History of Bankers Fidelity Insurance

Bankers Fidelity Life Insurance Company, headquartered in Atlanta, GA, and licensed in 46 states and the District of Columbia, has been protecting seniors across the country since 1955. As a wholly owned subsidiary of Atlantic American Corporation, Bankers Fidelity Life Insurance Company and its subsidiary Bankers Fidelity Assurance Company build upon their legacy and anticipate a promising future.

For over 60 years, Bankers Fidelity Life Insurance Company has helped thousands of Americans with reliable insurance coverage. They are known for fast, fair claims and excellent customer service.

As a trusted leader in life and health insurance, they offer innovative products and valuable services. Their strong reputation is backed by industry recognition:

- Named one of the Top 100 Highest Ranking Companies by National Underwriter Life & Health magazine.

- Listed among Ward’s 50 Top Performing Life & Health Insurers.

- Rated A- (Excellent) by A.M. Best Company.

- Holds a 4.7 out of 5-star customer satisfaction rating.

Bankers Fidelity delivers on its promises, providing coverage you can count on.

Who are they?

Bankers Fidelity Life Insurance Company offers life and health insurance plans to help with your needs. Their products include:

- Medicare Supplement Insurance

- Short-Term Care Insurance

- Lump Sum Cancer Insurance

- Hospital Indemnity Insurance

- Final Expense Life Insurance

Their extensive experience in the industry has equipped them with the knowledge and expertise to navigate the complexities of insurance, ensuring that their clients receive the most suitable coverage for their specific requirements. Furthermore, Bankers Fidelity’s focus on customer service means that policyholders can expect prompt and efficient assistance whenever they need it. Whether they have a query about a policy, a claim, or simply need advice, Bankers Fidelity’s team of professionals is always ready to help.

Medicare Supplement (Medigap) Insurance Plans

Bankers Fidelity’s Medicare Supplement plans help seniors get the coverage they need. Choosing the right health plan can be confusing, but we make it simple. We listen to your needs, explain your options clearly, and help you find the best coverage so you can enjoy life with peace of mind.

Medicare Supplement Insurance Benefits:

- Coverage Across the Country: Your coverage is valid anywhere in the country, as long as the doctor or provider accepts Medicare.

- Freedom to Choose Your Healthcare Providers: You can see any doctor or healthcare provider that accepts Medicare.

- Guaranteed Renewable Policy: Your policy can’t be canceled as long as you pay your premiums on time.

- Immediate Coverage for Pre-Existing Conditions: There is no waiting period for coverage of pre-existing health conditions.

- Multiple Payment Options: Benefits can be paid directly to you, your healthcare provider, or the hospital.

- No Waiting Period: Your coverage starts immediately on your policy’s effective date.

Pricing for Medicare Supplement Insurance

Rates can vary depending on the company you choose and where you live. We have provided illustrative rates, but your location might be cheaper or more expensive.

- The rates below were generated from 3 ZIP codes in 3 different states (VA, OH, and WV) for females and Males aged 65 and Non-Tobacco users. Rates vary based on ZIP code, gender, age, and, in some areas, health.

Female: Standard Rates | Male: Standard Rates | |||||

Zip Codes | Plan F | Plan G | Plan N | Plan F | Plan G | Plan N |

20129 | $147.76 | $120.67 | $89.46 | $168.71 | $136.36 | $102.88 |

43081 | $181.87 | $144.20 | $111.99 | $204.60 | $178.45 | $157.49 |

26554 | $243.86 | $194.00 | $134.94 | $270.69 | $228.89 | $135.00 |

- The rates below were generated from 3 ZIP codes in 3 different states (VA, OH, and WV), for females and Males aged 65 and Tobacco users. Rates vary based on ZIP code, gender, age, and, in some areas, health.

Female: Standard Rates | Male: Standard Rates | |||||

Zip Codes | Plan F | Plan G | Plan N | Plan F | Plan G | Plan N |

20129 | $169.93 | $138.47 | $117.62 | $198.22 | $159.24 | $133.00 |

43081 | $221.00 | $180.25 | $136.37 | $255.75 | $202.78 | $156.35 |

26554 | $284.00 | $232.82 | $148.36 | $326.00 | $258.43 | $163.22 |

Key Highlights of a Standardized Medicare Supplement Plan

Choosing a Medicare Supplement insurance policy provides peace of mind and nationwide flexibility for your healthcare needs. Here are some of the top benefits of enrolling in a standardized plan:

- Nationwide Provider Access: You can visit any doctor or healthcare provider in the U.S. who accepts Medicare. No networks or referrals required.

