Coverage

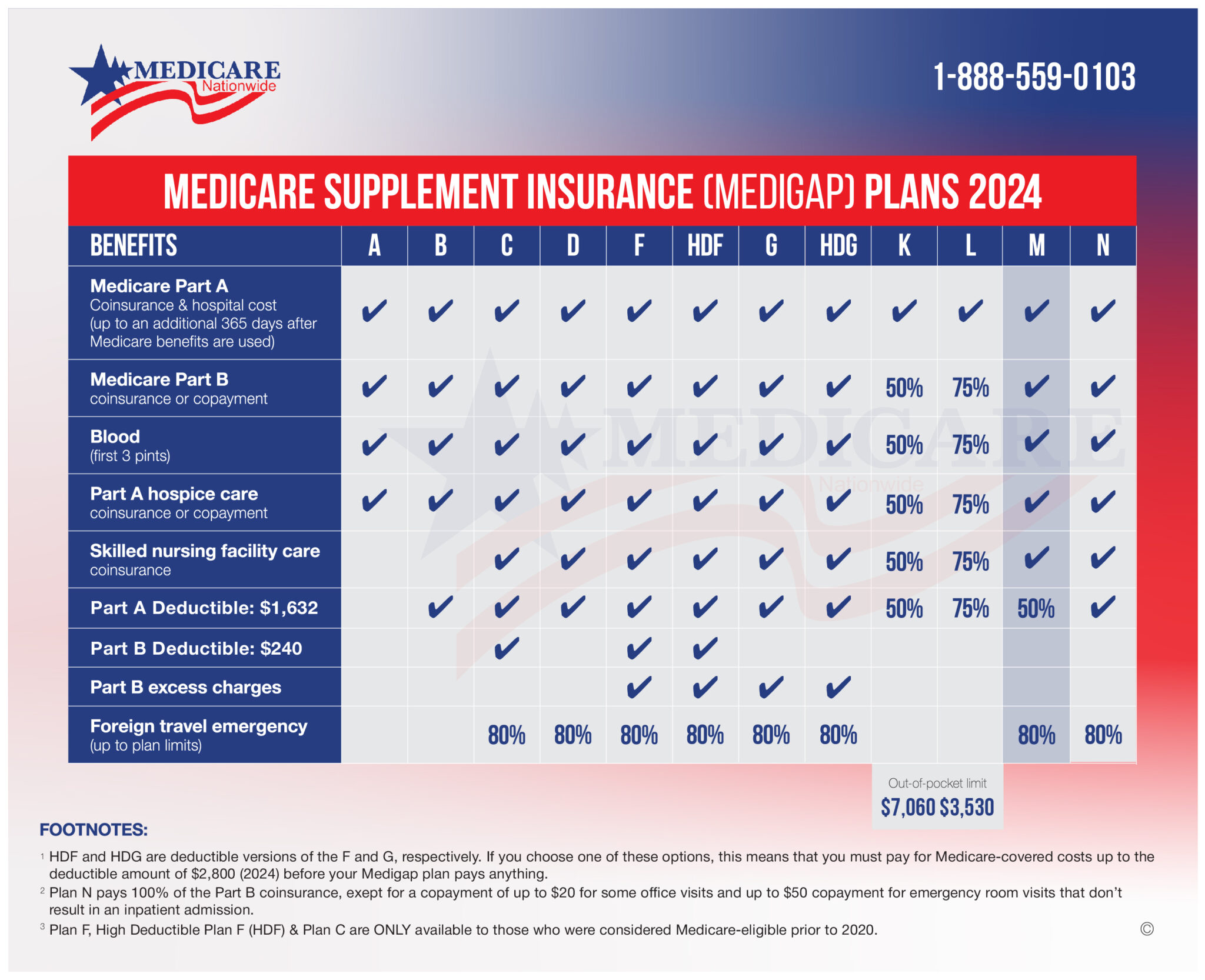

Medicare Supplement Plan M offers a comprehensive set of benefits to help beneficiaries manage healthcare expenses not covered by Original Medicare (Part A and Part B). While Plan M provides coverage for many healthcare services, it does not cover everything. Here’s an overview of the benefits included in Plan M:

Medicare Part A Coinsurance and Hospital Costs: Plan M covers Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

Medicare Part A Hospice Care Coinsurance or Copayment: Plan M covers coinsurance or copayment for hospice care under Medicare Part A.

