Who is Allstate?

Allstate Health Insurance is known for its most comprehensive coverage. Allstate Medigap and Original Medicare work to cover out-of-pocket expenses and medical costs. It pays the services cost of Medicare Part A and Part B. In addition, National General Insurance gives the flexibility to see any doctor or hospital, with no network restrictions or referrals, as long as Medicare is accepted. So, Allstate Medicare plans are less restrictive than its competitors.

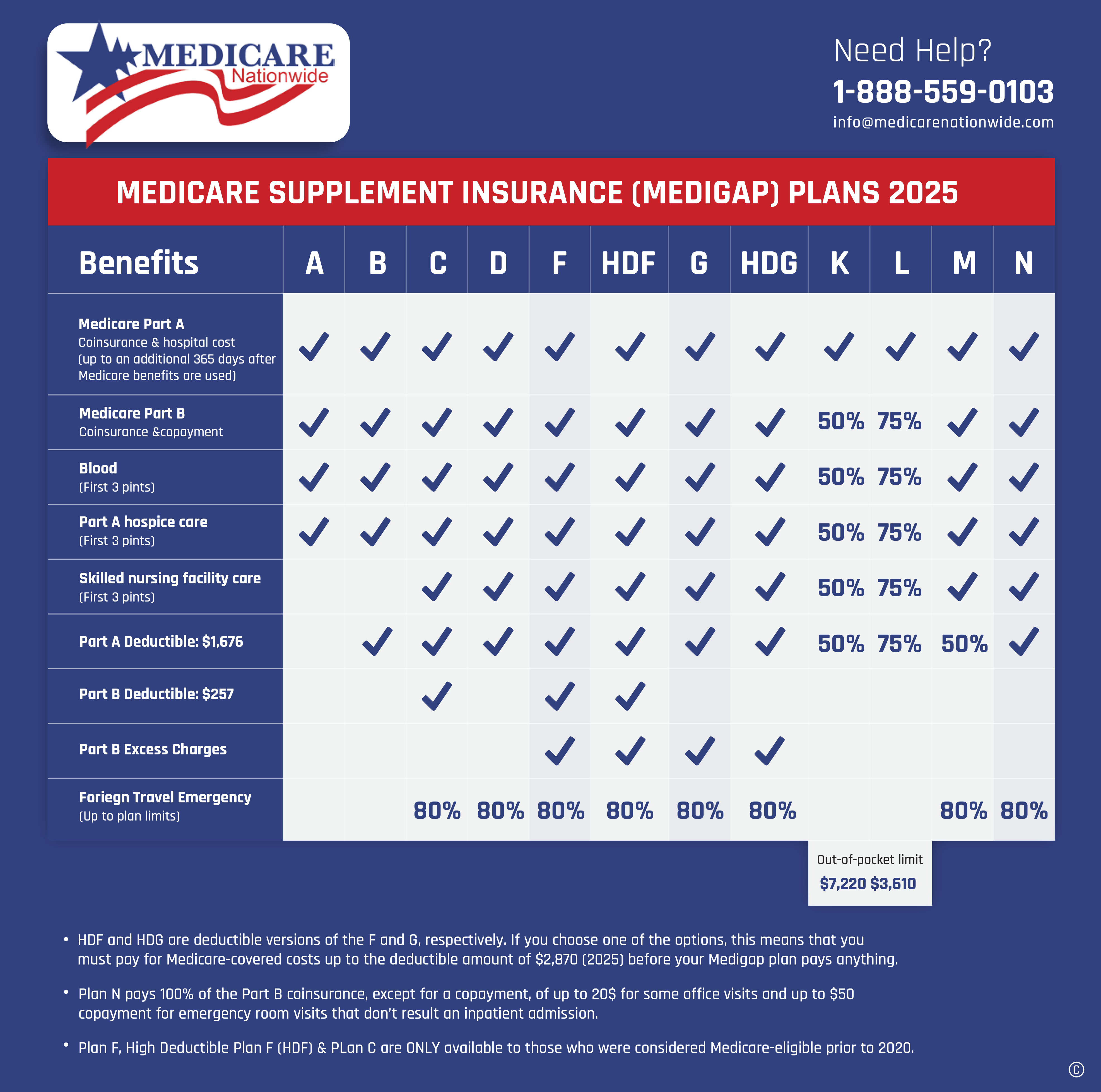

Allstate Medicare Supplement Insurance Plans

Allstate Medicare Supplement offers ten standardized Medicare Supplement Plans in different states of the US. This chart is helpful to understand what coverages its plans have.

Allstate is one of the companies that offer additional discounts for enrolling with certain products. For example, its Medigap premium gives a household discount for other family members.

