Who is Wellpoint

Wellpoint was relaunched for Anthem’s health plan (currently known as Amerigroup or UniCare Prescription Drug plans), and is committed to providing comprehensive health insurance plans and solutions that cater to the individual’s overall wellness. Wellpoint is an affiliate of Elevance Health.

We believe that to live well, we must focus on recognizing that health extends beyond just physical wellness. Wellpoint offers personalized solutions for individuals considering the behavioral and social drivers that impact one’s health.

It also offers a range of products and services for people of all ages who want to make the right decisions regarding their well-being. They provide access to simple, supportive health solutions that help promote consumers’ independence, self-reliance, and your welfare.

Discovering the Wonders of Wellpoint

Some people may not be familiar with the name Wellpoint, but it has been a significant part of Anthem’s history. For over 30 years, Wellpoint has been a trusted name in healthcare, serving customers with pride. The name Wellpoint is derived from the word “wellness,” which encompasses not only physical health but also the behavioral and social factors that affect it. This name reflects their dedication to helping individuals live well at every stage of life.

The brand was launched with a focus on improving the health of individuals and communities at all stages of life. At Wellpoint, they know that your health is more than just physical. It’s about living well. Therefore, your entire health is their priority.

Availability of Wellpoint Insurance to United States

Not all states in the United States offer Wellpoint Insurance. Unfortunately, it is not available everywhere. There are only 7 states that offer this insurance plan. These states are:

- Arizona

- Iowa

- Maryland

- New Jersey

- Tennessee

- Texas

- Washington

Finding the Right Plan For You

Wellpoint offers a variety of health and wellness products and services for people of all ages. Their solutions are designed to support individuals in promoting their independence, self-reliance, and welfare.