- Portable Coverage: Whether you’re at home or traveling across the country, your Medicare Supplement plan offers consistent benefits wherever you go.

- Flexible Payment Options: Benefits from your plan can be paid directly to you, your doctor, or your hospital, depending on your preferences.

- Guaranteed Renewable for Life: As long as premiums are paid on time, your policy cannot be canceled due to health conditions or age.

- No Waiting Period for Pre-Existing Conditions: With a Bankers Fidelity Medicare Supplement policy, your coverage begins on the effective date, without any delays due to pre-existing conditions.

This combination of flexibility, security, and nationwide access makes a Medicare Supplement plan an essential part of your retirement healthcare strategy.

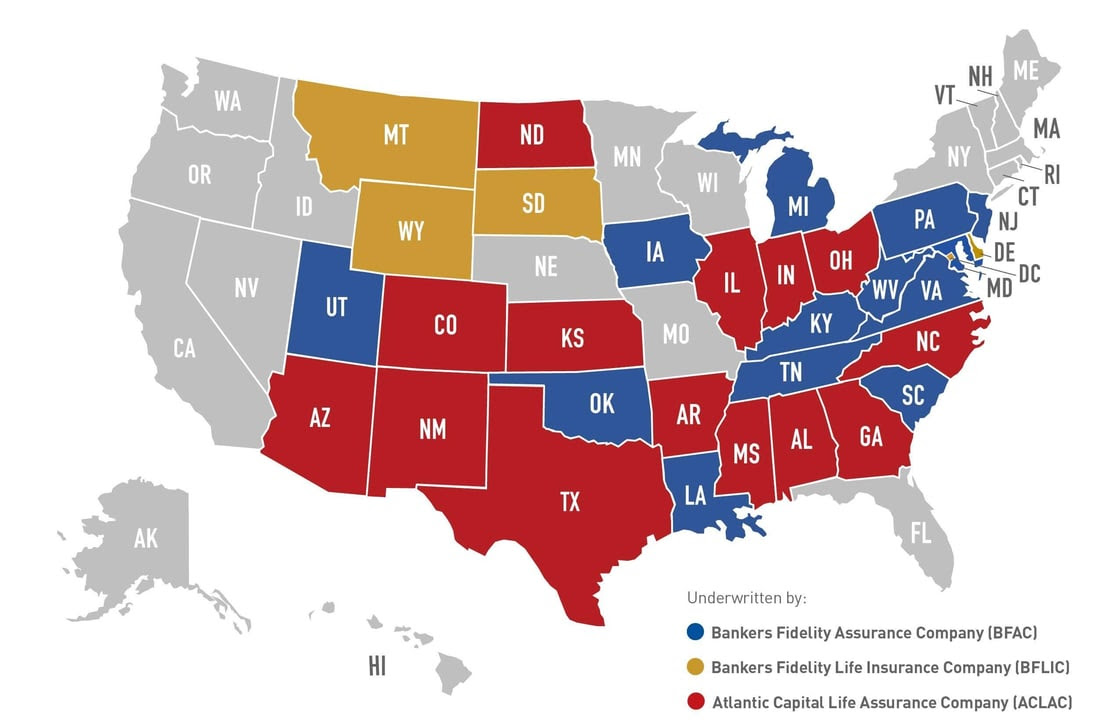

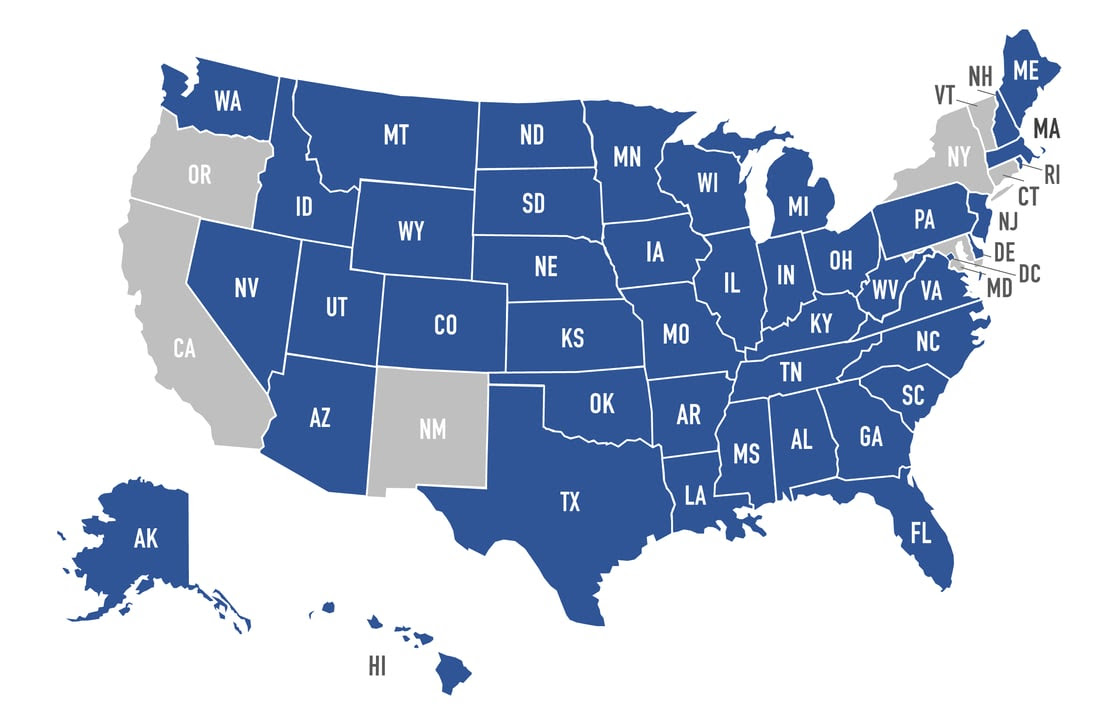

Availability of Medicare Supplement Insurance

Bankers Fidelity Insurance Plans are available in most states, offering reliable coverage tailored to meet a variety of healthcare needs. Known for their commitment to customer service and financial strength, Bankers Fidelity provides peace of mind through a range of supplemental insurance options. Explore their offerings to find a plan that fits your lifestyle and budget. See the photo below for a detailed reference on current availability by state.

Short-Term Care Insurance Plan

Vantage Recovery® from Bankers Fidelity is a practical and flexible short-term care insurance solution designed for individuals ages 18 to 85. Whether you’re recovering from surgery, managing a chronic illness, or facing an unforeseen injury, this plan helps protect your finances by covering the cost of care in a licensed nursing facility or through home health care services, without requiring a hospital stay.