National General offers Plans A, F, High Deductible F, G, and N in most areas. It gives several discounts to their enrollee, and its prices are very competitive. You can see any doctor you want. Your coverage is portable and travels with you all across the country.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Brief Details of the Available Plans

Medicare Supplement Plan A

National General Supplemental Insurance Plan A is considered the most basic plan of all health care plans. Its coverage is limited, but it is enough to save your out-of-pocket cost.

Here is the list of supplemental insurance products benefits:

- 100% of Hospital Care Coinsurance Covered

- First 3 Pints of Blood

- Hospice Care

- Part B Copayment

- If you are a healthy person and your health keeps stable then this plan is the best choice for you. This plan gives you an opportunity to make your needs fulfilled and saves you money.

Medicare Supplemental Plan F

It is one of the most popular insurance plans in the Medicare Insurance market. Plan F covers almost all gaps that Original Medicare does not cover.

- Medicare Part A Coinsurance and Hospital Costs

- Medicare Part A Deductible

- Medicare Part B Coinsurance and Copays

- Medicare Part B Deductible

- Medicare Part B Excess Charges

- Blood (first three pints)

- Part A Hospice Care Coinsurance and Copay (including room and board)

- Skilled Nursing Facility Coinsurance.

Medicare Supplemental Plan G

Medicare Supplemental Insurance Plan F covers almost all gaps that Original Medicare does not cover. Plan G includes all the benefits of Medicare Supplement Plans A, B, and C with the exception of the Medicare Part B deductible.

- Medicare Part A Coinsurance and Hospital Care

- Medicare Part B Coinsurance

- Blood (first three pints)

- Medicare Part A Deductible

- Medicare Part B Excess Charges

- Skilled Nursing Facility

- Hospice Care

- Foreign Travel Emergency

Medicare Supplement Plan N

Medicare Supplement Plan N is known for its comprehensive coverage. Not only this, it is a more focused and affordable plan. In addition, It covers all Medicare Part B Coinsurance expenses. The only out-of-pocket costs are that you have to pay $20 copays for doctor visits and $50 copays for emergency room visits.

Plan N coverage has:

- Part A Coinsurance (hospital care)

- Part B Coinsurance

- Skilled Nursing Facility

- Part A deductibles

- Hospice Care

- Foreign Travel Emergencies

National General Plans give you the opportunity to avail:

- It gives the flexibility to see any doctor or hospital, with no network restrictions or referrals, as long as Medicare is accepted.

- Automatic renewal as long as you pay the premium on time, with benefits that increase with the Medicare deductible increase.

- No paperwork to file. Just present your ID card, and benefits will be paid directly to the provider.

Above mentioned points are the limited policies offered by National General’s Medicare plans to cover the expenses which Medicare only approves but does not cover.

Benefits of Allstate Medigap

Here is a long list of its benefits:

- Multi-discount (Stackable discount of up to 25% in savings)

- E-app & Instant ID cards

- Increased Commission

- Online Signature and Electronic Signature Method

- Dual Application Discount up to 10%

- When two people in the same residence apply for MedSupp at the same time (7% roommate + 3% dual-applicant)

- Annual Pay Discount of 10%

- Select Annual Payment for a 10% Discount on the Premium

- Activity Tracker Discount _ 5%

- Register your Fitbit/Apple Watch or other wearables

- Allstate Medicare Supplement Plans are available in 41 states

- Medicare Supplements, Dental Plans, Fixed Benefit Medical, Short-Term Medical, and Accident Insurance

- Access to Active & Fit at over 10,000 Fitness Centers

Allstate Benefits offer a variety of insurance plans to help protect you from life’s uncertainties. It can help protect your savings from high-deductible health plans, coinsurance, and copayments.

Senior Dental/Vision/ Hearing

National General has a very comprehensive policy for dental, vision, and hearing programs. These programs are run through the Aetna network. These are some benefits one can get after enrollment.

Optional/Passive Aetna Network

- Up to 25% Day 1 Services

- Up to 100% Basic Coverage

- Denture Repairs Covered

- Full-mouth X-ray Covered

- Denture Coverage is available with Level Two and Level Three Plans only

- Implant Coverage is available with Level Three only

Dental Benefits

There are 3 levels of Dental Care Benefits:

| Benefits | Level One | Level Two | Level Three |

| Annual Deductible | Individual: $50 | Individual: $50 | Individual: $50 |

| Family: $150 | Family: $150 | Family: $150 | |

| Out-of-Network: $100/$300 | Out-of-Network: $100/$300 | Out-of-Network: $100/$300 | |

| Preventive Services | 100% | 100% | 100% |

| Out-of-Network: 100% after | Out-of-Network: 100% after | Out-of-Network: 100% after | |

