What Does Plan C Cover?

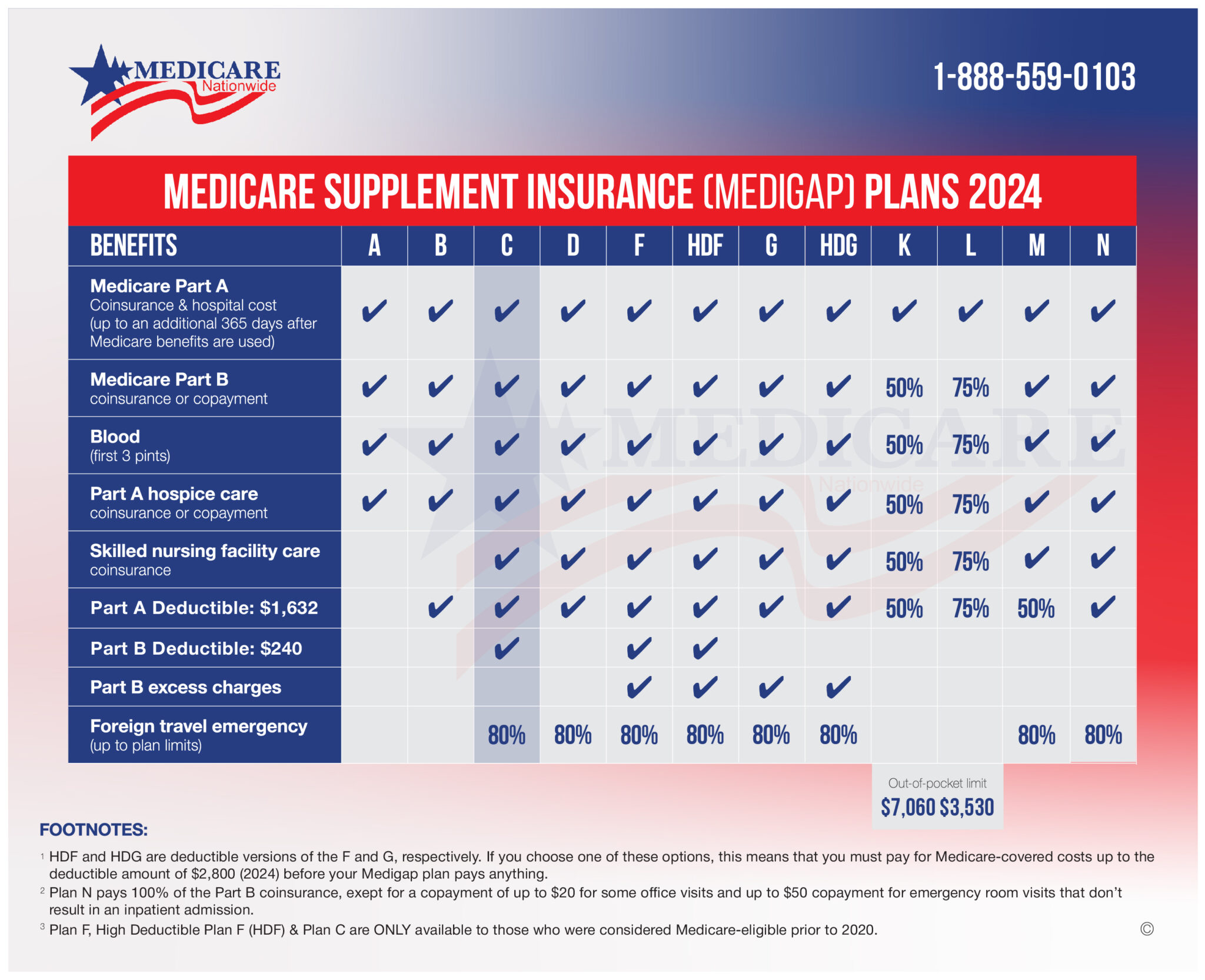

Plan C offered extensive coverage, including:

- Part A coinsurance and hospital costs: Covered the 20% coinsurance you typically pay for inpatient hospital stays and skilled nursing facility care. It even provided an additional 365 days of coverage after Medicare benefits ended.expand_more

- Part B coinsurance or copayment: Covered the 20% coinsurance or copayment for outpatient medical services and preventive care.expand_more

- Part A hospice care coinsurance: Covered the 20% coinsurance for hospice care.

- Skilled nursing facility care coinsurance: Covered the 20% coinsurance for skilled nursing facility care after the initial 20 days covered by Medicare.exclamation

- Blood (first 3 pints): Covered the cost of the first 3 pints of blood each year.expand_more

- Foreign travel emergency medical assistance: Provided limited emergency medical coverage while traveling outside the US.

Important Note: As of January 1, 2020, Plan C is no longer available to new beneficiaries. This means if you become eligible for Medicare on or after this date, you cannot purchase Plan C. However, if you enrolled in Plan C before 2020, you can generally keep your existing plan.

Costs and Premiums

Plan C premiums vary depending on several factors, including:

- Your age, location, and health status

- The insurance company you choose

- Any discounts or promotions offered

Since Plan C is no longer available to new enrollees, information about its current premiums may not be readily available. However, it’s important to remember that Medigap plans in general tend to have higher premiums compared to other Medicare options like Medicare Advantage plans.

| Medicare Supplement Plan C Average Monthly Cost in Simpsonville, SC (29681)* | |

| Gender: Female, Age 65 | $188.60 |

| Gender: Male, Age 65 | $206.01 |

| Gender: Female, Age 75 | $265.02 |

| Gender: Male, Age 75 | $290.42 |

| Medicare Supplement Plan C Average Monthly Cost in Saint Peters, MO (63376)* | |

| Gender: Female, Age 65 | $263.36 |

| Gender: Male, Age 65 | $288.62 |

| Gender: Female, Age 75 | $356.37 |

| Gender: Male, Age 75 | $389.78 |

| Medicare Supplement Plan C Average Monthly Cost in San Francisco, CA (94112)* | |

| Gender: Female, Age 65 | $217.39 |

| Gender: Male, Age 65 | $217.39 |

| Gender: Female, Age 75 | $318.15 |

| Gender: Male, Age 75 | $318.15 |

Here’s a sample of a Medicare Supplement Plan C Premium Comparison.

Alternatives to Plan C

If you’re not eligible for Plan C, several other Medigap plans offer varying levels of coverage:

- Plan N: Covers most costs except the Part B deductible and excess charges.

- Plan G: Covers all the costs that Plan N does, plus the Part B deductible.

- Plan F: Covers all the costs that Plan G does, except for foreign travel emergency medical assistance (no longer available to new enrollees after June 2020).

Choosing the Right Medicare Plan:

Selecting the right Medicare plan depends on your individual needs, budget, and health status. Consider factors like:

- Your expected medical expenses: If you anticipate extensive healthcare needs, a more comprehensive plan like Plan G might be suitable.

- Your budget: Medigap plans generally have higher premiums than Medicare Advantage plans, so factor in affordability.

- Your preferred network: Some Medigap plans offer broader network access than others.

Additional Resources:

- Medicare.gov: https://www.medicare.gov/medigap-supplemental-insurance-plans/

- National Association of Health Underwriters (NAHU): https://welcometonahu.org/

- State Health Insurance Assistance Programs (SHIPs): https://www.shiphelp.org/

Remember, consulting with a licensed insurance agent or healthcare professional can help you navigate your Medicare options and choose the plan that best suits your needs.