Unexpected health issues like joint replacements, strokes, or cognitive decline can happen at any age. Vantage Recovery® helps ease the financial burden during recovery by paying daily benefits for medically necessary care. With customizable coverage and optional riders, you can create a plan that fits your unique situation and budget.

Key Benefits of Vantage Recovery®:

- Issue Ages: 18–85

- Daily Benefit Options: $30 to $300

- Benefit Periods: 90, 180, 270, or 360 days*

- Elimination Period: 0 or 20 days

- Unisex Rates and Two Rate Classes (Preferred & Standard)

- 10% Household Premium Discount

- Simplified Application Process

- Guaranteed Renewable for Life

- 30-Day Free Look Period

This short-term nursing insurance plan is especially valuable for individuals at higher risk of chronic conditions or sudden health events, including knee or hip replacements, cardiac issues, or cancer diagnoses.

Flexible Coverage That Works on Your Terms

With Vantage Recovery®, you choose the care that suits your needs—whether it’s a short stay in a nursing facility for rehabilitation or home health care from a licensed provider.

Here’s how it works:

- No Prior Hospitalization Required: You can begin receiving benefits without first being admitted to a hospital.

- Choose When Benefits Begin: Start your benefits from Day 1 or Day 20, based on your elimination period selection.

- Customizable Benefit Periods: Choose coverage for up to 360 days, depending on your financial goals and care expectations.