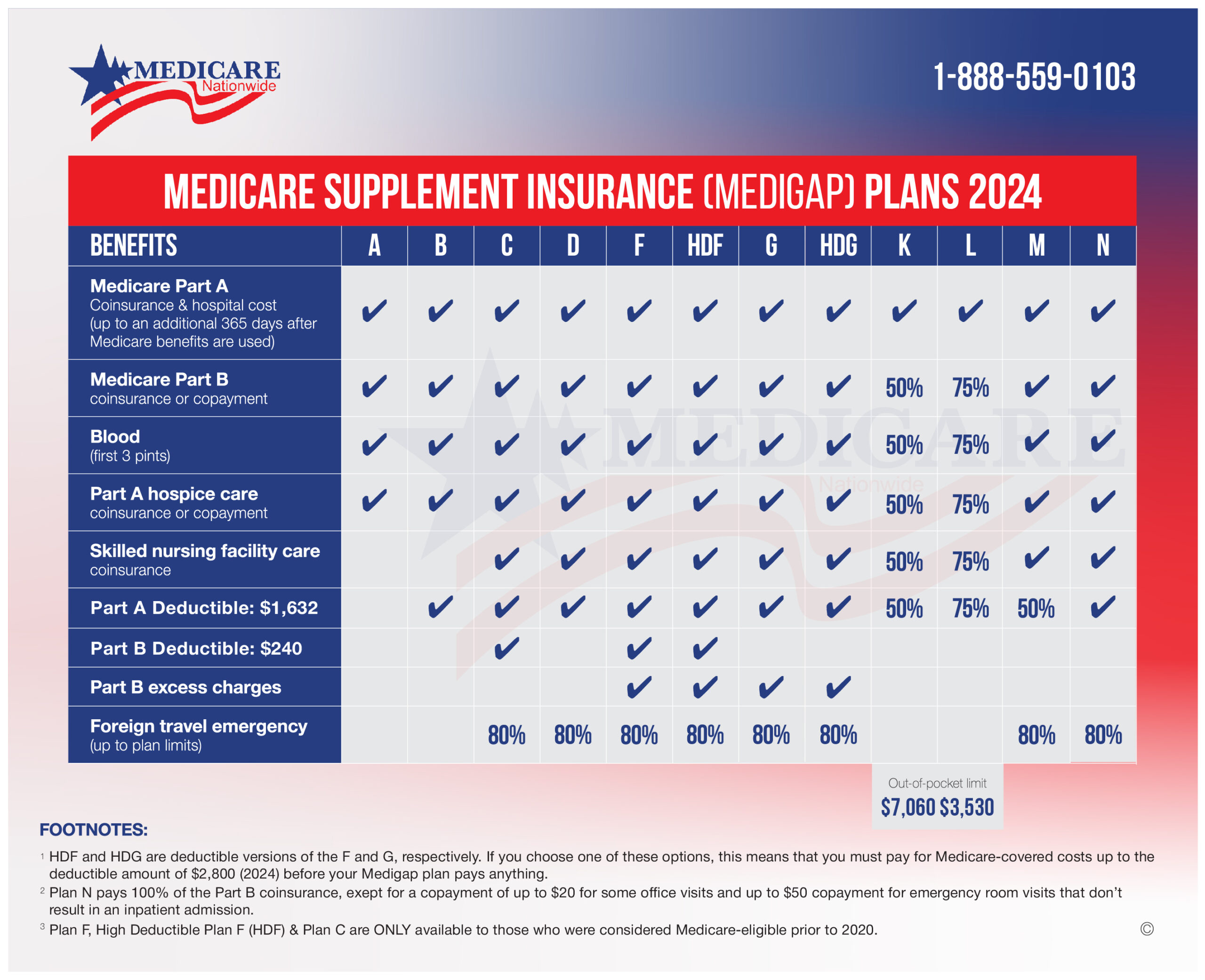

Wellpoint has offered 4 Medicare Supplement Insurance Plans. These plans are: Plan A, Plan F, Plan G and Plan N.

Medicare Supplement Plan Premium Average Cost Monthly

Premiums for the plan you select depend on your age, gender, and tobacco use. Future changes to premiums are also determined by these factors.

Wellpoint offers insurance policies where the rates stay the same as you get older. If you sign up between ages 65 and 74, you’ll get a discount based on your age when you enroll. This discount reduces by 3% each year until you turn 74. Also, your premium won’t change for the first 12 months after you start your coverage, which gives you peace of mind.

The tables below show the rates as of at the time this article was written.

- Male (Non-Tobacco)

If you haven’t used tobacco in the past year, you can use this premium chart to find your rate based on your age at the start of coverage. Your premium will stay the same for the first 12 months of coverage.

Male: Enrollment Premium Discount Rates* | Male: Standard Rates | |||||||

Age | Plan A | Plan F | Plan G | Plan N | Plan A | Plan F | Plan G | Plan N |

65 | $139.04 | $207.91 | $160.17 | $133.96 | $198.63 | $297.02 | $228.82 | $191.37 |

66 | 151.07 | 224.49 | 174.12 | 144.77 | 206.95 | 307.52 | 238.52 | 198.31 |

67 | 160.46 | 238.28 | 186.55 | 154.93 | 211.13 | 313.52 | 245.46 | 203.86 |

68 | 168.99 | 252.42 | 199.39 | 165.42 | 213.91 | 319.52 | 252.39 | 209.39 |

69 | 178.81 | 269.39 | 211.50 | 175.13 | 218.06 | 328.52 | 257.93 | 213.57 |

70 | 188.90 | 285.62 | 223.97 | 186.24 | 222.24 | 336.02 | 263.49 | 219.11 |

- Female (Non-Tobacco)

If you haven’t used tobacco in the past year, you can use this premium chart to find your rate based on your age at the start of coverage. Your premium will stay the same for the first 12 months of coverage.