| (ONN deductible) | (ONN deductible) | (ONN deductible) | |

| Basic Services | Day 1: $25% | Day 1: $25% | Day 1: $25% |

| Year 2+: 50% | Year 2+: 50% | Year 2+: 50% | |

| Major Services | Not Covered | Day 1: $25% | Day 1: $25% |

| Year 2+: 50% | Year 2+: 50% | ||

| Dentures | Not Covered | Day 1: $25% | Day 1: $25% |

| Year 2+: 50% | Year 2+: 50% | ||

| Implants | Not Covered | Not Covered | Day 1: $25% |

| Year 2+: 50% | |||

| Annual Maximum (Per Member) | Day 1: $750 | Day 1: $1,000 | Day 1: $1,500 |

| Year 2: $1,500 | Year 2+: $2,000 | Year 2+: $3,000 |

Dental Discount

- 10% Preferred Discount

- Has any applicant had a filling, crown, root canal, dentures, or implants within the last 12 months

- 10% Bundling Discount available when the Dental Plan is paired with either MedSupp or Sr. Indemnity on the same application (Online Enrollments)

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Vision – Optional Vision Benefits

Allstate Vision Benefits have Two Levels of Vision Benefits:

| Benefits | Level One | Level Two | Level Three |

| Annual Deductible | Individual: $50 | Individual: $50 | Individual: $50 |

| Family: $150 | Family: $150 | Family: $150 | |

| Out-of-Network: $100/$300 | Out-of-Network: $100/$300 | Out-of-Network: $100/$300 | |

| Preventive Services | 100% | 100% | 100% |

| Out-of-Network: 100% after | Out-of-Network: 100% after | Out-of-Network: 100% after | |

| (ONN deductible) | (ONN deductible) | (ONN deductible) | |

| Basic Services | Day 1: $25% | Day 1: $25% | Day 1: $25% |

| Year 2+: 50% | Year 2+: 50% | Year 2+: 50% | |

| Major Services | Not Covered | Day 1: $25% | Day 1: $25% |

| Year 2+: 50% | Year 2+: 50% | ||

| Dentures | Not Covered | Day 1: $25% | Day 1: $25% |

| Year 2+: 50% | Year 2+: 50% | ||

| Implants | Not Covered | Not Covered | Day 1: $25% |

| Year 2+: 50% | |||

| Annual Maximum (Per Member) | Day 1: $750 | Day 1: $1,000 | Day 1: $1,500 |

| Year 2: $1,500 | Year 2+: $2,000 | Year 2+: $3,000 |

Financial Strength and Ratings

Allstate Insurance Company is new and rapidly growing in the Medicare market. High quality and strict policies are the core values of this company. Its financial strength has been extreme and stable from its start until now. A.M, the rating company, gives an A+ rating to Allstate Medicare group Supplemental Insurance.

The financial strength of a Medicare company is based on these values:

- Quality Services

- Stable Rates

- Competitive Rates

- Claim Pressing Procedure

- Customer Review

This company has all these values to get customer satisfaction.

Reviews

The company offers the best plan, but some policies are not friendly for its users due to high premiums and costs. Here are some excellent points of National General Medicare plans:

- Strong Provider Network

- Flexible Short-Term Health Plan

- Deductibles

- Coinsurance Levels

- Out-Of-Pocket Maximums and Coverage Period

- Gym Facility

- Coverage in 35 States

- Good Range of Extras and Benefits

Allstate Insurance and Medicare

Allstate Medicare services have the same coverage as other insurance companies.

Allstate Medicare Part A

It covers a range of medical areas, hospice, skilled nursing care, hospital stays coverage, and home health care.

Part A provides:

- Inpatient Hospital Care

- Home Health Care

- Hospice Care

- Skilled Nursing Facility

It isn’t responsible for giving you all the healthcare costs. It would be best if you bought a proper plan to cover all the health care costs.

Allstate Medicare Part B

Focuses on outpatient services. It covers almost 80% of outpatient services.

1. Preventative Services – Minor illnesses at an early stage that can be treated rapidly (flu) are covered in this plan.

2. Medical necessary services – This part covers diseases that are needed to diagnose.

- Clinical Research

- Durable Medical Equipment

- Ambulatory Service

- Blood Transfusion

- Free Screening for Different Tests

- Doctoral Service

- Mental Health (Inpatient & Outpatient) Partial Hospitalization.

3. How much does Medicare Insurance help you?

Medicare Supplement Insurance can help pay costs that the Original Medicare supplemental doesn’t cover. These costs can include:

- Part A Coinsurance and Deductibles

- An additional 365 days of hospital costs after the lifetime limit on Part A coverage is reached

- Part B Coinsurance (20% of most services you receive) and Deductibles

- The additional costs you may face by receiving care from a doctor who charges more than the amount Medicare agrees to pay for a service or procedure.