Activities of Daily Living (ADLs) Coverage:

Vantage Recovery® pays benefits when you’re unable to perform two or more of the six ADLs:

- Bathing

- Dressing

- Toileting

- Transferring

- Continence

- Eating

Vantage Recovery® empowers you to recover with dignity, flexibility, and financial protection, whether you’re at home or in a care facility.

Optional Riders for Enhanced Coverage:

Maximize your plan with optional benefits designed to enhance your recovery journey:

- Home Health Care Rider: Up to 360 days of additional coverage at home or in a nursing facility; full restoration of benefits after 6 months of no treatment.

- Cancer First Occurrence Benefit Rider: A lump sum cash benefit paid upon initial cancer diagnosis after the first 30 days of coverage.

NOTE: Riders and benefit restoration features may vary by state. Always refer to the Outline of Coverage for details.

Lump Sum Cancer Insurance Plan

Vantage Care™ Lump Sum Cancer insurance provides valuable protection beyond traditional health coverage. Designed to ease the financial burden of a cancer diagnosis, this supplemental policy offers a lump sum benefit that can be used to cover various expenses related to cancer treatment and recovery.

Whether you, your spouse, or your child faces a cancer diagnosis, Vantage Care gives you options to help maintain financial stability and focus on recovery.

Cancer Insurance Plan Benefits:

- Issue Ages: 18-99 (18-74 for Specified Disease Benefits)

- Benefit Amounts: $5,000 to $75,000

- Lump-Sum Payment: Benefits are paid directly to the policyholder

- Unisex Rates: Rates are the same for all policyholders

- Coverage Options: Individual, individual + spouse, individual + child(ren), and family

- Guaranteed Renewable: Coverage is guaranteed renewable as long as premiums are paid on time

- Customizable: Optional riders are available for flexible coverage

- Protection: The plan can help policyholders cover cancer treatment costs and improve their quality of life.

State Availability: Where Can You Get Bankers Fidelity Vantage Care® Lump Sum Cancer?

Bankers Fidelity Vantage Care® Lump Sum Cancer is available in select states across the U.S. For current product availability, refer to the coverage map provided below or contact a licensed insurance agent for more information.

How Can You Use the Vantage Care Benefit?

Once diagnosed with cancer (after 30 days of policy coverage), you receive a lump sum benefit payable directly to you. This money can be used flexibly for:

- Medical expenses like hospital stays, diagnostic tests, radiation, chemotherapy, and physician visits

- Day-to-day necessities such as lost income, travel and lodging for treatment, and child care costs

- Other out-of-pocket costs not covered by traditional insurance

This flexibility empowers you to allocate funds where they are needed most during your treatment and recovery.

NOTE: Benefit amounts and eligible expenses vary by state.

Customizable Coverage Options and Optional Riders

Vantage Care’s flexibility allows you to tailor your policy with a range of optional riders to enhance protection:

- Carcinoma in Situ Benefit: Pays up to 100% of the invasive cancer benefit for early-stage cancer diagnosis.

- Heart-Stroke Benefit Rider: Covers major heart events and surgeries.

- Second Opinion & Travel Rider: Helps cover costs related to getting a second medical opinion and travel expenses to specialized treatment centers.

- Skin Cancer Rider: Offers coverage for skin cancer diagnosis.

- Cancer Hospitalization Rider: Provides additional benefits during hospital stays.

- Cancer Radiation & Chemotherapy Rider: Covers specific treatment-related costs.

- Benefit Builder Rider: Increases your benefit amount annually up to 20 years.

- Wellness Rider: Covers preventive tests and exams, such as mammograms, colonoscopies, and stress tests.

Choose the options that best suit your personal health risks and financial needs.

Important Exclusions, Limitations, and Waiting Periods

- Coverage does not apply to pre-existing conditions diagnosed within the first 12 months of policy or rider issuance.

- Benefits are only payable for covered cancer or heart-stroke conditions diagnosed after a 30-day waiting period.

- Losses due to self-inflicted injuries, suicide attempts, or treatments outside the United States are excluded.

- Partial payments may reduce future benefit amounts.

NOTE: Some exclusions vary by state (e.g., exclusion #6 not applicable for Nevada residents). Always review the full Outline of Coverage to understand all policy terms, conditions, and limitations before purchasing.

