saving more than the Part B deductible amount in premiums for the year by purchasing Plan G, then it makes sense to pick Plan G over F. You can see why so many people choose this one. So outside of the deductible, Plan G is identical and the second most comprehensive to Plan F.

This above cost comparison describes Plan F vs Plan G. We will discuss how to do a cost comparison for the High-deductible Plan G vs Standard Plan G below.

Insurance Terms:

Medigap: Medigap pays the “gap” in coverage for Part A and Part B. Medigap is also known as a Medicare supplement plan. Medigap plans are not Medicare Advantage plans. For more information on the difference, you can visit this article here: https://medicarenationwide.com/medicare-advantage-vs-medigap/

Deductible: The amount you pay to your medical provider before your insurance covers you.

Copayment: A fixed dollar amount. Such as $20 for an office visit.

Coinsurance: A percentage you would owe after you satisfy your deductible. Such as you owe 20% after Medicare pays as your primary insurance. However, if you get a Medigap plan as your secondary insurance, your 20% coinsurance would be covered and you would owe NOTHING.

Primary insurance: This could be a group plan, Medicare, or Medicare Advantage plan. Whoever is primarily responsible for approving and paying your medical claims.

Secondary insurance: This is who you go to after your primary insurance to approve and pay the remaining amount of your medical claims. Medigap carriers often have automatic claims filing where they automatically pay the remaining amount after Medicare pays first as your primary insurance. For more information about automatic claims filing and Medigap carriers that have that service read our top ten Medigap carrier article: https://medicarenationwide.com/10-best-medicare-supplemental-insurance-companies/

Understanding High Deductible Options in Medigap

What Does a High Deductible Plan Mean?

A High Deductible Plan is a plan designed where you adopt a deductible in order to lower your monthly premium. A deductible is what you pay your medical provider before your insurance kicks in. If you think about car insurance, your insurance premiums would be astronomical if you didn’t have a responsibility to pay the first $1,000 yourself. The same logic holds true for health insurance.

High Deductible Plan F

As we mentioned earlier, Plan F is being phased out and Plan G is replacing it. The best way to explain how the High Deductible G will work is to compare it to the current Plan F option.

In 2024, the HDF and HDG have a $2800 deductible.

Here are the deductible changes since 2015. As you can see, for some years, there has been very little price movement. In other years there is an increase, but it is usually small.

2015 – $2180

2016 – $2180

2017 – $2200

2018 – $2240

2019 – $2300

2020 – $2340

2021 – $2370

2022 – $2490

2023 – $2700

2024 – $2800

For the year 2024, there is a $1632 deductible and co-payments north of $300 a day for Part A. The out-of-pocket costs for Part A will go towards the $2800 deductible for the calendar year.

The 20% out-of-pocket costs for Part B and the Part B deductible will also be applied to the $2,800 deductible.

This example will help illustrate how the HDG works.

Susan is on Plan G. Her doctor visits will cost her the Part B deductible of $240. She is charged this amount prior to reaching her $2800 deductible. The $240 will be applied to the deductible.

However, if she has already spent the $2,800 on Part A (hospital costs), she still needs to satisfy the Part B deductible of $240. In this case, the total max limit would be $2,800 + $240 = $3,040.

On the HDF, it doesn’t matter when you satisfy your Part B deductible; you satisfy your deductible when you reach $2,800.

Why Choose a High-Deductible Medigap Plan?

It might feel like you are going to have more out-of-pocket expenses. Not necessarily.

Let’s use a 75-year-old woman under Plan F as an example. For a 75-year-old, the average premium is around $3,000 on Plan F. If she bought a Medigap High Deductible Plan, her premium offer drops to around $690. She is saving $2,310 in premiums for the year! In a worst-case scenario, she loses all the savings to satisfy the deductible of $2,800. The most likely way that would happen is she would have two hospital trips for the year since the Part A deductible is $1632 and if she had to go twice that would cap her at $2,800. In a best-case scenario, she doesn’t have any medical bills and she can keep the $2,310 she saved by lowering her premiums.

Make sure to quote both plans and consider the savings. We can see savings of many thousands a year by switching to HDG. Let’s say you save $1,000 on premiums, should you still buy it? If you are in good health and don’t anticipate any changes in medical expenses, it might be worth taking the chance of potentially paying that deductible of $2,800. Please keep in mind that Medicare will still pay your claims as your primary insurance during the deductible period. For example, let’s say your Medicare-approved claim was for $1,000. Medicare would still pay $800. Your secondary would wait for you to pay the $200. Once you reached $2,800 for the year, then your secondary would pay all those future balances after Medicare pays for Medicare-approved claims.

Other Considerations before choosing Medigap High Deductible Policies

There may be other considerations to choosing deductible plans besides financial ones.

A good example is someone on a Medicare Advantage Plan. With Advantage plans, the premiums may be cheaper, but there are co-pays and co-insurance that must be paid out-of-pocket. Often these costs are more than anyone would pay with a high-deductible plan. But money is not the only reason for switching plans.

One main difference is that the high deductible plan stays with Medicare as your secondary insurance to Medicare. This means that you do not have to go to a privately managed care plan, called a Medicare Advantage plan.

The Bottom Line

Any time you go for a doctor’s visit, Medicare will pay 80%, and you will get a bill for 20%. Each time you pay this amount, it will apply to the deductible. It is good practice to keep up with this running total so you know when you are getting close to satisfying your deductible.

Some people do not like this kind of financial management and will opt for the traditional plan F, G or N, so they don’t have to manage or track the deductible costs.

Medicare Nationwide offers hundreds of plan options that have been selected by thousands of American seniors since 2012. Medicare Nationwide offers independent brokers with a minimum of three years in the business, focusing on one-to-one connections to ensure seniors select a suitable plan. Our services can help find you a tailored product designed for your budget and health needs. It is entirely free to work with us, so take advantage of our services!

Prefer to chat by phone? Give us a call at 1-888-559-0103.