- Hospice Coinsurance

- Skilled Nursing Facility Coinsurance

- Emergency Care in a Foreign Country

- Blood Transfusions

Other Insurance offered by Allstate

Allstate Life Insurance

Allstate Life Insurance company is a complete package to secure health inflation. In addition, it protects you and your family even after you pass away. It can provide financial security and stability. A Life Insurance policy prepares you for the worst but can plan for the best.

Life Insurance can help your loved ones:

- Cover the Rising Cost of Funeral Expenses

- Replace Lost Wages or the Value of your Time (e.g., stay-at-home spouse)

- Pay off Debt

- Provide for a College Education

- Leave an Inheritance

Whatever kind of Life Insurance policy you’re looking for, Allstate’s insurance company probably has it. Allstate offers term life, Whole Life, Universal Life, and Variable Universal Life.

Allstate Car Insurance

Allstate Insurance is making a big name in the auto market. It has a long list of coverages and discounts for auto insurance. These are the auto coverage points that are covered by Allstate Car Insurance.

- Property and Auto Damage Liability Protection

- Bodily Injury Liability Protection

- Personal Injury Protection

- Uninsured or Underinsured Motorist Coverage

- Medical Payments

- Auto Collision Coverage

- Comprehensive Coverage

- Roadside Coverage

- Rental Reimbursement

- Ride for Hire

What are Allstate Auto insurance discounts included?

Allstate is known for giving vast discounts to its customers with amazing auto insurance. We have brought the list of auto insurance discounts for your ease.

- Anti-lock Brake Discount

- New Car Discount

- Anti-theft Device Discount

- Automatic Payment Plan Discount

- Multiple Policy Discount

- Homeowner Discount

- Paperless Documents Discount

- Early Signing Discount

- Full Pay Discount

- Responsible Payer Discount

- Safe Driver Discount

- Smart Student Discount

- Drivewise Policy Credit

Bankrate review for Allstate Auto Insurance

Bankrate reviewed Allstate auto Insurance has a higher premium than its competitors. However, customer satisfaction is below average and received low ratings from repair professionals.

Allstate Home Insurance

Allstate home insurance got solid reviews from rating company J.D. power ranked sixth out of the 23 insurance companies in 2020 in the U.S.

Here is the list of discounts provided by this insurance company:

- Multi-Policy Discount

- Easy Pay Plan

- Claim Free Discount

- Protective Device Discount

- Early Signing Discount

- Welcome and Loyalty Discount

- Home Buyer Discount

- Responsible Payment Discount

There are several home-related insurance coverages sold by Allstate insurance. It included the standard type of coverage for its valuable customers.

- Dwelling Coverage

- Other Structure Coverage

- Personal Property Coverage

- Liability Insurance

- Additional Living Expenses

For extra liability insurance, there is the option of an umbrella insurance policy for homeowners.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Frequently Asked Questions:

Question 1: What premium one has to pay when buying National General Medicare Supplement policy?

Answer: To receive insurance benefits, you are responsible for paying fixed monthly premiums. However, the premium cost depends on your chosen plan and coverage. So, premiums can vary for different scenarios.

Question 2: How can I check on the status of the claim?

Answer: You can log in to the Allstate mobile app or My Account or contact your agent for an update on the status of your claim.

Question 3: Why Allstate Medicare Supplement Insurance?

Answer: Medicare Supplement Insurance works as a bridge to the financial gap that Original Medicare does not cover, especially when you have an emergency. A person above 65 or has specific disabilities surely needs insurance to avoid further health inflation and difficulties. Here insurance works as a protective shield.

Question 4: Does Medicare pay for everything?

Answer: No, most plans only offer part of the basics of health insurance in retirement. Coinsurance Copays and deductibles are usually included in the plan; to buy part B, you must pay 20% of the pocket. Sometimes, if the doctor does not accept the amount that Medicare agrees to, you have to pay it on your own.

Question 5: Does Star Rating matter for Medicare Supplement companies?

Answer: Yes, star rating matters a lot for Medicare Supplement Insurance companies. Medicare Supplement reviews are released every year by different credit rating companies. These companies give star ratings based on how well other plans of each category perform over the year. Quality of care and customer service play pivotal roles in plan performance.

Question 6: What are the Eligibility Requirements for Medicare Coverage?

Answer: Medicare Supplement is for people above 65 or younger, people with disabilities, and people with end-stage renal disease, but there are still some requirements to get Medicare coverage.

- You have to be a citizen of the U.S. or a permanent resident who has lived in the U.S. for at least five years.

You can get Part A without having to pay premiums if:

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You or your spouse had Medicare-covered government employment.

Question 7: What does Allstate’s life insurance cover?

Answer: Depending on the type of policy chosen by the customer, Allstate’s various life insurance plans offer options for lifetime coverage or Coverage for predetermined terms of up to 30 years. In addition, these insurance policies provide benefits after the policyholder’s death to cover various financial needs and obligations.