Choosing Vantage Care means choosing financial peace of mind in the face of a serious illness. This supplemental insurance is designed to fill gaps left by traditional health plans, helping you manage both expected and unexpected costs of cancer and heart-stroke care.

With flexible coverage options, lump sum benefits, and a wide range of optional riders, you can customize your policy to protect what matters most, your health and financial security.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Hospital Indemnity Insurance Plan

If you’re unsure about what to look for in a Hospital Indemnity plan, Bankers Fidelity’s Vantage Flex Plus policy can help. It’s a customizable, supplemental insurance plan designed to assist with hospital costs due to illness or injury, so you can focus on living your life without worrying about medical bills.

Vantage Flex Plus gives you the flexibility to choose the right plan for your needs so that you can focus on living life. Before enrolling, consider these questions:

- How is your health? Even if you’re healthy, accidents or sudden illness can happen. Without enough coverage, these can drain your savings.

- Are you fully covered in an emergency? Vantage Flex Plus helps with hospital confinement costs and offers optional riders for extra support, like family member lodging or non-local transportation.

- Are there coverage gaps in your Medicare Advantage plan? Vantage Flex Plus offers daily benefits between $100 and $750 for hospital stays, with benefit periods from 3 to 31 days. Optional riders let you customize your plan to suit your needs.

NOTE: Benefits may vary by state.

How Vantage Flex Plus Works

Bankers Fidelity’s Vantage Flex Plus™ Hospital Indemnity policy stands out with a range of essential benefits:

- Guaranteed Benefits: Death benefits never decrease; premiums remain level.

- Immediate Coverage: No waiting period after the policy is issued.

- Builds Cash Value: Useful for emergency funds or future financial needs.

- Flexible Payouts: Use benefits for medical costs, funeral expenses, or debts.

- Tax-Free Benefits: Death benefits typically pass to beneficiaries tax-free.

- Guaranteed Renewable: As long as premiums are paid on time.

- 30-Day Free Look: Cancel within 30 days for a full refund.

Optional Benefits:

- ICU Admission & Daily ICU Confinement

- Rehabilitation Unit Confinement

- Skilled Nursing Facility Confinement

- Outpatient Surgery

- Minor, Major & Invasive Diagnostic Exams

- Non-Local Transportation

- Family Member Lodging

- Preventive Health Screening

NOTE: Benefits may vary by state.

New Coverage Options for Comprehensive Protection

- Maternity Coverage

- Substance Abuse Treatment

- Mental & Nervous Disorder Benefits

NOTE: Benefits may vary by state. Check with a licensed agent for complete details.