Medicare Part B Coinsurance or Copayment: Plan M covers 50% of the coinsurance or copayment for Medicare Part B services, excluding preventive care services, which are covered at 100%.

Blood: Plan M covers the first 3 pints of blood needed for a medical procedure.

Skilled Nursing Facility Care Coinsurance: Plan M covers coinsurance for care received in a skilled nursing facility.

Foreign Travel Emergency: Plan M provides coverage for emergency medical care received during travel outside the United States, up to the plan’s limits.

Costs and Premiums for Medicare Supplement Plan M

| Medicare Supplement Plan M Average Monthly Cost in Auburn, ME (04210)* | |

| Gender: Female, Age 65 | $210.03 |

| Gender: Male, Age 65 | $210.03 |

| Gender: Female, Age 75 | $210.03 |

| Gender: Male, Age 75 | $210.03 |

| Medicare Supplement Plan M Average Monthly Cost in Dubuque, IA (52001)* | |

| Gender: Female, Age 65 | $132.16 |

| Gender: Male, Age 65 | $149.03 |

| Gender: Female, Age 75 | $198.87 |

| Gender: Male, Age 75 | $224.26 |

| Medicare Supplement Plan M Average Monthly Cost in Columbia, MD (21044)* | |

| Gender: Female, Age 65 | $308.32 |

| Gender: Male, Age 65 | $329.34 |

| Gender: Female, Age 75 | $407.48 |

| Gender: Male, Age 75 | $437.18 |

Here’s a sample of a Medicare Supplement Plan M Premium Comparison.

While Medicare Supplement Plan M offers robust coverage, beneficiaries should be aware of the costs associated with the plan. Like other Medigap plans, Plan M typically involves monthly premiums, which vary depending on factors such as age, location, and the insurance company offering the plan. In addition to premiums, beneficiaries may also be responsible for deductibles, copayments, and coinsurance amounts, depending on their healthcare usage.

It’s essential to compare premiums from different insurance companies offering Plan M in your area to find the most competitive rates. Additionally, some insurance companies may offer discounts or pricing incentives for enrolling in Plan M, such as household discounts or preferred rates for non-smokers.

Considerations

Before enrolling in Medicare Supplement Plan M, it’s crucial to consider your healthcare needs, budget, and preferences. Here are some important factors to keep in mind:

Coverage Needs: Evaluate your current healthcare needs and anticipate any future medical expenses. Consider whether Plan M’s coverage aligns with your healthcare priorities and preferences.

Cost Analysis: Compare the premiums, deductibles, and out-of-pocket costs associated with Plan M from different insurance companies. Choose a plan that provides comprehensive coverage at a reasonable cost.

Network Restrictions: Unlike Medicare Advantage plans, Medicare Supplement plans like Plan M do not have provider networks. Beneficiaries have the freedom to choose any healthcare provider that accepts Medicare assignment.

Guaranteed Renewability: Medicare Supplement plans are guaranteed renewable, meaning the insurance company cannot cancel your coverage as long as you pay your premiums on time. This provides peace of mind and continuity of coverage.

Enrollment Period: The best time to enroll in a Medicare Supplement plan is during your Medigap Open Enrollment Period, which begins when you’re 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed-issue rights, meaning you cannot be denied coverage or charged higher premiums due to pre-existing conditions.

Conclusion

Medicare Supplement Plan M offers comprehensive coverage for Medicare beneficiaries seeking additional financial protection against healthcare expenses. By understanding the coverage, costs, and considerations associated with Plan M, you can make informed decisions about your healthcare coverage in retirement. Be sure to research and compare different insurance companies offering Plan M to find the most suitable option for your needs and budget. As always, consult with a licensed insurance agent or Medicare advisor to explore your options and make the best choice for your unique circumstances.

Additional Resources:

- Part of Medicare: https://www.medicare.gov/medigap-supplemental-insurance-plans/

- National Association of Health Underwriters (NAHU): https://welcometonahu.org/

- State Health Insurance Assistance Programs (SHIPs): https://www.shiphelp.org/