Female: Enrollment Premium Discount Rates* | Female: Standard Rates | |||||||

Age | Plan A | Plan F | Plan G | Plan N | Plan A | Plan F | Plan G | Plan N |

65 | $129.32 | $192.16 | $148.53 | $124.25 | $184.74 | $274.52 | $212.18 | $177.50 |

66 | 140.93 | 209.15 | 162.99 | 135.66 | 193.06 | 286.51 | 223.27 | 185.83 |

67 | 148.85 | 221.18 | 173.90 | 143.34 | 195.85 | 291.02 | 228.82 | 188.60 |

68 | 158.02 | 235.83 | 185.15 | 153.38 | 200.02 | 298.52 | 234.37 | 194.15 |

69 | 166.28 | 249.70 | 196.72 | 162.61 | 202.78 | 304.51 | 239.9 | 198.31 |

70 | 175.91 | 266.49 | 208.64 | 174.45 | 206.95 | 313.52 | 245.46 | 205.24 |

- Male (Tobacco)

If you’ve used tobacco in the last year, check this premium chart. Plans are based on your age when you start coverage. Find your age on the chart to see your premium. Your premium won’t increase in the first year of coverage.

Male: Enrollment Premium Discount Rates* | Male: Standard Rates | |||||||

Age | Plan A | Plan F | Plan G | Plan N | Plan A | Plan F | Plan G | Plan N |

65 | $155.73 | $232.86 | $179.40 | $150.03 | $222.47 | $332.66 | $256.28 | $214.33 |

66 | 169.20 | 251.43 | 195.01 | 162.14 | 231.78 | 344.42 | 267.14 | 222.11 |

67 | 179.72 | 266.87 | 208.94 | 173.52 | 236.47 | 351.14 | 274.92 | 228.32 |

68 | 189.27 | 282.71 | 223.32 | 185.27 | 239.58 | 357.86 | 282.68 | 234.52 |

69 | 200.27 | 301.71 | 236.88 | 196.14 | 244.23 | 367.94 | 288.88 | 239.20 |

70 | 211.57 | 319.89 | 250.84 | 208.59 | 248.91 | 376.34 | 295.11 | 245.40 |

- Female (Tobacco)

If you’ve used tobacco in the last year, check this premium chart. Plans are based on your age when you start coverage. Find your age on the chart to see your premium. Your premium won’t increase in the first year of coverage.

Female: Enrollment Premium Discount Rates* | Female: Standard Rates | |||||||

Age | Plan A | Plan F | Plan G | Plan N | Plan A | Plan F | Plan G | Plan N |

65 | $144.84 | $215.22 | $166.35 | $139.16 | $206.91 | $307.46 | $237.64 | $198.80 |

66 | 157.85 | 234.25 | 182.54 | 151.93 | 216.23 | 320.89 | 250.06 | 208.13 |

67 | 166.71 | 247.71 | 194.77 | 160.53 | 219.35 | 325.94 | 256.28 | 211.23 |

68 | 176.98 | 264.13 | 207.37 | 171.79 | 224.02 | 334.34 | 262.49 | 217.45 |

69 | 186.23 | 279.66 | 220.33 | 182.13 | 227.11 | 341.05 | 268.69 | 222.11 |

70 | 197.01 | 298.47 | 233.68 | 195.39 | 231.78 | 351.14 | 274.92 | 229.87 |

Important Plan Disclosure: What You Need to Be Aware Of

With Wellpoint Insurance Company, your premium can only go up if they raise prices for similar plans in your state. They will give you a 30-day notice before any increase. Your premium might increase over time because of inflation or other factors, but it won’t go up just because you get older.

If you intend to replace your current health insurance policy, it is advisable not to cancel it until you have received the new policy and confirmed that you want to keep it. Please note that the policy may not cover all of your medical expenses.

Summary

In the unpredictable journey of life, having the right insurance plan can be one’s greatest asset. Navigating the vast landscape of insurance plans can be a daunting task. However, with proper knowledge and careful consideration, we can find the right coverage to suit your needs. Whether one needs to safeguard against unexpected medical expenses, protect assets, or ensure peace of mind for loved ones, having a comprehensive insurance plan is crucial. The best insurance policy is the one that provides the right balance of coverage, affordability, and peace of mind. Therefore, it’s essential to take the time to review all options, consult with experts if needed, and make informed decisions that will protect oneself and loved ones in the years to come.

To learn more about Wellpoint Medicare Supplement Insurance Plans, please contact one of our trusted representatives directly at 1-888-559-0103.