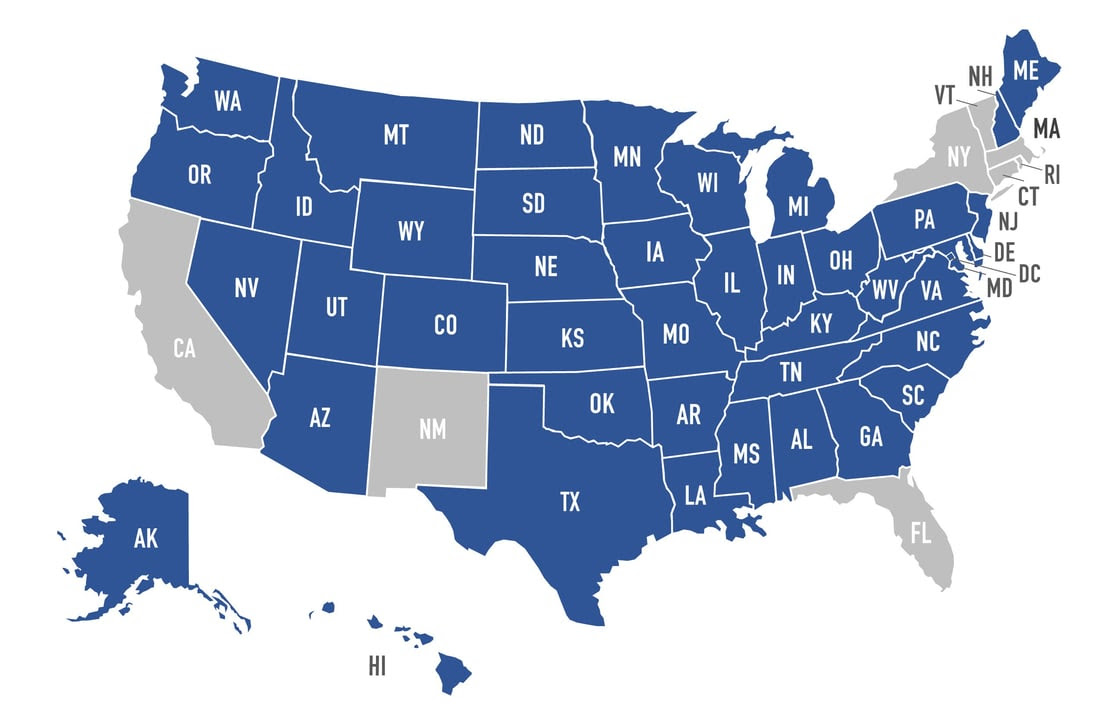

State Availability: Where Can You Get Vantage Flex Plus™?

Vantage Flex Plus™ is available in select states across the U.S. For current product availability, refer to the coverage map provided below or contact a licensed insurance agent for more information.

Final Expense Life Insurance Plan

Bankers Fidelity’s Vantage Secure life insurance helps your family manage costs after you’re gone. It covers expenses like medical bills, credit cards, funeral costs, and other debts. This type of insurance gives your loved ones financial peace of mind during a difficult time.

Get peace of mind with life insurance designed to protect your loved ones. Bankers Fidelity offers coverage for ages 45-85, with no waiting period once your policy is issued. Choose a guaranteed death benefit starting at $3,000, payable to anyone you choose. Your policy also builds cash value for emergencies or gifts.

- Accelerated Death Benefit Rider: If diagnosed with a terminal illness (12-month life expectancy), you can access up to 50% of your policy amount for any need.

- Waiver of Premium Rider: If confined to a hospital or nursing facility for 180+ days, your premiums are waived, so you won’t lose coverage.

NOTE: Benefits may vary by state. Not available in AK, CT, KS, MA, MD, NJ, NY.

How This Plan Works

Enjoy lifelong coverage with fixed benefits and premiums that never change. Your policy can’t be canceled as long as you pay on time, and your death benefit is usually tax-free for your loved ones.

- Guaranteed for Life – No changes to your benefits or premiums.

- 30-Day Free Look – Change your mind within 30 days for a full refund.

The average funeral costs between $6,000 and $9,000, according to the National Funeral Directors Association. While Social Security may provide a one-time $255 payment, it’s not nearly enough to cover funeral expenses. Planning ahead with Final Expense Insurance can help ease the financial burden on your loved ones.

*DISCLAIMER: This information is for general purposes only and should not be considered tax advice. Tax laws vary by state and individual circumstances. Please consult with a qualified tax advisor or financial professional to understand how these benefits may impact your specific tax situation.

Final Expense insurance from Bankers Fidelity helps cover costs beyond just a burial or cremation. It can help pay for a cemetery marker, travel and lodging for family, catering for guests, medical bills, legal fees, credit card debt, and other final expenses. These costs can add up quickly, making an already difficult time even harder. This coverage helps ease the financial burden, so your loved ones can focus on remembering and honoring your life.

Summary

Bankers Fidelity offers a range of insurance plans to help cover medical and final expenses, giving policyholders financial security and peace of mind. Their Medicare Supplement plans provide nationwide coverage, freedom to choose doctors, and no waiting periods for pre-existing conditions. Additional plans include Short-Term Care, Lump Sum Cancer, Hospital Indemnity, and Final Expense Insurance—each designed to fill coverage gaps and ease financial burdens.

With a strong reputation, decades of experience, and highly rated customer service, Bankers Fidelity ensures reliable coverage for seniors and families. Their policies are flexible, customizable, and guaranteed renewable for life, so you can focus on what matters most. Planning ahead with Bankers Fidelity can protect your savings and provide financial relief when you need it most.

Learn more about the Bankers Fidelity Insurance Plans by connecting directly with one of our trusted agents.

Prefer to chat by phone? Give us a call at 1-888-559-0103.